|

市场调查报告书

商品编码

1684863

肠外包装市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Parenteral Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

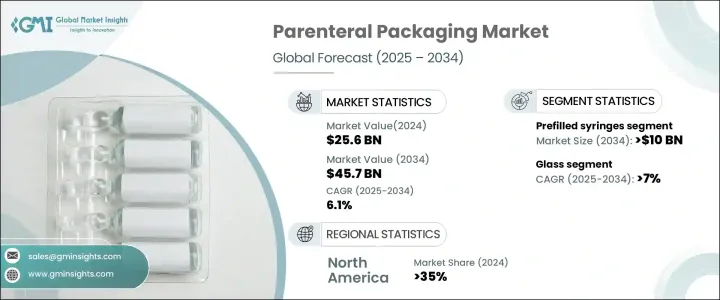

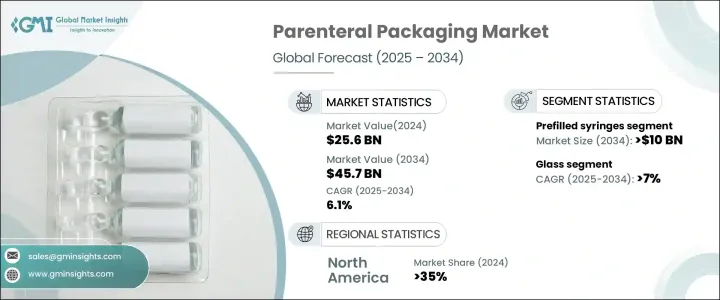

2024 年全球肠外包装市场价值为 256 亿美元,预估 2025 年至 2034 年期间复合年增长率为 6.1%。这一成长主要受即用型包装解决方案需求不断增长的推动。这些解决方案在提高药物稳定性、降低污染风险和降低生产成本方面发挥关键作用。随着医疗保健领域的发展,受生物製剂和个人化医疗进步的推动,注射药物的趋势日益明显。这一趋势推动了市场扩张,製药和生物技术公司优先考虑高品质的无菌包装,以确保其产品的安全性和有效性。

此外,医院和家庭医疗保健环境对先进药物输送系统的需求不断增长,为创新包装解决方案创造了重大机会。包装材料和形式的技术进步使得药物管理更加方便、安全和高效,并使肠外包装成为现代医疗实践的基石。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 256亿美元 |

| 预测值 | 457亿美元 |

| 复合年增长率 | 6.1% |

市场根据产品类型细分,主要类别包括药筒、小瓶和安瓿瓶、预充式註射器、输液瓶和袋、泡罩包装和其他形式。预充式註射器将主导市场,到 2034 年将创造 100 亿美元的收入。向自我管理的转变使预充式註射器成为患者和医疗保健提供者的首选。它们能够透过提供预先测量的剂量来最大限度地减少用药错误,这使它们成为各种治疗领域的理想选择。随着全球慢性病持续增加以及对精确剂量的需求不断增加,对预充式註射器的需求仍然强劲。

材料选择在市场动态中起着关键作用,其中玻璃、塑胶、纸和纸板是主要选择。玻璃领域预计将经历最高的成长,预计 2025 年至 2034 年的复合年增长率为 7%。玻璃因其非反应性而受到青睐,使其成为保存敏感注射药物(包括生物製剂和疫苗)完整性的理想选择。其惰性确保药物化合物保持稳定、无菌、不受化学降解或污染,为高价值治疗药物在整个保质期内提供无与伦比的保护。

北美在全球肠外包装市场占有相当大的份额,到 2024 年将达到 35%。美国引领区域市场,不断扩张的製药和生物技术产业推动了对尖端包装解决方案的需求。该国强大的医疗保健基础设施,加上对药物开发不断增加的投资,支持了市场持续成长。随着对病患安全和法规遵循的关注度不断提高,确保药物稳定性、易用性和高效输送的复杂包装技术正在成为标准。该地区对医疗保健和製药製造业创新的承诺将推动肠外包装市场的长期成长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 生物製剂和注射剂的需求不断增长

- 即用型包装解决方案的普及

- 包装材料的技术进步

- 监理要求提高安全标准

- 扩大新兴市场的医疗基础设施

- 产业陷阱与挑战

- 先进封装生产成本高

- 客製化包装解决方案的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按材料类型,2021-2034 年

- 主要趋势

- 玻璃

- 塑胶

- 纸和纸板

- 其他的

第 6 章:市场估计与预测:按产品类型,2021-2034 年

- 主要趋势

- 小瓶和安瓿瓶

- 墨水匣

- 预充式註射器

- 点滴瓶和输液袋

- 泡罩包装

- 其他的

第 7 章:市场估计与预测:依封装类型,2021-2034 年

- 主要趋势

- 初级包装

- 二次包装

- 三级包装

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Adelphi Group

- Amcor

- AptarGroup

- Baxter International

- Berry Global

- Catalent

- Datwyler

- Gerresheimer

- Nipro

- Oliver Healthcare Packaging

- Schott

- SGD Pharma

- Stevanato Group

- Tekni-Plex

- West Pharmaceutical Services

- WestRock

The Global Parenteral Packaging Market is valued at USD 25.6 billion in 2024 and is projected to expand at a CAGR of 6.1% from 2025 to 2034. This growth is primarily driven by the increasing demand for ready-to-use packaging solutions. These solutions play a critical role in enhancing drug stability, reducing the risk of contamination, and lowering production costs. As the healthcare landscape evolves, there is a growing shift toward injectable drugs propelled by advancements in biologics and personalized medicine. This trend is fueling market expansion, with pharmaceutical and biotechnology companies prioritizing high-quality, sterile packaging to guarantee the safety and efficacy of their products.

Furthermore, the rising need for advanced drug delivery systems in both hospital and home healthcare settings is creating significant opportunities for innovative packaging solutions. Technological advancements in packaging materials and formats are making drug administration more convenient, safer, and efficient, establishing parenteral packaging as a cornerstone in modern healthcare practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.6 Billion |

| Forecast Value | $45.7 Billion |

| CAGR | 6.1% |

The market is segmented based on product type, with key categories including cartridges, vials and ampoules, prefilled syringes, infusion solution bottles and bags, blister packs, and other formats. Prefilled syringes are poised to dominate the market, generating USD 10 billion in revenue by 2034. The shift towards self-administration has positioned prefilled syringes as a preferred option for patients and healthcare providers alike. Their ability to minimize medication errors by offering pre-measured doses makes them an ideal choice for a variety of therapeutic areas. As chronic diseases continue to rise globally and the demand for precise dosages intensifies, the need for prefilled syringes remains strong.

Material selection plays a pivotal role in the market's dynamics, with glass, plastic, paper, and paperboard being the primary options. The glass segment is expected to experience the highest growth, with a projected CAGR of 7% from 2025 to 2034. Glass is favored for its non-reactive properties, making it the ideal choice for preserving the integrity of sensitive injectable drugs, including biologics and vaccines. Its inert nature ensures that pharmaceutical compounds remain stable, sterile, and free from chemical degradation or contamination, offering unparalleled protection for high-value therapeutics throughout their shelf life.

North America holds a significant share of the global parenteral packaging market, accounting for 35% in 2024. The United States leads the regional market, with the expanding pharmaceutical and biotechnology sectors fueling the demand for cutting-edge packaging solutions. The country's strong healthcare infrastructure, combined with increasing investments in drug development, supports continued market growth. As the focus on patient safety and regulatory compliance intensifies, sophisticated packaging technologies that ensure drug stability, ease of use, and efficient delivery are becoming the standard. The commitment to innovation in healthcare and pharmaceutical manufacturing in the region is set to drive long-term growth in the parenteral packaging market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Key news & initiatives

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Rising demand for biologics and injectables

- 3.4.1.2 Popularity of ready-to-use packaging solutions

- 3.4.1.3 Technological advancements in packaging materials

- 3.4.1.4 Regulatory requirements boosting safety standards

- 3.4.1.5 Expanding healthcare infrastructure in emerging markets

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High production costs of advanced packaging

- 3.4.2.2 Complexity in customizing packaging solutions

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Glass

- 5.3 Plastic

- 5.4 Paper and paperboard

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Vials & ampoules

- 6.3 Cartridges

- 6.4 Prefilled syringes

- 6.5 Infusion solutions bottles & bags

- 6.6 Blister packs

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Primary packaging

- 7.3 Secondary packaging

- 7.4 Tertiary packaging

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Adelphi Group

- 9.2 Amcor

- 9.3 AptarGroup

- 9.4 Baxter International

- 9.5 Berry Global

- 9.6 Catalent

- 9.7 Datwyler

- 9.8 Gerresheimer

- 9.9 Nipro

- 9.10 Oliver Healthcare Packaging

- 9.11 Schott

- 9.12 SGD Pharma

- 9.13 Stevanato Group

- 9.14 Tekni-Plex

- 9.15 West Pharmaceutical Services

- 9.16 WestRock