|

市场调查报告书

商品编码

1685064

带嘴和不带嘴液体袋包装市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Spout and Non-Spout Liquid Pouch Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

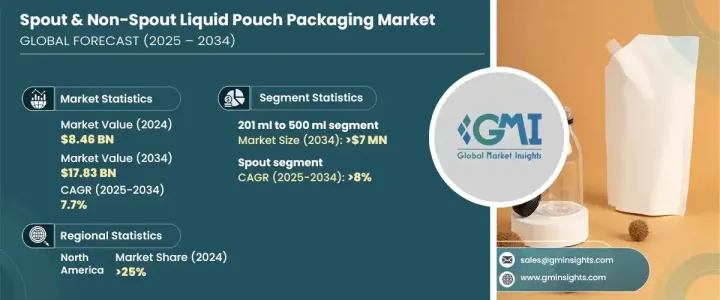

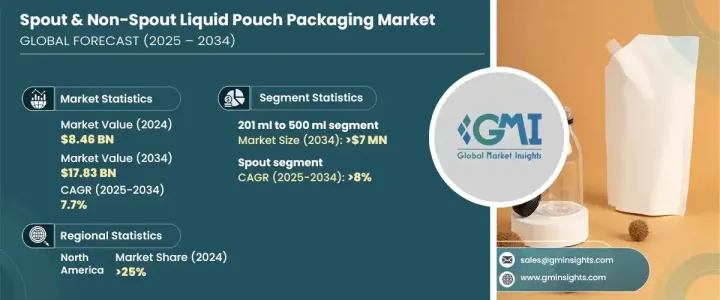

2024 年全球带嘴和非带嘴液体袋包装市场价值为 84.6 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.7%。对灵活、轻巧、节省空间的包装解决方案的需求不断增长,推动了这一扩张。随着消费者寻求方便、便携和可重新密封的包装选择,企业正在转向具有成本效益且高效的硬质容器替代品。人们对永续性的日益关注进一步加速了市场的成长,製造商纷纷投资可回收和可生物降解的包装袋,以符合不断变化的环境法规和消费者偏好。

电子商务的兴起在推动液体袋需求方面发挥了至关重要的作用,因为它们具有耐用性、防溢出性和降低运输成本的特性。这些包装解决方案对食品和饮料、个人护理和家用产品等行业特别有吸引力,因为功能性和便利性是这些行业的首要任务。单份和便携式包装形式的日益普及也推动了成长,迎合了寻求易于使用选择的忙碌消费者的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 84.6亿美元 |

| 预测值 | 178.3亿美元 |

| 复合年增长率 | 7.7% |

技术进步正在改变市场,各公司专注于创新材料设计,以增强液体袋的强度、柔韧性和阻隔性。二维码袋和温度敏感标籤等智慧包装解决方案正日益受到关注,提高了消费者参与度和产品安全性。此外,成本效益高的製造技术和生产自动化使液体袋包装成为寻求优化供应链的企业的首选。

按容量划分,市场分为 200 毫升以下、201 毫升至 500 毫升、501 毫升至 1 公升以及 1 公升以上。由于多个行业的广泛应用,201 毫升至 500 毫升细分市场预计到 2034 年将创收 700 万美元。此容量范围实现了便携性和实用性的完美平衡,非常适合包装饮料、酱汁、个人护理用品和家用液体。其紧凑的尺寸吸引了追求便利性的消费者,同时也确保了製造商高效的储存和运输。满足各种应用的能力增强了其市场地位。

根据类型,市场还分为带嘴包装和不带嘴包装。吸嘴袋市场预计将实现最高成长,2025 年至 2034 年之间的复合年增长率为 8%。吸嘴袋因其可控分配和可重新密封的特点而越来越受欢迎,具有增强的功能性和便利性。它们能够最大限度地减少产品浪费,同时确保易于使用,这使得它们成为液体包装的理想选择。这些袋子广泛用于饮料、调味品和个人护理用品,特别是在防溢出和便携性至关重要的地方。对一次性和旅行友善包装的需求不断增长是推动该领域扩张的重要因素。

2024 年北美占 25% 的市场份额,其中美国需求强劲。消费者对环保和便利包装的偏好继续推动该地区的成长。支持永续材料和可回收包装的监管措施进一步增强了市场。散装包装的日益普及和电子商务的扩张增加了对耐用、防溢液体袋的需求。成本效益生产技术的创新使液体袋包装成为希望提高营运效率同时降低运输成本的企业的一个有吸引力的选择。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 方便包装需求不断成长

- 永续性和减少材料使用

- 大容量包装的创新

- 电子商务和快速消费品的成长

- 成本效益和定制

- 产业陷阱与挑战

- 回收的复杂性

- 产品完整性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 喷口

- 无喷口

第六章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 最多 200 毫升

- 201 毫升至 500 毫升

- 501 毫升至 1 公升

- 1公升以上

第 7 章:市场估计与预测:按层压板,2021 年至 2034 年

- 主要趋势

- 两层

- 三层

- 四层

- 其他的

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 果汁和饮料

- 酱汁和调味品

- 乳製品

- 工业的

- 油和润滑剂

- 化学品

- 个人护理

- 液体肥皂

- 洗髮精和护髮素

- 居家护理

- 清洁剂

- 清洁解决方案

- 製药

- 乳霜和凝胶

- 糖浆

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Amcor

- Ampac

- Cellpack Packaging

- Chengde

- Constantia Flexibles

- Glenroy

- Huhtamaki

- Impak Corporation

- Pouch Makers CA

- Smart Pouches

- Smurfit Kappa

- Sonoco

- Swiss Pac

- Tetra Pak

- Uflex

The Global Spout And Non-Spout Liquid Pouch Packaging Market was valued at USD 8.46 billion in 2024 and is expected to grow at a CAGR of 7.7% between 2025 and 2034. The increasing demand for flexible, lightweight, and space-efficient packaging solutions is driving this expansion. As consumers seek convenient, portable, and resealable packaging options, businesses are shifting toward cost-effective and efficient alternatives to rigid containers. The growing focus on sustainability has further accelerated market growth, with manufacturers investing in recyclable and biodegradable pouches to align with evolving environmental regulations and consumer preferences.

The rise of e-commerce has played a crucial role in boosting demand for liquid pouches, as they offer durability, spill resistance, and reduced shipping costs. These packaging solutions are particularly appealing to industries such as food and beverage, personal care, and household products, where functionality and convenience are top priorities. The increasing adoption of single-serve and on-the-go packaging formats has also fueled growth, catering to busy consumers looking for easy-to-use options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.46 Billion |

| Forecast Value | $17.83 Billion |

| CAGR | 7.7% |

Technological advancements are transforming the market, with companies focusing on innovative material designs that enhance the strength, flexibility, and barrier properties of liquid pouches. Smart packaging solutions, such as QR-coded pouches and temperature-sensitive labels, are gaining traction, improving consumer engagement and product safety. Additionally, cost-efficient manufacturing techniques and automation in production are making liquid pouch packaging a preferred choice for businesses looking to optimize their supply chains.

The market is segmented by capacity into up to 200 ml, 201 ml to 500 ml, 501 ml to 1 liter, and above 1 liter. The 201 ml to 500 ml segment is projected to generate USD 7 million by 2034, driven by its widespread adoption across multiple industries. This capacity range provides the perfect balance of portability and practicality, making it ideal for packaging beverages, sauces, personal care items, and household liquids. Its compact size appeals to consumers looking for convenience while ensuring efficient storage and transportation for manufacturers. The ability to cater to various applications strengthens its market prominence.

The market is also categorized by type into spout and non-spout packaging. The spout segment is set to register the highest growth, with a CAGR of 8% between 2025 and 2034. Spout pouches are becoming increasingly popular due to their controlled dispensing and resealable features, offering enhanced functionality and convenience. Their ability to minimize product waste while ensuring ease of use makes them highly desirable for liquid packaging. These pouches are widely utilized for beverages, condiments, and personal care items, especially where spill prevention and portability are essential. The rising demand for single-use and travel-friendly packaging is a significant factor driving the expansion of this segment.

North America accounted for a 25% share of the market in 2024, with strong demand in the United States. Consumer preference for eco-friendly and convenient packaging continues to drive growth in the region. Regulatory initiatives supporting sustainable materials and recyclable packaging further strengthen the market. The increasing popularity of bulk packaging and the expansion of e-commerce have heightened the demand for durable, spill-proof liquid pouches. Innovations in cost-efficient production technologies have made liquid pouch packaging an attractive option for businesses looking to improve operational efficiency while reducing transportation costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Key news & initiatives

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Rising demand for convenience packaging

- 3.4.1.2 Sustainability and reduced material use

- 3.4.1.3 Innovation in large-capacity packaging

- 3.4.1.4 Growth in e-commerce and FMCG

- 3.4.1.5 Cost efficiency and customization

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 Recycling complexity

- 3.4.2.2 Product integrity issues

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Spout

- 5.3 Non-Spout

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Up to 200 ml

- 6.3 201 ml to 500 ml

- 6.4 501 ml to 1 liter

- 6.5 Above 1 liter

Chapter 7 Market Estimates & Forecast, By Laminates, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Two layers

- 7.3 Three layers

- 7.4 Four layers

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverages

- 8.2.1 Juices & beverages

- 8.2.2 Sauces & condiments

- 8.2.3 Dairy products

- 8.3 Industrial

- 8.3.1 Oils & lubricants

- 8.3.2 Chemicals

- 8.4 Personal care

- 8.4.1 Liquid soaps

- 8.4.2 Shampoos & conditioners

- 8.5 Home care

- 8.5.1 Detergents

- 8.5.2 Cleaning solutions

- 8.6 Pharmaceutical

- 8.6.1 Creams & gels

- 8.6.2 Syrups

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amcor

- 10.2 Ampac

- 10.3 Cellpack Packaging

- 10.4 Chengde

- 10.5 Constantia Flexibles

- 10.6 Glenroy

- 10.7 Huhtamaki

- 10.8 Impak Corporation

- 10.9 Pouch Makers CA

- 10.10 Smart Pouches

- 10.11 Smurfit Kappa

- 10.12 Sonoco

- 10.13 Swiss Pac

- 10.14 Tetra Pak

- 10.15 Uflex