|

市场调查报告书

商品编码

1684855

止血带系统市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Tourniquet Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

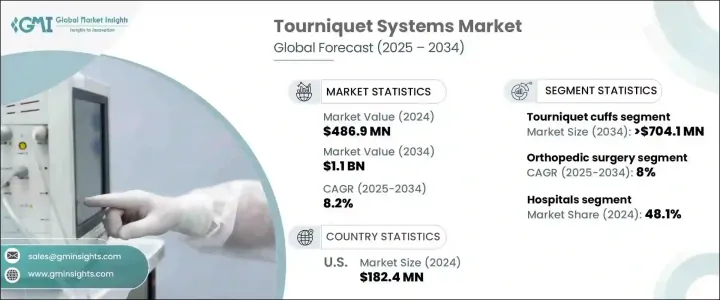

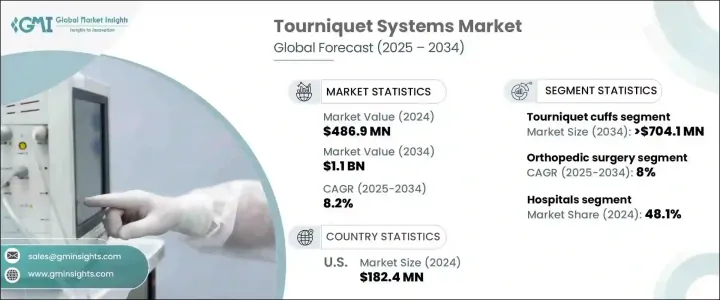

2024 年全球止血带系统市场价值达到 4.869 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 8.2%。创伤性损伤发生率的上升,加上全球外科手术数量的增加,正在推动对这些基本医疗设备的需求。由于医疗保健提供者优先考虑手术期间有效的失血管理,因此先进止血带解决方案的采用持续受到关注。气动和自动止血带系统设计精确、安全且易于使用,广泛应用于各种医疗环境。对优化手术技术的日益重视,加上智慧医疗设备的优惠报销政策,进一步加速了市场扩张。改善病患治疗效果和手术效率的技术创新是产业进步的核心,塑造了止血带系统的未来。

医疗基础设施的改善、人口老化以及选择性手术的增加是影响市场趋势的其他因素。随着老年人口的不断增长,对外科手术的需求也不断增加,特别是与骨科和血管疾病相关的手术需求。需要手术治疗的肌肉骨骼疾病、慢性病和生活方式疾病的增加凸显了止血带系统在现代医学中的重要角色。此外,医院和门诊手术中心越来越多地采用自动化和配备感测器的止血带装置,以最大限度地减少併发症并提高病患安全性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.869 亿美元 |

| 预测值 | 11亿美元 |

| 复合年增长率 | 8.2% |

从组件来看,市场由止血带袖带和器械组成,其中袖带预计将对市场扩张做出重大贡献。用于实现无血手术领域的止血带袖带预计将以 8% 的复合年增长率增长,到 2034 年将达到 7.041 亿美元。止血带袖带在提高手术准确性和减少术中失血方面发挥着重要作用,使其成为多个医学专业领域不可或缺的一部分。影响血液循环和肌肉骨骼健康的疾病发生率不断上升,增加了医院和专科诊所对止血带袖带的需求。医疗保健提供者越来越认识到使用高品质、可调节袖带的优势,以确保更好的手术精度和患者安全。

该市场还按应用进行细分,包括外科手术和紧急护理,其中骨科手术预计将大幅成长。预计该领域将以 8% 的复合年增长率扩张,到 2034 年将达到 5.284 亿美元。肌肉骨骼疾病的盛行率不断上升以及需要关节置换和骨折治疗的老年人口不断增加是主要的成长动力。随着骨科手术变得越来越复杂,对止血带系统等高精准度工具的需求也随之增加,以确保可控的手术环境和更好的病患治疗效果。

美国止血带系统市值在 2024 年将达到 1.824 亿美元,预计到 2034 年将以 7.4% 的复合年增长率成长。创伤病例、工作场所伤害和道路事故数量的增加导致需求不断增加,尤其是在紧急情况下。此外,需要手术干预的慢性病的流行也推动了市场扩张。该国完善的医疗保健基础设施和不断引进的先进医疗技术支撑了持续的成长。随着对病人安全和效率的日益关注,美国医疗机构对下一代止血带系统的采用持续加速。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 创伤和事故案例不断增加

- 关节置换手术数量不断增加

- 成年人口中退化性骨病和肌肉骨骼疾病的盛行率不断上升

- 失血管理意识不断增强

- 止血带系统的技术进步

- 产业陷阱与挑战

- 缺乏熟练的专业人员

- 重复使用袖口导致传染病传播

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按组件,2021 年至 2034 年

- 主要趋势

- 止血袖口

- 气动

- 可重复使用的

- 一次性的

- 非气动

- 气动

- 止血带器械

第六章:市场估计与预测:按应用,2021 — 2034 年

- 主要趋势

- 骨科手术

- 创伤护理

- 其他应用

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用户

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Anetic Aid

- CAT Resources

- Delfi

- Hpm Hammarplast Medical

- Huaxin

- OHK Medical Devices

- Pyng Medical

- Riester

- Sam Medical

- Stryker

- Teleflex

- ulrich Medical

- VBM

- Zimmer Biomet

The Global Tourniquet Systems Market reached a valuation of USD 486.9 million in 2024 and is projected to grow at a CAGR of 8.2% between 2025 and 2034. The rising incidence of traumatic injuries, coupled with a growing number of surgical procedures worldwide, is fueling demand for these essential medical devices. As healthcare providers prioritize effective blood loss management during surgeries, the adoption of advanced tourniquet solutions continues to gain traction. Pneumatic and automatic tourniquet systems, designed for precision, safety, and ease of use, are being widely integrated into various medical settings. The growing emphasis on optimizing surgical techniques, along with favorable reimbursement policies for smart medical devices, is further accelerating market expansion. Technological innovations that improve patient outcomes and surgical efficiency are at the core of industry advancements, shaping the future of tourniquet systems.

Healthcare infrastructure improvements, an aging population, and an increase in elective surgeries are additional factors influencing market trends. As the elderly demographic continues to grow, so does the demand for surgical interventions, particularly those related to orthopedic and vascular conditions. The rise in musculoskeletal disorders, chronic illnesses, and lifestyle diseases requiring surgical treatment underscores the critical role of tourniquet systems in modern medicine. Furthermore, hospitals and ambulatory surgical centers are increasingly adopting automated and sensor-equipped tourniquet devices that minimize complications and enhance patient safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $ 486.9 Million |

| Forecast Value | $ 1.1 Billion |

| CAGR | 8.2% |

By component, the market consists of tourniquet cuffs and instruments, with cuffs anticipated to contribute significantly to market expansion. Tourniquet cuffs, used to create a bloodless surgical field, are expected to grow at a CAGR of 8%, reaching USD 704.1 million by 2034. Their role in improving surgical accuracy and reducing intraoperative blood loss makes them indispensable across multiple medical specialties. The rising prevalence of conditions that affect blood circulation and musculoskeletal health has amplified the demand for tourniquet cuffs in hospitals and specialized clinics. Healthcare providers are increasingly recognizing the advantages of using high-quality, adjustable cuffs to ensure better surgical precision and patient safety.

The market is also segmented by application, including surgical procedures and emergency care, with orthopedic procedures expected to witness substantial growth. This segment is projected to expand at a CAGR of 8%, generating USD 528.4 million by 2034. The increasing prevalence of musculoskeletal disorders and the growing elderly population requiring joint replacements and fracture treatments are primary growth drivers. As orthopedic surgeries become more sophisticated, the demand for high-precision tools like tourniquet systems rises, ensuring a controlled surgical environment and better patient outcomes.

The U.S. tourniquet systems market, valued at USD 182.4 million in 2024, is forecasted to grow at a CAGR of 7.4% through 2034. A rising number of trauma cases, workplace injuries, and road accidents is increasing demand, particularly in emergency settings. Additionally, the prevalence of chronic conditions requiring surgical intervention is fueling market expansion. The country's well-developed healthcare infrastructure, alongside the steady introduction of advanced medical technologies, supports sustained growth. With an increasing focus on patient safety and efficiency, the adoption of next-generation tourniquet systems in U.S. healthcare facilities continues to accelerate.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of trauma and accident cases

- 3.2.1.2 Rising number of joint replacement surgeries

- 3.2.1.3 Increasing prevalence of degenerative bone disorders and musculoskeletal diseases among adult population

- 3.2.1.4 Rising awareness of blood loss management

- 3.2.1.5 Technological advancements in tourniquet systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled professionals

- 3.2.2.2 Transmission of infectious diseases associated with increasing use of reusable cuffs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Tourniquet cuffs

- 5.2.1 Pneumatic

- 5.2.1.1 Reusable

- 5.2.1.2 Disposable

- 5.2.2 Non-pneumatic

- 5.2.1 Pneumatic

- 5.3 Tourniquet instruments

Chapter 6 Market Estimates and Forecast, By Application, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Orthopedic surgery

- 6.3 Trauma care

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anetic Aid

- 9.2 C.A.T Resources

- 9.3 Delfi

- 9.4 Hpm Hammarplast Medical

- 9.5 Huaxin

- 9.6 OHK Medical Devices

- 9.7 Pyng Medical

- 9.8 Riester

- 9.9 Sam Medical

- 9.10 Stryker

- 9.11 Teleflex

- 9.12 ulrich Medical

- 9.13 VBM

- 9.14 Zimmer Biomet