|

市场调查报告书

商品编码

1684869

肺支架市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Lung Stent Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

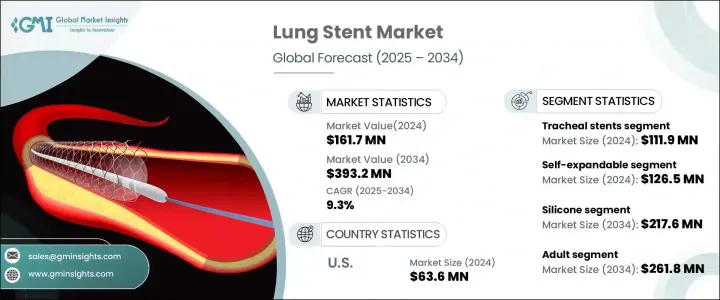

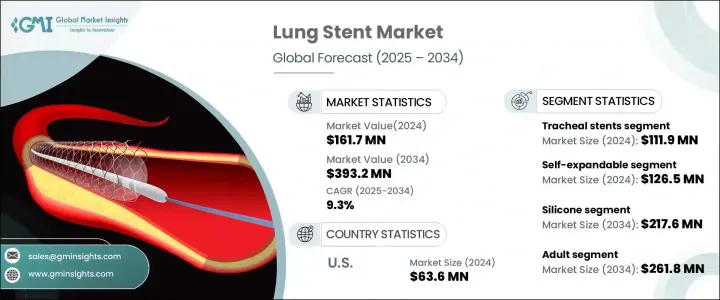

2024 年全球肺支架市场价值为 1.617 亿美元,预计 2025 年至 2034 年期间将实现 9.3% 的强劲成长率。市场快速扩张可归因于多种因素,包括慢性呼吸系统疾病盛行率上升、微创手术的进步以及旨在开发创新医疗技术的投资激增。由于空气污染、吸烟和久坐的生活方式等因素,呼吸系统疾病变得越来越普遍。这些情况导致对肺支架的需求增加,因为它们对于因肿瘤、感染或先天性异常引起阻塞的患者维持气道通畅和改善呼吸方面发挥着至关重要的作用。

肺支架因其透过提供有效的气道管理解决方案来改善患者治疗效果的能力而越来越受到认可。随着医疗保健系统的发展,人们越来越倾向于采用微创治疗,因为这种治疗可以缩短恢復时间、减少併发症并降低医疗成本。技术进步使得肺支架能够更适应各种气道解剖结构,人工智慧驱动的成像和导航系统的整合进一步提高了支架放置的精准度。这种技术整合为更好的治疗效果和成功率铺平了道路。此外,全球人口老化更容易患上呼吸系统疾病,从而增加对此类医疗设备的需求。政府支持先进呼吸照护的倡议和优惠的报销政策也推动了市场的成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.617 亿美元 |

| 预测值 | 3.932亿美元 |

| 复合年增长率 | 9.3% |

肺支架市场分为三种产品类型:气管支架、支气管支架和喉支架。气管支架领域在 2024 年以 1.119 亿美元的市场规模领先。气管支架在治疗严重气道阻塞方面已被广泛应用,成为医疗保健提供者中最受欢迎的选择。这些支架可以在出现严重呼吸道阻塞的情况下立即缓解症状,确保气流不间断,并显着降低併发症的风险。因此,气管支架通常用于紧急手术和计划手术。

设备类型细分包括自膨胀支架和球囊膨胀支架。自膨胀支架领域在 2024 年创造了 1.265 亿美元的收入,预计在 2025 年至 2034 年期间的复合年增长率为 9.4%。这些支架因其易于部署且能够适应复杂的气道结构而受到青睐。放置后,自膨胀支架会自动膨胀,从而缩短手术时间并确保准确定位。它们的可靠性和效率使得它们在快速恢復气流至关重要的紧急情况下特别有价值。

在美国,肺支架市场在 2024 年达到 6,360 万美元,预计到 2034 年将以 8.8% 的复合年增长率成长。由于美国拥有先进的医疗基础设施、较高的肺部疾病发生率以及对微创治疗的日益重视,美国将继续主导全球市场。人工智慧成像等尖端技术的融合,提高了支架置入的精准度,进一步巩固了中国在该领域的领先地位。政府的支持性政策和报销框架也对美国市场的成长轨迹做出了重大贡献。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 肺癌发生率上升

- 慢性阻塞性肺病和结核病后狭窄的发生率不断上升

- 公共和私人组织加大对非血管支架开发的投资

- 呼吸系统疾病微创手术越来越受青睐

- 产业陷阱与挑战

- 替代治疗的可用性

- 严格的规定

- 成长动力

- 成长潜力分析

- 2024 年定价分析

- 监管格局

- 报销场景

- 技术格局

- 管道分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 气管支架

- 支气管支架

- 喉支架

第 6 章:市场估计与预测:按设备类型,2021 - 2034 年

- 主要趋势

- 自膨胀式

- 球囊扩张型

第 7 章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 硅酮

- 金属

- 不銹钢

- 镍钛合金

- 杂交种

第 8 章:市场估计与预测:按患者,2021 - 2034 年

- 主要趋势

- 成人

- 儿科

第 9 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用户

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Boston Medical Products

- Boston Scientific

- HEALTH MICROPORT MEDICAL

- COOK GROUP

- EFER ENDOSCOPY

- HOOD LABORATORIES

- mi-TECH

- MERIT MEDICAL

- MICRO-TECH ENDOSCOPY

- NOVATECH

- STENING

- TaeWoong MEDICAL

- Teleflex

The Global Lung Stent Market, valued at USD 161.7 million in 2024, is projected to experience a robust growth rate of 9.3% CAGR from 2025 to 2034. This rapid market expansion can be attributed to several factors, including the rising prevalence of chronic respiratory diseases, advancements in minimally invasive procedures, and a surge in investments aimed at developing innovative medical technologies. Respiratory conditions are becoming more widespread, driven by factors like air pollution, smoking, and sedentary lifestyles. These conditions have led to an increased demand for lung stents, as they play a crucial role in maintaining airway patency and improving breathing for patients suffering from blockages caused by tumors, infections, or congenital abnormalities.

Lung stents are increasingly recognized for their ability to improve patient outcomes by offering effective solutions for airway management. As healthcare systems evolve, there is a growing shift toward minimally invasive treatments that provide quicker recovery times, reduced complications, and lower healthcare costs. Technological advancements have made lung stents more adaptable to various airway anatomies, and the integration of artificial intelligence-driven imaging and navigation systems has further enhanced the precision of stent placement. This technological integration is paving the way for better treatment outcomes and success rates. Additionally, the aging global population is more vulnerable to respiratory diseases, contributing to a higher demand for such medical devices. Government initiatives supporting advanced respiratory care and favorable reimbursement policies are also fueling the market's growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $161.7 Million |

| Forecast Value | $393.2 Million |

| CAGR | 9.3% |

The lung stent market is divided into three product types: tracheal, bronchial, and laryngeal stents. The tracheal stents segment led the market with USD 111.9 million in 2024. Their widespread use in treating severe airway obstructions has made them the most preferred choice among healthcare providers. These stents offer immediate relief in cases of critical respiratory blockages, ensuring uninterrupted airflow and significantly reducing the risk of complications. As a result, tracheal stents are commonly used in both emergency and planned procedures.

Device type segmentation includes self-expandable and balloon-expandable stents. The self-expandable stents segment generated USD 126.5 million in 2024 and is expected to grow at a CAGR of 9.4% between 2025 and 2034. These stents are favored for their ease of deployment and their ability to conform to complex airway structures. Upon placement, self-expandable stents automatically expand, cutting down procedural time and ensuring accurate positioning. Their reliability and efficiency make them especially valuable in emergency scenarios where quick restoration of airflow is critical.

In the U.S., the lung stent market reached USD 63.6 million in 2024 and is anticipated to grow at a CAGR of 8.8% through 2034. The U.S. continues to dominate the global market, thanks to its advanced healthcare infrastructure, high incidence of lung diseases, and increasing focus on minimally invasive treatments. The integration of cutting-edge technologies, such as AI-driven imaging, is improving the precision of stent placements, further bolstering the country's leading position in this sector. Supportive government policies and reimbursement frameworks are also contributing significantly to the U.S. market's growth trajectory.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of lung cancer

- 3.2.1.2 Growing incidence of COPD and post-tuberculosis stenosis

- 3.2.1.3 Increasing investments by the public and private organizations for the development of non-vascular stents

- 3.2.1.4 Growing preference for minimally invasive surgeries for respiratory disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of alternative substitute treatment

- 3.2.2.2 Stringent regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pricing analysis, 2024

- 3.5 Regulatory landscape

- 3.6 Reimbursement scenario

- 3.7 Technology landscape

- 3.8 Pipeline analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Tracheal stents

- 5.3 Bronchial stents

- 5.4 Laryngeal stents

Chapter 6 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Self-expandable

- 6.3 Balloon-expandable

Chapter 7 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Silicone

- 7.3 Metal

- 7.3.1 Stainless steel

- 7.3.2 Nitinol

- 7.4 Hybrid

Chapter 8 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Adult

- 8.3 Pediatric

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Ambulatory surgical centers

- 9.4 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Boston Medical Products

- 11.2 Boston Scientific

- 11.3 HEALTH MICROPORT MEDICAL

- 11.4 COOK GROUP

- 11.5 EFER ENDOSCOPY

- 11.6 HOOD LABORATORIES

- 11.7 mi-TECH

- 11.8 MERIT MEDICAL

- 11.9 MICRO-TECH ENDOSCOPY

- 11.10 NOVATECH

- 11.11 STENING

- 11.12 TaeWoong MEDICAL

- 11.13 Teleflex