|

市场调查报告书

商品编码

1684561

被动光学元件市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Passive Optical Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

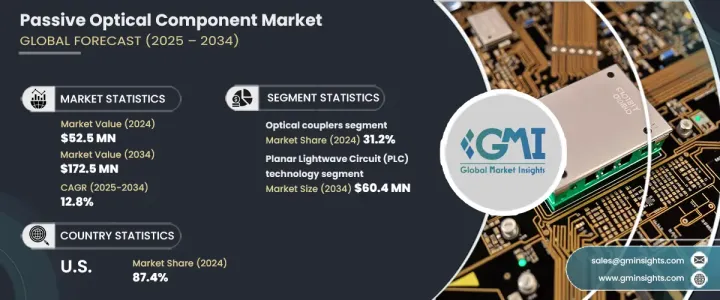

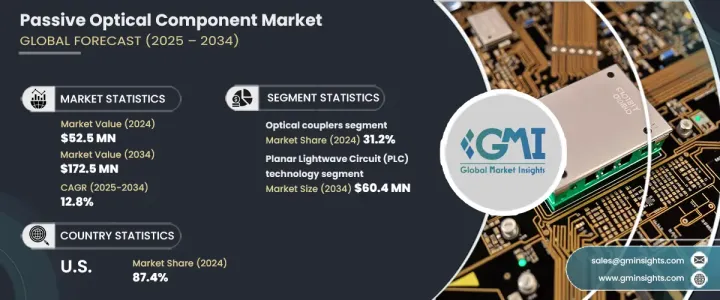

2024 年全球被动光元件市场规模达到 5,250 万美元,预计 2025 年至 2034 年期间复合年增长率将达到惊人的 12.8%。对高速互联网的不断增长的需求和资料消费的急剧增长,推动着光纤通讯成为现代网路基础设施的关键要素。随着产业和消费者优先考虑无缝数位连接,被动光元件对于确保资料的有效传输、路由和放大已成为不可或缺的。此外,5G、人工智慧 (AI) 和物联网 (IoT) 等下一代技术的兴起正在推动对强大光纤网路的需求。这些元件支援高频宽、低延迟和节能的资料传输,对于电信营运商、企业和超大规模资料中心来说至关重要。

随着企业迁移到基于云端的应用程式和储存解决方案,云端运算继续受到青睐。超大规模资料中心是这些云端服务的骨干,严重依赖先进的光纤网路来管理大量资料流量。被动光学元件,包括光耦合器、分光器和波分复用器 (WDM),在实现这些网路内的无缝资料流方面发挥关键作用。它们能够提供高效、经济的资料路由和讯号分发解决方案,使其成为现代数位基础设施的基石。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5250 万美元 |

| 预测值 | 1.725亿美元 |

| 复合年增长率 | 12.8% |

市场按元件类型细分,包括光耦合器、光分路器、光滤波器、光循环器、WDM 和其他元件。 2024年光耦合器占31.2%的市占率。这些设备是光纤网路不可或缺的一部分,能够组合或分割光讯号而无需将其转换为电讯号,从而保持其效率和完整性。光耦合器广泛应用于电信、工业自动化和资料中心等应用领域,这些领域的可靠讯号路由是首要考虑因素。

从技术面来看,被动光元件市场包括平面光波电路(PLC)技术、光纤布拉格光栅(FBG)技术、薄膜技术、熔融双锥(FBT)技术等。预计到 2034 年,PLC 技术的市场规模将达到 6,040 万美元,这得益于将光波导蚀刻到二氧化硅基板上的先进製造流程。该技术可确保精度并实现小型化,使其成为分离器和多路復用器等组件的理想选择。

在美国,无源光元件市场在 2024 年占有 87.4% 的份额。北美的成长受到基础设施的大量投资推动,包括 5G 部署、光纤到府 (FTTH) 计画和资料中心扩建。电信营运商和科技公司处于增强数位连接的前沿,推动了对耦合器、分离器和 WDM 设备等组件的需求。美国注重创新和采用先进的网路技术,并持续引领全球市场。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 光纤通讯的普及率不断提高

- 云端服务和资料中心的激增

- 增加对5G基础设施的投资

- 无源光学技术的进步

- 产业陷阱与挑战

- 安装和维护复杂

- 来自无线技术的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 玻璃

- 塑胶

- 其他的

第 6 章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 平面光波电路(PLC)技术

- 光纤布拉格光栅(FBG)技术

- 薄膜技术

- 熔融双锥 (FBT) 技术

- 其他的

第 7 章:市场估计与预测:按组件类型,2021 年至 2034 年

- 主要趋势

- 光耦合器

- 光分路器

- 光学滤光片

- 光学环行器

- 波分复用器 (WDM)

- 其他的

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 电信

- 资料中心

- 有线电视(CATV)

- 光纤到府 (FTTH)

- 企业网路

- 航太和国防

- 医疗和保健

- 工业网络

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Accelink Technologies Co., Ltd.

- Amphenol Corporation

- Broadcom Inc.

- Ciena Corporation

- Cisco Systems, Inc.

- Corning Incorporated

- Fujitsu Limited

- Furukawa Electric Co., Ltd.

- Huawei Technologies Co., Ltd.

- Huber+Suhner AG

- II-VI Incorporated

- Lumentum Holdings Inc.

- Molex LLC

- NEC Corporation

- Nokia Corporation

- Sterlite Technologies Limited

- Sumitomo Electric Industries Ltd.

- TE Connectivity

- Tellabs Inc.

- ZTE Corporation

The Global Passive Optical Component Market reached USD 52.5 million in 2024 and is projected to grow at an impressive CAGR of 12.8% between 2025 and 2034. The growing demand for high-speed internet and the exponential increase in data consumption are driving the adoption of fiber optic communication as a critical element of modern network infrastructures. As industries and consumers prioritize seamless digital connectivity, passive optical components have become indispensable for ensuring the efficient transmission, routing, and amplification of data. Furthermore, the rise of next-generation technologies, such as 5G, artificial intelligence (AI), and the Internet of Things (IoT), is fueling the need for robust optical networks. These components support high bandwidth, low latency, and energy-efficient data transmission, making them essential for telecom operators, enterprises, and hyperscale data centers.

Cloud computing continues to gain traction as businesses migrate to cloud-based applications and storage solutions. Hyperscale data centers, which form the backbone of these cloud services, depend heavily on advanced optical networks to manage vast volumes of data traffic. Passive optical components, including optical couplers, splitters, and wavelength division multiplexers (WDMs), play a pivotal role in enabling seamless data flow within these networks. Their ability to provide efficient, cost-effective solutions for data routing and signal distribution makes them a cornerstone of modern digital infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $52.5 Million |

| Forecast Value | $172.5 Million |

| CAGR | 12.8% |

The market is segmented by component type, including optical couplers, optical splitters, optical filters, optical circulators, WDMs, and other components. In 2024, optical couplers accounted for 31.2% of the market share. These devices are integral to optical fiber networks, enabling the combination or division of light signals without converting them to electrical signals, thereby preserving their efficiency and integrity. Optical couplers are widely used in applications such as telecommunications, industrial automation, and data centers, where reliable signal routing is a priority.

In terms of technology, the passive optical component market encompasses Planar Lightwave Circuit (PLC) technology, Fiber Bragg Grating (FBG) technology, thin-film technology, Fused Biconical Taper (FBT) technology, and others. PLC technology is projected to reach USD 60.4 million by 2034, driven by its advanced fabrication processes that etch optical waveguides onto silica substrates. This technology ensures precision and enables miniaturization, making it ideal for components like splitters and multiplexers.

In the United States, the passive optical component market held an 87.4% share in 2024. Growth in North America is propelled by significant investments in infrastructure, including 5G rollouts, fiber-to-the-home (FTTH) initiatives, and data center expansions. Telecom operators and technology firms are at the forefront of enhancing digital connectivity, driving demand for components like couplers, splitters, and WDM devices. The U.S. continues to lead the global market thanks to its focus on innovation and adoption of advanced networking technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising adoption of fiber optic communication

- 3.6.1.2 Proliferation of cloud services and data centers

- 3.6.1.3 Increasing investments in 5G infrastructure

- 3.6.1.4 Advancements in passive optical technologies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Complex installation and maintenance

- 3.6.2.2 Competition from wireless technologies

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Glass

- 5.3 Plastic

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Planar Lightwave Circuit (PLC) Technology

- 6.3 Fiber Bragg Grating (FBG) Technology

- 6.4 Thin film technology

- 6.5 Fused Biconical Taper (FBT) Technology

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Component Type, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Optical couplers

- 7.3 Optical splitters

- 7.4 Optical filters

- 7.5 Optical circulators

- 7.6 Wavelength Division Multiplexers (WDMs)

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Telecommunications

- 8.3 Data centers

- 8.4 Cable Television (CATV)

- 8.5 Fiber to the Home (FTTH)

- 8.6 Enterprise networks

- 8.7 Aerospace and defense

- 8.8 Medical and healthcare

- 8.9 Industrial networking

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Accelink Technologies Co., Ltd.

- 10.2 Amphenol Corporation

- 10.3 Broadcom Inc.

- 10.4 Ciena Corporation

- 10.5 Cisco Systems, Inc.

- 10.6 Corning Incorporated

- 10.7 Fujitsu Limited

- 10.8 Furukawa Electric Co., Ltd.

- 10.9 Huawei Technologies Co., Ltd.

- 10.10 Huber+Suhner AG

- 10.11 II-VI Incorporated

- 10.12 Lumentum Holdings Inc.

- 10.13 Molex LLC

- 10.14 NEC Corporation

- 10.15 Nokia Corporation

- 10.16 Sterlite Technologies Limited

- 10.17 Sumitomo Electric Industries Ltd.

- 10.18 TE Connectivity

- 10.19 Tellabs Inc.

- 10.20 ZTE Corporation