|

市场调查报告书

商品编码

1685076

血液学诊断市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Hematology Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

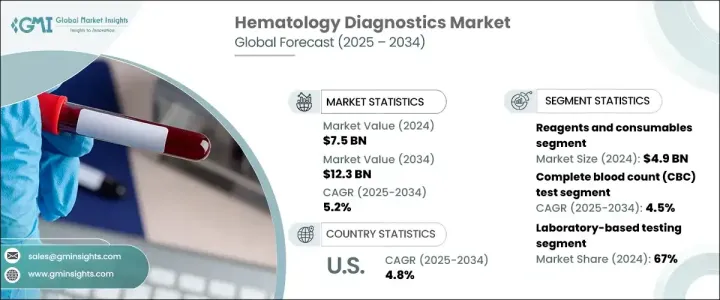

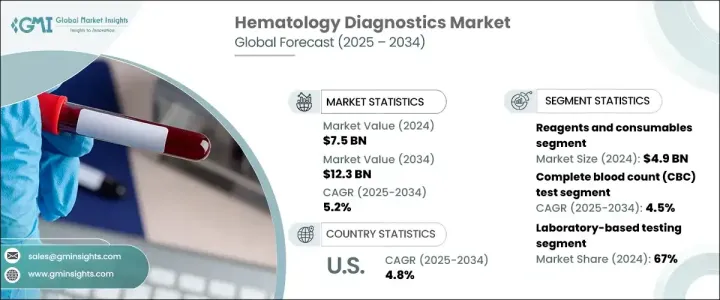

2024 年全球血液学诊断市场价值为 75 亿美元,预计在 2025 年至 2034 年期间的复合年增长率为 5.2%。这一增长是由血液病患病率不断上升、人口快速老化以及慢性病发病率上升所推动的。随着贫血、白血病和镰状细胞疾病等血液相关疾病变得越来越普遍,对准确、有效的诊断解决方案的需求也不断增加。医疗保健提供者越来越重视早期疾病检测,从而推动了对先进诊断技术的需求。自动化血液分析仪、人工智慧驱动的诊断工具和分子诊断技术正在改变产业,确保更快、更精确的结果。医疗保健基础设施和技术创新方面不断增长的投资进一步支持了市场扩张,使血液学诊断成为现代医疗实践不可或缺的一部分。

根据产品类型,市场分为试剂和消耗品以及仪器。仪器包括血液分析仪、流式细胞仪和其他诊断设备,而试剂和消耗品对于提供准确的测试结果起着至关重要的作用。 2024 年试剂和耗材部门以 49 亿美元的收入引领市场。这种主导地位是由这些产品在测试程序中的重要性质以及高容量实验室越来越多地采用自动血液分析仪所推动的。随着实验室和医疗机构追求更高的效率和准确性,对高品质试剂和消耗品的需求持续增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 75亿美元 |

| 预测值 | 123亿美元 |

| 复合年增长率 | 5.2% |

根据测试类型,市场分为全血球计数 (CBC)、血小板功能、血红蛋白、血球容积比和其他诊断测试。其中,CBC 测试部分在 2024 年创造了 27 亿美元的收入,预计到 2034 年将以 4.5% 的复合年增长率成长。 CBC 测试提供有关红血球和白血球计数、血红蛋白水平和血小板计数的关键讯息,使其成为常规检查和预防性医疗保健中不可或缺的一部分。由于医学界注重早期疾病检测,CBC 测试的广泛使用仍然是市场成长的主要驱动力。血液疾病发病率的不断上升以及对全面血液分析的需求不断增长进一步促进了该领域的扩张。

美国仍然是血液学诊断市场的主导者,2024 年的收入为 29 亿美元。由于该国大量受血液疾病影响的患者,该市场预计到 2034 年将以 4.8% 的复合年增长率成长。医院和临床实验室对精确、高效的诊断解决方案的需求持续推动市场成长。扩大医疗保健基础设施、增加医疗保健支出以及诊断工具的进步是推动市场扩张的关键因素。随着对早期和准确检测的日益重视,美国血液学诊断市场有望实现持续成长,确保改善患者的治疗效果并提高尖端诊断解决方案的可及性。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 血液及相关疾病盛行率不断上升

- 发展中国家对即时检测的需求不断增长

- 提高认识和筛检计划

- 对综合数位解决方案的需求激增

- 产业陷阱与挑战

- 进阶诊断带来的高成本

- 缺乏报销和保险覆盖不足

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 报销场景

- 定价分析

- 波特的分析

- PESTEL 分析

- 差距分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 — 2034 年

- 主要趋势

- 试剂和耗材

- 仪器

- 血液学分析仪

- 流式细胞仪

- 其他工具

第六章:市场估计与预测:按测试类型,2021 年至 2034 年

- 主要趋势

- 全血球计数 (CBC) 检测

- 血小板功能检测

- 血红素检测

- 血球容积比检测

- 其他测试类型

第 7 章:市场估计与预测:按方式,2021 年至 2034 年

- 主要趋势

- 实验室检测

- 即时诊断(POC)检测

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 肿瘤学

- 贫血

- 传染病

- 心血管疾病

- 其他应用

第 9 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊断实验室

- 其他最终用户

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Abbott

- BAG DIAGNOSTICS

- BECKMAN COULTER

- BIO-RAD

- BioSystems

- Boule

- diatron

- HemoCue

- HORIBA Medical

- mindray

- NIHON KOHDEN

- Roche

- SIEMENS Healthineers

- sysmex

- Thermo Fisher Scientific

The Global Hematology Diagnostics Market, valued at USD 7.5 billion in 2024, is set to expand at a CAGR of 5.2% between 2025 and 2034. This growth is fueled by the increasing prevalence of hematological disorders, a rapidly aging population, and the rising incidence of chronic diseases. As blood-related conditions such as anemia, leukemia, and sickle cell disease become more common, the need for accurate and efficient diagnostic solutions continues to rise. Healthcare providers are increasingly prioritizing early disease detection, driving demand for advanced diagnostic technologies. Automated hematology analyzers, artificial intelligence-driven diagnostic tools, and molecular diagnostic techniques are transforming the industry, ensuring faster and more precise results. Growing investments in healthcare infrastructure and technological innovation further support market expansion, making hematology diagnostics an integral part of modern medical practice.

By product type, the market is divided into reagents and consumables and instruments. Instruments include hematology analyzers, flow cytometers, and other diagnostic devices, while reagents and consumables play a crucial role in delivering accurate test results. The reagents and consumables segment led the market in 2024 with USD 4.9 billion in revenue. This dominance is driven by the essential nature of these products in testing procedures and the increasing adoption of automated hematology analyzers in high-volume laboratories. As laboratories and healthcare facilities aim for greater efficiency and accuracy, the demand for high-quality reagents and consumables continues to grow.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 Billion |

| Forecast Value | $12.3 Billion |

| CAGR | 5.2% |

The market is segmented by test type into complete blood count (CBC), platelet function, hemoglobin, hematocrit, and other diagnostic tests. Among these, the CBC test segment generated USD 2.7 billion in revenue in 2024 and is projected to grow at a CAGR of 4.5% through 2034. CBC tests provide critical information about red and white blood cell counts, hemoglobin levels, and platelet counts, making them indispensable in routine check-ups and preventive healthcare. As the medical community focuses on early disease detection, the widespread use of CBC tests remains a key driver of market growth. The increasing incidence of blood disorders and the rising demand for comprehensive blood analysis further contribute to the segment's expansion.

The United States remains a dominant player in the hematology diagnostics market, generating USD 2.9 billion in revenue in 2024. The market is expected to grow at a CAGR of 4.8% through 2034, driven by the country's substantial patient population affected by hematological disorders. The need for precise and efficient diagnostic solutions in hospitals and clinical laboratories continues to propel market growth. Expanding healthcare infrastructure, rising healthcare expenditure and advancements in diagnostic tools are key factors contributing to the market's expansion. With an increasing emphasis on early and accurate detection, the U.S. hematology diagnostics market is poised for sustained growth, ensuring improved patient outcomes and greater accessibility to cutting-edge diagnostic solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of blood & related disorders

- 3.2.1.2 Rising demand for point-of-care testing in developing countries

- 3.2.1.3 Growing awareness and screening programs

- 3.2.1.4 Surging need for integrated digital solutions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with advanced diagnostics

- 3.2.2.2 Lack of reimbursement and inadequate insurance coverage

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Gap analysis

- 3.11 Future market trends

- 3.12 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reagents and consumables

- 5.3 Instruments

- 5.3.1 Hematology analyzers

- 5.3.2 Flow cytometers

- 5.3.3 Other instruments

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Complete blood count (CBC) test

- 6.3 Platelet function test

- 6.4 Hemoglobin test

- 6.5 Hematocrit test

- 6.6 Other test types

Chapter 7 Market Estimates and Forecast, By Modality, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Laboratory-based testing

- 7.3 Point-of-care (POC) testing

Chapter 8 Market Estimates and Forecast, By Application, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oncology

- 8.3 Anemia

- 8.4 Infectious diseases

- 8.5 Cardiovascular disorders

- 8.6 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic laboratories

- 9.4 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott

- 11.2 BAG DIAGNOSTICS

- 11.3 BECKMAN COULTER

- 11.4 BIO-RAD

- 11.5 BioSystems

- 11.6 Boule

- 11.7 diatron

- 11.8 HemoCue

- 11.9 HORIBA Medical

- 11.10 mindray

- 11.11 NIHON KOHDEN

- 11.12 Roche

- 11.13 SIEMENS Healthineers

- 11.14 sysmex

- 11.15 Thermo Fisher Scientific