|

市场调查报告书

商品编码

1685090

医疗器材测试服务市场机会、成长动力、产业趋势分析与预测 2025 - 2034Medical Devices Testing Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

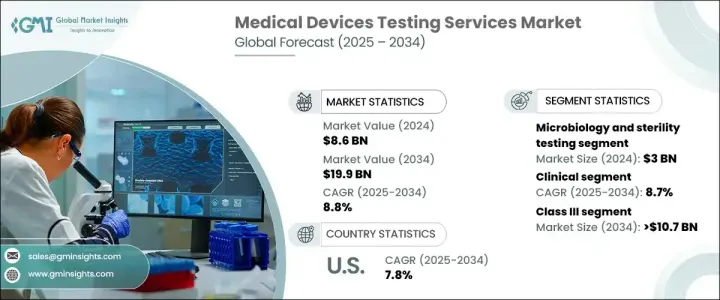

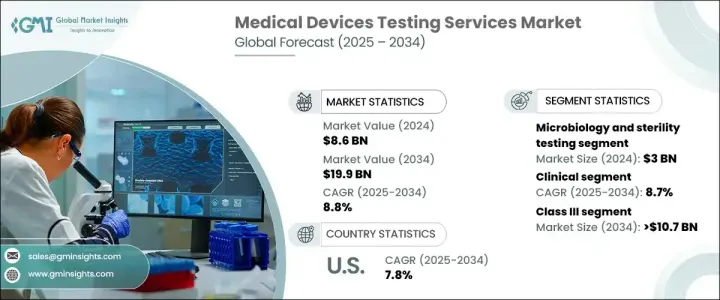

2024 年全球医疗器材测试服务市场价值为 86 亿美元,预计 2025 年至 2034 年期间将以 8.8% 的强劲复合年增长率成长。这一增长主要得益于满足严格监管要求的需求日益增长,以确保医疗器材的安全性、性能和功效。随着医疗技术的不断创新,对全面、严格的检测服务的需求比以往任何时候都更加重要。医疗器材製造商优先进行测试以符合国际监管标准并避免代价高昂的产品召回或安全问题。随着穿戴式装置、植入式科技和诊断工具等医疗设备的复杂性不断增加,对先进测试方法的需求也随之增加。透过临床和临床前试验以及微生物测试来确保安全性和有效性的需求将继续影响市场的未来。

在各种检测服务中,微生物学和无菌检测在 2024 年占据了市场主导地位,创收 30 亿美元。这项服务对于检测微生物污染和验证灭菌技术至关重要,对于确保设备符合安全标准至关重要。医疗机构对感染控制的日益重视进一步推动了对这些服务的需求。鑑于医疗相关感染仍然是人们最关心的问题,无菌测试的需求预计将继续上升。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 86亿美元 |

| 预测值 | 199亿美元 |

| 复合年增长率 | 8.8% |

医疗器材测试服务市场也分为临床测试和临床前测试。临床测试领域预计将以 8.7% 的复合年增长率成长,到 2034 年预计将达到 131 亿美元。临床试验对于在现实条件下验证医疗器材的安全性和有效性至关重要,确保它们符合监管和市场预期。随着医疗技术的进步,临床测试在评估穿戴式装置和植入物等装置的可用性、生物相容性和整体安全性方面变得更加重要。这些设备日益复杂,需要更详细的临床评估方法,尤其是对于可以无缝融入人体的新创新设备。

美国医疗器材测试服务市场在 2024 年达到 22 亿美元,预计 2025 年至 2034 年的复合年增长率为 7.8%。在先进的医疗基础设施和强大的监管框架的推动下,北美仍然在全球市场占据主导地位。该地区受益于 FDA 等完善的监管机构网络,这些机构实施全面的测试协议,以确保医疗器械的最高安全和品质标准。这种严格的监管环境,加上对研发和测试服务的大量投资,使得北美成为医疗器材测试的中心。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 越来越重视严格的审核规范

- 医疗科技的持续快速进步

- 医疗器材验证和确认的需求不断增长

- 产业陷阱与挑战

- 缺乏熟练的专业人员和测试设施

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL 分析

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按服务,2021 - 2034 年

- 主要趋势

- 微生物学和无菌测试

- 抗菌测试

- 热原和内毒素检测

- 无菌测试和验证

- 生物负荷测定

- 其他微生物学和无菌测试

- 生物相容性测试

- 化学测试

- 包验证

第六章:市场估计与预测:依阶段,2021 - 2034 年

- 主要趋势

- 临床

- 临床前

第 7 章:市场估计与预测:按设备类别,2021 - 2034 年

- 主要趋势

- III 级

- II 类

- 一级

第 8 章:市场估计与预测:按模式,2021 - 2034 年

- 主要趋势

- 外包

- 内部

第 9 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 医疗器材製造商

- 临床研究组织 (CRO)

- 学术及研究机构

- 其他最终用户

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- charles river

- element

- eurofins

- intertek

- labcorp

- NAMSA

- Pace

- SGS

- Sterigenics

- TUV SUD

- WuXiAppTec

The Global Medical Devices Testing Services Market, valued at USD 8.6 billion in 2024, is projected to grow at a robust CAGR of 8.8% from 2025 to 2034. This growth is largely driven by an increasing need to meet stringent regulatory requirements that ensure medical devices' safety, performance, and efficacy. With continuous innovations in healthcare technology, the demand for comprehensive and rigorous testing services is more essential than ever. Medical device manufacturers are prioritizing testing to comply with international regulatory standards and avoid costly product recalls or safety issues. As the complexity of medical devices such as wearables, implantable technologies, and diagnostic tools rises, so does the need for advanced testing methods. The need to ensure safety and effectiveness through clinical and preclinical trials, as well as microbiological testing, will continue to shape the future of the market.

Among the various testing services, microbiology and sterility testing dominated the market in 2024, generating USD 3 billion. This service is critical in detecting microbial contamination and validating sterilization techniques, which is crucial for ensuring that devices meet safety standards. The growing emphasis on infection control in healthcare facilities further drives the demand for these services. Given that healthcare-associated infections remain a top concern, the need for sterility testing is expected to continue its upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.6 Billion |

| Forecast Value | $19.9 Billion |

| CAGR | 8.8% |

The medical devices testing services market is also segmented into clinical and preclinical testing. The clinical testing segment, which is expected to grow at a CAGR of 8.7%, is projected to reach USD 13.1 billion by 2034. Clinical trials are essential for validating the safety and efficacy of medical devices under real-world conditions, ensuring they meet both regulatory and market expectations. As medical technology advances, clinical testing is becoming even more critical in assessing the usability, biocompatibility, and overall safety of devices like wearables and implants. The increasing complexity of these devices requires a more detailed approach to clinical evaluations, especially with newer innovations that integrate seamlessly into the human body.

The U.S. medical devices testing services market garnered USD 2.2 billion in 2024 and is expected to grow at a CAGR of 7.8% from 2025 to 2034. North America, driven by its advanced healthcare infrastructure and strong regulatory framework, remains a dominant player in the global market. The region benefits from a well-established network of regulatory bodies, such as the FDA, that enforce comprehensive testing protocols to ensure the highest safety and quality standards for medical devices. This rigorous regulatory landscape, combined with considerable investments in R&D and testing services, makes North America a hub for medical devices testing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing focus on strict approval norms

- 3.2.1.2 Consistent and rapid advancements in medical technologies

- 3.2.1.3 Rising need for verification and validation of medical devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled professionals and testing facilities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Services, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Microbiology and sterility testing

- 5.2.1 Antimicrobial testing

- 5.2.2 Pyrogen and endotoxin testing

- 5.2.3 Sterility test and validation

- 5.2.4 Bioburden determination

- 5.2.5 Other microbiology and sterility testings

- 5.3 Biocompatibility tests

- 5.4 Chemistry test

- 5.5 Package validation

Chapter 6 Market Estimates and Forecast, By Phase, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Clinical

- 6.3 Preclinical

Chapter 7 Market Estimates and Forecast, By Device Class, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Class III

- 7.3 Class II

- 7.4 Class I

Chapter 8 Market Estimates and Forecast, By Mode, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Outsourced

- 8.3 In-house

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Medical device manufacturers

- 9.3 Clinical research organizations (CROs)

- 9.4 Academic and research institutions

- 9.5 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 charles river

- 11.2 element

- 11.3 eurofins

- 11.4 intertek

- 11.5 labcorp

- 11.6 NAMSA

- 11.7 Pace

- 11.8 SGS

- 11.9 Sterigenics

- 11.10 TUV SUD

- 11.11 WuXiAppTec