|

市场调查报告书

商品编码

1684618

心绞痛药物市场机会、成长动力、产业趋势分析与预测 2025 - 2034Angina Pectoris Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

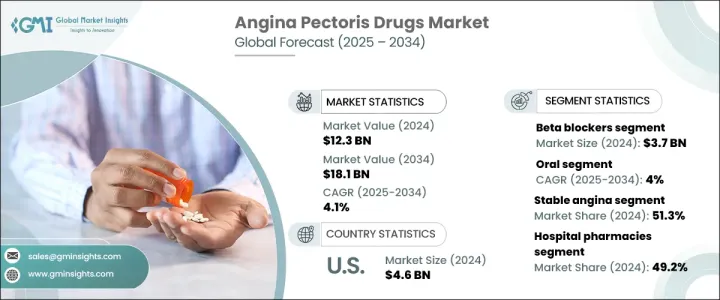

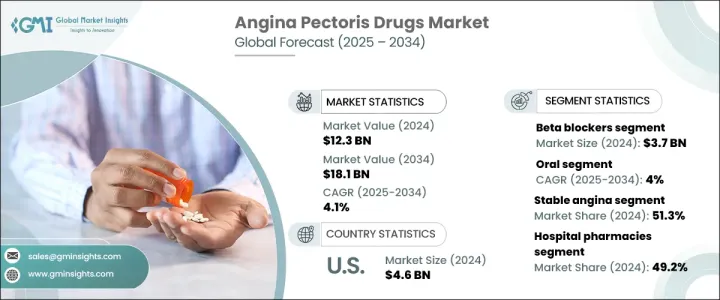

2024 年全球心绞痛药物市场价值为 123 亿美元,预计 2025 年至 2034 年期间将以 4.1% 的复合年增长率稳步增长。与生活方式相关的健康风险(如不良饮食、缺乏运动、吸烟、压力和肥胖)的增加导致心绞痛等心血管疾病发病率的上升。随着心臟病盛行率不断上升,对有效治疗方案的需求也不断扩大。医疗保健产业正在采取创新措施,旨在改善心绞痛患者的生活品质。此外,医疗保健意识的提高、医疗保健基础设施的改善以及药物可近性的提高等因素进一步推动了该市场的成长。

市场按类型分类,稳定型心绞痛占据主导地位,在 2024 年占 51.3% 的份额。鑑于稳定型心绞痛的普遍性,它对市场有重大影响,尤其是因为它常见于冠状动脉疾病患者。硝酸盐、β受体阻断剂和钙通道阻断剂等成熟治疗方案的出现确保了对病情的有效管理,并鼓励患者和医疗保健专业人员广泛使用它们。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 123亿美元 |

| 预测值 | 181亿美元 |

| 复合年增长率 | 4.1% |

根据给药途径,心绞痛药物市场分为口服、注射和外用製剂。口服药物在市场份额方面占据领先地位,预计整个预测期内将以 4% 的复合年增长率增长。口服药物,例如β受体阻断剂、硝酸盐和钙通道阻断剂,由于其方便且价格便宜而受到人们的普遍青睐。它们通常是治疗心绞痛的首选药物,因为它们可以轻鬆使用而不需要频繁地去医疗机构。这些治疗方法的製造和分销成本较低,对患者和提供者来说都是有吸引力的选择。鑑于心绞痛需要长期治疗,口服药物是日常使用的理想选择,并且可以显着提高患者的依从性。

美国心绞痛药物市场价值 2024 年为 46 亿美元,在推动整体市场成长方面发挥关键作用。该国心绞痛盛行率不断上升,加上对更有效治疗方法的需求,刺激了市场扩张。此外,美国继续在医学研究和创新方面处于领先地位,心绞痛治疗领域不断发展,包括先进的联合疗法和增强型β受体阻断剂,进一步加速了市场的成长。药物开发的持续进步,加上该国强大的医疗保健基础设施,使美国成为全球市场未来成功的重要贡献者。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心血管疾病盛行率上升

- 药物开发的进展

- 与生活方式相关的危险因子增多

- 产业陷阱与挑战

- 与药物相关的副作用

- 微创手术的采用日益广泛

- 成长动力

- 成长潜力分析

- 监管格局

- 管道分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 稳定型心绞痛

- 不稳定性心绞痛

- 微血管性心绞痛

- 心绞痛

第 6 章:市场估计与预测:按药物类别,2021 年至 2034 年

- 主要趋势

- β受体阻断剂

- 硝酸盐

- 抗血小板

- 钙通道阻断剂

- 抗凝血剂

- 血管紧张素转换酶 (ACE) 抑制剂

- 其他药物类别

第 7 章:市场估计与预测:按管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 注射剂

- 主题

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AdvaCare Pharma

- Amgen

- AstraZeneca

- Bayer

- Boehringer Ingelheim International

- Eli Lilly and Company

- Gilead Sciences

- GlaxoSmithKline

- Merck

- Novartis

- Otsuka Pharmaceutical

- Pfizer

- Sanofi

The Global Angina Pectoris Drugs Market was valued at USD 12.3 billion in 2024 and is expected to grow at a steady rate of 4.1% CAGR between 2025 and 2034. This growth is largely driven by the increasing prevalence of cardiovascular diseases, significant advancements in therapeutic treatments, and a rapidly aging population. The rise in lifestyle-related health risks-such as poor diets, lack of physical activity, smoking, stress, and obesity-has contributed to a higher incidence of cardiovascular conditions, including angina. As the prevalence of heart disease continues to rise, the demand for effective treatment options is also expanding. The healthcare industry is responding with innovations aimed at improving the quality of life for patients dealing with angina. Additionally, factors such as rising healthcare awareness, improved healthcare infrastructure, and increasing accessibility to medication are further fueling the growth of this market.

The market is categorized by type, with stable angina leading the segment, accounting for a 51.3% share in 2024. This form of angina is the most common and is characterized by chest pain that is predictable and often triggered by physical exertion or emotional stress. Given its prevalence, stable angina has a significant impact on the market, especially as it is commonly found in patients with coronary artery disease. The availability of well-established treatment options-such as nitrates, beta-blockers, and calcium channel blockers-ensures efficient management of the condition, encouraging their widespread use among patients and healthcare professionals alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.3 Billion |

| Forecast Value | $18.1 Billion |

| CAGR | 4.1% |

In terms of administration route, the angina pectoris drug market is divided into oral, injectable, and topical formulations. Oral medications take the lead in terms of market share and are projected to grow at a 4% CAGR throughout the forecast period. Oral drugs, such as beta-blockers, nitrates, and calcium channel blockers, are commonly preferred due to their convenience and affordability. They are often the first choice for treating angina, as they can be easily administered without the need for frequent visits to healthcare facilities. These treatments offer lower manufacturing and distribution costs, making them an attractive option for both patients and providers. Given that angina pectoris requires long-term treatment, oral medications are ideal for daily use and can significantly enhance patient compliance.

The U.S. angina pectoris drug market, valued at USD 4.6 billion in 2024, plays a critical role in driving the overall market growth. The country's increasing prevalence of angina, combined with a demand for more effective therapies, has spurred market expansion. Moreover, the U.S. continues to be a leader in medical research and innovation, with ongoing developments in angina treatments, including advanced combination therapies and enhanced beta blockers, further accelerating market growth. This consistent advancement in drug development, coupled with the country's robust healthcare infrastructure, positions the U.S. as a significant contributor to the future success of the global market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cardiovascular diseases

- 3.2.1.2 Advancements in drug development

- 3.2.1.3 Increasing lifestyle-related risk factors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects associated with the drugs

- 3.2.2.2 Growing adoption of minimally invasive surgeries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Stable angina

- 5.3 Unstable angina

- 5.4 Microvascular angina

- 5.5 Prinzmetal angina

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Beta blockers

- 6.3 Nitrates

- 6.4 Anti-platelets

- 6.5 Calcium channel blockers

- 6.6 Anticoagulants

- 6.7 ACE inhibitors

- 6.8 Other drug classes

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

- 7.4 Topical

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AdvaCare Pharma

- 10.2 Amgen

- 10.3 AstraZeneca

- 10.4 Bayer

- 10.5 Boehringer Ingelheim International

- 10.6 Eli Lilly and Company

- 10.7 Gilead Sciences

- 10.8 GlaxoSmithKline

- 10.9 Merck

- 10.10 Novartis

- 10.11 Otsuka Pharmaceutical

- 10.12 Pfizer

- 10.13 Sanofi