|

市场调查报告书

商品编码

1684664

甲酸钾市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Potassium Formate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

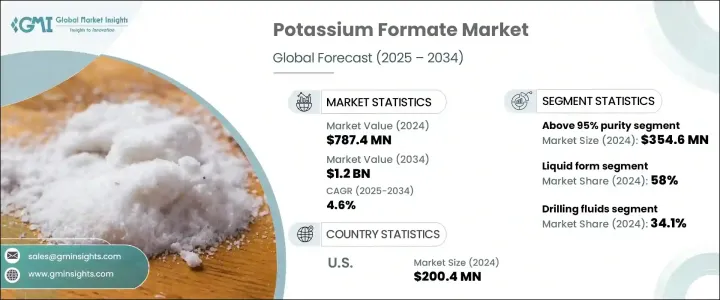

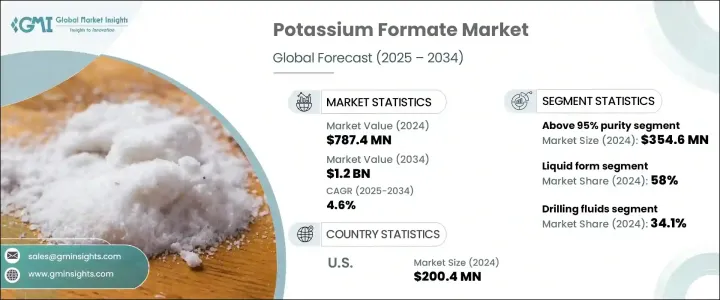

2024 年全球甲酸钾市场价值为 7.874 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.6%。甲酸钾是一种由用氢氧化钾中和甲酸而产生的有机盐,是一种用途广泛的化合物,由于其出色的性能,尤其是在极端条件下,可应用于各个行业。由于其环保特性,甲酸钾在多个领域的应用日益广泛,成为注重永续发展的产业的首选解决方案。

该化合物在高温环境下有效发挥作用的能力及其低毒性使其成为具有挑战性的应用的理想选择,特别是在石油和天然气、航空和除冰等领域。随着全球对环保和永续产品的需求不断增长,甲酸钾作为一种更安全的替代品,在传统上依赖刺激性化学品的行业中正获得显着的关注。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.874 亿美元 |

| 预测值 | 12亿美元 |

| 复合年增长率 | 4.6% |

甲酸钾市场成长的关键驱动力之一是提高石油采收率(EOR)产业。甲酸钾具有优异的热稳定性和最小的环境影响,是从困难油藏中提取石油的最佳选择。石油采收过程中对更永续和无毒化学品的需求正在增加,而甲酸钾越来越多地被用作满足这些需求的解决方案。除了石油和天然气工业之外,甲酸钾的低毒性、高稳定性和环保特性也吸引了包括传热流体和除冰剂在内的其他各种应用的关注。

甲酸钾市场按纯度等级细分,如低于 90%、90%-95% 和 95% 以上。 2024 年,纯度 95% 以上的部分引领市场,创造 3.546 亿美元的收入。这种高纯度的甲酸钾广泛用于关键应用,包括 EOR、除冰和传热流体,这些应用的性能和稳定性至关重要。其优异的溶解性和低杂质含量使其成为需要精确、可靠解决方案的行业的理想选择。随着永续实践继续受到重视,高纯度应用对甲酸钾的需求预计将进一步增长。

从形态上看,市场分为固体甲酸钾和液体甲酸钾。 2024 年液体甲酸钾占据市场主导地位,占有 58% 的份额。它易于使用、溶解迅速、流动顺畅,在各种应用中都非常有效,特别是在 EOR、除冰和传热流体中。液体形式因其效率和满足工业流程不断变化的需求的能力而受欢迎。随着对环保产品的需求不断增长,液体甲酸钾市场预计在未来几年将保持领先地位。

在美国,甲酸钾市场在 2024 年创造了 2.004 亿美元的收入,主要得益于其在石油和天然气、航空和暖通空调行业的应用。提高石油采收率和除冰等领域对永续、无毒化学品的推动极大地促进了市场的发展。此外,鼓励使用更安全、更环保的替代品的监管框架也促进了北美对甲酸钾的需求不断增加。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 高纯度甲酸钾在提高石油采收率作业的应用日益广泛

- 航空和运输业对环保除冰剂的需求不断增长

- 暖通空调和冷冻系统的进步推动了传热流体应用的成长

- 产业陷阱与挑战

- 对环境敏感地区钻井和完井液的监管限制。

- 来自替代除冰和钻井液配方的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模及预测:依纯度,2021-2034 年

- 主要趋势

- 低于 90%

- 90% - 95%

- 95%以上

第六章:市场规模及预测:依形式,2021-2034

- 主要趋势

- 坚硬的

- 液体

第 7 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 钻井液

- 完井液

- 除冰剂

- 传热流体

- 其他的

第 8 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Addcon

- American Elements

- BASF SE

- Clariant

- Dynalene

- Hangzhou Focus Chemical

- Hawkins

- Honeywell International

- Perstorp

- TETRA Technologies

The Global Potassium Formate Market was valued at USD 787.4 million in 2024 and is expected to grow at a CAGR of 4.6% from 2025 to 2034. Potassium formate, an organic salt created by neutralizing formic acid with potassium hydroxide, is a versatile compound with applications across various industries due to its outstanding performance, particularly under extreme conditions. The increasing adoption of potassium formate in several sectors is driven by its environmentally friendly properties, making it a preferred solution for industries focused on sustainability.

The compound's ability to perform effectively in high-temperature environments and its low toxicity make it ideal for challenging applications, especially in sectors like oil and gas, aviation, and de-icing. As the global demand for eco-friendly and sustainable products continues to rise, potassium formate is gaining significant traction as a safer alternative in industries traditionally reliant on harsher chemicals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $787.4 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 4.6% |

One of the key drivers of the potassium formate market growth is the enhanced oil recovery (EOR) sector. Potassium formate's excellent thermal stability and minimal environmental impact make it an optimal choice for oil extraction from difficult reservoirs. The demand for more sustainable and non-toxic chemicals in oil recovery processes is rising, and potassium formate is increasingly being adopted as a solution to meet these needs. Beyond the oil and gas industry, potassium formate's low toxicity, high stability, and eco-friendly characteristics are attracting attention from various other applications, including heat transfer fluids and de-icing agents.

The potassium formate market is segmented by purity levels, such as below 90%, 90%-95%, and above 95%. The above 95% purity segment led the market in 2024, generating USD 354.6 million in revenue. This high-purity form of potassium formate is widely used in critical applications, including EOR, de-icing, and heat transfer fluids, where performance and stability are paramount. Its superior solubility and low impurity levels make it ideal for industries that demand precise, reliable solutions. As sustainable practices continue to gain priority, the demand for potassium formate in high-purity applications is expected to grow even further.

In terms of form, the market is divided into solid and liquid potassium formate. Liquid potassium formate dominated the market in 2024, holding 58% of the share. Its ease of use, quick dissolution, and smooth flow make it highly effective in various applications, particularly in EOR, de-icing, and heat transfer fluids. The liquid form is popular due to its efficiency and ability to meet the evolving needs of industrial processes. With growing demand for environmentally safe products, the liquid potassium formate segment is projected to maintain its leading position in the coming years.

In the U.S., the potassium formate market generated USD 200.4 million in 2024, driven by its applications in the oil and gas, aviation, and HVAC industries. The push for sustainable, non-toxic chemicals in sectors such as EOR and de-icing has significantly boosted the market. Additionally, regulatory frameworks encouraging the use of safer, environmentally friendly alternatives are contributing to the rising demand for potassium formate across North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing adoption of high-purity potassium formate in enhanced oil recovery operations

- 3.6.1.2 Rising demand for environmentally friendly de-icing agents in aviation and transportation industries

- 3.6.1.3 Growth in heat transfer fluid applications driven by advancements in HVAC and refrigeration systems

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Regulatory restrictions on drilling and completion fluids in environmentally sensitive regions.

- 3.6.2.2 Competition from alternative de-icing and drilling fluid formulations

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Purity, 2021-2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Below 90%

- 5.3 90% - 95%

- 5.4 Above 95%

Chapter 6 Market Size and Forecast, By Form, 2021-2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Solid

- 6.3 Liquid

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 Drilling fluids

- 7.3 Completion fluids

- 7.4 De-icing agents

- 7.5 Heat transfer fluids

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Addcon

- 9.2 American Elements

- 9.3 BASF SE

- 9.4 Clariant

- 9.5 Dynalene

- 9.6 Hangzhou Focus Chemical

- 9.7 Hawkins

- 9.8 Honeywell International

- 9.9 Perstorp

- 9.10 TETRA Technologies