|

市场调查报告书

商品编码

1684685

智慧汽车架构市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Smart Vehicle Architecture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

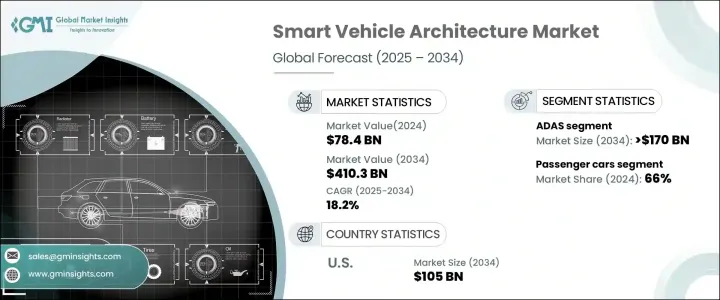

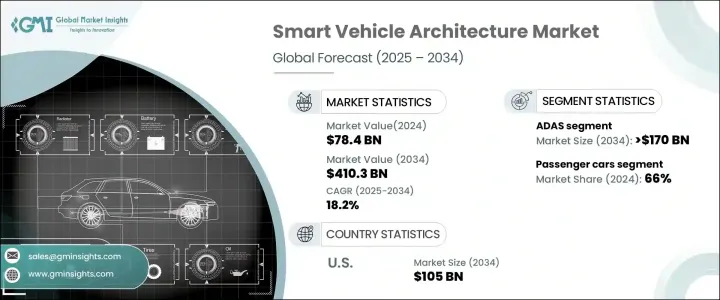

2024 年全球智慧汽车架构市场价值 784 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到 18.2%。随着汽车技术的发展,製造商优先考虑无缝连接,整合车对车 (V2X)、智慧远端资讯处理和先进诊断工具等尖端通讯系统。 5G网路的广泛部署进一步加速了这一转变,实现了更快的资料传输、增强了服务可靠性并降低了延迟。

这些进步正在改变汽车格局,为提供无与伦比的连接性和用户体验的智慧、软体驱动汽车铺平了道路。随着电动车 (EV) 的发展势头强劲,汽车製造商正在重新构想车辆架构,以适应支援传统和电动动力系统的灵活模组化设计。这种转变不仅优化了生产效率,也满足了消费者对增强安全性、便利性和自动化程度的连网、软体定义汽车日益增长的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 784亿美元 |

| 预测值 | 4103亿美元 |

| 复合年增长率 | 18.2% |

智慧汽车架构由一系列变革性技术驱动,包括 V2X 通讯、高级驾驶辅助系统 (ADAS)、资讯娱乐和连接、无线 (OTA) 更新、网路安全解决方案以及具有机器学习 (ML) 的人工智慧 (AI)。 2024年,ADAS占据51%的市场份额,在提高车辆安全性和自动化方面发挥关键作用。随着汽车製造商专注于先进的驾驶辅助功能,自适应巡航控制、自动紧急煞车和交通标誌识别等功能正在成为业界标准。随着监管机构推动更严格的安全合规,这些技术的快速整合不仅增强了使用者体验,也推动了市场成长。

市场按车辆类型细分,包括乘用车、商用车和电动车。 2024 年,受高产量、不断增长的消费者需求以及先进车载技术的广泛采用的推动,乘用车将以 66% 的份额占据市场主导地位。随着城市化加速和城市人口成长,乘用车仍然是首选的交通方式,消费者越来越多地寻求具有无缝连接、电气化和创新功能的车辆。对下一代资讯娱乐系统、自动驾驶功能和整合 AI 解决方案的需求正在推动进一步创新,使智慧汽车架构成为汽车未来的关键组成部分。

2024 年,美国智慧汽车架构市场占有 85% 的份额,证明了该国在汽车创新方面的领导地位。到 2034 年,美国市场预计将创收 1,050 亿美元,反映出其积极采用先进的汽车技术。大型科技公司的存在,加上对人工智慧驱动的自动驾驶汽车开发的高度重视,使美国成为智慧汽车架构的全球领导者。该地区的汽车製造商正在率先在电动车和自动驾驶汽车中整合智慧汽车系统,从而巩固了市场主导地位。随着人工智慧、连接性和电气化的不断进步,智慧汽车架构的未来将在全球范围内重新定义移动性和交通运输。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 技术提供者

- 零件供应商

- 原始设备製造商

- 最终用户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 连网汽车需求不断成长

- 电动车的成长

- 自动驾驶汽车的普及率不断提高

- 越来越关注软体定义汽车

- 产业陷阱与挑战

- 开发成本高

- 资料安全和隐私问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 高级驾驶辅助系统

- 资讯娱乐和连接

- V2x 通信

- 无线 (OTA) 更新

- 网路安全解决方案

- 人工智慧与机器学习

第六章:市场估计与预测:依建筑分类,2021 - 2034 年

- 主要趋势

- 集中式架构

- 区域架构

- 模组化平台

- 分散式架构

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 商用车

- 电动车

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 自动驾驶

- 资讯娱乐和使用者体验

- 安全与保障

- 车队管理

- 能源管理

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Aptiv

- Mobileye

- Magna International

- RT-RK

- Huawei Intelligent Automotive Solution (Yinwang)

- Infineon Technologies

- Momenta

- Bosch

- Continental AG

- NVIDIA

- Qualcomm

- Texas Instruments

- Renesas Electronics

- Valeo

- Denso Corporation

- ZF Friedrichshafen

- Panasonic Automotive Systems

- Harman International

- Delphi Technologies

- Lear Corporation

The Global Smart Vehicle Architecture Market generated USD 78.4 billion in 2024 and is expected to expand at a remarkable CAGR of 18.2% between 2025 and 2034. As automotive technology evolves, manufacturers are prioritizing seamless connectivity, integrating cutting-edge communication systems such as Vehicle-to-Everything (V2X), intelligent telematics, and advanced diagnostic tools. The widespread rollout of 5G networks is further accelerating this shift, enabling faster data transmission, enhanced service reliability, and reduced latency.

These advancements are transforming the automotive landscape, paving the way for intelligent, software-driven vehicles that offer unparalleled connectivity and user experience. With electric vehicles (EVs) gaining momentum, automakers are reimagining vehicle architectures to accommodate flexible, modular designs that support both traditional and electric powertrains. This shift is not only optimizing production efficiency but also meeting the rising consumer demand for connected, software-defined vehicles that enhance safety, convenience, and automation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $78.4 Billion |

| Forecast Value | $410.3 Billion |

| CAGR | 18.2% |

Smart vehicle architecture is being driven by a suite of transformative technologies, including V2X communication, Advanced Driver Assistance Systems (ADAS), infotainment and connectivity, Over-the-Air (OTA) updates, cybersecurity solutions, and artificial intelligence (AI) with machine learning (ML). In 2024, ADAS accounted for 51% of the market share, playing a critical role in improving vehicle safety and automation. As automakers focus on advanced driver-assistance capabilities, features such as adaptive cruise control, automatic emergency braking, and traffic sign recognition are becoming industry standards. The rapid integration of these technologies is not only enhancing user experience but also propelling market growth as regulatory bodies push for stricter safety compliance.

The market is segmented by vehicle type, including passenger cars, commercial vehicles, and EVs. In 2024, passenger cars dominated the market with a 66% share, driven by high production volumes, growing consumer demand, and widespread adoption of advanced in-car technologies. As urbanization accelerates and city populations grow, passenger vehicles remain the preferred mode of transport, with consumers increasingly seeking vehicles that offer seamless connectivity, electrification, and innovative features. The demand for next-generation infotainment systems, autonomous driving capabilities, and integrated AI solutions is fueling further innovation, making smart vehicle architectures a key component of the automotive future.

U.S. smart vehicle architecture market held a commanding 85% share in 2024, a testament to the country's leadership in automotive innovation. By 2034, the U.S. market is projected to generate USD 105 billion, reflecting its aggressive adoption of advanced automotive technologies. The presence of major tech companies, along with a strong emphasis on AI-driven autonomous vehicle development, is positioning the U.S. as a global leader in smart vehicle architecture. Automakers in the region are spearheading the integration of intelligent vehicle systems in both EVs and autonomous vehicles, reinforcing the market's dominance. With ongoing advancements in AI, connectivity, and electrification, the future of smart vehicle architecture is set to redefine mobility and transportation on a global scale.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Technology providers

- 3.1.2 Component suppliers

- 3.1.3 OEMs

- 3.1.4 End user

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing demand for connected vehicles

- 3.7.1.2 Growth of electric vehicles

- 3.7.1.3 Rising adoption of autonomous vehicles

- 3.7.1.4 Increasing focus on software-defined vehicles

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High development costs

- 3.7.2.2 Data security & privacy concerns

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 ADAS

- 5.3 Infotainment & connectivity

- 5.4 V2x communication

- 5.5 Over-the-air (OTA) updates

- 5.6 Cybersecurity solutions

- 5.7 AI & ML

Chapter 6 Market Estimates & Forecast, By Architecture, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Centralized architectures

- 6.3 Zonal architectures

- 6.4 Modular platforms

- 6.5 Distributed architectures

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.3 Commercial vehicles

- 7.4 Electric vehicles

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Autonomous driving

- 8.3 Infotainment & user experience

- 8.4 Safety & security

- 8.5 Fleet management

- 8.6 Energy management

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aptiv

- 10.2 Mobileye

- 10.3 Magna International

- 10.4 RT-RK

- 10.5 Huawei Intelligent Automotive Solution (Yinwang)

- 10.6 Infineon Technologies

- 10.7 Momenta

- 10.8 Bosch

- 10.9 Continental AG

- 10.10 NVIDIA

- 10.11 Qualcomm

- 10.12 Texas Instruments

- 10.13 Renesas Electronics

- 10.14 Valeo

- 10.15 Denso Corporation

- 10.16 ZF Friedrichshafen

- 10.17 Panasonic Automotive Systems

- 10.18 Harman International

- 10.19 Delphi Technologies

- 10.20 Lear Corporation