|

市场调查报告书

商品编码

1684776

轻型卡车市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Light Duty Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

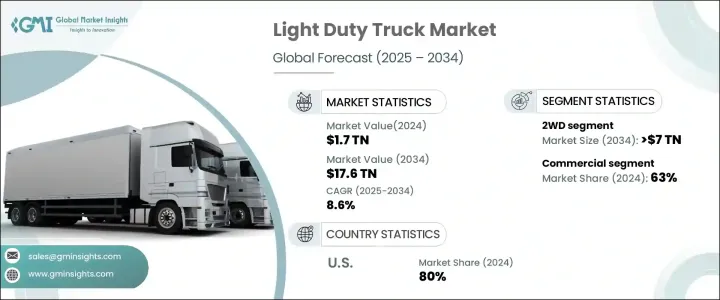

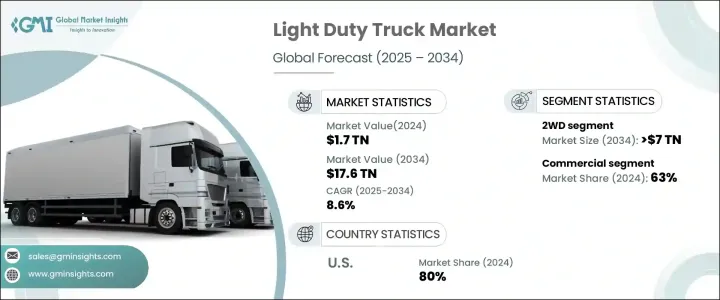

2024 年全球轻型卡车市场价值为 1.7 兆美元,预计 2025 年至 2034 年期间将以 8.6% 的强劲复合年增长率成长。这一令人印象深刻的成长可归因于多种因素,其中最显着的是电子商务行业的蓬勃发展,这大大增加了对高效最后一英里交付解决方案的需求。随着线上购物继续主导消费者行为,对多功能、可靠且经济高效的车辆的需求从未如此强烈。轻型卡车兼具载货能力、燃油效率和适应性,已成为企业和个人的首选。此外,这些卡车能够满足个人和商业需求,再加上燃油效率技术的进步,对于有环保意识的消费者来说尤其具有吸引力。它们在城市和乡村环境中的表现进一步增强了它们的吸引力,为企业提供了在不断变化的市场中保持竞争力所需的灵活性。

市场根据驱动配置进行细分,包括 2WD、4WD 和 AWD。其中,2WD 领域在 2024 年占据了 45% 的市场份额,预计到 2034 年将创造 7 兆美元的市场价值。 2WD 受欢迎程度的上升可以归功于它的成本效益和卓越的燃油效率,它们在价格和性能之间实现了最佳平衡。这使其成为寻求实用、价值导向且不损害性能的车辆的消费者和企业的首选。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.7兆美元 |

| 预测值 | 17.6兆美元 |

| 复合年增长率 | 8.6% |

在应用方面,市场分为商业和工业领域,其中商业部门在 2024 年占据 63% 的市场份额。与重型卡车相比,轻型卡车因其价格实惠、维护要求较低、燃油经济性更好而受到商业应用的青睐。它们的尺寸和容量使其成为运输货物的理想选择,从小件货物到更大型、更笨重的货物,确保企业保持灵活和高效。

从地区来看,到 2024 年,美国轻型卡车市场将占据高达 80% 的份额。这一增长是由北美的城市化所推动的,城市正在迅速扩张,对能够在拥挤的城市街道上行驶同时提供充足载货空间的车辆的需求也随之增加。随着企业寻求在城市范围内提供兼具机动性和实用性的可靠配送解决方案,轻型卡车将继续主导市场,为商业营运提供必要的解决方案。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 最终客户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻及倡议

- 监管格局

- 成本分析

- 衝击力

- 成长动力

- 快速便捷配送的需求日益增加

- 货物运输和配送需求不断成长

- 卡车製造业不断进步

- 建筑和基础设施活动增加

- 产业陷阱与挑战

- 轻型卡车的初始投资较高

- 燃料成本上涨

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按驱动配置,2021 - 2034 年

- 主要趋势

- 2WD

- 四轮驱动

- 全轮驱动

第六章:市场估计与预测:按燃料,2021 - 2034 年

- 主要趋势

- 汽油

- 柴油引擎

- 电的

第 7 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 商业的

- 工业的

第 8 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- Daimler

- Flat

- Ford

- Freightliner

- GM

- Hino

- Hyundai

- Isuzu

- Kenworth

- Mack Trucks

- Ram

- Renault

- Tata

- Toyota

- Volkswagen

The Global Light Duty Truck Market was valued at USD 1.7 trillion in 2024 and is expected to grow at a robust CAGR of 8.6% between 2025 and 2034. This impressive growth can be attributed to several factors, the most notable being the booming e-commerce industry, which has significantly heightened the demand for efficient last-mile delivery solutions. As online shopping continues to dominate consumer behavior, the need for versatile, reliable, and cost-effective vehicles has never been greater. Light-duty trucks, with their combination of cargo capacity, fuel efficiency, and adaptability, have emerged as the preferred choice for businesses and individuals alike. Furthermore, their ability to meet both personal and commercial needs, coupled with advancements in fuel-efficient technologies, makes these trucks especially appealing to environmentally conscious consumers. Their performance in both urban and rural settings further enhances their appeal, providing businesses with the flexibility they require to stay competitive in an ever-evolving market.

The market is segmented based on drive configuration, including 2WD, 4WD, and AWD. Among these, the 2WD segment accounted for 45% of the market share in 2024 and is projected to generate USD 7 trillion by 2034. The rise of 2WD's popularity can be credited to its cost-effectiveness and superior fuel efficiency, which provide an optimal balance of affordability and performance. This makes it a preferred option for consumers and businesses seeking practical, value-oriented vehicles without compromising on capability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Trillion |

| Forecast Value | $17.6 Trillion |

| CAGR | 8.6% |

In terms of application, the market is split into commercial and industrial segments, with the commercial sector commanding a dominant 63% market share in 2024. Light-duty trucks are highly favored in commercial applications due to their affordability, lower maintenance requirements, and better fuel economy compared to heavier alternatives. Their size and capacity make them ideal for transporting goods, from small deliveries to larger, bulkier shipments, ensuring businesses can remain agile and efficient.

Regionally, the U.S. market for light-duty trucks held an impressive 80% share in 2024. This growth is driven by urbanization across North America, where cities are rapidly expanding and creating a demand for vehicles that can navigate congested urban streets while providing ample cargo space. As businesses seek reliable delivery solutions that offer both mobility and practicality within city limits, light-duty trucks are poised to continue dominating the market, providing essential solutions for commercial operations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component providers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End customers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cost analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand for fast & convenient delivery

- 3.9.1.2 Rising need for transportation and distribution of goods

- 3.9.1.3 Growing advancements in truck manufacturing

- 3.9.1.4 Rising construction and infrastructure activities

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial investments in light-duty trucks

- 3.9.2.2 Rising fuel costs

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Drive Configuration, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 2WD

- 5.3 4WD

- 5.4 AWD

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Industrial

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Daimler

- 9.2 Flat

- 9.3 Ford

- 9.4 Freightliner

- 9.5 GM

- 9.6 Hino

- 9.7 Hyundai

- 9.8 Isuzu

- 9.9 Kenworth

- 9.10 Mack Trucks

- 9.11 Ram

- 9.12 Renault

- 9.13 Tata

- 9.14 Toyota

- 9.15 Volkswagen