|

市场调查报告书

商品编码

1684673

生物模拟市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Biosimulation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

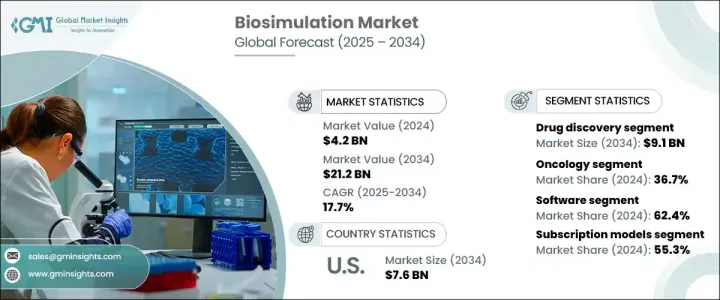

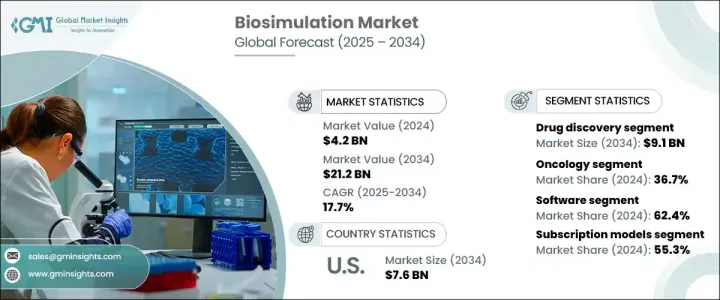

2024 年全球生物模拟市场规模达到 42 亿资料,预计 2025 年至 2034 年期间复合年增长率将达到 17.7%。这项创新技术提供了对不同条件下生物行为的无与伦比的洞察,支持药物发现、临床试验优化和个人化医疗开发等关键领域。

透过使研究人员能够以极高的精度模拟复杂的生物过程,生物模拟正在改变治疗方法的开发、评估和优化方式。它在降低开发成本、减轻风险和提高整体效率方面的作用使其成为现代医疗保健创新的基石。精准医疗的需求不断增长以及人工智慧和机器学习的日益应用进一步放大了生物模拟在医疗保健和製药行业的重要性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 42亿美元 |

| 预测值 | 212亿美元 |

| 复合年增长率 | 17.7% |

市场根据产品(包括软体和服务)进行细分。 2024 年,软体领域将占据 62.4% 的份额,这得益于其利用机器学习和先进演算法模拟复杂生物系统的能力。生物模拟软体主要分为两大类:整合软体套件/平台和独立模组。该技术透过提高药物功效和安全性的预测能力,增强了研究人员的能力,使他们能够在开发週期的早期就发现有前景的候选药物。这种早期识别加速了开发过程并显着降低了相关成本,增强了生物模拟在简化研发操作方面的价值。

生物模拟的应用涵盖多个领域,其中药物发现将在 2024 年引领市场,占据 42.5% 的份额。预计药物研发领域将大幅成长,到 2034 年将达到 91 亿美元。研究人员可以模拟生物过程、改进分子设计并精确验证目标,从而提高治疗效果并缩短新疗法的上市时间。对候选药物和生物系统之间复杂相互作用进行建模的能力将改变游戏规则,推动生物模拟市场向医疗保健领域的变革性进步迈进。

美国将继续保持生物模拟创新领域的全球领先地位,预计到 2034 年其市场规模将达到 76 亿美元。精准医疗的广泛应用严重依赖生物模拟来开发客製化疗法,这进一步推动了市场的成长。基于基因图谱的个人化治疗确保了对先进生物模拟工具的持续需求,加强了美国在临床和研究应用领域的开创性进步中的作用。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病盛行率上升

- 计算建模的技术进步

- 个人化医疗需求不断成长

- 增加人工智慧和机器学习的使用

- 产业陷阱与挑战

- 生物模拟软体和服务成本高昂

- 缺乏熟练的专业人员

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按供应量,2021 – 2034 年

- 主要趋势

- 软体

- 整合软体套件/平台

- 分子建模和模拟软体

- 临床试验设计软体

- PK/PD 建模和模拟软体

- Pbpk建模与模拟软体

- 毒性预测软体

- 其他整合软体套件/平台

- 独立模组

- 整合软体套件/平台

- 服务

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 药物研发

- 药物开发

- 疾病模型

- 其他应用

第 7 章:市场估计与预测:按治疗领域,2021 年至 2034 年

- 主要趋势

- 肿瘤学

- 心血管疾病

- 神经系统疾病

- 传染病

- 其他治疗领域

第 8 章:市场估计与预测:按交付模式,2021 年至 2034 年

- 主要趋势

- 订阅模式

- 所有权模式

- 基于许可的模式

- 按使用付费模式

- 基于服务的模型

第 9 章:市场估计与预测:按部署模型,2021 年至 2034 年

- 主要趋势

- 本地模型

- 基于云端的模型

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 製药和生物技术公司

- 合约研究组织 (CRO)

- 学术研究机构

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 12 章:公司简介

- Allucent

- Advanced Chemistry Development

- Certara, USA

- Cellworks

- Chemical Computing Group

- Dassault Systèmes

- Genedata

- In Silico Biosciences

- Immunetrics

- OpenEye

- Physiomics

- Simulations Plus

- Schrödinger

- Thermo Fisher Scientific

- VeriSIM Life

The Global Biosimulation Market reached USD 4.2 billion in 2024 and is projected to grow at an impressive CAGR of 17.7% between 2025 and 2034. Biosimulation, a cutting-edge approach in computational biology, leverages advanced mathematical models, sophisticated algorithms, and experimental data to replicate biological systems, processes, and interactions. This innovative technology delivers unparalleled insights into biological behavior under diverse conditions, supporting critical sectors such as drug discovery, clinical trial optimization, and personalized medicine development.

By enabling researchers to simulate complex biological processes with exceptional accuracy, biosimulation is transforming how therapies are developed, assessed, and optimized. Its role in reducing development costs, mitigating risks, and enhancing overall efficiency makes it a cornerstone of modern healthcare innovation. The growing demand for precision medicine and the increasing adoption of artificial intelligence and machine learning further amplify the significance of biosimulation in the healthcare and pharmaceutical industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $21.2 Billion |

| CAGR | 17.7% |

The market is segmented based on offerings, including software and services. In 2024, the software segment dominated with a 62.4% share, driven by its ability to leverage machine learning and advanced algorithms for simulating intricate biological systems. Biosimulation software is available in two primary categories: integrated software suites/platforms and standalone modules. This technology empowers researchers by improving the prediction of drug efficacy and safety, enabling the identification of promising drug candidates earlier in the development cycle. This early identification accelerates the development process and significantly reduces associated costs, reinforcing the value of biosimulation in streamlining research and development operations.

Applications of biosimulation span multiple domains, with drug discovery leading the market in 2024, accounting for a 42.5% share. The drug discovery segment is anticipated to grow substantially, reaching USD 9.1 billion by 2034. Biosimulation enables the use of computational models to predict the behavior of potential drugs, minimizing the likelihood of costly late-stage failures. Researchers can simulate biological processes, refine molecular designs, and validate targets with precision, enhancing therapeutic efficacy and reducing time-to-market for new treatments. The ability to model complex interactions between drug candidates and biological systems is a game-changer, propelling the biosimulation market toward transformative advancements in healthcare.

The United States is set to remain a global leader in biosimulation innovation, with its market projected to reach USD 7.6 billion by 2034. The country's robust ecosystem, featuring premier research institutions and universities, underpins advancements in computational biology and biosimulation. The widespread adoption of precision medicine, which relies heavily on biosimulation to develop tailored therapies, further fuels market growth. The focus on personalized treatments based on genetic profiles ensures sustained demand for advanced biosimulation tools, strengthening the role of the U.S. in pioneering advancements across clinical and research applications.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Technological advancements in computational modeling

- 3.2.1.3 Rising demand for personalized medicine

- 3.2.1.4 Increasing use of AI and machine Learning

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of biosimulation software and services

- 3.2.2.2 Lack of skilled professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Offering, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Integrated software suites/platform

- 5.2.1.1 Molecular modeling and simulation software

- 5.2.1.2 Clinical trial design software

- 5.2.1.3 PK/PD modeling and simulation software

- 5.2.1.4 Pbpk modeling and simulation software

- 5.2.1.5 Toxicity prediction software

- 5.2.1.6 Other integrated software suites/platforms

- 5.2.2 Standalone modules

- 5.2.1 Integrated software suites/platform

- 5.3 Service

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Drug discovery

- 6.3 Drug development

- 6.4 Disease modeling

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Therapeutic Area, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oncology

- 7.3 Cardiovascular disease

- 7.4 Neurological disorder

- 7.5 Infectious diseases

- 7.6 Other therapeutic areas

Chapter 8 Market Estimates and Forecast, By Delivery Model, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Subscription models

- 8.3 Ownership models

- 8.3.1 License-based model

- 8.3.2 Pay per use model

- 8.4 Service based models

Chapter 9 Market Estimates and Forecast, By Deployment Model, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 On premises model

- 9.3 Cloud based model

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Pharmaceutical and biotechnology companies

- 10.3 Contract research organizations (CROs)

- 10.4 Academic research institutions

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Allucent

- 12.2 Advanced Chemistry Development

- 12.3 Certara, USA

- 12.4 Cellworks

- 12.5 Chemical Computing Group

- 12.6 Dassault Systèmes

- 12.7 Genedata

- 12.8 In Silico Biosciences

- 12.9 Immunetrics

- 12.10 OpenEye

- 12.11 Physiomics

- 12.12 Simulations Plus

- 12.13 Schrödinger

- 12.14 Thermo Fisher Scientific

- 12.15 VeriSIM Life