|

市场调查报告书

商品编码

1684729

长期演进基地台市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Long-Term Evolution Base Station Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

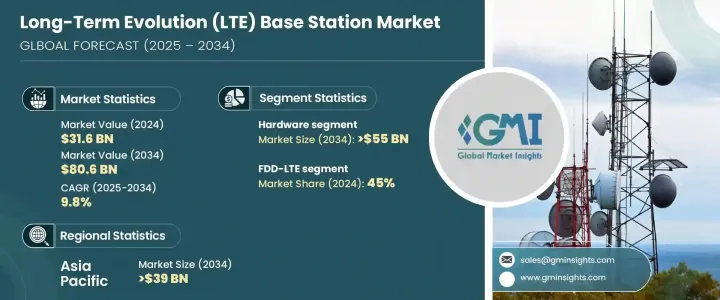

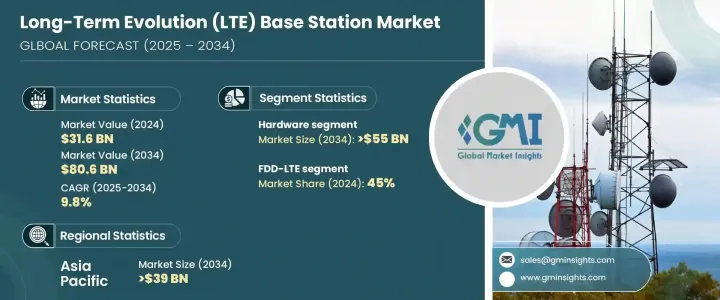

2024 年全球长期演进基地台市场价值为 316 亿美元,预计将大幅成长,预计 2025 年至 2034 年期间的复合年增长率为 9.8%。这一快速扩张的动力源于对高速行动互联网的需求不断增长、行动资料消费激增以及先进无线网路的广泛部署。随着行动用户不断期待无缝连接,从过时的 3G 网路过渡到 LTE 及更高版本已成为必要。智慧型设备和物联网 (IoT) 的日益普及进一步加剧了对更可靠、更有效率的网路基础设施的需求。世界各国政府的措施也在推动 LTE 基地台部署方面发挥关键作用,并在网路升级和 5G 解决方案整合方面投入了大量资金。因此,LTE 基础设施不再只是一种连接选项;它已成为现代数位生态系统的支柱,支援企业和消费者追求高速、不间断的通讯。

市场分为硬体和软体,其中硬体部分在 2024 年占据 65% 的市场份额。随着技术进步推动效率和效能的提高,预计到 2034 年将达到 550 亿美元。影响硬体格局的最显着趋势之一是基地台和天线的小型化。这项创新使网路供应商能够以紧凑且节省空间的形式部署高效能解决方案。此外,製造商优先考虑节能硬体组件,以优化功耗,同时保持峰值网路效能。模组化硬体设计正在获得发展势头,提供可扩展的解决方案,简化网路升级并确保现有基础设施面向未来。随着 LTE 网路的扩展,营运商越来越多地寻求经济高效、性能卓越的硬体解决方案,以满足不断增长的不间断连接需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 316亿美元 |

| 预测值 | 806亿美元 |

| 复合年增长率 | 9.8% |

LTE基地台市场分为三个关键技术部分:FDD-LTE、TDD-LTE和小型基地台。 FDD-LTE 在 2024 年占据 45% 的主导份额,这主要归功于它能够提供均衡的上传和下载速度。该技术特别适合资料流量大的地区,因为它可以确保城市和郊区的无缝用户体验。 FDD-LTE 基础设施的持续扩张,尤其是在已开发市场,继续推动其应用。此外,网路供应商正在投资节能基地台,以降低营运成本,同时保持稳定的连线。随着对可扩展且经济高效的 LTE 解决方案的需求不断增长,FDD-LTE 仍然是网路营运商和消费者的首选。

2024 年,亚太地区以 39% 的份额领先全球 LTE 基地台市场,预计到 2034 年将超过 390 亿美元。在政府支持的网路升级和不断增长的行动资料需求的支持下,中国等主要市场快速采用 LTE 是这一增长的主要驱动力。 TDD-LTE 技术因其频谱效率而广受好评,该技术的日益普及进一步增强了该地区的主导地位。随着亚太国家继续投资下一代连接解决方案,LTE 市场将会扩大,缩小当前技术与即将到来的 5G 革命之间的差距。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 零件供应商

- 设备製造商

- 软体供应商

- 系统整合商

- 电信营运商

- 最终用户

- 利润率分析

- 技术与创新格局

- 专利分析

- 成本明细分析

- 重要新闻及倡议

- 监管格局

- 技术差异化

- FDD-LTE 与 TDD-LTE

- Micro、Pico 和 Femto

- 衝击力

- 成长动力

- 高速行动宽频需求不断成长

- 行动资料流量和消费不断增加

- 全球 4G 和 LTE 网路的扩展

- 物联网和连网设备的普及率不断提高

- 产业陷阱与挑战

- LTE网路基础设施部署成本高

- 频谱分配与管理方面的挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 基频单元 (BBU)

- 远程无线电单元 (RRU)

- 天线

- 功率放大器

- 冷却系统

- 软体

- 基地台控制器

- 网路管理软体

- 优化工具

第六章:市场估计与预测:依技术,2021 - 2034 年

- 主要趋势

- LTE-FDD

- 时分双工

- 小细胞

第 7 章:市场估计与预测:按供应量,2021 - 2034 年

- 主要趋势

- 城市的

- 郊区

- 乡村的

第 8 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 住宅及 SOHO

- 企业

- 电信营运商

- 政府和公共部门

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Airspan

- Alpha Wireless

- AT&T

- Baicells

- Blinq Networks

- Cassava Technologies

- Cisco

- CommScope

- Ericsson

- Fujitsu

- Huawei

- Motorola

- NEC

- Nokia

- NuRAN Solutions

- Qualcomm

- Samsung

- Tektelic Communications

- ZTE

The Global Long-Term Evolution Base Station Market, valued at USD 31.6 billion in 2024, is poised for significant growth, with projections indicating a CAGR of 9.8% between 2025 and 2034. This rapid expansion is fueled by the increasing demand for high-speed mobile internet, surging mobile data consumption, and the widespread deployment of advanced wireless networks. As mobile users continue to expect seamless connectivity, the transition from outdated 3G networks to LTE and beyond has become a necessity. The growing penetration of smart devices and the Internet of Things (IoT) is further intensifying the need for more reliable and efficient network infrastructure. Government initiatives worldwide are also playing a crucial role in advancing LTE base station deployment, with substantial investments in network upgrades and the integration of 5G-ready solutions. As a result, LTE infrastructure is no longer just a connectivity option; it has become the backbone of modern digital ecosystems, supporting businesses and consumers alike in their quest for high-speed, uninterrupted communication.

The market is segmented into hardware and software, with the hardware segment accounting for 65% of the market share in 2024. This segment is expected to reach USD 55 billion by 2034 as technological advancements drive efficiency and performance improvements. One of the most notable trends shaping the hardware landscape is the miniaturization of base stations and antennas. This innovation allows network providers to deploy high-performance solutions in compact and space-efficient formats. Additionally, manufacturers are prioritizing energy-efficient hardware components to optimize power consumption while maintaining peak network performance. Modular hardware designs are gaining momentum, offering scalable solutions that simplify network upgrades and future-proof existing infrastructure. As LTE networks expand, operators are increasingly looking for cost-effective, high-performance hardware solutions to meet the ever-growing demand for uninterrupted connectivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $31.6 billion |

| Forecast Value | $80.6 billion |

| CAGR | 9.8% |

The LTE base station market is divided into three key technology segments: FDD-LTE, TDD-LTE, and small cells. FDD-LTE held a dominant 45% share in 2024, primarily due to its ability to deliver balanced upload and download speeds. This technology is particularly well-suited for regions with high data traffic, as it ensures a seamless user experience across urban and suburban areas. The sustained expansion of FDD-LTE infrastructure, especially in developed markets, continues to drive its adoption. Additionally, network providers are investing in energy-efficient base stations that lower operational costs while maintaining robust connectivity. With the growing need for scalable and cost-effective LTE solutions, FDD-LTE remains a preferred choice for both network operators and consumers.

Asia Pacific led the global LTE base station market with a 39% share in 2024 and is projected to surpass USD 39 billion by 2034. Rapid LTE adoption in key markets like China is a major driving force behind this growth, supported by government-backed network upgrades and a rising demand for mobile data. The increasing deployment of TDD-LTE technology, known for its spectrum efficiency, further strengthens the region's dominance. As Asia Pacific nations continue investing in next-generation connectivity solutions, the LTE market is set to expand, bridging the gap between current technologies and the upcoming 5G revolution.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Equipment manufacturers

- 3.2.3 Software providers

- 3.2.4 System integrators

- 3.2.5 Telecom operators

- 3.2.6 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Technology differentiators

- 3.9.1 FDD-LTE vs TDD-LTE

- 3.9.2 Micro vs Pico vs Femto

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for high-speed mobile broadband

- 3.10.1.2 Increasing mobile data traffic and consumption

- 3.10.1.3 Expansion of 4G and LTE networks worldwide

- 3.10.1.4 Growing adoption of IoT and connected devices

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High cost of LTE network infrastructure deployment

- 3.10.2.2 Challenges in spectrum allocation and management

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Baseband units (BBU)

- 5.2.2 Remote radio units (RRU)

- 5.2.3 Antennas

- 5.2.4 Power amplifiers

- 5.2.5 Cooling systems

- 5.3 Software

- 5.3.1 Base station controllers

- 5.3.2 Network management software

- 5.3.3 Optimization tools

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 FDD-LTE

- 6.3 TDD-LTE

- 6.4 Small cells

Chapter 7 Market Estimates & Forecast, By Provision, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Urban

- 7.3 Suburban

- 7.4 Rural

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Residential & SOHO

- 8.3 Enterprise

- 8.4 Telecom operators

- 8.5 Government and public sector

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Number of base stations)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airspan

- 10.2 Alpha Wireless

- 10.3 AT&T

- 10.4 Baicells

- 10.5 Blinq Networks

- 10.6 Cassava Technologies

- 10.7 Cisco

- 10.8 CommScope

- 10.9 Ericsson

- 10.10 Fujitsu

- 10.11 Huawei

- 10.12 Motorola

- 10.13 NEC

- 10.14 Nokia

- 10.15 NuRAN Solutions

- 10.16 Qualcomm

- 10.17 Samsung

- 10.18 Tektelic Communications

- 10.19 ZTE