|

市场调查报告书

商品编码

1684809

槟榔市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Areca Nuts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

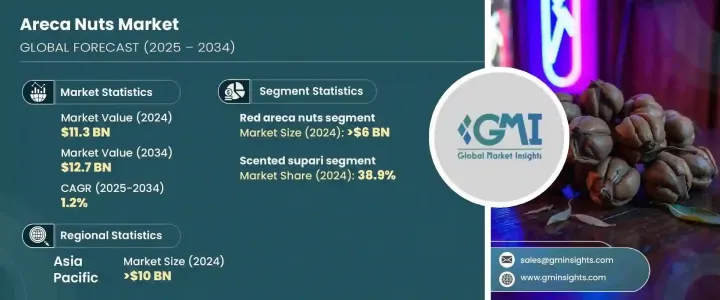

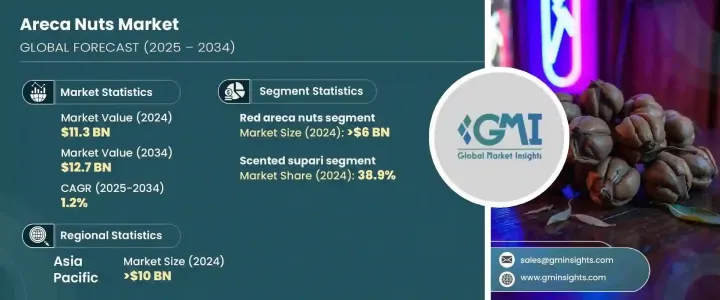

2024 年全球槟榔市场规模达到 113 亿美元,预计 2025 年至 2034 年期间将以 1.2% 的复合年增长率稳定成长。这一增长可归因于槟榔根深蒂固的文化和传统意义,尤其是在亚太地区。槟榔在社会和宗教仪式中发挥着重要作用,尤其是在印度、马来西亚、孟加拉和印尼等国家,多年来其需求量一直居高不下。随着这些国家继续将槟榔融入日常生活和庆祝活动中,市场依然保持着弹性。此外,人们越来越认识到槟榔的潜在健康益处,例如其在传统药物和天然补充剂中的用途,这引起了注重健康的消费者的兴趣。全世界对健康和有机生活的日益关注,增加了对槟榔等产品的需求,进一步提升了市场的潜力。

随着消费者偏好转向更健康的替代品以及更全球化的市场出现,槟榔产业正在发生重大变化。迎合现代生活方式的创新有助于吸引更广泛的消费者群体。全球化和电子商务的兴起使得这些产品比以往任何时候都更容易获得,并增加了它们在传统地区之外的供应。注重健康的买家尤其被槟榔的天然特性所吸引,因为槟榔被宣传为有益于消化健康、皮肤护理等。人们的认识不断提高,槟榔成为保健产品、食品和饮料中越来越受欢迎的成分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 113亿美元 |

| 预测值 | 127亿美元 |

| 复合年增长率 | 1.2% |

2024 年,红槟榔市场占据了市场主导地位,价值达到 60 亿美元。红槟榔以其优良的品质而闻名,采用传统的晒干技术可以增强其风味和香气。这些坚果不仅仅是一种产品;它们是东南亚深厚根基的文化象征,在礼仪和日常生活中都具有特殊重要性。因此,他们的需求持续强劲,进一步推动整体市场成长。此外,香味 supari(槟榔的一种调味品种)的市场持续成长,到 2024 年将占据 38.9% 的市场份额。香味 supari 注入了香料和香料,迎合了那些寻求更芳香和更美味体验的人的需求,使其成为更广泛消费者的热门选择。

亚太地区是槟榔的主要市场,2024 年的产值将达到 100 亿美元。尤其是印度,是主要贡献者,占据了 61 亿美元的市场份额。槟榔在该地区的日常生活和仪式中扮演着重要的角色,确保了强劲的国内需求。此外,印度、印尼和马来西亚等国家的出口市场持续扩大,巩固了亚太地区在全球槟榔市场的中心地位。由于这些坚果在该地区的文化重要性以及消费者对健康的兴趣日益增加,预计亚太市场将在整个预测期内保持领先地位。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 文化意义

- 健康和医学观念。

- 创新产品

- 产业陷阱与挑战

- 健康问题和监管挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模与预测:按类型,2021-2034 年

- 主要趋势

- 红色的

- 白槟榔

第 6 章:市场规模与预测:依产品,2021-2034 年

- 主要趋势

- 香味苏帕里

- 单宁

- 槟榔

第 7 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 潘和潘马萨拉产品

- 咀嚼烟草製品

- 医药及保健产品

- 其他

第 8 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Ashapura Agrocomm

- GM Group

- Godrej Agrovet

- KRBL

- Mangalam Group

- PT. Ruby Privatindo

- Saaha Agro Industries

- Surya Exim

- The Campco

- VIETDELTA INDUSTRIAL

- Vimal Agro Products

The Global Areca Nuts Market reached USD 11.3 billion in 2024 and is projected to grow at a steady CAGR of 1.2% from 2025 to 2034. This growth can be attributed to the deep-rooted cultural and traditional significance of areca nuts, particularly in the Asia-Pacific region. The role of areca nuts in social and religious ceremonies, especially in countries like India, Malaysia, Bangladesh, and Indonesia, has kept demand high over the years. As these countries continue to integrate areca nuts into daily life and celebrations, the market remains resilient. Additionally, the growing recognition of areca nuts for their potential health benefits, such as their use in traditional medicine and natural supplements, has spurred interest from health-conscious consumers. The increasing focus on wellness and organic living worldwide has only strengthened the demand for products like areca nuts, further boosting the market's potential.

As consumer preferences shift towards healthier alternatives and a more globalized market emerges, the areca nut industry is seeing significant changes. Innovations catering to modern lifestyles are helping to appeal to a broader consumer base. Globalization, alongside the rise of e-commerce, has made these products more accessible than ever before, increasing their availability beyond traditional regions. Health-conscious buyers are particularly drawn to areca nuts for their natural properties, as the nuts are being marketed as beneficial for digestive health, skincare, and more. This increasing awareness has made the areca nut an increasingly popular ingredient in both wellness products and food and beverage offerings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.3 Billion |

| Forecast Value | $12.7 Billion |

| CAGR | 1.2% |

The red areca nut segment dominated the market in 2024, reaching USD 6 billion. Renowned for its superior quality, the red areca nut benefits from traditional sun-drying techniques that enhance its flavor and aroma. These nuts are not just a product; they are a cultural symbol with deep roots in Southeast Asia, where they hold particular importance in both ceremonial and everyday life. As a result, their demand remains consistently strong, further driving the overall market growth. Additionally, the market for scented supari, a flavored variety of areca nut, continues to grow, accounting for 38.9% of the market share in 2024. Infused with spices and fragrances, scented supari caters to those seeking a more aromatic and flavorful experience, making it a popular choice for a wider range of consumers.

The Asia-Pacific region was the dominant market for areca nuts, generating USD 10 billion in 2024. India, in particular, was a major contributor, accounting for USD 6.1 billion of the market share. Areca nuts play a significant role in daily life and rituals across the region, ensuring strong domestic demand. Additionally, the growing export market from countries like India, Indonesia, and Malaysia continues to expand, reinforcing the Asia-Pacific region's central position in the global areca nut market. With the cultural importance of these nuts in the region and increasing health-driven consumer interest, the Asia-Pacific market is expected to maintain its leadership throughout the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Cultural significance

- 3.6.1.2 Health and medicinal perceptions.

- 3.6.1.3 Innovative product offerings

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Health concerns and regulatory challenges

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Red

- 5.3 White areca nuts

Chapter 6 Market Size and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Scented supari

- 6.3 Tannin

- 6.4 Pan masala

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Pan and pan masala products

- 7.3 Chewing tobacco products

- 7.4 Pharmaceutical and healthcare products

- 7.5 Other

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ashapura Agrocomm

- 9.2 GM Group

- 9.3 Godrej Agrovet

- 9.4 KRBL

- 9.5 Mangalam Group

- 9.6 PT. Ruby Privatindo

- 9.7 Saaha Agro Industries

- 9.8 Surya Exim

- 9.9 The Campco

- 9.10 VIETDELTA INDUSTRIAL

- 9.11 Vimal Agro Products