|

市场调查报告书

商品编码

1685098

儿科家庭医疗保健市场机会、成长动力、行业趋势分析和 2025 - 2034 年预测Pediatric Home Healthcare Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

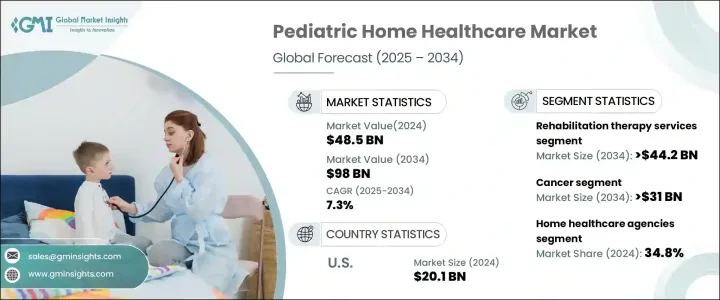

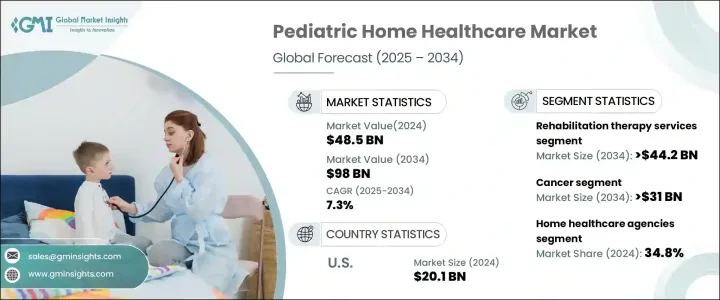

2024 年全球儿科家庭医疗保健市场价值为 485 亿美元,预计 2025 年至 2034 年的复合年增长率为 7.3%。由于对患有慢性和复杂健康状况的儿童的个人化和经济高效的护理解决方案的需求不断增加,该市场正在经历显着增长。气喘、糖尿病、神经系统疾病和先天性心臟缺陷等儿童慢性病发病率不断上升,推动了对家庭医疗保健服务的需求。越来越多的家庭选择家庭医疗保健来满足孩子的长期医疗需求,这为临床环境提供了更舒适、更灵活的替代方案。此外,远距医疗和远端监控工具等技术的进步使得有特殊需求的儿童能够更方便、更有效地获得家庭医疗保健。这些创新不仅提高了护理质量,而且减轻了医疗机构的负担,进一步推动了市场成长。父母对家庭医疗保健的好处的认识不断提高,包括减少住院时间和提高孩子的舒适度,这也促进了市场的扩张。报销计划和医疗补助等政府措施在支持这一增长方面发挥着至关重要的作用。预计市场将见证医疗设备和数位健康解决方案的持续进步,这将进一步提高儿科家庭医疗服务的效率和可近性。

市场分为不同的服务类别,包括復健治疗服务、专业护理服务、个人护理援助和其他医疗保健服务。復健治疗服务预计将经历强劲成长,预计复合年增长率为 6.8%,到 2034 年将达到 442 亿美元。这一增长是由针对患有发育和慢性疾病的儿童的定制治疗需求不断增长所推动的。家庭物理、职业和语言治疗的需求正在上升,特别是对于患有神经系统疾病和身体障碍的儿童,他们需要持续的治疗支持来促进他们的成长。这些服务正成为儿科照护不可或缺的一部分,满足家庭环境中儿童的独特需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 485亿美元 |

| 预测值 | 980亿美元 |

| 复合年增长率 | 7.3% |

根据适应症,市场分为癌症、呼吸系统疾病、心血管疾病、听力障碍和其他健康状况。癌症领域预计将以 7.1% 的复合年增长率成长,到 2034 年将达到 310 亿美元。白血病、淋巴瘤和脑瘤等儿童癌症的诊断率不断上升,推动了对专业家庭照护的需求。免疫疗法和标靶疗法等治疗方法的进步往往需要长期护理,因此家庭保健成为管理这些疾病的关键组成部分。在熟悉的环境中提供专业护理的能力可增强治疗效果并改善儿科患者及其家人的生活品质。

在美国,儿科家庭医疗保健市场在 2024 年创造了 201 亿美元的产值,预计在 2025 年至 2034 年期间的复合年增长率为 6.5%。儿童慢性病(如气喘和神经系统疾病)的增加是推动长期家庭照护解决方案需求的关键因素。便携式呼吸器和远距医疗系统等医疗技术的创新使得家庭护理变得越来越可行和有效。父母越来越意识到家庭医疗保健的好处,例如减少住院时间和提高孩子的舒适度,这进一步刺激了需求。政府倡议,包括报销计划和对家庭医疗保健服务的医疗补助支持,也促进了美国市场的成长。这些因素加上持续的技术进步,预计将在未来几年维持市场上升的势头。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 提高早产儿的预期寿命

- 持续护理先进技术的出现

- 婴幼儿慢性病发生率不断上升

- 家庭医疗保健设备的技术进步

- 家庭医疗保健服务提供者数量不断增加

- 产业陷阱与挑战

- 儿科家庭健康服务费用高昂

- 儿科家庭护理护理师短缺

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按服务,2021 年至 2034 年

- 主要趋势

- 復健治疗服务

- 专业护理服务

- 个人护理协助

- 其他服务

第六章:市场估计与预测:按适应症,2021 — 2034 年

- 主要趋势

- 癌症

- 心血管疾病

- 呼吸系统疾病

- 听力障碍

- 其他适应症

第 7 章:市场估计与预测:按护理提供者,2021 年至 2034 年

- 主要趋势

- 家庭医疗保健机构

- 医院和诊所

- 独立护理人员

- 其他护理提供者

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Angels of Care Pediatric Home Health

- At Home Healthcare

- aveanna healthcare

- BAYADA Home Health Care

- BrightStar Care

- DJK Home Healthcare

- eKidzCare

- ENVIVA PAEDIATRIC CARE

- Interim HEALTHCARE

- KidsCare HOME HEALTH

- MGA Homecare

- New England Home Care

- Paramed

- Pediatric Home Healthcare

- Tendercare HOME HEALTH

The Global Pediatric Home Healthcare Market was valued at USD 48.5 billion in 2024 and is projected to grow at a CAGR of 7.3% from 2025 to 2034. This market is experiencing significant growth due to the increasing demand for personalized and cost-effective care solutions for children with chronic and complex health conditions. The rising prevalence of pediatric chronic illnesses, including asthma, diabetes, neurological disorders, and congenital heart defects, is driving the need for home-based healthcare services. Families are increasingly choosing home healthcare to manage their children's long-term medical needs, offering a more comfortable and flexible alternative to clinical settings. Additionally, advancements in technology, such as telemedicine and remote monitoring tools, have made home healthcare more accessible and effective for children with specialized needs. These innovations are not only improving the quality of care but also reducing the burden on healthcare facilities, further fueling market growth. The growing awareness among parents about the benefits of home healthcare, including reduced hospital stays and enhanced child comfort, is also contributing to the market's expansion. Government initiatives, such as reimbursement programs and Medicaid coverage, are playing a crucial role in supporting this growth. The market is expected to witness continued advancements in medical devices and digital health solutions, which will further enhance the efficiency and accessibility of pediatric home healthcare services.

The market is segmented into various service categories, including rehabilitation therapy services, skilled nursing services, personal care assistance, and other healthcare services. Rehabilitation therapy services are anticipated to experience strong growth, with a projected CAGR of 6.8%, reaching USD 44.2 billion by 2034. This growth is driven by the increasing need for customized therapies for children with developmental and chronic conditions. The demand for in-home physical, occupational, and speech therapies is rising, particularly for children with neurological disorders and physical impairments who require ongoing therapeutic support to aid their development. These services are becoming an integral part of pediatric care, addressing the unique needs of children in a home setting.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $ 48.5 Billion |

| Forecast Value | $98 Billion |

| CAGR | 7.3% |

Based on indication, the market is categorized into cancer, respiratory diseases, cardiovascular diseases, hearing disorders, and other health conditions. The cancer segment is expected to grow at a CAGR of 7.1%, generating USD 31 billion by 2034. The increasing diagnosis of pediatric cancers, such as leukemia, lymphoma, and brain tumors, is driving the demand for specialized home-based care. Advances in treatments, including immunotherapies and targeted therapies, often require extended care, making home healthcare a critical component in managing these conditions. The ability to provide specialized care in a familiar environment enhances treatment outcomes and improves the quality of life for pediatric patients and their families.

In the United States, the pediatric home healthcare market generated USD 20.1 billion in 2024 and is anticipated to grow at aCAGR of 6.5% between 2025 and 2034. The rise in pediatric chronic conditions, such as asthma and neurological disorders, is a key factor driving the demand for long-term home-based care solutions. Innovations in medical technology, including portable ventilators and telehealth systems, have made home care increasingly feasible and effective. Parents are becoming more aware of the benefits of home healthcare, such as reduced hospital stays and improved comfort for their children, which is further fueling demand. Government initiatives, including reimbursement programs and Medicaid support for home healthcare services, are also contributing to the market's growth in the United States. These factors, combined with ongoing technological advancements, are expected to sustain the market's upward trajectory in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Improved life expectancy of premature infants

- 3.2.1.2 Emergence of advanced technologies for continuous care

- 3.2.1.3 Increasing prevalence of chronic ailments among infants

- 3.2.1.4 Technological advancements in home healthcare devices

- 3.2.1.5 Rising number of home healthcare service providers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of pediatric home healthcare services

- 3.2.2.2 Shortage of pediatric home care nurses

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Service, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Rehabilitation therapy services

- 5.3 Skilled nursing services

- 5.4 Personal care assistance

- 5.5 Other services

Chapter 6 Market Estimates and Forecast, By Indication, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cancer

- 6.3 Cardiovascular diseases

- 6.4 Respiratory diseases

- 6.5 Hearing disorders

- 6.6 Other indications

Chapter 7 Market Estimates and Forecast, By Care Provider, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Home healthcare agencies

- 7.3 Hospitals and clinics

- 7.4 Independent caregivers

- 7.5 Other care providers

Chapter 8 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Angels of Care Pediatric Home Health

- 9.2 At Home Healthcare

- 9.3 aveanna healthcare

- 9.4 BAYADA Home Health Care

- 9.5 BrightStar Care

- 9.6 DJK Home Healthcare

- 9.7 eKidzCare

- 9.8 ENVIVA PAEDIATRIC CARE

- 9.9 Interim HEALTHCARE

- 9.10 KidsCare HOME HEALTH

- 9.11 MGA Homecare

- 9.12 New England Home Care

- 9.13 Paramed

- 9.14 Pediatric Home Healthcare

- 9.15 Tendercare HOME HEALTH