|

市场调查报告书

商品编码

1685116

肺功能测试系统市场机会、成长动力、产业趋势分析与预测 2025 - 2034Pulmonary Function Testing Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

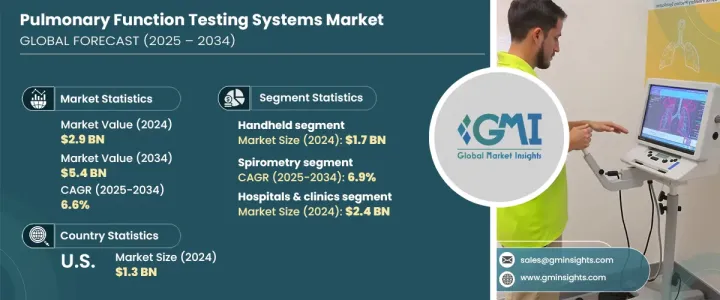

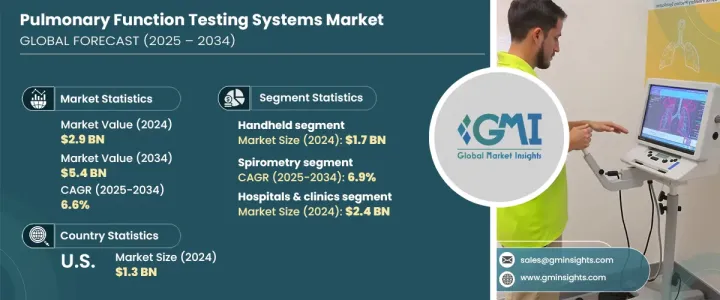

2024 年全球肺功能测试系统市场规模达 29 亿美元,预估 2025 年至 2034 年期间复合年增长率为 6.6%。诊断技术的不断进步、人口老化、早期疾病检测意识的增强以及医疗保健基础设施的改善推动了这一快速增长。随着呼吸系统疾病变得越来越普遍,医疗保健提供者优先考虑早期诊断和有效的疾病管理,这大大增加了对先进肺功能测试系统的需求。紧凑型、高精度设备的创新使得各种医疗保健环境中的肺部评估更加容易进行。向具有成本效益和用户友好的诊断工具的转变正在塑造整个行业,推动其在临床和家庭环境中的更广泛应用。

医疗技术和数位整合的持续投资进一步支持了市场成长,提高了肺部评估的效率和可靠性。对持续呼吸监测的需求日益增长,促使製造商开发具有更高功能和准确性的设备。穿戴式和远端监控解决方案的兴起正在改变呼吸诊断,使患者和医疗保健专业人员都更加方便。随着产业走向个人化医疗,肺功能测试系统也在不断发展,以提供更精确、更针对患者的见解。预防保健措施和广泛的筛检计画正在加速应用,确保未来几年稳步扩大。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 29亿美元 |

| 预测值 | 54亿美元 |

| 复合年增长率 | 6.6% |

便携式紧凑型诊断设备由于其易于使用且能够在各种医疗环境中提供精确的结果而受到广泛需求。手持设备引领了市场,2024 年创造了 17 亿美元的收入。这些具有成本效益的设备比大型实验室设备更受青睐,尤其是对于需要经济实惠但准确的呼吸评估的小型医疗机构。它们在提供即时测试方面的灵活性已在多种医疗应用中广泛采用。随着製造商不断改进设备性能并提高用户便利性,业界正在转向数位连接和远端监控功能。对准确且易于获取的肺功能测试解决方案的需求不断增长,这推动着创新,并强化了其在现代医疗保健系统中的重要作用。

慢性呼吸系统疾病是推动市场扩张的主要因素,其中慢性病占需求的很大一部分。慢性阻塞性肺病 (COPD) 领域在 2024 年占据了 39.8% 的市场。由于环境污染物和生活方式因素导致肺部疾病发病率上升,肺功能测试成为常规医疗保健的重要组成部分。随着慢性呼吸系统疾病变得越来越普遍,医疗保健提供者正在投资先进的诊断设备以便于早期介入。早期检测对于减缓疾病进展的重要性日益增加,对精确肺部评估的需求也随之增加。检测技术的进步正在提高效率,从而提供更好的监测和疾病管理解决方案。不断扩大的医疗保健基础设施也改善了人们获得最先进肺功能测试设备的机会,从而推动了整体市场的成长。

2024 年美国肺功能测试系统市值为 13 亿美元,预计到 2034 年将以 5.4% 的复合年增长率成长。作为全球医疗技术的领导者,美国继续将高精度诊断工具整合到医疗机构中,以提高肺部评估的准确性和效率。数位和无线设备的广泛应用进一步简化了肺功能测试,增加了整体市场需求。凭藉对医疗保健创新的大力投资和对早期疾病检测的日益关注,美国市场在未来十年内有望实现持续成长。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性呼吸道疾病盛行率上升

- 技术进步

- 政府的有利倡议

- 产业陷阱与挑战

- 肺功能检测设备成本高

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 报销场景

- 定价分析

- 波特的分析

- PESTEL 分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 — 2034 年

- 主要趋势

- 手持式

- 桌面

第六章:市场估计与预测:按测试类型,2021 年至 2034 年

- 主要趋势

- 肺量测定

- 运动压力测试

- 肺容量测试

- 高空模拟测试

- 气体扩散试验

- 其他测试类型

第 7 章:市场估计与预测:按应用,2021 — 2034 年

- 主要趋势

- 慢性阻塞性肺臟疾病

- 气喘

- 慢性呼吸困难

- 肺纤维化

- 其他应用

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院和诊所

- 诊断中心

- 家庭护理设置

- 其他最终用户

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Baxter

- CHEST MI

- COSMED

- ECO MEDICS

- FUKUDA SANGYO

- GANSHORN SCHILLER GROUP

- Geratherm Respiratory

- medical equipment europe

- MGC DIAGNOSTICS

- MINATO MEDICAL SCIENCE

- MORGAN

- ndd Medical Technologies

- PHILIPS

- Vitalograph

- Vyaire MEDICAL

The Global Pulmonary Function Testing Systems Market reached USD 2.9 billion in 2024 and is on track to expand at a CAGR of 6.6% between 2025 and 2034. This rapid growth is fueled by continuous advancements in diagnostic technologies, an aging population, increased awareness of early disease detection, and improved healthcare infrastructure. With respiratory diseases becoming more prevalent, healthcare providers are prioritizing early diagnosis and efficient disease management, which is significantly boosting the demand for advanced pulmonary function testing systems. Innovations in compact, high-precision devices are making pulmonary assessments more accessible across various healthcare settings. The shift toward cost-effective and user-friendly diagnostic tools is shaping the industry, driving greater adoption in clinical and home-based environments.

Market growth is further supported by ongoing investments in medical technology and digital integration, enhancing the efficiency and reliability of pulmonary assessments. The increasing need for continuous respiratory monitoring is pushing manufacturers to develop devices with improved functionality and accuracy. The rise of wearable and remote monitoring solutions is transforming respiratory diagnostics, making them more convenient for both patients and healthcare professionals. As the industry moves toward personalized medicine, pulmonary function testing systems are evolving to provide more precise and patient-specific insights. Preventive care initiatives and widespread screening programs are accelerating adoption, ensuring steady expansion in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 6.6% |

Portable and compact diagnostic devices are experiencing significant demand due to their ease of use and ability to provide precise results in various healthcare environments. The handheld segment led the market, generating USD 1.7 billion in revenue in 2024. These cost-efficient devices are favored over larger, laboratory-based equipment, particularly by smaller healthcare facilities that require affordable yet accurate respiratory assessments. Their flexibility in delivering real-time testing has led to increased adoption across multiple medical applications. As manufacturers refine device performance and enhance user convenience, the industry is shifting toward digital connectivity and remote monitoring capabilities. The rising demand for accurate and accessible pulmonary function testing solutions is driving innovation, reinforcing their essential role in modern healthcare systems.

Chronic respiratory conditions are a major factor driving market expansion, with chronic diseases accounting for a substantial portion of demand. The chronic obstructive pulmonary disease (COPD) segment held a 39.8% market share in 2024. The rising incidence of pulmonary disorders due to environmental pollutants and lifestyle factors has made pulmonary function testing a crucial part of routine healthcare. As chronic respiratory diseases become more prevalent, healthcare providers are investing in advanced diagnostic equipment to facilitate early intervention. The importance of early detection in slowing disease progression is increasing demand for precise pulmonary assessments. Advancements in testing technology are improving efficiency, thus offering better monitoring and disease management solutions. Expanding healthcare infrastructure is also improving access to state-of-the-art pulmonary function testing devices, driving overall market growth.

The US pulmonary function testing systems market was valued at USD 1.3 billion in 2024 and is projected to grow at a CAGR of 5.4% through 2034. As a global leader in medical technology, the US continues to integrate high-precision diagnostic tools into healthcare institutions, improving accuracy and efficiency in pulmonary assessments. The widespread adoption of digital and wireless-enabled devices is further streamlining pulmonary function testing, increasing overall market demand. With strong investments in healthcare innovation and a rising focus on early disease detection, the US market is well-positioned for consistent growth over the next decade.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in prevalence of chronic respiratory diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Favourable government initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with pulmonary function testing devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Handheld

- 5.3 Tabletop

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Spirometry

- 6.3 Exercise stress test

- 6.4 Lung volume test

- 6.5 High altitude simulation testing

- 6.6 Gas diffusion test

- 6.7 Other test types

Chapter 7 Market Estimates and Forecast, By Application, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Chronic obstructive pulmonary disease

- 7.3 Asthma

- 7.4 Chronic shortness of breath

- 7.5 Pulmonary fibrosis

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals & clinics

- 8.3 Diagnostic centers

- 8.4 Homecare settings

- 8.5 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Baxter

- 10.2 CHEST M.I

- 10.3 COSMED

- 10.4 ECO MEDICS

- 10.5 FUKUDA SANGYO

- 10.6 GANSHORN SCHILLER GROUP

- 10.7 Geratherm Respiratory

- 10.8 medical equipment europe

- 10.9 MGC DIAGNOSTICS

- 10.10 MINATO MEDICAL SCIENCE

- 10.11 MORGAN

- 10.12 ndd Medical Technologies

- 10.13 PHILIPS

- 10.14 Vitalograph

- 10.15 Vyaire MEDICAL