|

市场调查报告书

商品编码

1685092

医疗器材奈米技术市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Nanotechnology in Medical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

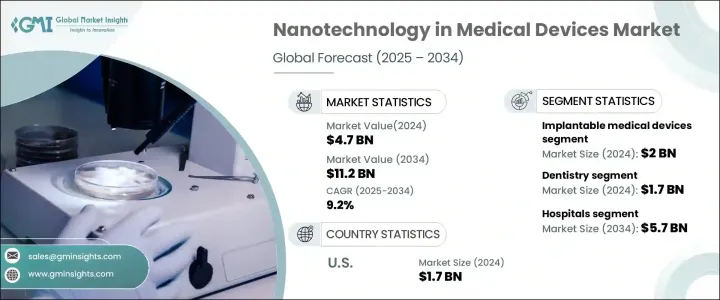

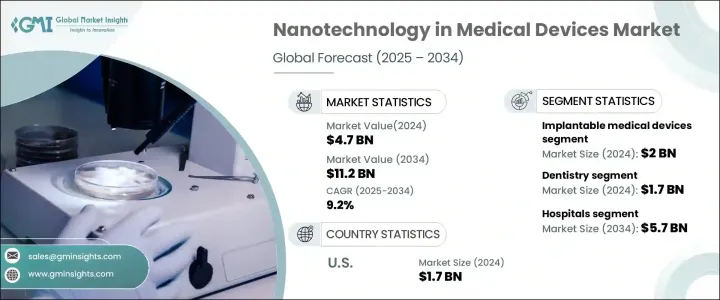

2024 年全球医疗器材奈米技术市场价值为 47 亿美元,预计 2025 年至 2034 年的复合年增长率为 9.2%。这一令人印象深刻的成长轨迹受到多种因素的推动,包括奈米医学的日益普及、向个人化医疗保健的转变以及对小型便携式设备的需求不断增长。随着技术的发展,奈米技术正在透过实现高效的药物输送系统、提高设备性能和增强整体患者护理来彻底改变医疗器材领域。奈米粒子和奈米管的整合等尖端技术正在为创造不仅更精确而且更耐用和更高效的医疗设备开闢令人兴奋的新可能性。正在进行的研究和开发不断突破奈米技术的界限,为有望进一步加速市场成长的突破性产品铺平了道路。对这项技术的不断探索将为改变生活的创新打开大门,改变医疗保健的未来。

市场依产品类型分类,其中植入式医疗设备、牙科材料、伤口护理产品等为主要细分市场。其中,植入式设备是最大、最重要的类别,2024 年将产生 20 亿美元的产值。奈米技术透过推进这些设备中使用的材料,例如开发先进的奈米涂层和奈米颗粒,对这一领域产生了深远的影响。这些创新使得植入物与人体更相容,降低了排斥的可能性,并提高了其整体性能。植入式设备寿命的延长以及与周围组织的无缝整合是奈米技术带来的主要优势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 47亿美元 |

| 预测值 | 112亿美元 |

| 复合年增长率 | 9.2% |

医疗器材市场中的奈米技术也按最终用户进行细分,其中医院、专科诊所和其他医疗机构占据主导地位。预计到 2034 年医院部分将达到 57 亿美元,占据最大的市场份额。作为奈米技术驱动医疗设备的主要消费者,医院越来越多地转向奈米感测器、先进的成像系统和尖端药物传输平台,以提高诊断准确性、治疗效果和患者治疗效果。对最先进技术的大量投资使医院成为市场成长的驱动力,因为它们继续引领更好的医疗服务和病患照护。

在美国,医疗器材奈米技术市场规模在 2024 年将达到 17 亿美元,预计到 2034 年复合年增长率为 8.4%。这一增长得益于政府的大力支持,尤其是美国国立卫生研究院 (NIH) 等机构的支持,以及私营部门的大力投资。美国在个人化医疗领域处于领先地位,利用奈米技术进行更有针对性的治疗、提供先进的诊断工具和针对特定生物标记的疗法。精准医疗的推动是该地区市场快速成长的关键因素。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 医疗器材对奈米技术的需求不断增长

- 提高护理品质的潜力

- 奈米技术在疾病治疗与预防的应用

- 政府的有利倡议

- 产业陷阱与挑战

- 奈米装置成本高昂

- 奈米材料的潜在毒性

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 报销场景

- 波特的分析

- PESTEL 分析

- 差距分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 — 2034 年

- 主要趋势

- 植入式医疗器材

- 矫形器械

- 助听器

- 牙科植体

- 其他植入性医疗器械

- 牙科填充材料

- 伤口护理

- 其他产品

第六章:市场估计与预测:按适应症,2021 年至 2034 年

- 主要趋势

- 牙科

- 骨科

- 听力损失

- 伤口护理

- 其他适应症

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 专科诊所

- 其他最终用户

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- 3M

- Abbott

- Audina HEARING INSTRUMENT INC.

- COLTENE

- convatec

- Dentsply Sirona

- Interton

- Medtronic

- SEBOTEK HEARING SYSTEMS

- SHOFU DENTAL

- Smith & Nephew

- Starkey

- straumann

- Stryker

- ZIMMER BIOMET

The Global Nanotechnology In Medical Devices Market, valued at USD 4.7 billion in 2024, is projected to grow at a CAGR of 9.2% from 2025 to 2034. This impressive growth trajectory is driven by several factors, including the increasing adoption of nanomedicine, the shift toward personalized healthcare treatments, and the growing demand for smaller, portable devices. As technology evolves, nanotechnology is revolutionizing the medical device landscape by enabling highly efficient drug delivery systems, improving device performance, and enhancing overall patient care. Cutting-edge advancements, such as the integration of nanoparticles and nanotubes, are unlocking exciting new possibilities for creating medical devices that are not only more precise but also more durable and efficient. Ongoing research and development continue to push the boundaries of nanotechnology, paving the way for breakthrough products that promise to further accelerate market growth. The continuous exploration of this technology opens doors to life-changing innovations, transforming the future of healthcare.

The market is categorized by product types, with implantable medical devices, dental materials, wound care products, and others as the key segments. Among them, implantable devices are the largest and most significant category, generating USD 2 billion in 2024. Nanotechnology has made a profound impact on this segment by advancing the materials used in these devices, such as the development of advanced nanocoatings and nanoparticles. These innovations are making implants more compatible with the human body, reducing the likelihood of rejection, and improving their overall performance. The enhanced longevity and seamless integration of implantable devices with surrounding tissues are key benefits that nanotechnology is bringing to the table.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $11.2 Billion |

| CAGR | 9.2% |

The nanotechnology in medical devices market is also segmented by end-users, with hospitals, specialty clinics, and other healthcare facilities leading the way. The hospital segment is expected to reach USD 5.7 billion by 2034, holding the largest market share. As the primary consumers of nanotechnology-driven medical devices, hospitals are increasingly turning to nanosensors, advanced imaging systems, and cutting-edge drug delivery platforms to improve diagnostic accuracy, treatment efficacy, and patient outcomes. The heavy investments in state-of-the-art technologies make hospitals a driving force in market growth as they continue to lead the charge toward better healthcare delivery and patient care.

In the U.S., the nanotechnology in medical devices market reached USD 1.7 billion in 2024, with a projected CAGR of 8.4% through 2034. This growth is fueled by substantial government support, particularly from organizations like the National Institutes of Health (NIH), alongside strong private sector investments. The U.S. is leading the charge in personalized medicine, using nanotechnology for more targeted treatments, advanced diagnostic tools, and therapies focused on specific biomarkers. This drive for precision medicine is a key factor contributing to the rapid market growth in the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for nanotechnology in medical devices

- 3.2.1.2 Potential to increase quality of care delivery

- 3.2.1.3 Application of nanotechnology in disease treatment and prevention

- 3.2.1.4 Favourable government initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with nanodevices

- 3.2.2.2 Potential toxicity of nanomaterials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Future market trends

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implantable medical devices

- 5.2.1 Orthopedic devices

- 5.2.2 Hearing aids

- 5.2.3 Dental implants

- 5.2.4 Other implantable medical devices

- 5.3 Dental filling material

- 5.4 Wound care

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By Indication, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dentistry

- 6.3 Orthopedics

- 6.4 Hearing loss

- 6.5 Wound care

- 6.6 Other indications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 Abbott

- 9.3 Audina HEARING INSTRUMENT INC.

- 9.4 COLTENE

- 9.5 convatec

- 9.6 Dentsply Sirona

- 9.7 Interton

- 9.8 Medtronic

- 9.9 SEBOTEK HEARING SYSTEMS

- 9.10 SHOFU DENTAL

- 9.11 Smith & Nephew

- 9.12 Starkey

- 9.13 straumann

- 9.14 Stryker

- 9.15 ZIMMER BIOMET