|

市场调查报告书

商品编码

1684643

捲烟设备市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Cigarette Making Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

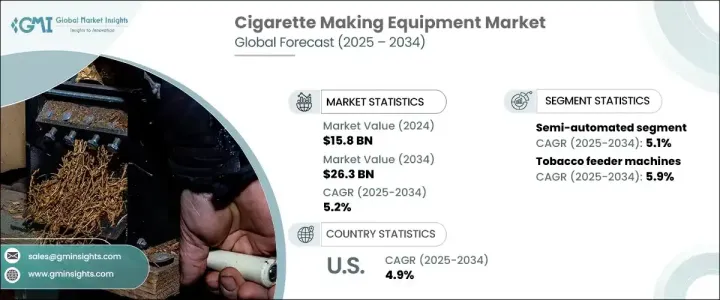

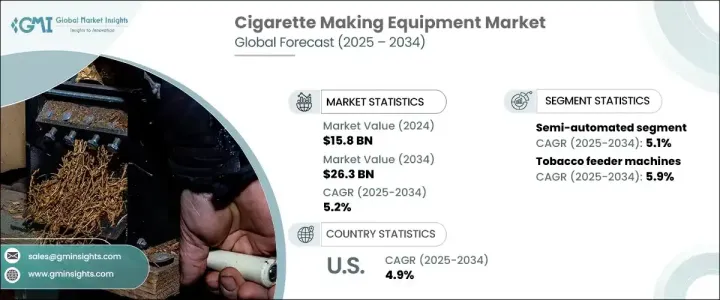

2024 年全球捲烟製造设备市场价值为 158 亿美元,预估 2025 年至 2034 年期间复合年增长率为 5.2%。这一增长是由捲烟生产自动化需求的不断增长所推动的。製造商越来越多地转向先进的自动化机械来提高生产效率、降低成本、满足日益增长的大规模生产需求,同时保持一致的品质。特别是,透过自动化减少体力劳动的趋势很明显,这使企业能够简化营运并提高整体生产力。这种转变不仅解决了劳动力短缺的问题,也满足了消费者对以更具成本效益的方式生产高品质产品的期望。随着自动化技术日益复杂,製造商正在投资能够提高产量和精度的设备,进一步推动市场的扩张。

推动这一市场发展的关键细分市场之一是烟草送料机,它在 2024 年为市场贡献了 36 亿美元。预计这些机器将继续呈上升趋势,到 2034 年预计复合年增长率为 5.9%。烟草送料机对于确保准确、一致地将烟草送入捲烟系统至关重要。它们在提高营运效率、减少材料浪费和维持高产品品质方面发挥着重要作用,使其成为现代香烟生产线中不可或缺的一部分。由于采用模组化设计,这些机器可以轻鬆升级以满足不断变化的生产需求,从而进一步推动其应用。儘管它们具有先进的自动化功能,但对于某些任务(例如过滤器的放置和包装)来说,可能仍需要一些手动或半自动化步骤。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 158亿美元 |

| 预测值 | 263亿美元 |

| 复合年增长率 | 5.2% |

半自动化领域也占有相当大的市场份额,到 2024 年将占 45%,预计在 2025 年至 2034 年期间的复合年增长率为 5.1%。半自动化机器因其价格实惠和灵活性而特别受到新兴市场的中小型製造商的青睐。这些机器在成本效益和自动化之间取得了平衡,可以执行烟草进料、纸张切割和烟桿形成等核心任务,同时允许在某些区域进行人工干预。它们的模组化使企业能够根据需要扩展营运规模,而无需预先实现全面自动化。

2024 年,美国捲烟製造设备市场价值为 19 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.9%。这一成长主要归功于该国注重采用先进的自动化技术和精密工程。美国拥有多家以创新方式和高品质标准而闻名的领先製造商,它们不仅满足国内需求,也迎合全球市场。这些製造商致力于维持高监管标准,进一步推动美国市场的成长

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 提高生产流程的自动化程度。

- 对自产香烟和客製化香烟的需求不断增加。

- 新兴市场的扩张。

- 采用永续的生产实践。

- 产业陷阱与挑战

- 政府对烟草产品的严格管制。

- 由于健康意识增强,已开发地区香烟消费量下降

- 成长动力

- 科技与创新格局

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按设备类型,2021 年至 2034 年

- 主要趋势

- 烟草进料机

- 香烟包装机

- 初级包装机(包装、密封)

- 二次包装机(装箱、捆扎)

- 棒材成型机

- 香烟过滤嘴製造机

- 切割机

- 调味和混合机械

- 物料搬运设备

- 其他(滚压机、硫化机等)

第六章:市场估计与预测:按自动化水平,2021 – 2034 年

- 主要趋势

- 手动的

- 半自动化

- 全自动

第 7 章:市场估计与预测:按产能,2021 年至 2034 年

- 主要趋势

- 低速机器(低于 4000 支/分钟)

- 中速机(4000-8000支/分钟)

- 高速机(8000支/分钟以上)

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 烟草製造商

- 小规模生产者

- 合约製造商

- 其他的

第 9 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- CBK

- Cipta Bena Kencana

- Decouflé

- Dynamic Tools Pvt Ltd.

- Focke & Co.

- GD SpA

- Hauni Maschinenbau GmbH

- HK UPPERBOND INDUSTRIAL LIMITED

- ITM Group

- Körber Technologies

- Makepak International

- Molins

- Orchid Tobacco Machinery

- Sasib SpA

- Tianjin Pioneering Machinery

The Global Cigarette Making Equipment Market was valued at USD 15.8 billion in 2024, with projections indicating a steady growth at a CAGR of 5.2% from 2025 to 2034. This growth is driven by the rising demand for automation within cigarette production. Manufacturers are increasingly turning to advanced automated machinery to enhance production efficiency, minimize costs, and meet the increasing demand for large-scale production while upholding consistent quality. In particular, there is a noticeable trend toward reducing manual labor through automation, which allows businesses to streamline operations and improve overall productivity. This shift not only addresses labor shortages but also responds to consumer expectations for high-quality products produced more cost-effectively. As automation technologies become more sophisticated, manufacturers are investing in equipment that can increase output and precision, further fueling the market's expansion.

One of the key segments driving this market is the tobacco feeder machines, which contributed USD 3.6 billion to the market in 2024. These machines are expected to continue their upward trajectory, with a forecasted CAGR of 5.9% through 2034. Tobacco feeder machines are integral to ensuring the accurate and consistent feeding of tobacco into rolling systems. Their role in enhancing operational efficiency, reducing material waste, and maintaining high product quality has made them essential in modern cigarette production lines. With their modular design, these machines can be easily upgraded to meet evolving production demands, further driving their adoption. Despite their advanced automation capabilities, some manual or semi-automated steps may still be necessary for certain tasks, such as filter placement and packaging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.8 Billion |

| Forecast Value | $26.3 Billion |

| CAGR | 5.2% |

The semi-automated segment also holds a significant market share, accounting for 45% in 2024, and is set to grow at a CAGR of 5.1% between 2025 and 2034. Semi-automated machines are particularly favored by small- and medium-scale manufacturers in emerging markets due to their affordability and flexibility. These machines offer a balance between cost-effectiveness and automation, performing core tasks like tobacco feeding, paper cutting, and rod formation while allowing for manual intervention in certain areas. Their modularity enables businesses to scale operations as needed without committing to full automation upfront.

The U.S. cigarette-making equipment market generated USD 1.9 billion in 2024, and it is projected to grow at a CAGR of 4.9% from 2025 to 2034. This growth is largely attributed to the country's focus on adopting advanced automation technologies and precision engineering. The U.S. is home to several leading manufacturers known for their innovative approaches and high-quality standards, which not only serve domestic needs but also cater to global markets. These manufacturers are committed to maintaining high regulatory standards, further propelling the growth of the market within the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing automation in production processes.

- 3.6.1.2 Rising demand for RYO and customizable cigarettes.

- 3.6.1.3 Expansion in emerging markets.

- 3.6.1.4 Adoption of sustainable manufacturing practices.

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Stringent government regulations on tobacco products.

- 3.6.2.2 Declining cigarette consumption in developed regions due to health awareness

- 3.6.1 Growth drivers

- 3.7 Technological & innovation landscape

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 – 2034 (USD Billion) (Thousand units)

- 5.1 Key trends

- 5.2 Tobacco feeder machines

- 5.3 Cigarette packaging machines

- 5.3.1 Primary packaging machines (Wrapping, Sealing)

- 5.3.2 Secondary packaging machines(Cartooning, Bundling)

- 5.4 Rod forming machinery

- 5.5 Cigarette filter making machines

- 5.6 Cutting machines

- 5.7 Flavoring & blending machinery

- 5.8 Material handling equipment

- 5.9 Others (rolling machines, curing machines, etc.)

Chapter 6 Market Estimates and Forecast, By Automation level, 2021 – 2034 (USD Billion) (Thousand units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-Automated

- 6.4 Fully automated

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 – 2034 (USD Billion) (Thousand units)

- 7.1 Key trends

- 7.2 Low-speed machines (under 4000 cigarettes/min)

- 7.3 Medium-speed machines (4000-8000 cigarettes/min)

- 7.4 High-speed machines (above 8000 cigarettes/min)

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Thousand units)

- 8.1 Key trends

- 8.2 Tobacco manufacturers

- 8.3 Small-Scale producers

- 8.4 Contract manufacturers

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Thousand units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Thousand units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 CBK

- 11.2 Cipta Bena Kencana

- 11.3 Decouflé

- 11.4 Dynamic Tools Pvt Ltd.

- 11.5 Focke & Co.

- 11.6 G.D S.p.A.

- 11.7 Hauni Maschinenbau GmbH

- 11.8 HK UPPERBOND INDUSTRIAL LIMITED

- 11.9 ITM Group

- 11.10 Körber Technologies

- 11.11 Makepak International

- 11.12 Molins

- 11.13 Orchid Tobacco Machinery

- 11.14 Sasib S.p.A.

- 11.15 Tianjin Pioneering Machinery