|

市场调查报告书

商品编码

1684679

十二指肠镜市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Duodenoscopes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

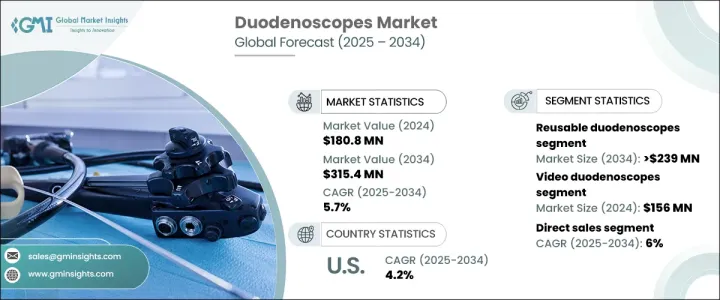

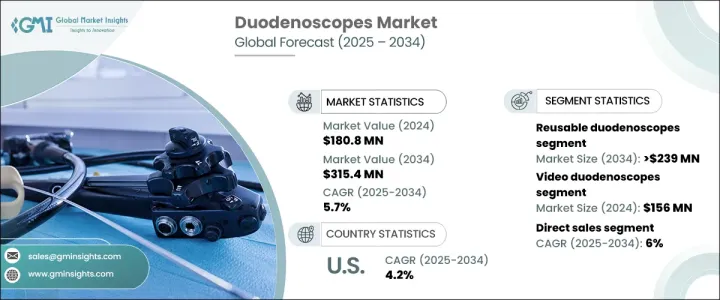

2024 年全球十二指肠镜市场价值为 1.808 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.7%。这一成长轨迹反映了对微创手术的需求激增以及胃肠道医疗保健的进步。十二指肠镜在诊断和治疗多种胃肠道和肝臟胰胆疾病中发挥至关重要的作用。这些设备在支架置入、结石取出、狭窄管理等治疗介入的应用,使得它们成为现代医疗保健中不可或缺的设备。人们对感染控制的日益重视,加上科技的进步,进一步推动了十二指肠镜的普及。此外,全球人口老化导致易患胃肠道疾病,这继续推动对有效诊断工具的需求,巩固了市场的上升趋势。

市场分为可重复使用和一次性十二指肠镜,其中可重复使用的设备占据显着的成长。可重复使用的十二指肠镜市场预计将以 5.5% 的复合年增长率成长,到 2034 年将达到 2.39 亿美元。可重复使用的十二指肠镜因其成本效益和对大容量环境的适应性而成为医院和诊所的首选。这些设备具有可拆卸组件,旨在彻底清洁,最大限度地降低交叉污染风险并增强其长期使用的吸引力。这使得它们成为专注于保持安全性和效率同时降低程序成本的医疗保健提供者的理想解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.808 亿美元 |

| 预测值 | 3.154 亿美元 |

| 复合年增长率 | 5.7% |

十二指肠镜有两种:视讯十二指肠镜和光纤十二指肠镜。视讯十二指肠镜占据市场主导地位,占有相当大的份额,到 2024 年价值将达到 1.56 亿美元。这些先进的设备提供无与伦比的成像质量,使医疗专业人员能够准确诊断和治疗胃肠道问题。凭藉即时视觉化功能,视讯十二指肠镜可支援手术过程中的精确决策。它们整合了窄带成像 (NBI) 等先进的成像技术,增强了对血管和黏膜异常的检测。这些特点对于微创手术尤其有价值,与传统手术方法相比,微创手术可确保更快的恢復时间并降低风险。

2024 年美国十二指肠镜市场价值为 7,140 万美元,预计 2025 年至 2034 年期间的复合年增长率为 4.2%。这一增长是由胃肠道疾病的高盛行率和对先进诊断和治疗工具的不断增长的需求所推动的。视讯十二指肠镜采用高清成像和人工智慧,显着提高了诊断准确性,进一步刺激了美国医疗保健行业的需求。这些进步提高了手术效率和病患治疗效果,巩固了十二指肠镜作为现代医疗实践的重要组成部分的地位。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 胃肠道疾病发生率不断上升

- 设备技术进步

- 意识和诊断率不断提高

- 产业陷阱与挑战

- 成本高且监管要求严格

- 成长动力

- 成长潜力分析

- 监管格局

- 定价分析

- 报销场景

- 技术格局

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 可重复使用的十二指肠镜

- 免洗十二指肠镜

第六章:市场估计与预测:依类别,2021 — 2034 年

- 主要趋势

- 影片十二指肠镜

- 光纤十二指肠镜

第 7 章:市场估计与预测:按销售管道,2021 年至 2034 年

- 主要趋势

- 直接销售

- 经销商

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用户

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Ambu

- Boston Scientific

- FUJIFILM

- OLYMPUS

- Ottomed Endoscopy

- PENTAX MEDICAL

- SonoScape

- STORZ

The Global Duodenoscopes Market was valued at USD 180.8 million in 2024 and is projected to expand at a CAGR of 5.7% between 2025 and 2034. This growth trajectory reflects a surge in demand for minimally invasive procedures and advancements in gastrointestinal healthcare. Duodenoscopes play a vital role in diagnosing and treating a wide range of gastrointestinal and hepatopancreaticobiliary conditions. Their use in therapeutic interventions such as stent placements, stone removals, and stricture management has made these devices indispensable in modern healthcare. A growing emphasis on infection control, coupled with technological advancements, is further propelling the adoption of duodenoscopes. Additionally, the aging global population-vulnerable to gastrointestinal disorders-continues to fuel the demand for effective diagnostic tools, cementing the market's upward trend.

The market is divided into reusable and single-use duodenoscopes, with reusable devices accounting for significant growth. The reusable duodenoscope segment is expected to grow at a CAGR of 5.5%, reaching USD 239 million by 2034. Reusable duodenoscopes are a preferred choice for hospitals and clinics due to their cost-effectiveness and adaptability to high-volume settings. These devices feature removable components designed for thorough cleaning, minimizing cross-contamination risks and enhancing their appeal for long-term use. This makes them an ideal solution for healthcare providers focused on maintaining safety and efficiency while reducing procedural costs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $180.8 Million |

| Forecast Value | $315.4 Million |

| CAGR | 5.7% |

Duodenoscopes are available in two categories: video duodenoscopes and fiber optic duodenoscopes. Video duodenoscopes dominate the market, holding a substantial share with a value of USD 156 million in 2024. These advanced devices offer unparalleled imaging quality, enabling healthcare professionals to accurately diagnose and treat gastrointestinal issues. With real-time visualization capabilities, video duodenoscopes support precise decision-making during procedures. Their integration of advanced imaging technologies, such as narrow band imaging (NBI), enhances the detection of vascular and mucosal abnormalities. These features are particularly valuable for minimally invasive procedures, which ensure quicker recovery times and reduced risks compared to traditional surgical methods.

The U.S. duodenoscopes market was valued at USD 71.4 million in 2024 and is set to grow at a CAGR of 4.2% between 2025 and 2034. This growth is driven by a high prevalence of gastrointestinal disorders and a rising demand for advanced diagnostic and therapeutic tools. The adoption of high-definition imaging and artificial intelligence in video duodenoscopes is significantly improving diagnostic accuracy, further boosting demand in the U.S. healthcare sector. These advancements enhance procedural efficiency and patient outcomes, solidifying the role of duodenoscopes as an essential component of modern medical practice.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of gastrointestinal diseases

- 3.2.1.2 Technological advancements in devices

- 3.2.1.3 Rising awareness and diagnosis rates

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pricing analysis

- 3.6 Reimbursement scenario

- 3.7 Technology landscape

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reusable duodenoscopes

- 5.3 Single-use duodenoscopes

Chapter 6 Market Estimates and Forecast, By Category, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Video duodenoscopes

- 6.3 Fiber optic duodenoscopes

Chapter 7 Market Estimates and Forecast, By Sales Channel, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Distributors

Chapter 8 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ambu

- 10.2 Boston Scientific

- 10.3 FUJIFILM

- 10.4 OLYMPUS

- 10.5 Ottomed Endoscopy

- 10.6 PENTAX MEDICAL

- 10.7 SonoScape

- 10.8 STORZ