|

市场调查报告书

商品编码

1685058

涡轮机油市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Turbine Oil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

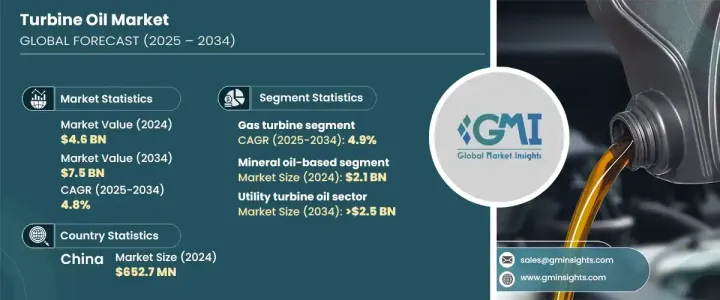

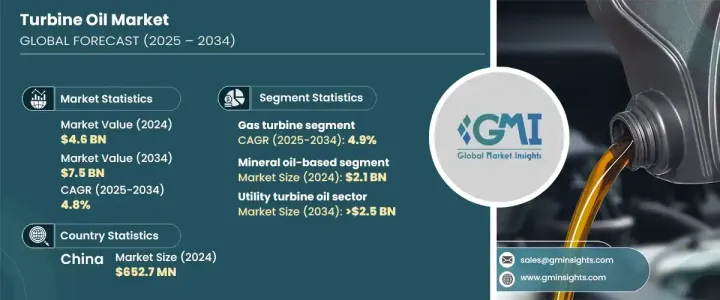

2024 年全球涡轮机油市场价值为 46 亿美元,预计在 2025 年至 2034 年期间的复合年增长率为 4.8%,这得益于电力需求的增长和全球发电能力的持续扩张。随着全球能源产业的不断发展,对高性能润滑油的需求变得越来越重要。涡轮机油透过减少摩擦、防止腐蚀和提高整体效率在确保涡轮机无缝运行方面发挥着至关重要的作用。它们能够承受极端操作条件,这使得它们在发电厂、航空和海洋应用中不可或缺。

对清洁能源的追求和老化电力基础设施的现代化进一步推动了对先进涡轮机油的需求。新兴经济体,特别是亚洲和中东的经济体,正在经历快速工业化,导致电力消费激增。对风能和水力发电等再生能源项目的投资也促进了市场成长。製造商专注于创新,开发具有更好的热稳定性、抗氧化性和更长使用寿命的涡轮机油,以满足能源产业不断变化的需求。此外,发电厂数位监控系统的整合可以实现预测性维护,从而推动优质润滑油的采用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 46亿美元 |

| 预测值 | 75亿美元 |

| 复合年增长率 | 4.8% |

涡轮机油市场依产品分为矿物油基、合成基和生物基涡轮机油。矿物油基涡轮机油引领市场,2024 年创收 21 亿美元,预计预测期内复合年增长率为 5.1%。它们在发电厂和工业应用中的广泛使用,加上其成本效益,继续推动需求。此外,对设备维护和效率优化的认识不断提高,正在影响最终用户投资高品质的涡轮机油,进一步推动市场扩张。

按应用划分,燃气涡轮机占据行业主导地位,2024 年的收入为 22 亿美元。预计在分析期内,该领域的复合年增长率为 4.9%。向节能解决方案的转变以及持续的研发努力正在塑造竞争格局。製造商正在推出具有优异氧化稳定性和增强性能的下一代涡轮机油,以延长设备寿命并最大限度地降低维护成本。这些创新有望加速产品的采用,特别是在优先考虑永续性的领域。

中国仍然是涡轮机油市场的关键参与者,2024 年的估值为 6.527 亿美元,并且在预测期内呈现强劲的成长轨迹。在快速工业化、基础设施发展和大力投资再生能源的推动下,该国的能源产业正在经历重大转型。作为全球最大的能源消费国和生产国,中国正在扩大风电和水力发电装置容量,以满足不断增长的能源需求并实现碳中和目标。能源生产项目的激增极大地增加了对涡轮机油的需求,特别是在风力涡轮机和蒸汽涡轮机应用中。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 电力需求不断成长

- 扩大发电能力

- 再生能源投资激增

- 执行严格的法规和标准

- 产业陷阱与挑战

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模及预测:依产品,2021-2034 年

- 主要趋势

- 矿物油基涡轮机油

- 合成涡轮机油

- 生物基涡轮机油

第 6 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 瓦斯涡轮机

- 蒸汽涡轮机

- 水力涡轮机

- 其他的

第 7 章:市场规模与预测:依最终用途,2021-2034 年

- 主要趋势

- 工业的

- 公用事业

第 8 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Afton Chemical

- BP plc

- Castrol

- Chevron USA Inc.

- Eastern Petroleum

- Eastman Chemical Company

- Exxon Mobil Corporation

- FUCHS

- Idemitsu

- Indian Oil Corporation Ltd.

- Kluber Lubrication

- Lubrizol

- LUKOIL Marine Lubricants

- NYCO

- Paras Lubricants Ltd.

- Penrite Oil

- PETRONAS

- Quaker Chemical Corporation

- Repsol

- Shell

- TotalEnergies

- Valvoline Global

The Global Turbine Oil Market generated USD 4.6 billion in 2024 and is projected to grow at a CAGR of 4.8% between 2025 and 2034, driven by rising electricity demand and the ongoing expansion of power generation capacities worldwide. As the global energy sector continues to evolve, the need for high-performance lubricants becomes increasingly critical. Turbine oils play a vital role in ensuring the seamless operation of turbines by reducing friction, preventing corrosion, and enhancing overall efficiency. Their ability to withstand extreme operating conditions makes them indispensable in power plants, aviation, and marine applications.

The push for cleaner energy sources and the modernization of aging power infrastructure are further propelling the demand for advanced turbine oils. Emerging economies, particularly in Asia and the Middle East, are witnessing rapid industrialization, leading to an upsurge in electricity consumption. Investments in renewable energy projects, such as wind and hydropower, are also contributing to market growth. Manufacturers are focusing on innovation, developing turbine oils with improved thermal stability, oxidation resistance, and extended service life to meet the evolving requirements of the energy sector. Additionally, the integration of digital monitoring systems in power plants enables predictive maintenance, driving the adoption of premium-quality lubricants.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 4.8% |

The turbine oil market is segmented by product into mineral oil-based, synthetic, and bio-based turbine oils. Mineral oil-based turbine oils led the market, generating USD 2.1 billion in 2024, and are anticipated to grow at a CAGR of 5.1% through the forecast period. Their widespread use in power plants and industrial applications, combined with cost-effectiveness, continues to drive demand. Additionally, increasing awareness about equipment maintenance and efficiency optimization is influencing end users to invest in high-quality turbine oils, further fueling market expansion.

By application, gas turbines dominated the industry, accounting for USD 2.2 billion in revenue in 2024. The segment is forecasted to grow at a CAGR of 4.9% during the analysis period. The transition toward energy-efficient solutions, along with continuous R&D efforts, is shaping the competitive landscape. Manufacturers are introducing next-generation turbine oils with superior oxidative stability and enhanced performance to extend equipment life and minimize maintenance costs. These innovations are expected to accelerate product adoption, especially in sectors prioritizing sustainability.

China remains a key player in the turbine oil market, with a valuation of USD 652.7 million in 2024 and a strong growth trajectory over the forecast period. The country's energy sector is undergoing a major transformation fueled by rapid industrialization, infrastructure development, and aggressive investments in renewable energy. As the largest energy consumer and producer globally, China is expanding its wind and hydropower capacity to meet rising energy demands and achieve carbon neutrality targets. The surge in energy generation projects is significantly boosting the demand for turbine oils, particularly in wind and steam turbine applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for electricity

- 3.6.1.2 Expansion of power generation capacity

- 3.6.1.3 Surging investments in renewable energy

- 3.6.1.4 Implementation of stringent regulations and standards

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Price volatility of raw materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Mineral oil-based turbine oil

- 5.3 Synthetic turbine oil

- 5.4 Bio-based turbine oil

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Gas turbine

- 6.3 Steam turbine

- 6.4 Hydro turbine

- 6.5 Others

Chapter 7 Market Size and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Industrial

- 7.3 Utility

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Afton Chemical

- 9.2 BP p.l.c.

- 9.3 Castrol

- 9.4 Chevron U.S.A. Inc.

- 9.5 Eastern Petroleum

- 9.6 Eastman Chemical Company

- 9.7 Exxon Mobil Corporation

- 9.8 FUCHS

- 9.9 Idemitsu

- 9.10 Indian Oil Corporation Ltd.

- 9.11 Kluber Lubrication

- 9.12 Lubrizol

- 9.13 LUKOIL Marine Lubricants

- 9.14 NYCO

- 9.15 Paras Lubricants Ltd.

- 9.16 Penrite Oil

- 9.17 PETRONAS

- 9.18 Quaker Chemical Corporation

- 9.19 Repsol

- 9.20 Shell

- 9.21 TotalEnergies

- 9.22 Valvoline Global