|

市场调查报告书

商品编码

1684637

自行车中轴市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Bicycle Bottom Bracket Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

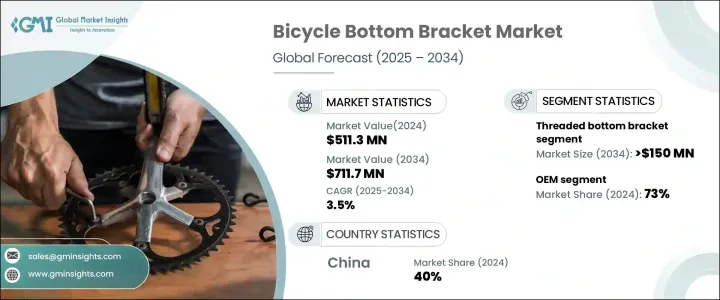

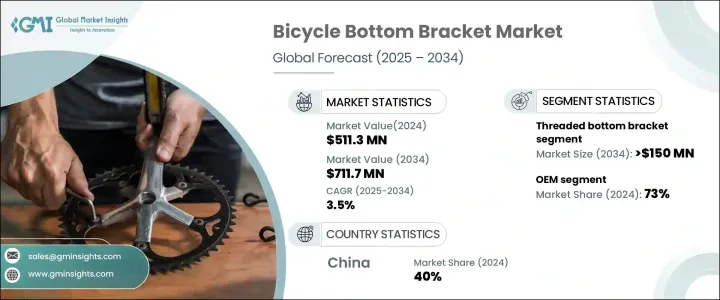

2024 年全球自行车中轴市场价值为 5.113 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 3.5%。骑自行车作为一种可持续且注重健康的交通方式越来越受欢迎,这推动了对高性能自行车零件的需求。世界各地的城市都在加强自行车基础设施建设,例如自行车道、自行车共享系统和改进的安全措施。这些发展使骑自行车成为更安全、更方便的选择,特别是在交通拥挤和污染严重的城市。此外,骑自行车健身和休閒的人数越来越多,以及竞技自行车赛事的日益普及,进一步推动了市场的成长。自行车製造商专注于轻巧、耐用和高效的零件,不断创新,满足休閒骑行者和专业人士的多样化需求。

市场主要分为两个分销管道:原始设备製造商(OEM)和售后市场。 2024 年, OEM领域占据市场主导地位,占有 73% 的显着份额。为提高自行车性能而定制的高品质零件的需求不断增长,推动了该领域的成长。原始设备製造商 (OEM) 在为高端自行车製造商提供优质底部支架方面发挥着重要作用,可以满足日益增长的重视可靠性和创新性的消费者群体的期望。 OEM领域的突出地位凸显了业界向专为耐用性和卓越功能而设计的先进、专业零件的转变。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.113亿美元 |

| 预测值 | 7.117亿美元 |

| 复合年增长率 | 3.5% |

在产品供应方面,自行车中轴市场包括螺纹中轴、压入式中轴、外部中轴、筒式中轴和其他类型。其中,螺纹底部支架在 2024 年占据了 25% 的市场份额,预计到 2034 年将产生 1.5 亿美元的产值。人们对螺纹底部支架兴趣的復苏与经典自行车的復兴以及定制自行车製造趋势的兴起有关。骑乘者重视这些零件的简单性、坚固性和怀旧魅力,因此它们成为追求可靠性和復古感的爱好者的首选。

受电动自行车产业快速发展的推动,中国将在 2024 年占据自行车中轴市场的 40%。城市化加上政府对永续交通的激励措施极大地推动了对专用零件的需求。电动自行车具有更重的车架和机动系统,需要耐用且高效的底部支架以确保最佳性能和使用寿命。这一趋势凸显了满足不断发展的循环技术需求的先进製造解决方案日益增长的重要性。随着自行车运动在世界各地日益流行,在创新和消费者需求增加的推动下,中轴市场必将持续成长。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 最终客户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻及倡议

- 监管格局

- 定价分析

- 衝击力

- 成长动力

- 骑自行车作为永续交通方式的普及度不断提高

- 自行车零件的技术进步

- 扩大城市自行车基础设施

- 自行车客製化需求日益增长

- 产业陷阱与挑战

- 跨自行车型号的兼容性问题

- 耐用性和维护问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依供应量,2021 - 2034 年

- 主要趋势

- 螺纹底部支架

- 压入式底部支架

- 外部底部支架

- 墨盒底部支架

- 其他的

第 6 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 公路自行车

- 登山车

- 赛车

- 砾石自行车

第 7 章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 钢

- 铝

- 碳纤维

- 钛

- 复合材料

第 8 章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- BBInfinite

- Campagnolo

- Cane Creek

- CeramicSpeed

- Chris King

- Enduro Bearings

- First Components

- Full Speed Ahead

- Hawk Racing

- Hope Technology

- Park Tool

- Praxis Works

- Race Face

- Rotor Bike Components

- Shimano

- SRAM

- Token Products

- VP Components

- Wheels Manufacturing

- White Industries

The Global Bicycle Bottom Bracket Market was valued at USD 511.3 million in 2024 and is projected to grow at a CAGR of 3.5% between 2025 and 2034. The rising popularity of cycling as a sustainable and health-conscious mode of transportation is driving demand for high-performance bike components. Urban areas worldwide are embracing cycling infrastructure enhancements, such as bike lanes, bike-sharing systems, and improved safety measures. These developments make cycling a safer and more convenient alternative, particularly in cities dealing with traffic congestion and pollution. Additionally, the growing adoption of cycling for fitness and leisure, alongside the increasing popularity of competitive cycling events, is further fueling market growth. With a focus on lightweight, durable, and efficient components, bicycle manufacturers are continuously innovating, catering to the diverse needs of both casual riders and professionals.

The market is primarily segmented into two distribution channels: Original Equipment Manufacturer (OEM) and aftermarket. In 2024, the OEM segment dominated the market, accounting for a significant 73% share. The segment growth is propelled by the increasing demand for high-quality components tailored to enhance bike performance. OEMs are essential in providing premium bottom brackets to manufacturers of high-end bicycles, meeting the expectations of a growing consumer base that values reliability and innovation. The OEM segment's prominence underscores the industry's shift toward advanced, specialized parts designed for durability and superior functionality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $511.3 Million |

| Forecast Value | $711.7 Million |

| CAGR | 3.5% |

In terms of product offerings, the bicycle bottom bracket market includes threaded bottom brackets, press-fit bottom brackets, external bottom brackets, cartridge bottom brackets, and other types. Among these, threaded bottom brackets held a 25% market share in 2024 and are anticipated to generate USD 150 million by 2034. The resurgence of interest in threaded bottom brackets is linked to the restoration of classic bicycles and the rise of custom bike-building trends. Cyclists value these components for their simplicity, robustness, and nostalgic appeal, making them a preferred choice for enthusiasts seeking reliability and a vintage touch.

China represented 40% of the bicycle bottom bracket market in 2024, driven by its rapidly expanding e-bike industry. Urbanization, coupled with government incentives for sustainable transportation, has significantly boosted the demand for specialized components. E-bikes, which feature heavier frames and motorized systems, require durable and efficient bottom brackets to ensure optimal performance and longevity. This trend highlights the growing importance of advanced manufacturing solutions tailored to meet the needs of evolving cycling technologies. As cycling gains traction worldwide, the market for bottom brackets is set to witness sustained growth fueled by innovation and increased consumer demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component providers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End customers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of cycling as a sustainable transportation option

- 3.9.1.2 Technological advancements in bicycle components

- 3.9.1.3 Expansion of cycling infrastructure in urban areas

- 3.9.1.4 Increasing demand for customization in bicycles

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Compatibility issues across bicycle models

- 3.9.2.2 Durability and maintenance concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Threaded bottom bracket

- 5.3 Press-fit bottom bracket

- 5.4 External bottom bracket

- 5.5 Cartridge bottom bracket

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Road bike

- 6.3 Mountain bike

- 6.4 Racing bike

- 6.5 Gravel bike

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Aluminum

- 7.4 Carbon fiber

- 7.5 Titanium

- 7.6 Composite materials

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 North America

- 9.1.1 U.S.

- 9.1.2 Canada

- 9.2 Europe

- 9.2.1 UK

- 9.2.2 Germany

- 9.2.3 France

- 9.2.4 Italy

- 9.2.5 Spain

- 9.2.6 Russia

- 9.2.7 Nordics

- 9.3 Asia Pacific

- 9.3.1 China

- 9.3.2 India

- 9.3.3 Japan

- 9.3.4 Australia

- 9.3.5 South Korea

- 9.3.6 Southeast Asia

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.2 Mexico

- 9.4.3 Argentina

- 9.5 MEA

- 9.5.1 UAE

- 9.5.2 South Africa

- 9.5.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 BBInfinite

- 10.2 Campagnolo

- 10.3 Cane Creek

- 10.4 CeramicSpeed

- 10.5 Chris King

- 10.6 Enduro Bearings

- 10.7 First Components

- 10.8 Full Speed Ahead

- 10.9 Hawk Racing

- 10.10 Hope Technology

- 10.11 Park Tool

- 10.12 Praxis Works

- 10.13 Race Face

- 10.14 Rotor Bike Components

- 10.15 Shimano

- 10.16 SRAM

- 10.17 Token Products

- 10.18 VP Components

- 10.19 Wheels Manufacturing

- 10.20 White Industries