|

市场调查报告书

商品编码

1684700

自行车功率计市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Cycling Power Meter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

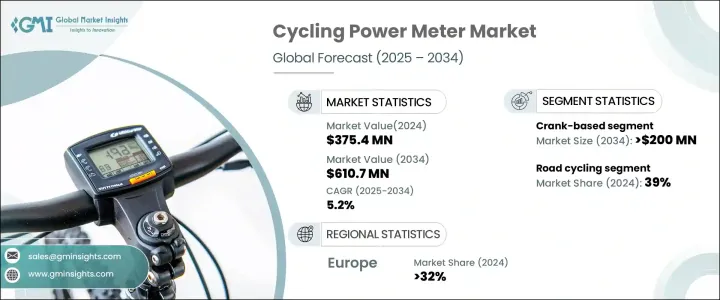

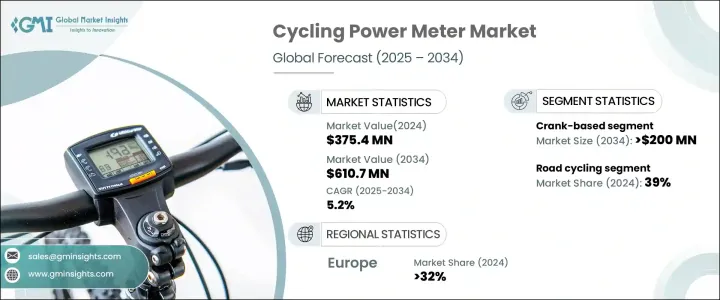

2024 年全球自行车功率计市场规模达到 3.754 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.2%。自行车界越来越多地采用数位框架和数据驱动的训练方法,大大推动了对自行车功率计的需求。这些设备可以测量骑车人踩踏板时施加的力,这对于提高运动表现至关重要。竞技自行车和耐力训练的日益普及,促使骑士寻求精确的表现追踪工具,以确保他们的训练方案达到最高效率。

市场也见证了创新的激增,特别是在智慧训练器、网路连接自行车平台和穿戴式健身设备方面。这些进步加强了自行车功率计与其他智慧仪器的集成,创造了无缝的训练生态系统。这种增强的连接功能使骑乘者能够分析即时资料、优化他们的表现并获得对需要改进的领域的宝贵见解。随着越来越多的骑乘者接受结构化的训练计划,对这些设备的需求也会增加。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.754 亿美元 |

| 预测值 | 6.107 亿美元 |

| 复合年增长率 | 5.2% |

根据功率计类型,市场分为基于踏板的、基于曲柄的、基于轮毂的、底部支架的和其他的。 2024 年,基于曲柄的细分市场占据了超过 31% 的市场份额,预计到 2034 年将超过 2 亿美元。基于曲柄的功率计仍然是一种受欢迎的选择,因为它们可以精确地测量功率输出,这对于有效的训练至关重要。这些仪表位于自行车传动系统的核心,可提供可靠的资料,同时保持与其他零件的相对独立性。路边骑行者,特别是使用电动自行车的骑行者,推动了曲柄式功率计设计的创新,确保了其在市场上的持续主导地位。

根据应用,市场分为公路自行车、山地自行车、室内训练和其他。 2024 年,公路车占据了约 39% 的市场。对数据驱动的训练方法的日益重视导致人们越来越依赖自行车功率计来优化性能。特别是在竞技公路自行车赛中,对这些设备的需求激增,因为它们可以提供精确的踏板力测量,帮助骑乘者提高速度和耐力。业余和专业骑士都认为功率计是提高训练效率的重要工具。

2024 年,欧洲将以超过 32% 的市场份额引领全球自行车功率计市场,其中德国占据了该地区相当大一部分需求。德国强大的自行车文化、先进的基础设施以及对基于表现的训练的日益重视促进了市场扩张。德国作为竞技自行车运动实力最强的国家之一,拥有大量专业和业余自行车手,他们积极使用功率计来微调自己的表现。预计这一趋势将持续下去,巩固欧洲作为自行车功率计主要市场的地位。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 原物料供应商

- 电力仪表生产厂家

- 软体和资料分析提供商

- 最终用户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 定价分析

- 衝击力

- 成长动力

- 对数据驱动培训的需求不断增加

- 竞技自行车运动日益流行

- 智慧自行车技术的进步

- 室内自行车和虚拟自行车平台的成长

- 产业陷阱与挑战

- 初期成本高

- 相容性和整合挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按功率计类型,2021 - 2034 年

- 主要趋势

- 踏板式

- 曲柄式

- 基于枢纽

- 底部支架

- 其他的

第 6 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 公路骑行

- 山区骑行

- 室内训练

- 其他的

第 7 章:市场估计与预测:按连结类型,2021 - 2034 年

- 主要趋势

- ANT+

- 蓝牙

第 8 章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 在线的

- 离线

- 专业体育用品店

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- 4iiii Innovations

- Easton Cycling

- Favero electronics

- Full Speed Ahead

- Garmin

- LOOK

- Magene

- Polar Electro

- Power2max

- Rotor

- Shimano

- SRAM

- SRM

- Stages Cycling

- Team ZWATT

- Verve Cycling

- Wahoo Fitness

The Global Cycling Power Meter Market reached USD 375.4 million in 2024 and is expected to grow at a CAGR of 5.2% between 2025 and 2034. The increasing adoption of digital frameworks and data-driven training methodologies in the cycling community has significantly fueled the demand for cycling power meters. These devices measure the force exerted by a cyclist during pedaling, making them essential for performance enhancement. The growing popularity of competitive cycling and endurance training has pushed riders to seek precise performance-tracking tools, ensuring maximum efficiency in their training regimens.

The market has also witnessed a surge in innovations, particularly in smart trainers, internet-connected cycling platforms, and wearable fitness devices. These advancements have strengthened the integration of cycling power meters with other smart instruments, creating a seamless training ecosystem. This enhanced connectivity allows cyclists to analyze real-time data, optimize their performance, and gain valuable insights into areas that require improvement. As more cyclists embrace structured training programs, the demand for these devices is set to rise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $375.4 Million |

| Forecast Value | $610.7 Million |

| CAGR | 5.2% |

Based on power meter type, the market is segmented into pedal-based, crank-based, hub-based, bottom bracket, and others. In 2024, the crank-based segment accounted for over 31% of the market and is expected to exceed USD 200 million by 2034. Crank-based power meters remain a popular choice due to their precise power output measurements, which are critical for effective training. Positioned at the heart of a bike's drivetrain, these meters provide reliable data while remaining relatively independent of other components. Roadside cyclists, particularly those using electric bicycles, have driven innovations in crank-based power meter design, ensuring their continued dominance in the market.

By application, the market is categorized into road cycling, mountain biking, indoor training, and others. Road cycling held approximately 39% of the market share in 2024. The growing emphasis on data-driven training methods has led to an increasing reliance on cycling power meters for performance optimization. Competitive road cycling, in particular, has seen a surge in demand for these devices as they offer precise pedal force measurements, helping cyclists enhance their speed and endurance. Amateur and professional riders alike consider power meters an essential tool for improving their training efficiency.

Europe led the global cycling power meter market with over 32% market share in 2024, with Germany holding a substantial portion of the regional demand. Germany's robust cycling culture, advanced infrastructure, and growing focus on performance-based training have contributed to market expansion. As one of the strongest countries in competitive cycling, Germany boasts a large population of both professional and recreational cyclists who actively use power meters to fine-tune their performance. This trend is expected to continue, reinforcing Europe's position as a key market for cycling power meters.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material supplier

- 3.1.2 Power meter manufacturer

- 3.1.3 Software and data analysis providers

- 3.1.4 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing demand for data-driven training

- 3.8.1.2 Growing popularity of competitive cycling

- 3.8.1.3 Advancements in smart cycling technology

- 3.8.1.4 Growth in indoor cycling and virtual cycling platforms

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial cost

- 3.8.2.2 Compatibility and integration challenges

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Power Meter Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Pedal-based

- 5.3 Crank-based

- 5.4 Hub-based

- 5.5 Bottom bracket

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Road cycling

- 6.3 Mountain biking

- 6.4 Indoor training

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Connection Type, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 ANT+

- 7.3 Bluetooth

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

- 8.4 Specialty sports stores

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 4iiii Innovations

- 10.2 Easton Cycling

- 10.3 Favero electronics

- 10.4 Full Speed Ahead

- 10.5 Garmin

- 10.6 LOOK

- 10.7 Magene

- 10.8 Polar Electro

- 10.9 Power2max

- 10.10 Rotor

- 10.11 Shimano

- 10.12 SRAM

- 10.13 SRM

- 10.14 Stages Cycling

- 10.15 Team ZWATT

- 10.16 Verve Cycling

- 10.17 Wahoo Fitness