|

市场调查报告书

商品编码

1684784

车载诊断 (OBD) 售后市场规模 - 按产品、按车辆、按应用、按组件、增长预测,2025 - 2034 年On-Board Diagnostics (OBD) Aftermarket Size - By Product, By Vehicle, By Application, By Component, Growth Forecast, 2025 - 2034 |

||||||

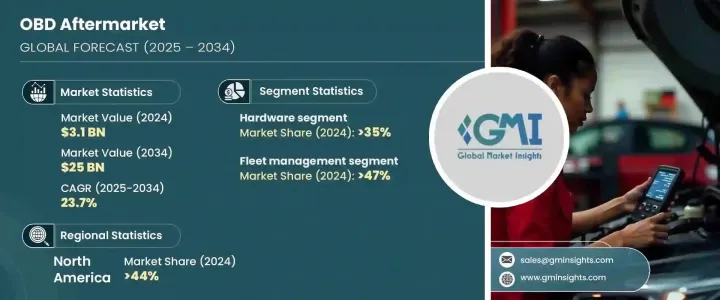

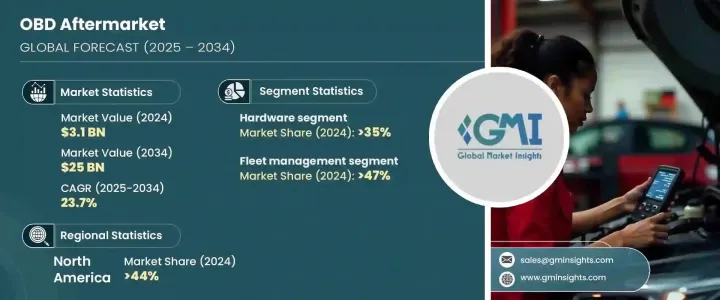

全球车载诊断售后市场将于 2024 年实现 31 亿美元的价值,并将经历显着增长,预计 2025 年至 2034 年的复合年增长率为 23.7%。这项快速扩张的动力来自于人们对数据驱动技术的远端车辆诊断系统的日益依赖。这些先进的解决方案可即时存取车辆的运行资料,实现远端监控和主动维护。透过提供车辆性能的即时洞察,OBD 系统可以提高安全性、防止意外故障并确保及时维修。随着汽车产业不断拥抱数位转型,OBD 售后市场解决方案在延长车辆寿命、优化性能和维持严格的安全标准方面发挥关键作用。

智慧汽车解决方案需求激增、法规合规要求以及消费者对增强型车辆管理工具的偏好是市场成长的主要驱动力。 OBD 解决方案具有预测性维护、即时分析以及与现代连接协议的无缝整合等功能,正在不断发展以满足内燃机、混合动力和电动车的多样化需求。这些先进的系统对于改善诊断、确保车辆平稳运行以及向用户提供可操作的见解至关重要。尖端车辆连接技术的采用进一步推动了市场的发展,使其成为现代车辆管理的基石。随着汽车製造商和售后服务供应商不断投资于创新,OBD 解决方案将继续处于汽车进步的前沿。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 31亿美元 |

| 预测值 | 250亿美元 |

| 复合年增长率 | 23.7% |

硬体部分在 2024 年占据了 35% 的市场份额,预计到 2034 年将占据 30%。先进诊断工具的稳定推出正在推动这一领域的发展,为分析车辆资料和提供即时洞察提供了增强的能力。这些创新正在彻底改变汽车诊断,使用户能够更有效地评估车辆性能。随着技术的进步,下一代 OBD 硬体将提供更高的准确性,使用户能够在问题恶化之前检测并解决问题。这一转变强调了业界对预测性和预防性维护的关注,确保车辆长期保持最佳状态。

OBD 售后市场根据应用分为消费者远端资讯处理、车队管理、汽车共享和基于使用情况的保险。车队管理领域在 2024 年占据主导地位,占据 47% 的市场。车队营运商越来越多地利用 OBD 技术来监控车辆移动、优化路线并即时追踪驾驶行为。透过将 OBD 与数位地图和先进的追踪功能相结合,车队经理可以更好地控制车辆使用率,从而提高效率并节省成本。此外,OBD 系统与车队管理平台的无缝整合提高了营运透明度,减少了未经授权的活动并最大限度地减少了停机时间,使其成为物流和运输行业的重要工具。

由于汽车行业的成熟和车辆诊断技术的不断进步,北美在 2024 年占据了 OBD 售后市场的 44% 的份额。该地区高度重视法规遵循、预防性维护和汽车创新,加速了 OBD 解决方案的广泛采用。凭藉领先汽车製造商的强大影响力和成熟的售后市场生态系统,北美已成为全球市场的领导者。对连网汽车技术和车队优化解决方案的需求不断增长,进一步推动了区域成长,确保了未来几年市场的持续扩张。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 零件供应商

- 技术提供者

- 经销商

- 最终用户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 将重点转向远端诊断技术

- 汽车物联网(IoT)日益增长的趋势

- 全球汽车产量不断增加

- 越来越重视排放控制标准

- 产业陷阱与挑战

- 网路安全威胁和隐私问题

- 相容性和互通性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

第 6 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 消费者远端资讯处理

- 车队管理

- 汽车共享

- 基于使用情况的保险 (UBI)

第七章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- OBD 扫描仪

- OBD 适配器

- 软体

- 基于 PC 的 OBD 扫描工具

- 应用程式(OBD 远端资讯处理平台)

- 服务

- 培训和咨询

- 整合与管理

- 託管服务

第 8 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- Autel

- Agilis Systems

- AVL DiTEST

- Bridgestone

- CalAmp Corporation

- Continental

- Danlaw

- ERM Electronic Systems LTD (Ituran)

- Geotab

- Hella

- Innova Electronics

- Launch Tech

- Nexar

- Robert Bosch

- ScanTool

- TomTom Telematics

- Verizon Connect

- Xirgo Technologies

- ZF Friedrichshafen

- Zubie

The global on-board diagnostics aftermarket, valued at USD 3.1 billion in 2024, is set to experience remarkable growth, with projections indicating a CAGR of 23.7% from 2025 to 2034. This rapid expansion is fueled by the increasing reliance on remote vehicle diagnostic systems powered by data-driven technologies. These advanced solutions provide real-time access to a vehicle's operational data, enabling remote monitoring and proactive maintenance. By offering instant insights into vehicle performance, OBD systems enhance safety, prevent unexpected breakdowns, and ensure timely servicing. As the automotive industry continues to embrace digital transformation, OBD aftermarket solutions are playing a critical role in vehicle longevity, optimizing performance, and maintaining stringent safety standards.

The Surge In Demand For Smart Automotive Solutions, Regulatory Compliance Requirements, And Consumer Preferences For Enhanced Vehicle Management Tools Are Key Drivers Of Market growth. With features such as predictive maintenance, real-time analytics, and seamless integration with modern connectivity protocols, OBD solutions are evolving to meet the diverse needs of internal combustion, hybrid, and electric vehicles. These advanced systems are essential for improving diagnostics, ensuring smooth vehicle operations, and delivering actionable insights to users. The adoption of cutting-edge vehicle connectivity technologies has further propelled the market, making it a cornerstone of modern vehicle management. As automakers and aftermarket service providers continue investing in innovation, OBD solutions will remain at the forefront of automotive advancements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $25 Billion |

| CAGR | 23.7% |

The hardware segment, which accounted for 35% of the market share in 2024, is expected to hold 30% by 2034. The steady introduction of advanced diagnostic tools is driving this segment, offering enhanced capabilities for analyzing vehicle data and delivering real-time insights. These innovations are revolutionizing automotive diagnostics, enabling users to assess vehicle performance more efficiently. As technology advances, next-generation OBD hardware will provide even greater accuracy, allowing users to detect and address issues before they escalate. This shift underscores the industry's focus on predictive and preventive maintenance, ensuring vehicles remain in optimal condition for extended periods.

The OBD aftermarket is categorized based on application into consumer telematics, fleet management, car sharing, and usage-based insurance. The fleet management segment dominated in 2024, capturing 47% of the market share. Fleet operators are increasingly leveraging OBD technology to monitor vehicle movement, optimize routes, and track driving behavior in real time. By integrating OBD with digital mapping and advanced tracking features, fleet managers gain greater control over vehicle utilization, leading to improved efficiency and cost savings. Additionally, the seamless integration of OBD systems with fleet management platforms enhances operational transparency, reduces unauthorized activities, and minimizes downtime, making it an essential tool for logistics and transportation industries.

North America held a commanding 44% share of the OBD aftermarket in 2024, driven by a well-established automotive industry and continuous advancements in vehicle diagnostics technology. The region's strong emphasis on regulatory compliance, preventive maintenance, and automotive innovation has accelerated the widespread adoption of OBD solutions. With a robust presence of leading automotive manufacturers and a mature aftermarket ecosystem, North America has positioned itself as a leader in the global market. The growing demand for connected vehicle technologies and fleet optimization solutions is further fueling regional growth, ensuring sustained market expansion in the years to come.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Component suppliers

- 3.1.2 Technology providers

- 3.1.3 Distributors

- 3.1.4 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Shifting focus toward remote diagnostics technology

- 3.7.1.2 Growing trend of automotive Internet of Things (IoT)

- 3.7.1.3 Increasing global automotive production

- 3.7.1.4 Rising emphasis on emission control standards

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Cybersecurity threats and privacy concerns

- 3.7.2.2 Compatibility and interoperability issues

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUVs

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCVs)

- 5.3.2 Heavy commercial vehicles (HCVs)

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Consumer telematics

- 6.3 Fleet management

- 6.4 Car sharing

- 6.5 Usage-based insurance (UBI)

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Hardware

- 7.2.1 OBD scanners

- 7.2.2 OBD dongles

- 7.3 Software

- 7.3.1 PC-based OBD scanning tools

- 7.3.2 Apps (OBD telematics platforms)

- 7.4 Service

- 7.4.1 Training and consulting

- 7.4.2 Integration and management

- 7.4.3 Managed service

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Autel

- 9.2 Agilis Systems

- 9.3 AVL DiTEST

- 9.4 Bridgestone

- 9.5 CalAmp Corporation

- 9.6 Continental

- 9.7 Danlaw

- 9.8 ERM Electronic Systems LTD (Ituran)

- 9.9 Geotab

- 9.10 Hella

- 9.11 Innova Electronics

- 9.12 Launch Tech

- 9.13 Nexar

- 9.14 Robert Bosch

- 9.15 ScanTool

- 9.16 TomTom Telematics

- 9.17 Verizon Connect

- 9.18 Xirgo Technologies

- 9.19 ZF Friedrichshafen

- 9.20 Zubie