|

市场调查报告书

商品编码

1684844

维生素 B12 成分市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Vitamin B12 ingredient Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

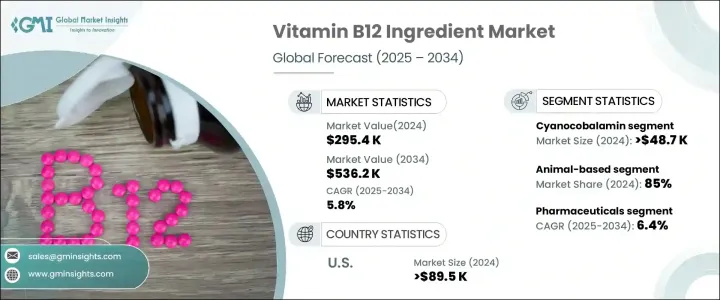

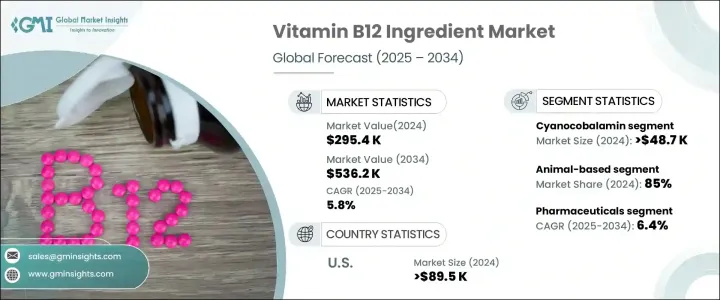

2024 年全球维生素 B12 成分市场价值为 295.4 万美元,预计 2025 年至 2034 年期间将以 5.8% 的强劲复合年增长率增长。随着消费者的健康意识日益增强,他们越来越意识到维生素和矿物质在维持整体健康方面发挥的关键作用,这大大增加了对维生素 B12 等必需营养素的需求。此外,全球转向植物性和纯素饮食,而这些饮食通常缺乏维生素 B12 的天然来源,这加剧了对强化食品和膳食补充剂的需求。饮食习惯的不断转变,加上健康意识的不断增强,使得维生素 B12 成为全球食品和补充剂中的关键成分。

人们对植物性饮食的偏好日益增长,加上纯素食者和素食者的数量增加,为维生素 B12 在补充营养缺乏方面发挥更大作用创造了机会。许多人,尤其是城市地区的人们,都将强化食品纳入日常营养方案中。由于消费者正在寻找方便的方法来确保满足他们的营养需求,市场对维生素 B12 补充剂的需求也显着增加。这些因素,加上富含维生素 B12 的产品的普及,预计将在未来十年继续推动市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 295.4 千美元 |

| 预测值 | 536.2 千美元 |

| 复合年增长率 | 5.8% |

2024 年,氰钴胺素领域创收 48.7 万美元,巩固了其作为市场上最重要的维生素 B12 形式之一的地位。氰钴胺素因价格便宜、保质期长、易于大规模生产而受到製造商的青睐。这些因素促使它在食品和补充品行业中广泛应用。此外,其在储存和运输过程中的稳定性以及成本效益巩固了其作为强化用途最受欢迎的维生素 B12 形式的地位。

市场仍严重依赖动物来源,动物来源占 2024 年维生素 B12 成分市场总量的 85%。这一细分市场受益于传统上使用肉类、乳製品和鸡蛋作为维生素 B12 的主要来源。这些动物性产品在强化牛奶、优格和肉类等主食方面发挥着不可或缺的作用,而这些主食是不同人群的常见消费品。儘管植物性饮食越来越受欢迎,但动物性维生素 B12 仍然占据主导地位,因为它在传统饮食习惯中长期存在,并且在食品强化中发挥重要作用。

在美国,受消费者对健康和保健产品的需求激增的推动,维生素 B12 成分市场在 2024 年创下了 89.5 万美元的产值。膳食补充剂和强化食品的日益普及进一步加速了北美市场的成长。消费者越来越意识到适当营养的好处,并继续优先考虑富含维生素 B12 的食品和补充剂,这使得美国成为全球最有利可图的市场之一。由于该地区注重健康的人群比例很高,预计未来几年对富含维生素 B12 的产品的需求将持续存在。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 强化食品的需求不断增加

- 维生素 B12 缺乏症盛行率

- 健康意识不断增强

- 不断扩张的製药业

- 产业陷阱与挑战

- 维生素B12成分

- 品质控制和纯度

- 监理合规性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模与预测:依形式,2021-2034 年

- 主要趋势

- 氰钴胺

- 甲钴胺

- 羟钴胺

- 腺苷钴胺

第 6 章:市场规模与预测:依来源,2021-2034 年

- 主要趋势

- 动物性

- 植物性

第 7 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 药品

- 膳食补充剂

- 药物

- 食品和饮料

- 强化食品

- 能量饮料和能量饮料

- 婴儿配方奶粉

- 化妆品和个人护理

- 保养产品

- 护髮产品

- 口腔护理产品

- 动物饲料和营养

第 8 章:市场规模与预测:依最终用途产业,2021-2034 年

- 主要趋势

- 人类营养

- 动物营养

第 9 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Adisseo

- BASF SE

- DSM Nutritional Products

- Gnosis by Lesaffre

- Jubilant Life Sciences

- Lonza

- Merck KGaA

- NOW Foods

- NutraGenesis

- Nutrilo

- Pharmavit

- Rousselot

- Spectrum Chemical Manufacturing

- Thermo Fisher Scientific

- Zhejiang Shengda Bio-Pharm

The Global Vitamin B12 Ingredient Market was valued at USD 295.4 thousand in 2024 and is projected to grow at a robust CAGR of 5.8% from 2025 to 2034. As consumers become increasingly health-conscious, there is a rising awareness of the critical role vitamins and minerals play in maintaining overall well-being, which has significantly boosted the demand for essential nutrients like Vitamin B12. Additionally, the global shift towards plant-based and vegan diets, which often lack natural sources of Vitamin B12, has intensified the demand for fortified foods and dietary supplements. This growing shift in dietary habits, combined with increasing health awareness, is positioning Vitamin B12 as a key ingredient in food and supplements across the world.

The growing preference for plant-based diets, coupled with a rise in the number of vegans and vegetarians, has created an opportunity for Vitamin B12 to play a larger role in supplementing nutrient deficiencies. Many people, especially in urbanized regions, are incorporating fortified foods into their daily nutrition regimen. The market is also witnessing a significant increase in demand for Vitamin B12 supplements, as consumers are looking for convenient ways to ensure they meet their nutritional needs. These factors, combined with greater access to Vitamin B12-enriched products, are expected to continue driving the market's expansion over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $295.4 Thousand |

| Forecast Value | $536.2 Thousand |

| CAGR | 5.8% |

In 2024, the cyanocobalamin segment generated USD 48.7 thousand, solidifying its position as one of the most crucial forms of Vitamin B12 in the market. Cyanocobalamin is favored by manufacturers due to its affordability, long shelf life, and ease of large-scale production. These factors contribute to its widespread adoption across the food and supplement industries. Moreover, its stable nature during storage and transportation, along with its cost-effectiveness, has solidified its status as the most popular form of Vitamin B12 for fortification purposes.

The market remains heavily reliant on animal-based sources, which accounted for 85% of the total Vitamin B12 ingredient market share in 2024. This segment benefits from the traditional use of meat, dairy, and eggs as primary sources of Vitamin B12. These animal-based products play an integral role in fortifying staple foods such as milk, yogurt, and meat, which are commonly consumed across diverse populations. Despite the increasing popularity of plant-based diets, animal-derived Vitamin B12 remains a dominant player due to its long-standing presence in conventional dietary habits and its essential role in food fortification.

In the U.S., the Vitamin B12 ingredient market generated USD 89.5 thousand in 2024, driven by a surge in consumer demand for health and wellness products. The growing popularity of dietary supplements and fortified foods is further accelerating market growth in North America. Consumers, increasingly aware of the benefits of proper nutrition, continue to prioritize foods and supplements rich in Vitamin B12, making the U.S. one of the most lucrative markets globally. With a high percentage of health-conscious individuals, the region is expected to see sustained demand for Vitamin B12-rich products in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for fortified foods

- 3.6.1.2 Prevalence of Vitamin B12 deficiency

- 3.6.1.3 Rising health & wellness consciousness

- 3.6.1.4 Expanding pharmaceutical industry

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Vitamin B12 ingredient

- 3.6.2.2 Quality control and purity

- 3.6.2.3 Regulatory compliance

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Form, 2021-2034 (USD Thousand) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cyanocobalamin

- 5.3 Methylcobalamin

- 5.4 Hydroxocobalamin

- 5.5 Adenosylcobalamin

Chapter 6 Market Size and Forecast, By Source, 2021-2034 (USD Thousand) (Kilo Tons)

- 6.1 Key trends

- 6.2 Animal-Based

- 6.3 Plant-Based

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Thousand) (Kilo Tons)

- 7.1 Key trends

- 7.2 Pharmaceuticals

- 7.3 Dietary supplements

- 7.4 Medications

- 7.5 Food and beverages

- 7.6 Fortified foods

- 7.7 Energy drinks and shots

- 7.8 Infant formula

- 7.9 Cosmetics and personal care

- 7.10 Skin care products

- 7.11 Hair care products

- 7.12 Oral care products

- 7.13 Animal feed and nutrition

Chapter 8 Market Size and Forecast, By End-Use Industries, 2021-2034 (USD Thousand) (Kilo Tons)

- 8.1 Key trends

- 8.2 Human nutrition

- 8.3 Animal nutrition

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Thousand) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adisseo

- 10.2 BASF SE

- 10.3 DSM Nutritional Products

- 10.4 Gnosis by Lesaffre

- 10.5 Jubilant Life Sciences

- 10.6 Lonza

- 10.7 Merck KGaA

- 10.8 NOW Foods

- 10.9 NutraGenesis

- 10.10 Nutrilo

- 10.11 Pharmavit

- 10.12 Rousselot

- 10.13 Spectrum Chemical Manufacturing

- 10.14 Thermo Fisher Scientific

- 10.15 Zhejiang Shengda Bio-Pharm