|

市场调查报告书

商品编码

1684779

ECG 压力测试市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测ECG Stress Test Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

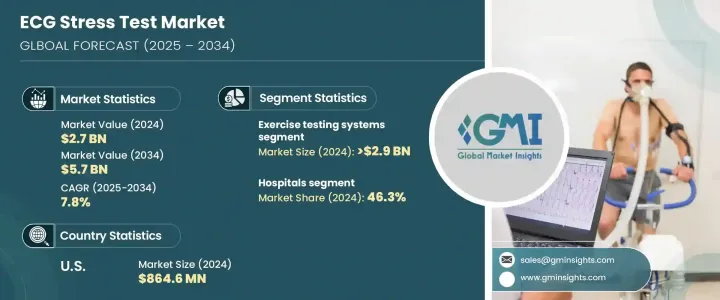

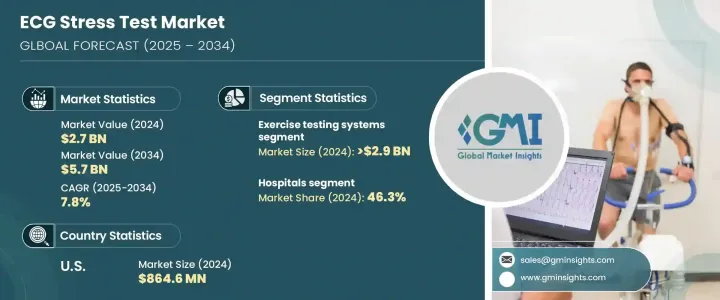

2024 年全球心电图压力测试市场规模达到 27 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.8%。这一增长是由全球心血管疾病发病率上升所推动的,而久坐的生活方式、不健康的饮食习惯和人口老化是导致这一现象的原因。由于心臟病仍然是死亡的主要原因,医疗保健提供者优先考虑早期诊断和预防性护理,从而增加了对心电图压力测试系统的需求。先进的诊断技术在改善患者治疗效果、降低长期医疗成本和提高心臟评估效率方面发挥着至关重要的作用。由于定期心臟监测已成为疾病管理的重要组成部分,预防性医疗保健的转变进一步加速了心电图压力测试的采用。

心电图压力测试系统的技术进步使得这些诊断工具更加准确、有效率且易于使用。人工智慧驱动的心电图分析、无线监测以及与电子健康记录 (EHR) 的整合正在改变心臟诊断,以实现更快、更精确的评估。此外,对远距医疗和远端监控解决方案的日益关注进一步扩大了市场的成长潜力,使得心电图压力测试更加方便和广泛可用。医疗机构也正在投资先进的心电图系统,以提供增强的资料分析和即时监控,从而可以早期发现心血管疾病。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 27亿美元 |

| 预测值 | 57亿美元 |

| 复合年增长率 | 7.8% |

依产品类型,市场分为运动测试系统、压力心电图、压力血压监测器和脉搏血氧仪。运动测试系统预计将达到最高成长,预计复合年增长率为 8.1%,到 2034 年将达到 29 亿美元。这些系统对于评估体力消耗下的心臟功能至关重要,对于检测冠状动脉疾病和心律不整不可或缺。人们对心血管筛检重要性的认识不断提高以及运动测试设备的进步正在推动医疗保健机构的广泛采用。随着心臟病发病率的上升,对高精度压力测试解决方案的需求持续增长,医疗专业人士强调早期干预策略以降低风险。

根据最终用途,心电图压力测试市场分为医院、诊断中心、门诊手术中心和其他医疗机构。 2024 年,医院占据最大的市场份额,占总收入的 46.3%。医院配备了最先进的诊断工具和专门的心臟护理单元,仍然是心电图压力测试的首选。心臟病负担日益加重,导致医院就诊人数激增,患者寻求专家的医疗评估和准确的心血管评估。医院基础设施的扩张以及心臟护理的进步进一步支持了市场的成长。

2024 年美国心电图压力测试市值为 8.646 亿美元,预计到 2034 年复合年增长率为 7.1%。不良饮食习惯、肥胖和缺乏运动等生活方式相关的健康风险导致心血管疾病发生率高,是推动需求的关键因素。随着人口老化导致心臟病患者数量不断增加,医疗保健提供者正在投资尖端诊断技术,以促进早期发现和预防护理。人们对心血管健康的认识不断提高,加上诊断设备技术的快速进步,预计将维持市场上升的趋势。人工智慧、基于云端的心电图监测和增强资料分析的整合进一步加强了美国市场,使心电图压力测试更加高效,患者和医疗保健专业人员都可以更方便地进行心电图压力测试。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心血管疾病盛行率上升

- 提高人们对早期诊断心臟病益处的认识

- 运动员接受测试次数激增

- 与电子健康记录 (EHR) 集成

- 产业陷阱与挑战

- 心电图压力测试系统成本高

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

- 价值链分析

- 机器学习在心臟压力测试解释的应用

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 运动测试系统

- 压力心电图

- 压力血压监测仪

- 脉搏血氧仪

第六章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊断中心

- 门诊手术中心

- 其他最终用户

第七章:市场估计与预测:按地区,2021 — 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Baxter

- BD (Becton Dickinson)

- BIOSENSORS INTERNATIONAL

- Cardinal Health

- COSMED

- FUKUDA

- GE (General Electric)

- Halma

- MGC DIAGNOSTICS

- Neurosoft

- NIHON KOHDEN

- NONIN

- OSI

- PHILIPS

- SCHILLER

The Global ECG Stress Test Market reached USD 2.7 billion in 2024 and is projected to grow at a CAGR of 7.8% between 2025 and 2034. This growth is driven by the rising incidence of cardiovascular diseases worldwide, fueled by sedentary lifestyles, unhealthy dietary habits, and an aging population. As heart disease remains a leading cause of mortality, healthcare providers are prioritizing early diagnosis and preventive care, increasing the demand for ECG stress test systems. Advanced diagnostic technologies are playing a crucial role in improving patient outcomes, reducing long-term healthcare costs, and enhancing the efficiency of cardiac assessments. The shift towards preventive healthcare has further accelerated the adoption of ECG stress tests, as regular cardiac monitoring becomes an essential component of disease management.

Technological advancements in ECG stress testing systems have made these diagnostic tools more accurate, efficient, and accessible. AI-driven ECG analysis, wireless monitoring, and integration with electronic health records (EHR) are transforming cardiac diagnostics, enabling faster and more precise assessments. Additionally, the increasing focus on telehealth and remote monitoring solutions has further expanded the market's growth potential, making ECG stress testing more convenient and widely available. Healthcare facilities are also investing in sophisticated ECG systems that offer enhanced data analytics and real-time monitoring, allowing for early detection of cardiovascular conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $ 2.7 Billion |

| Forecast Value | $ 5.7 Billion |

| CAGR | 7.8% |

The market is segmented by product type into exercise testing systems, stress ECG, stress blood pressure monitors and pulse oximeters. Exercise testing systems are expected to witness the highest growth, with a projected CAGR of 8.1%, reaching USD 2.9 billion by 2034. These systems are vital in assessing heart function under physical exertion, making them indispensable for detecting coronary artery disease and irregular heart rhythms. Growing awareness about the importance of cardiovascular screening and advancements in exercise testing equipment are driving widespread adoption across healthcare settings. As the prevalence of heart disease rises, demand for high-precision stress testing solutions continues to grow, with medical professionals emphasizing early intervention strategies to mitigate risks.

By end use, the ECG stress test market is categorized into hospitals, diagnostic centers, ambulatory surgical centers, and other healthcare facilities. Hospitals held the largest market share in 2024, accounting for 46.3% of total revenue. Equipped with state-of-the-art diagnostic tools and specialized cardiac care units, hospitals remain the preferred choice for ECG stress testing. The increasing burden of heart disease has led to a surge in hospital visits, with patients seeking expert medical evaluations and accurate cardiovascular assessments. Hospital infrastructure expansion, along with advancements in cardiac care, is further supporting market growth.

The U.S. ECG stress test market was valued at USD 864.6 million in 2024 and is projected to grow at a CAGR of 7.1% through 2034. The high prevalence of cardiovascular diseases, driven by lifestyle-related health risks such as poor dietary habits, obesity, and physical inactivity, is a key factor fueling demand. With an aging population contributing to a rising number of heart conditions, healthcare providers are investing in cutting-edge diagnostic technologies to facilitate early detection and preventive care. Increasing awareness of cardiovascular health, coupled with rapid technological advancements in diagnostic equipment, is expected to sustain the market's upward trajectory. The integration of AI, cloud-based ECG monitoring, and enhanced data analytics is further strengthening the U.S. market, making ECG stress tests more efficient and accessible for both patients and healthcare professionals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in prevalence of cardiovascular disorders

- 3.2.1.2 Rising awareness for benefits associated with early diagnosis of heart diseases

- 3.2.1.3 Surge in number of tests performed by sporting athletes

- 3.2.1.4 Integration with electronic health records (EHRs)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of ECG stress testing systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

- 3.11 Machine learning in cardiac stress test interpretation

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Exercise testing systems

- 5.3 Stress ECG

- 5.4 Stress blood pressure monitors

- 5.5 Pulse oximeters

Chapter 6 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Diagnostic centers

- 6.4 Ambulatory surgical centers

- 6.5 Other end users

Chapter 7 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Baxter

- 8.2 BD (Becton Dickinson)

- 8.3 BIOSENSORS INTERNATIONAL

- 8.4 Cardinal Health

- 8.5 COSMED

- 8.6 FUKUDA

- 8.7 GE (General Electric)

- 8.8 Halma

- 8.9 MGC DIAGNOSTICS

- 8.10 Neurosoft

- 8.11 NIHON KOHDEN

- 8.12 NONIN

- 8.13 OSI

- 8.14 PHILIPS

- 8.15 SCHILLER