|

市场调查报告书

商品编码

1685094

聚合物涂层织物市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Polymer Coated Fabrics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

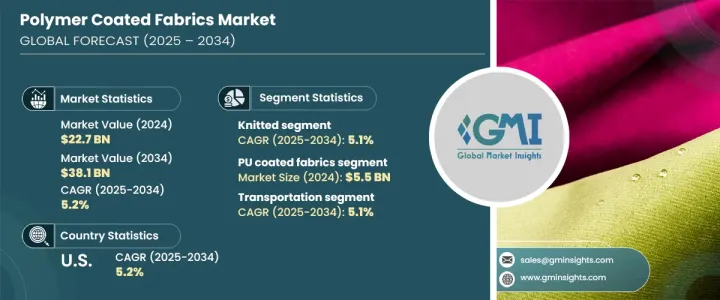

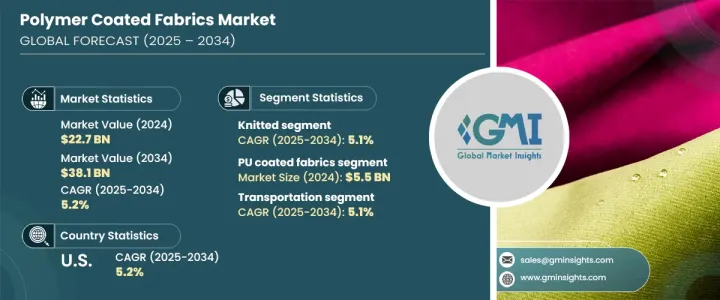

2024 年全球聚合物涂层织物市场规模达到 227 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.2%。快速的工业化、材料技术的进步以及交通运输、家具、航太和建筑等主要行业的需求不断增长,推动着这一增长。由于聚合物涂料具有优异的耐用性、耐候性和客製化能力,各公司都在大力投资该领域。随着各行各业继续优先考虑高性能材料,聚合物涂层织物的采用预计将激增。

推动市场发展的最重要因素之一是市场对灵活、轻质和永续材料的需求不断增长。製造商正在开发创新的聚合物涂层,以增强织物性能,同时确保环保。向节能和可回收材料的转变正在推动企业将生物基和水基涂料整合到其产品中。此外,电子商务领域的扩张也刺激了对保护性和美观包装材料的需求,进一步促进了市场成长。随着越来越多的产业强调安全性、效率和永续性,聚合物涂层织物在现代材料解决方案中发挥着至关重要的作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 227亿美元 |

| 预测值 | 381亿美元 |

| 复合年增长率 | 5.2% |

根据产品类型,聚合物涂层织物市场分为 PE 涂层织物、乙烯基涂层织物、PU 涂层织物和其他。 2024 年 PU 涂层织物领域创收 55 亿美元,预计在预测期内复合年增长率为 5.3%。 PU 涂层因其出色的耐久性、柔韧性和透气性而脱颖而出,成为需要舒适性和耐用性的应用的理想选择。与其他聚合物涂层不同,PU 具有柔软光滑的质地,与天然材料非常相似,使其成为防护服、高性能服装和高级室内装饰的首选。 PU 涂层织物在汽车内饰、时尚和医疗应用中的日益普及,进一步加强了市场扩张。

根据纺织材料类型,聚合物涂层织物市场分为针织、机织和非织造织物。针织布料领域占据市场主导地位,2024 年创收 105 亿美元,预计在预测期内以 5.1% 的复合年增长率成长。针织布料因其灵活性、可拉伸性和适应性而受到高度重视,这使得其在舒适性和活动性至关重要的行业中必不可少。其无缝结构增强了触觉吸引力,增加了运动服、汽车内装和运动服的需求。随着永续发展的势头增强,製造商正在将环保和可生物降解的材料融入针织布料的生产中,进一步推动市场成长。

2024 年美国聚合物涂层织物市场价值为 63 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.2%。汽车、航太、船舶、建筑和医疗保健领域不断扩大的应用基础是市场成长的主要驱动力。这些面料由于其重量轻、耐用和阻燃的特性,被广泛用于室内应用。对节能材料和永续生产实践的日益重视迫使企业推出环保聚合物涂料。随着创新不断塑造产业,在技术进步和消费者意识增强的支持下,美国市场预计将实现持续扩张。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 汽车产业需求不断成长

- 防护衣意识不断增强

- 扩大建筑和基础设施项目

- 产业陷阱与挑战

- 环境议题与永续发展挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品,2021-2034 年

- 主要趋势

- 乙烯基涂层织物

- PU涂层布料

- PE 涂层布料

- 其他的

第 6 章:市场估计与预测:依纺织材料类型,2021-2034 年

- 主要趋势

- 针织

- 编织

- 非织物

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 运输

- 防护服

- 工业的

- 屋顶

- 遮阳篷和天篷

- 家具和座椅

- 其他的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- BASF

- Covestro

- Dow

- DuPont

- Eastman

- Evonik

- Huntsman

- Solvay

The Global Polymer Coated Fabrics Market reached USD 22.7 billion in 2024 and is set to expand at a CAGR of 5.2% between 2025 and 2034. Rapid industrialization, advancements in material technology, and increasing demand across key industries, including transportation, furniture, aerospace, and construction, are driving this growth. Companies are investing heavily in polymer coatings due to their superior durability, weather resistance, and customization capabilities. As industries continue to prioritize high-performance materials, the adoption of polymer-coated fabrics is expected to surge.

One of the most significant factors fueling the market is the rising demand for flexible, lightweight, and sustainable materials. Manufacturers are developing innovative polymer coatings to enhance fabric performance while ensuring eco-friendliness. The shift towards energy-efficient and recyclable materials is pushing companies to integrate bio-based and water-based coatings into their offerings. Additionally, the expansion of the e-commerce sector has bolstered the demand for protective and aesthetic packaging materials, further contributing to market growth. With an increasing number of industries emphasizing safety, efficiency, and sustainability, polymer-coated fabrics are playing a crucial role in modern material solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.7 Billion |

| Forecast Value | $38.1 Billion |

| CAGR | 5.2% |

Based on product type, the polymer coated fabrics market is categorized into PE-coated fabrics, vinyl-coated fabrics, PU-coated fabrics, and others. The PU-coated fabrics segment generated USD 5.5 billion in 2024 and is projected to grow at a CAGR of 5.3% during the forecast period. PU coatings stand out due to their exceptional endurance, flexibility, and breathability, making them an ideal choice for applications requiring comfort and durability. Unlike other polymer coatings, PU offers a soft and smooth texture that closely resembles natural materials, making it a preferred option for protective clothing, high-performance apparel, and premium upholstery. The increasing adoption of PU-coated fabrics in automotive interiors, fashion, and medical applications is further strengthening market expansion.

By textile material type, the polymer coated fabrics market is segmented into knitted, woven, and non-woven fabrics. The knitted fabrics segment dominated the market, generating USD 10.5 billion in 2024, and is anticipated to grow at a CAGR of 5.1% during the forecast period. Knitted fabrics are highly valued for their flexibility, stretchability, and adaptability, making them essential in industries where comfort and movement are paramount. Their seamless construction enhances the tactile appeal, boosting demand in activewear, automotive interiors, and sportswear. As sustainability gains traction, manufacturers are incorporating eco-friendly and biodegradable materials into knitted fabric production, further propelling market growth.

The U.S. polymer coated fabrics market was valued at USD 6.3 billion in 2024 and is forecast to grow at a CAGR of 5.2% from 2025 to 2034. The expanding application base across automotive, aerospace, marine, construction, and healthcare sectors is a primary driver of market growth. These fabrics are widely preferred for interior applications due to their lightweight nature, durability, and flame-retardant properties. The growing emphasis on energy-efficient materials and sustainable manufacturing practices is compelling companies to introduce eco-conscious polymer coatings. As innovation continues to shape the industry, the U.S. market is expected to witness sustained expansion, backed by technological advancements and increasing consumer awareness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand in automotive sector

- 3.6.1.2 Rising awareness of protective clothing

- 3.6.1.3 Expanding construction and infrastructure projects

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Environmental concerns and sustainability challenges

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Vinyl coated fabrics

- 5.3 PU coated fabrics

- 5.4 PE coated fabrics

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Textile Material Type, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Knitted

- 6.3 Woven

- 6.4 Non-woven

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Transportation

- 7.3 Protective clothing

- 7.4 Industrial

- 7.5 Roofing

- 7.6 Awnings & canopies

- 7.7 Furniture & seating

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BASF

- 9.2 Covestro

- 9.3 Dow

- 9.4 DuPont

- 9.5 Eastman

- 9.6 Evonik

- 9.7 Huntsman

- 9.8 Solvay