|

市场调查报告书

商品编码

1684579

环氧活性稀释剂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Epoxy Active Diluent Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

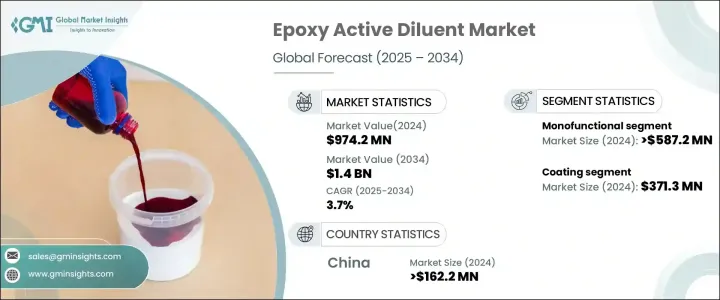

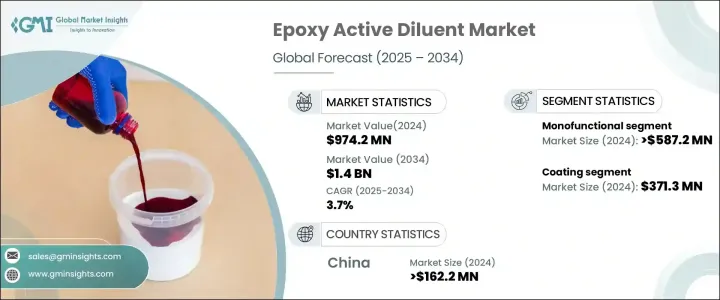

2024 年全球环氧活性稀释剂市场价值为 9.742 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 3.7%。这些稀释剂在降低树脂黏度方面起着关键作用,使其更易于加工和应用。随着製造商寻求提高耐用性和效率的高性能材料,它们的应用正在多个行业中不断扩大。对具有持久保护和美观功能的优质涂料的追求进一步推动了市场扩张。

环保产品的转变正在改变市场格局。环氧活性稀释剂比传统溶剂释放的挥发性有机化合物(VOC)含量更低,因此成为注重永续发展的企业的首选。此外,生物基稀释剂的进步提供了符合全球法规的环保替代品。随着各行业整合创新配方以满足性能和环境标准,市场可望稳步成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.742亿美元 |

| 预测值 | 14亿美元 |

| 复合年增长率 | 3.7% |

单功能部分在 2024 年创造了超过 5.872 亿美元的收入,预计到 2034 年将以 3.9% 的复合年增长率增长。这些稀释剂可确保更好的固化性能、耐化学性和黏附性,使其成为高精度应用的必需品。注重控制黏度和提高加工效率的行业继续推动对单功能稀释剂的需求。它们可预测的性能使其成为专业涂料和配方中不可或缺的一部分,从而巩固了其市场领导地位。

涂料部门在 2024 年以 3.713 亿美元的收入领先市场,预计 2025 年至 2034 年期间的复合年增长率为 3.8%。各行各业越来越依赖这些涂层来提高产品的寿命和美学价值。随着製造商优先考虑效率和永续性,对涂料的需求持续上升,巩固了其作为领先应用领域的地位。

2024 年中国市场规模将超过 1.622 亿美元,预计复合年增长率为 3.4%。其在全球市场的主导地位是由强大的製造基础和对高性价比、高性能材料不断增长的需求所推动的。该国正在进行的工业化和基础设施项目导致环氧树脂的消费量大幅增加。此外,促进永续发展的监管措施正在加速向低VOC和环保解决方案的转变。中国持续发挥生产和消费重要角色,在全球市场的影响力不断增强。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 汽车和航太对轻质材料的需求不断增加

- 扩大建筑和基础设施项目

- 产业陷阱与挑战

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 单功能

- 双官能基

- 其他的

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 涂料

- 工业涂料

- 船舶涂料

- 保护涂层

- 黏合剂和密封剂

- 结构胶合剂

- 非结构胶黏剂

- 复合材料

- 电气和电子

- 建造

- 其他的

第 7 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Adeka Corporation

- Aditya Birla Chemicals

- Anhui Hengyuan (Group)

- EMS-GRILTECH

- Evonik Industries

- Hexion Inc.

- Hubei Green Home Chemical

- Huntsman Corporation

- Kukdo Chemical

- Leuna Harze GmbH

- Olin Corporation

- Sanmu Group

The Global Epoxy Active Diluent Market was valued at USD 974.2 million in 2024 and is projected to grow at a CAGR of 3.7% from 2025 to 2034. The increasing demand for epoxy resins in coatings, adhesives, and composites is driving this growth. These diluents play a critical role in reducing resin viscosity, making them easier to process and apply. Their use is expanding across multiple industries as manufacturers seek high-performance materials that enhance durability and efficiency. The push for superior coatings that offer long-lasting protection and aesthetic appeal is further fueling market expansion.

The shift toward environmentally friendly products is shaping the market landscape. Epoxy active diluents emit lower levels of volatile organic compounds (VOCs) than traditional solvents, making them a preferred choice as companies focus on sustainability. Additionally, advancements in bio-based diluents are providing eco-conscious alternatives, aligning with global regulations. The market is poised to grow steadily as industries integrate innovative formulations to meet performance and environmental standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $974.2 million |

| Forecast Value | $1.4 billion |

| CAGR | 3.7% |

The monofunctional segment generated over USD 587.2 million in 2024 and is set to expand at a CAGR of 3.9% through 2034. Its dominance is attributed to versatility and reliability in industrial applications. These diluents ensure better curing properties, chemical resistance, and adhesion, making them essential for high-precision applications. Industries favoring controlled viscosity and improved processing efficiency continue to drive the demand for monofunctional diluents. Their predictable performance makes them indispensable for specialized coatings and formulations, reinforcing their market leadership.

The coatings segment led the market with USD 371.3 million in revenue in 2024 and is expected to grow at a 3.8% CAGR from 2025 to 2034. The widespread adoption of epoxy-based coatings stems from their ability to provide excellent adhesion, durability, and resistance to environmental factors. Industries increasingly rely on these coatings to enhance product longevity and aesthetic value. As manufacturers prioritize efficiency and sustainability, demand for coatings continues to rise, solidifying their position as the leading application segment.

China accounted for over USD 162.2 million in 2024 and is expected to grow at a 3.4% CAGR. Its dominant position in the global market is driven by a strong manufacturing base and rising demand for cost-effective, high-performance materials. The country's ongoing industrialization and infrastructure projects contribute to substantial consumption of epoxy resins. Moreover, regulatory measures promoting sustainability are accelerating the transition toward low-VOC and eco-friendly solutions. China remains a key player in production and consumption, strengthening its influence in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for lightweight materials in automotive and aerospace

- 3.6.1.2 Expansion of construction and infrastructure projects

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuating raw material prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Monofunctional

- 5.3 Difunctional

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Coatings

- 6.2.1 Industrial coatings

- 6.2.2 Marine coatings

- 6.2.3 Protective coatings

- 6.3 Adhesives and sealants

- 6.3.1 Structural adhesives

- 6.3.2 Non-structural adhesives

- 6.4 Composite material

- 6.5 Electrical and electronics

- 6.6 Construction

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Adeka Corporation

- 8.2 Aditya Birla Chemicals

- 8.3 Anhui Hengyuan (Group)

- 8.4 EMS-GRILTECH

- 8.5 Evonik Industries

- 8.6 Hexion Inc.

- 8.7 Hubei Green Home Chemical

- 8.8 Huntsman Corporation

- 8.9 Kukdo Chemical

- 8.10 Leuna Harze GmbH

- 8.11 Olin Corporation

- 8.12 Sanmu Group