|

市场调查报告书

商品编码

1684612

数控等离子切割机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测CNC Plasma Cutting Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

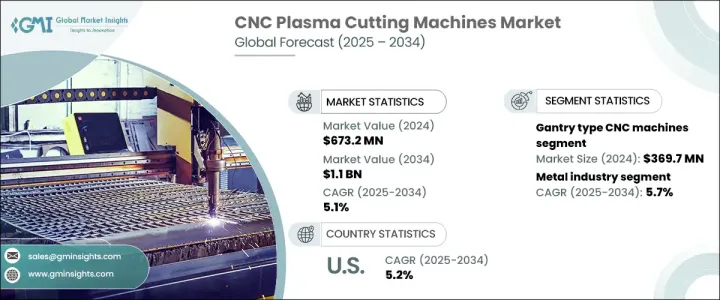

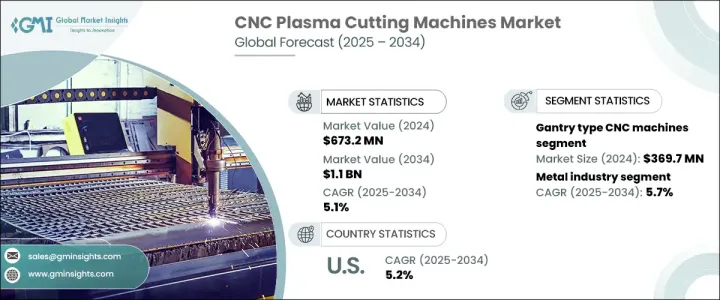

2024 年全球 CNC 等离子切割机市场规模达到 6.732 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.1%。金属加工、汽车、建筑和造船等行业都依赖这些机器,因为它们具有无与伦比的精度、速度和成本效益。製造业和建筑业对客製化切割解决方案的需求日益增长,进一步推动了需求。此外,钢铁和其他金属产量的提高也促进了市场扩张。

数控等离子切割机中的自动化和先进控制系统可最大限度地减少人工劳动并确保始终一致的精度,从而提高生产效率。高清等离子技术透过提供更清洁、无失真的切割彻底改变了产业,使其成为需要高性能切割解决方案的行业必不可少的工具。这些进步与工业营运中对效率和品质的日益重视相一致,使企业能够简化工作流程并降低成本。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.732亿美元 |

| 预测值 | 11亿美元 |

| 复合年增长率 | 5.1% |

就机器类型而言,龙门数控等离子切割机占据市场主导地位,2024 年创收 3.697 亿美元,预计到 2034 年复合年增长率为 5.4 %。它们的大规模能力,加上自动化和高清等离子切割方面的进步,使其在工业用途上具有极大的吸引力。随着行业优先考虑效率和精度,龙门数控机床继续满足对可处理大型复杂项目的切割解决方案日益增长的需求。

2024 年,金属产业占全球 CNC 等离子切割机市场的 31%,预计 2025 年至 2034 年期间的复合年增长率为 5.7%。先进的等离子技术和经济高效的切割解决方案是该领域的关键驱动力,与产业对精度和高品质输出的关註一致。

在美国,数控等离子切割机市场规模在 2024 年达到 1.227 亿美元,预计到 2034 年复合年增长率为 5.2%。 增长的动力来自高清等离子技术的进步、航太、汽车和金属製造行业不断增长的需求以及政府对基础设施建设的投资。高清等离子切割以卓越的切割品质和最少的后製而闻名,在这些行业中尤其受到青睐。它能够提供更清洁、更准确的结果,支持该国对永续性和创新的关注,进一步提升市场潜力。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 技术进步

- 製造和建筑活动增加

- 产业陷阱与挑战

- 初期投资高

- 来自替代切割技术的竞争

- 成长动力

- 技术概览

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按机器类型,2021 年至 2034 年

- 主要趋势

- 龙门CNC工具机

- 桌上型CNC工具机

- 其他(双重用途等)

第 6 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 便携的

- 固定的

第 7 章:市场估计与预测:按自动化等级,2021 年至 2034 年

- 主要趋势

- 半自动

- 全自动

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 金属加工

- 木工

- 石材加工

- 其他(玻璃加工等)

第 9 章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 汽车

- 金属工业

- 製造业

- 航太和国防

- 航运和海事

- 建筑和基础设施

- 其他(能源电力等)

第 10 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接销售

- 间接销售

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 12 章:公司简介

- Ador Welding

- Ajan Electronics

- AKS Cutting Systems

- ALLtra

- Daihen

- Fengwei

- Hildebrand Machinery

- Hornet Cutting Systems

- Hypertherm

- Kinetic

- Koike Aronson

- Kutavar

- Messer

- Torchmate

- Zinser Cutting Systems

The Global CNC Plasma Cutting Machines Market reached USD 673.2 million in 2024 and is estimated to exhibit a CAGR of 5.1% between 2025 and 2034. This growth is driven by technological advancements, increasing demand from key industries, and the rising adoption of automation. Industries like metalworking, automotive, construction, and shipbuilding rely on these machines for their unmatched precision, speed, and cost-effectiveness. The growing need for customized cutting solutions in the manufacturing and construction sectors further propels demand. Additionally, higher production levels of steel and other metals are contributing to market expansion.

Automation and advanced control systems in CNC plasma cutting machines enhance productivity by minimizing manual labor and ensuring consistent precision. High-definition plasma technology has revolutionized the industry by delivering cleaner, distortion-free cuts, making it an essential tool for industries requiring high-performance cutting solutions. These advancements align with the increasing emphasis on efficiency and quality in industrial operations, enabling businesses to streamline workflows and reduce costs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $673.2 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 5.1% |

In terms of machine type, gantry CNC plasma cutting machines dominated the market, generating USD 369.7 million in 2024, with an anticipated CAGR of 5.4% through 2034. These machines are integral to heavy-duty applications across industries like shipbuilding, aerospace, construction, and metal fabrication. Their large-scale capabilities, combined with advancements in automation and high-definition plasma cutting, make them highly attractive for industrial use. As industries prioritize efficiency and precision, gantry CNC machines continue to meet the growing demand for cutting solutions that can handle large, complex projects.

The metal industry accounted for 31% of the global CNC plasma cutting machines market in 2024 and is expected to grow at a CAGR of 5.7% between 2025 and 2034. This sector relies heavily on precise cutting for materials such as steel and stainless steel, addressing the increasing demand for custom metal components in fabrication and metalworking. Advanced plasma technology and cost-effective cutting solutions are key drivers for this segment, aligning with the industry's focus on precision and high-quality outputs.

In the United States, the CNC plasma cutting machines market reached USD 122.7 million in 2024, with a projected CAGR of 5.2% through 2034. Growth is fueled by advancements in high-definition plasma technology, expanding demand across aerospace, automotive, and metal fabrication sectors, and government investments in infrastructure development. High-definition plasma cutting, known for superior cut quality and minimal post-processing, is particularly favored in these industries. Its ability to deliver cleaner, more accurate results supports the country's focus on sustainability and innovation, further boosting market potential.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Technological advancements

- 3.6.1.2 Increased manufacturing and construction activities

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investments

- 3.6.2.2 Competition from alternative cutting technologies

- 3.6.1 Growth drivers

- 3.7 Technological overview

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Gantry type CNC machines

- 5.3 Table type CNC machines

- 5.4 Others (dual purpose etc.)

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Portable

- 6.3 Fixed

Chapter 7 Market Estimates & Forecast, By Automation Grade, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Semi-automatic

- 7.3 Fully automatic

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Metal working

- 8.3 Wood working

- 8.4 Stone working

- 8.5 Others (glass working etc.)

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Metal industry

- 9.4 Manufacturing

- 9.5 Aerospace & defense

- 9.6 Shipping and maritime

- 9.7 Construction and infrastructure

- 9.8 Others (energy & power etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Ador Welding

- 12.2 Ajan Electronics

- 12.3 AKS Cutting Systems

- 12.4 ALLtra

- 12.5 Daihen

- 12.6 Fengwei

- 12.7 Hildebrand Machinery

- 12.8 Hornet Cutting Systems

- 12.9 Hypertherm

- 12.10 Kinetic

- 12.11 Koike Aronson

- 12.12 Kutavar

- 12.13 Messer

- 12.14 Torchmate

- 12.15 Zinser Cutting Systems