|

市场调查报告书

商品编码

1684798

加密软体市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Encryption Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

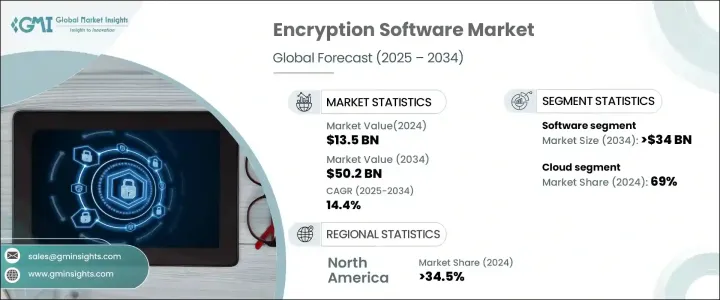

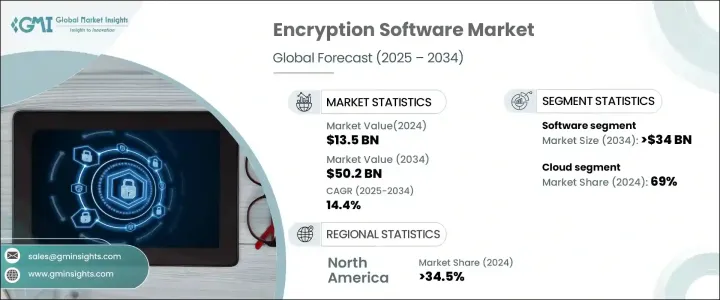

2024 年全球加密软体市场价值为 135 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 14.4%。随着全球企业面临日益严重的网路威胁、资料外洩和更严格的合规法规,对强大加密解决方案的需求持续上升。各行各业的组织都优先使用加密软体来保护敏感资料、降低网路安全风险并满足不断变化的监管要求。随着技术的快速进步,加密软体现在更加复杂,利用人工智慧、区块链和量子加密来提供下一代安全解决方案。

人工智慧驱动的加密正在透过不断适应新威胁和改进即时风险检测来重新定义资料保护。同时,基于区块链的加密透过确保防篡改资料传输来增强安全性,使其成为金融交易、医疗记录和政府通讯的理想选择。量子加密虽然仍处于早期阶段,但它利用量子力学原理来防止未经授权的访问,并有望实现前所未有的资料安全水平。随着数位转型的加速,企业正在大力投资加密技术,以维护信任、保护智慧财产权和保护关键基础设施。云端运算、物联网 (IoT) 设备和远端劳动力的迅猛增长进一步凸显了保护分散式网路中资料的高级加密解决方案的必要性。市场的上升趋势反映了全球对更强大的网路安全框架的推动,企业和政府都认识到加密是抵御网路威胁的重要防御手段。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 135亿美元 |

| 预测值 | 502亿美元 |

| 复合年增长率 | 14.4% |

软体产业在 2024 年占据了 70% 的市场份额,预计到 2034 年将创造 340 亿美元的市场价值。企业继续青睐加密软体,因为它能够保护各种网路、储存系统和数位平台上的敏感资讯。网路攻击的激增增加了企业部署保护结构化和非结构化资料的尖端加密工具的必要性。金融、医疗保健和零售等行业依靠加密软体来遵守严格的资料保护法,同时确保客户和内部营运的无缝安全。

2024 年,云端部署占据了加密软体市场份额的 69%,反映了向基于云端的资料储存和运算的广泛转变。企业越来越多地将业务迁移到云端,需要强大的加密措施来保护敏感资讯免受网路威胁和未经授权的存取。云端原生加密解决方案可确保资料在储存和传输过程中的安全,解决了人们对资料完整性、合规性和存取控制日益增长的担忧。企业意识到加密在维护 GDPR、CCPA 和 HIPAA 等框架的监管合规性方面发挥关键作用,从而增加了对先进云端安全解决方案的投资。

2024 年,北美占据加密软体市场的 34.5%,成为网路安全创新的重要中心。凭藉完善的技术基础设施和严格的资料隐私法规,该地区的企业积极将加密软体整合到其安全策略中。金融部门、医疗保健产业和政府机构优先考虑加密,以保护高价值资产、防止资料外洩并确保交易安全。人们对网路安全风险的认识不断增强,加上对数位转型的投资不断增加,继续推动市场扩张。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 云端服务供应商

- 託管安全服务提供者

- 加密软体整合商

- 最终用户

- 利润率分析

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 资料安全疑虑加剧

- 资料量不断增加

- 云端服务的激增

- 加密技术的创新

- 产业陷阱与挑战

- 实施的复杂性与成本

- 与现有系统的整合挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 软体

- 端点加密

- 电子邮件加密

- 云端加密

- 磁碟加密

- 资料库加密

- 其他的

- 服务

- 培训与咨询

- 整合与维护

- 託管服务

第六章:市场估计与预测:依部署模型,2021 - 2034 年

- 主要趋势

- 本地

- 云

第 7 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 资讯科技和电信

- 金融保险业协会

- 卫生保健

- 零售

- 政府和公共部门

- 製造业

- 其他的

第 8 章:市场估计与预测:按企业规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- AO Kaspersky Lab

- Bitdefender

- Broadcom

- Check Point Software

- Cisco Systems

- Dell Technologies

- ESET

- F-Secure

- HPE

- IBM

- McAfee

- Microsoft

- OpenText

- Oracle

- Palo Alto

- Panda Security

- Proofpoint

- Sophos Ltd.

- Thales

- Trend Micro

The Global Encryption Software Market, valued at USD 13.5 billion in 2024, is on track to grow at a CAGR of 14.4% between 2025 and 2034. As businesses worldwide face increasing cyber threats, data breaches, and stricter compliance regulations, the demand for robust encryption solutions continues to rise. Organizations across industries prioritize encryption software to safeguard sensitive data, mitigate cybersecurity risks, and meet evolving regulatory requirements. With rapid technological advancements, encryption software is now more sophisticated, leveraging artificial intelligence, blockchain, and quantum encryption to provide next-generation security solutions.

AI-driven encryption is redefining data protection by continuously adapting to new threats and improving real-time risk detection. Meanwhile, blockchain-based encryption enhances security by ensuring tamper-proof data transfers, making it ideal for financial transactions, healthcare records, and government communications. Quantum encryption, though still in its early stages, promises an unprecedented level of data security by leveraging the principles of quantum mechanics to prevent unauthorized access. As digital transformation accelerates, enterprises are investing heavily in encryption technologies to maintain trust, protect intellectual property, and secure critical infrastructure. The exponential growth of cloud computing, Internet of Things (IoT) devices, and remote workforces further underscores the necessity for advanced encryption solutions that protect data across distributed networks. The market's upward trajectory reflects a global push for stronger cybersecurity frameworks, with businesses and governments alike recognizing encryption as an essential defense against cyber threats.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.5 Billion |

| Forecast Value | $50.2 Billion |

| CAGR | 14.4% |

The software segment, which accounted for 70% of the market share in 2024, is set to generate USD 34 billion by 2034. Companies continue to favor encryption software due to its ability to secure sensitive information across various networks, storage systems, and digital platforms. The surge in cyberattacks has heightened the need for businesses to deploy cutting-edge encryption tools that protect both structured and unstructured data. Industries such as finance, healthcare, and retail rely on encryption software to comply with stringent data protection laws while ensuring seamless security for their customers and internal operations.

Cloud deployment accounted for 69% of the encryption software market share in 2024, reflecting the widespread shift toward cloud-based data storage and computing. Businesses increasingly migrate their operations to the cloud, necessitating strong encryption measures to protect sensitive information from cyber threats and unauthorized access. Cloud-native encryption solutions ensure data remains secure both in storage and in transit, addressing growing concerns over data integrity, compliance, and access control. Enterprises recognize the critical role encryption plays in maintaining regulatory compliance with frameworks such as GDPR, CCPA, and HIPAA, leading to increased investment in advanced cloud security solutions.

North America held a 34.5% share of the encryption software market in 2024, establishing itself as a key hub for cybersecurity innovation. With a well-developed technological infrastructure and stringent data privacy regulations, businesses in the region actively integrate encryption software into their security strategies. The financial sector, healthcare industry, and government institutions prioritize encryption to protect high-value assets, prevent data breaches, and ensure secure transactions. Growing awareness of cybersecurity risks, coupled with increasing investments in digital transformation, continues to drive market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Cloud service providers

- 3.2.2 Managed security service providers

- 3.2.3 Encryption software integrators

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising data security concerns

- 3.7.1.2 Increasing data volume

- 3.7.1.3 Proliferation of cloud services

- 3.7.1.4 Innovations in encryption technologies

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Complexity and cost of implementation

- 3.7.2.2 Integration challenges with existing systems

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Endpoint encryption

- 5.2.2 Email encryption

- 5.2.3 Cloud encryption

- 5.2.4 Disk encryption

- 5.2.5 Database encryption

- 5.2.6 Others

- 5.3 Services

- 5.3.1 Training & consulting

- 5.3.2 Integration & maintenance

- 5.3.3 Managed service

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 IT & telecom

- 7.3 BFSI

- 7.4 Healthcare

- 7.5 Retail

- 7.6 Government & public sector

- 7.7 Manufacturing

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large enterprises

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AO Kaspersky Lab

- 10.2 Bitdefender

- 10.3 Broadcom

- 10.4 Check Point Software

- 10.5 Cisco Systems

- 10.6 Dell Technologies

- 10.7 ESET

- 10.8 F-Secure

- 10.9 HPE

- 10.10 IBM

- 10.11 McAfee

- 10.12 Microsoft

- 10.13 OpenText

- 10.14 Oracle

- 10.15 Palo Alto

- 10.16 Panda Security

- 10.17 Proofpoint

- 10.18 Sophos Ltd.

- 10.19 Thales

- 10.20 Trend Micro