|

市场调查报告书

商品编码

1684765

医用电极市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Medical Electrodes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

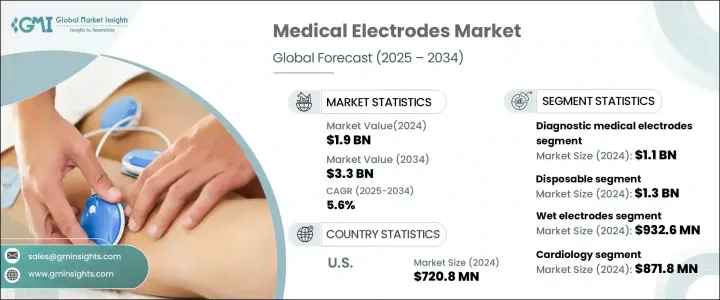

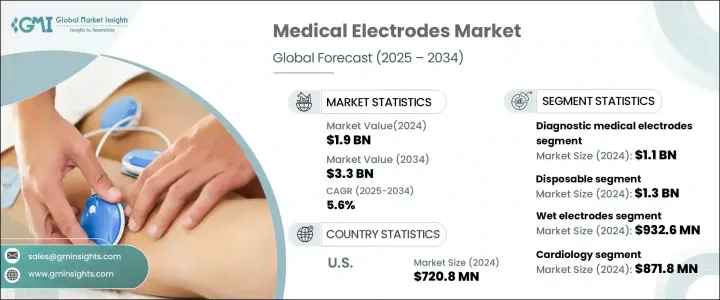

2024 年全球医用电极市场价值为 19 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.6%。这一增长是由心血管和神经系统疾病等慢性疾病的发病率不断上升,加上可穿戴医疗设备的日益普及和电极技术的进步所推动的。人们对非侵入性诊断程序的日益重视以及对持续健康监测的需求进一步推动了对医用电极的需求。随着全球医疗保健系统致力于改善患者治疗效果并减少就诊次数,医疗电极与穿戴式装置和家庭护理应用的整合正在获得发展动力。此外,市场还受益于电极设计的创新,从而提高了准确性、患者舒适度和整体性能。在预计预测期内,已开发地区和发展中地区医疗保健支出的增加以及向家庭护理的转变将维持市场成长。

医疗电极对于将电讯号从身体传输到诊断或治疗设备至关重要,在捕捉心率、脑电波和肌肉收缩等生理资料方面发挥关键作用。这些设备广泛应用于心电图 (ECG)、脑电图 (EEG)、肌电图 (EMG) 和除颤器等应用。诊断医疗电极部门在 2024 年创造了 11 亿美元的收入,这得益于其在监测和诊断各种医疗状况方面的广泛应用。随着心血管疾病和神经系统疾病发生率的上升,对诊断电极的需求激增。这些电极使医疗保健提供者能够检测早期症状,确保及时治疗并改善患者的治疗效果。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19亿美元 |

| 预测值 | 33亿美元 |

| 复合年增长率 | 5.6% |

湿电极在 2024 年的收入为 9.326 亿美元,因其在传输高品质电讯号方面的卓越性能而占据市场主导地位。这些电极使用导电凝胶或液体与皮肤建立牢固的连接,确保最小的阻抗,使其成为 EEG、ECG 和 EMG 等诊断应用的理想选择。其高信噪比提高了病患监测的准确性和可靠性。儘管干电极技术取得了进步,但湿电极仍然是医院环境和电疗应用(如 TENS 和神经肌肉刺激)长期使用的首选。

一次性电极市场价值预计在 2024 年达到 13 亿美元,由于其便利性、卫生性和成本效益而占据相当大的市场份额。一次性电极专为一次性使用而设计,消除了交叉污染的风险,使其成为急诊室和手术室等高容量医疗环境的理想选择。居家护理应用和穿戴式健康监测设备的日益普及进一步增加了对一次性电极的需求,因为它们易于使用并能提高患者的舒适度。

心臟病学领域在 2024 年创造了 8.718 亿美元的收入,预计 2025 年至 2034 年的复合年增长率为 6%。全球心血管疾病发生率的上升推动了对用于诊断和监测心律不整和心肌梗塞等心臟疾病的电极的需求。电极技术的创新,包括无线功能和灵活的设计,正在扩大其在穿戴式心电图设备中的应用,以实现临床环境之外的即时心臟健康监测。

医院是最大的终端使用领域,预计到 2032 年将达到 20 亿美元。作为管理急性和慢性疾病的重要医疗保健提供者,医院在诊断和治疗应用中严重依赖医用电极。可穿戴和无线电极越来越多地用于即时患者监测,从而提高了医院环境中的护理效率。

在美国,医用电极市场在 2024 年的营收为 7.208 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.9%。完善的医疗保健体系、不断上涨的医疗支出以及慢性病盛行率的上升是推动该地区市场成长的关键因素。家庭医疗保健和穿戴式装置的日益普及以及电极技术的进步进一步支持了美国市场的扩张。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病盛行率不断上升

- 对微创和非侵入性诊断程序的需求不断增长

- 电极设计和材料的技术进步

- 穿戴式医疗设备的普及率不断提高

- 产业陷阱与挑战

- 生物相容性和患者舒适度方面的挑战

- 严格的监管要求

- 成长动力

- 成长潜力分析

- 2024 年定价分析

- 监管格局

- 技术格局

- 价值链分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按产品类型,2021 年至 2034 年

- 主要趋势

- 诊断医用电极

- 心电图 (ECG) 电极

- 脑电图 (EEG) 电极

- 其他诊断电极

- 治疗医用电极

- 除颤器电极

- 起搏器电极

- 其他治疗电极

第六章:市场估计与预测:按技术,2021 – 2034 年

- 主要趋势

- 湿电极

- 干电极

- 针电极

第 7 章:市场估计与预测:按可用性,2021 年至 2034 年

- 主要趋势

- 一次性的

- 可重复使用的

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 心臟病学

- 神经生理学

- 睡眠障碍

- 其他应用

第 9 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊断中心

- 其他最终用户

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 3M

- Ambu

- B. Braun

- Boston Scientific

- Cardinal Health

- ConMed

- Dymedix Diagnostics

- GE Healthcare

- Medtronic

- Nihon Kohden

- Nissha Medical

- Philips Healthcare

- Rhythmlink

- Schiller AG

- ZOLL Medical

The Global Medical Electrodes Market was valued at USD 1.9 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2034. This growth is driven by the increasing prevalence of chronic diseases such as cardiovascular and neurological disorders, coupled with the rising adoption of wearable medical devices and advancements in electrode technology. The demand for medical electrodes is further fueled by the growing emphasis on non-invasive diagnostic procedures and the need for continuous health monitoring. As healthcare systems worldwide focus on improving patient outcomes and reducing hospital visits, the integration of medical electrodes in wearable devices and homecare applications is gaining momentum. Additionally, the market benefits from innovations in electrode design, which enhance accuracy, patient comfort, and overall performance. The increasing healthcare expenditure in both developed and developing regions, along with the shift towards at-home care, is expected to sustain market growth over the forecast period.

Medical electrodes, essential for transmitting electrical signals from the body to diagnostic or therapeutic equipment, play a critical role in capturing physiological data such as heart rate, brain waves, and muscle contractions. These devices are widely used in applications like electrocardiography (ECG), electroencephalography (EEG), electromyography (EMG), and defibrillators. The diagnostic medical electrodes segment generated USD 1.1 billion in revenue in 2024, driven by their extensive use in monitoring and diagnosing various medical conditions. With the rising prevalence of cardiovascular diseases and neurological disorders, the demand for diagnostic electrodes has surged. These electrodes enable healthcare providers to detect early symptoms, ensuring timely treatment and improving patient outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.3 Billion |

| CAGR | 5.6% |

Wet electrodes, which accounted for USD 932.6 million in revenue in 2024, dominate the market due to their superior performance in delivering high-quality electrical signals. These electrodes use conductive gel or liquid to establish a strong connection with the skin, ensuring minimal impedance and making them ideal for diagnostic applications like EEG, ECG, and EMG. Their high signal-to-noise ratio enhances the accuracy and reliability of patient monitoring. Despite advancements in dry electrode technology, wet electrodes remain the preferred choice for long-term use in hospital settings and electrotherapy applications such as TENS and neuromuscular stimulation.

The disposable electrodes segment, valued at USD 1.3 billion in 2024, holds a significant market share due to their convenience, hygiene benefits, and cost-effectiveness. Designed for single use, disposable electrodes eliminate the risk of cross-contamination, making them ideal for high-volume healthcare settings like emergency departments and operating rooms. The growing adoption of homecare applications and wearable health monitoring devices has further increased the demand for disposable electrodes, as they offer ease of use and improved patient comfort.

The cardiology segment, which generated USD 871.8 million in revenue in 2024, is anticipated to grow at a CAGR of 6% from 2025 to 2034. The rising prevalence of cardiovascular diseases globally drives the demand for electrodes used in diagnosing and monitoring heart conditions such as arrhythmias and myocardial infarctions. Innovations in electrode technology, including wireless capabilities and flexible designs, are expanding their applications in wearable ECG devices, enabling real-time heart health monitoring outside clinical settings.

Hospitals, the largest end-use segment, are projected to reach USD 2 billion by 2032. As critical healthcare providers managing acute and chronic conditions, hospitals rely heavily on medical electrodes for diagnostic and therapeutic applications. The increasing adoption of wearable and wireless electrodes for real-time patient monitoring is enhancing care delivery efficiency in hospital environments.

In the United States, the medical electrodes market accounted for USD 720.8 million in revenue in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2034. The well-established healthcare system, rising healthcare expenditures, and increasing prevalence of chronic diseases are key factors driving market growth in the region. The growing popularity of home healthcare and wearable devices, along with advancements in electrode technology, further supports the expansion of the US market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Rising demand for minimally invasive and non-invasive diagnostic procedures

- 3.2.1.3 Technological advancements in electrode design and materials

- 3.2.1.4 Growing adoption of wearable medical devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Challenges in biocompatibility and patient comfort

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pricing analysis, 2024

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Value chain analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostic medical electrodes

- 5.2.1 Electrocardiography (ECG) electrodes

- 5.2.2 Electroencephalography (EEG) electrodes

- 5.2.3 Other diagnostic electrodes

- 5.3 Therapeutic medical electrodes

- 5.3.1 Defibrillator electrodes

- 5.3.2 Pacemaker electrodes

- 5.3.3 Other therapeutic electrodes

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Wet electrodes

- 6.3 Dry electrodes

- 6.4 Needle electrodes

Chapter 7 Market Estimates and Forecast, By Usability, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Disposable

- 7.3 Reusable

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cardiology

- 8.3 Neurophysiology

- 8.4 Sleep disorders

- 8.5 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic centers

- 9.4 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 3M

- 11.2 Ambu

- 11.3 B. Braun

- 11.4 Boston Scientific

- 11.5 Cardinal Health

- 11.6 ConMed

- 11.7 Dymedix Diagnostics

- 11.8 GE Healthcare

- 11.9 Medtronic

- 11.10 Nihon Kohden

- 11.11 Nissha Medical

- 11.12 Philips Healthcare

- 11.13 Rhythmlink

- 11.14 Schiller AG

- 11.15 ZOLL Medical