|

市场调查报告书

商品编码

1684676

静脉注射 (IV) 布洛芬市场机会、成长动力、产业趋势分析与预测 2025 - 2034Intravenous (IV) Ibuprofen Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

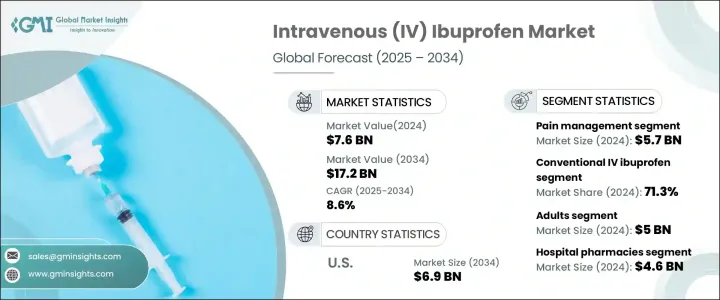

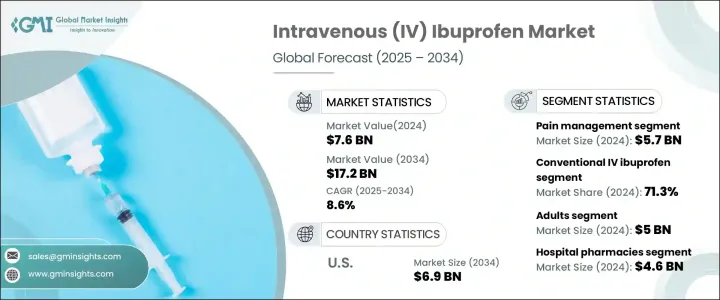

2024 年全球静脉注射布洛芬市值达到 76 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到惊人的 8.6%。这一增长轨迹反映了慢性和急性疾病(包括关节炎、心血管疾病和特定癌症)的盛行率上升,这些疾病通常需要静脉注射布洛芬等有效的疼痛管理解决方案。此外,医疗保健基础设施的进步、人们对非阿片类疼痛管理替代品的认识的提高以及静脉注射药物配方的创新正在促进市场扩张。不同医疗环境中对快速、有效、安全的镇痛解决方案的需求持续增长,使得静脉注射布洛芬成为全球医疗保健提供者的首选。

市场包括两个主要产品类别:常规静脉注射布洛芬和高浓度静脉注射布洛芬。传统静脉注射布洛芬占 2024 年 71.3% 的市场份额,由于其广泛用于快速缓解疼痛,尤其是在急诊室和术后场景,仍然是主导产品类型。其经过验证的功效和安全性巩固了其作为医疗专业人士信赖的解决方案的地位。由于其易于操作和对控制疼痛具有即时的效果,它成为了现代医疗保健中不可或缺的工具,推动了该领域的持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 76亿美元 |

| 预测值 | 172亿美元 |

| 复合年增长率 | 8.6% |

按年龄层划分,市场服务于儿童和成年人群,仅 2024 年成年人市场就将创收 50 亿美元。人口老化,特别是患有关节炎和肌肉骨骼疾病等慢性疼痛疾病的人,对静脉注射布洛芬的需求巨大。这种人口结构的变化凸显了人们对快速止痛疗法的日益依赖,尤其是当医疗保健提供者优先考虑在临床和门诊环境中尽量减少患者的不适时。随着全球老年人口的不断扩大,预计成年人口群体在预测期内仍将占据主导地位。

在美国,静脉注射布洛芬市场预计将大幅成长,到 2034 年将达到 69 亿美元。推动这一增长的因素包括术后疼痛、肌肉骨骼疾病和其他与伤害相关的疾病的高盛行率。美国医疗保健系统注重有效的疼痛管理解决方案和庞大的患者群体,这增加了对静脉注射布洛芬的需求。监管部门的认可进一步支持了这一趋势。政府和卫生部门在通讯中强调了静脉注射布洛芬在治疗轻度至中度疼痛方面的功效,以及其与阿片类镇痛药一起在治疗重度疼痛方面的补充作用。这项监管支持增强了医疗保健提供者的信心,使静脉注射布洛芬成为全国范围内值得信赖的、缓解疼痛的首选方案。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 术后疼痛发生率增加

- 非阿片类疼痛管理的进展

- 急诊和急救部门的入院人数不断增加

- 静脉给药技术的进展

- 产业陷阱与挑战

- 与口服替代品相比成本较高

- 潜在的副作用和禁忌症

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按产品类型,2021 年至 2034 年

- 主要趋势

- 常规静脉注射布洛芬

- 高浓度静脉注射布洛芬

第 6 章:市场估计与预测:按适应症,2021 年至 2034 年

- 主要趋势

- 疼痛管理

- 发热管理

第七章:市场估计与预测:依年龄组,2021 – 2034 年

- 主要趋势

- 儿科

- 成年人

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 电子商务

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AFT Pharmaceuticals

- Al Nabeel International

- Alveda Pharmaceuticals

- CSL Limited

- Cumberland Pharmaceuticals

- Fresenius SE & Co. KGaA

- Grifols

- Harbin Gloria Pharmaceuticals

- Hyloris Pharmaceuticals

- Laboratorios Valmorca

- Recordati

- Sandor Medicaids

- Soho Industri Pharmasi

- Teligent

- XGEN Pharmaceuticals

The Global Intravenous Ibuprofen Market reached a valuation of USD 7.6 billion in 2024 and is forecasted to expand at an impressive CAGR of 8.6% between 2025 and 2034. This growth trajectory reflects the rising prevalence of chronic and acute conditions, including arthritis, cardiovascular diseases, and specific cancers, which frequently necessitate effective pain management solutions like intravenous ibuprofen. Additionally, advancements in healthcare infrastructure, increasing awareness about non-opioid pain management alternatives, and innovations in intravenous drug formulations are bolstering market expansion. The demand for quick, effective, and safe analgesic solutions across diverse medical settings continues to grow, positioning intravenous ibuprofen as a preferred option for healthcare providers worldwide.

The market comprises two primary product categories: conventional intravenous ibuprofen and high-concentration intravenous ibuprofen. Conventional intravenous ibuprofen, accounting for 71.3% of the market share in 2024, remains the dominant product type due to its widespread use for rapid pain relief, especially in emergency rooms and post-surgical scenarios. Its proven efficacy and safety profile have solidified its place as a trusted solution among medical professionals. The ease of administration and immediate impact in managing pain make it an indispensable tool in modern healthcare, driving continued growth for this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $17.2 Billion |

| CAGR | 8.6% |

Segmented by age group, the market serves both pediatric and adult populations, with adults generating USD 5 billion in 2024 alone. The aging population, particularly those dealing with chronic pain conditions such as arthritis and musculoskeletal disorders, is driving significant demand for intravenous ibuprofen. This demographic shift underscores the increasing reliance on fast-acting pain relief options, especially as healthcare providers prioritize minimizing patient discomfort in clinical and outpatient settings. With the elderly population expanding globally, the adult segment is expected to maintain its dominance over the forecast period.

In the United States, the intravenous ibuprofen market is projected to grow substantially, reaching USD 6.9 billion by 2034. Factors fueling this growth include the high prevalence of post-surgical pain, musculoskeletal disorders, and other injury-related conditions. The U.S. healthcare system's focus on effective pain management solutions and the large patient base amplifies the demand for intravenous ibuprofen. Regulatory endorsements further support this trend. Government and health authority communications have emphasized the efficacy of intravenous ibuprofen in treating mild to moderate pain and its complementary role alongside opioid analgesics for severe pain management. This regulatory backing enhances healthcare providers' confidence, making intravenous ibuprofen a trusted and preferred option in pain relief protocols across the nation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of post-operative pain

- 3.2.1.2 Advancements in non-opioid pain management

- 3.2.1.3 Rising admissions in emergency and acute care departments

- 3.2.1.4 Advances in intravenous drug delivery technologies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost compared to oral alternatives

- 3.2.2.2 Potential side effects and contraindications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Conventional IV ibuprofen

- 5.3 High-concentration IV ibuprofen

Chapter 6 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pain management

- 6.3 Fever management

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatrics

- 7.3 Adults

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AFT Pharmaceuticals

- 10.2 Al Nabeel International

- 10.3 Alveda Pharmaceuticals

- 10.4 CSL Limited

- 10.5 Cumberland Pharmaceuticals

- 10.6 Fresenius SE & Co. KGaA

- 10.7 Grifols

- 10.8 Harbin Gloria Pharmaceuticals

- 10.9 Hyloris Pharmaceuticals

- 10.10 Laboratorios Valmorca

- 10.11 Recordati

- 10.12 Sandor Medicaids

- 10.13 Soho Industri Pharmasi

- 10.14 Teligent

- 10.15 XGEN Pharmaceuticals