|

市场调查报告书

商品编码

1684827

芝麻市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Sesame Seeds Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

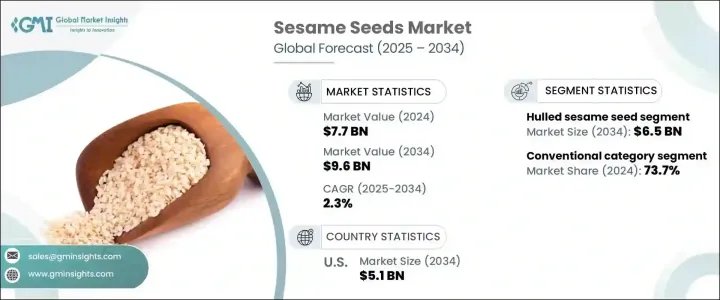

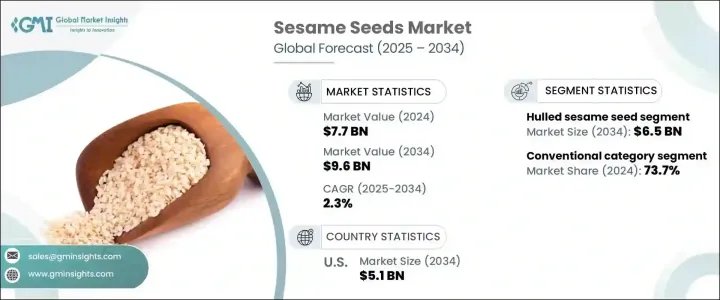

2024 年全球芝麻市场规模达到 77 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 2.3%。芝麻需求的不断增长源于其在食品工业中的广泛应用,芝麻对于烘焙、糖果和零食生产至关重要。此外,芝麻在芝麻酱和芝麻油的製作中起着至关重要的作用,芝麻酱和芝麻油是中东和亚洲美食的两种主要原料。它们的营养价值,包括高含量的健康脂肪、蛋白质、纤维和抗氧化剂,持续吸引註重健康、寻求天然和植物成分的消费者。

全球对清洁标籤和最低限度加工食品的需求激增进一步推动了市场扩张。製造商越来越多地在包装零食、烘焙产品和功能性食品中使用芝麻,利用其多功能性和消费者吸引力。人们越来越意识到芝麻的健康益处,例如其有益于心臟健康、减少发炎和改善消化的能力,这为市场成长增添了动力。此外,人们对民族美食的兴趣日益浓厚,以及植物性饮食中芝麻製品的使用越来越多,也推动了市场的发展。芝麻加工技术的进步,包括更好的去壳和烘焙技术,也提高了产品品质并延长了保质期,使芝麻成为多种食品应用中的首选成分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 77亿美元 |

| 预测值 | 96亿美元 |

| 复合年增长率 | 2.3% |

预计到 2034 年,去壳芝麻籽市场规模将达到 65 亿美元,复合年增长率为 2.6%。去除外壳后,去壳芝麻具有精緻的风味和光滑的质地,非常适合用于烘焙产品和零食产品。它们保质期延长、可用性增强,受到食品製造商的青睐,食品製造商将其加入即用型配料中,以方便消费者使用。该细分市场的持续成长也受到消费者对易于使用的食品成分的日益偏好的推动,这些成分可以增强各种应用的口感和质地。

2024 年,传统芝麻占据市场主导地位,占有 73.7% 的份额,价值 57 亿美元。预计到 2034 年,该领域的复合年增长率将达到 2.7%。传统芝麻由于价格低廉、随处可见,仍是最受欢迎的选择。价格敏感的市场和大批量食品生产设施继续依赖传统种子作为经济有效的解决方案,以确保稳定的供应链和经济可行性。芝麻在加工和包装食品类别的使用越来越广泛,进一步增强了对传统芝麻的需求。

预计到 2034 年美国芝麻市场规模将达到 51 亿美元,复合年增长率为 2.2%。美国消费者越来越重视健康和保健,这导致他们对芝麻等营养丰富的成分的偏好日益增加。芝麻因其富含健康脂肪、纤维和抗氧化剂而闻名,并被广泛应用于各种食品中,包括富含蛋白质的零食、烘焙食品和植物替代品。食品製造商透过将芝麻加入功能性食品和有机产品系列来应对这些不断变化的饮食趋势。有机芝麻需求的不断增长反映了消费者越来越倾向于选择高品质、符合道德标准的原料。此外,加工技术的改进确保了更高的产品品质和更好的市场渗透率,进一步推动了产业成长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 产业衝击力

- 成长动力

- 人们对芝麻健康益处的认识不断提高

- 植物性食品和纯素食品的需求不断增长

- 食品和饮料业对芝麻的需求不断增加

- 市场挑战

- 芝麻价格波动

- 成长动力

- 法规和市场影响

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模及预测:依产品,2021-2034 年

- 主要趋势

- 去壳芝麻

- 天然芝麻

第 6 章:市场规模及预测:依类别,2021-2034 年

- 主要趋势

- 有机的

- 传统的

第 7 章:市场规模与预测:依最终用途,2021-2034 年

- 主要趋势

- 食品工业

- 製药业

- 化妆品和个人护理行业

- 其他的

第 8 章:市场规模及预测:按配销通路,2021-2034 年

- 主要趋势

- 超市和大卖场

- 便利商店

- 网路零售

- 专卖店

- 其他的

第 9 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Ami Enterprise

- Dipasa USA, Inc.

- ECOM Agroindustrial Corporation

- ETICO Group

- Fuerst Day Lawson

- HL Agro Products

- Olam International

- Shyam Industries

- SHREEJI EXPELLER INDUSTRIES

- Triangle Wholefoods

The Global Sesame Seeds Market reached USD 7.7 billion in 2024 and is projected to grow at a CAGR of 2.3% between 2025 and 2034. The growing demand for sesame seeds stems from their widespread application in the food industry, where they are essential for baking, confectionery, and snack production. Additionally, sesame seeds play a crucial role in the preparation of tahini and sesame oil, two staple ingredients in Middle Eastern and Asian cuisines. Their nutritional benefits, including high levels of healthy fats, protein, fiber, and antioxidants, continue to attract health-conscious consumers seeking natural and plant-based ingredients.

A surge in global demand for clean-label and minimally processed foods further fuels market expansion. Manufacturers are increasingly utilizing sesame seeds in packaged snacks, bakery products, and functional foods, capitalizing on their versatility and consumer appeal. The rising awareness of the health benefits associated with sesame seeds, such as their ability to support heart health, reduce inflammation, and improve digestion, adds momentum to market growth. Furthermore, growing interest in ethnic cuisines and the increasing use of sesame-based products in plant-based diets contribute to the market's upward trajectory. Advances in sesame seed processing technology, including better hulling and roasting techniques, are also enhancing product quality and extending shelf life, making sesame seeds a preferred ingredient across multiple food applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 2.3% |

The hulled sesame seeds segment is expected to generate USD 6.5 billion by 2034, growing at a CAGR of 2.6%. With their outer shells removed, hulled sesame seeds offer a refined flavor and smooth texture, making them highly desirable in bakery and snack products. Their extended shelf life and enhanced usability drive their popularity among food manufacturers, who are incorporating them into ready-to-use ingredients for consumer convenience. This segment's sustained growth is also driven by increasing consumer preference for easy-to-use food components that enhance the taste and texture of a wide range of applications.

Conventional sesame seeds dominated the market in 2024, holding a 73.7% share and generating USD 5.7 billion. This segment is forecasted to grow at a CAGR of 2.7% through 2034. Conventional sesame seeds remain the most preferred option due to their affordability and widespread availability. Price-sensitive markets and high-volume food production facilities continue to rely on conventional seeds as a cost-effective solution, ensuring a steady supply chain and economic viability. The expanding use of sesame seeds in processed and packaged food categories further reinforces the demand for conventional variants.

The U.S. sesame seeds market is projected to reach USD 5.1 billion by 2034, registering a CAGR of 2.2%. Consumers in the United States are increasingly prioritizing health and wellness, which has led to a growing preference for nutrient-rich ingredients like sesame seeds. Recognized for their high content of healthy fats, fiber, and antioxidants, sesame seeds are finding their way into a broader range of food products, including protein-enriched snacks, bakery items, and plant-based alternatives. Food manufacturers are responding to these evolving dietary trends by incorporating sesame seeds into functional foods and organic product lines. The rising demand for organic sesame seeds reflects a broader consumer shift toward high-quality, ethically sourced ingredients. Additionally, improvements in processing technology are ensuring higher product quality and better market penetration, further driving industry growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising awareness of the health benefits of sesame seeds

- 3.7.1.2 Rising demand for plant-based and vegan foods

- 3.7.1.3 Increasing demand for sesame seeds in the food and beverage industry

- 3.7.2 Market challenges

- 3.7.2.1 Volatility in sesame seed prices

- 3.7.1 Growth drivers

- 3.8 Regulations & market impact

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Hulled sesame seeds

- 5.3 Natural sesame seeds

Chapter 6 Market Size and Forecast, By Category, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Organic

- 6.3 Conventional

Chapter 7 Market Size and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food industry

- 7.3 Pharmaceutical industry

- 7.4 Cosmetic and personal care industry

- 7.5 Others

Chapter 8 Market Size and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Supermarkets and hypermarkets

- 8.3 Convenience stores

- 8.4 Online retail

- 8.5 Specialty stores

- 8.6 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ami Enterprise

- 10.2 Dipasa USA, Inc.

- 10.3 ECOM Agroindustrial Corporation

- 10.4 ETICO Group

- 10.5 Fuerst Day Lawson

- 10.6 HL Agro Products

- 10.7 Olam International

- 10.8 Shyam Industries

- 10.9 SHREEJI EXPELLER INDUSTRIES

- 10.10 Triangle Wholefoods