|

市场调查报告书

商品编码

1685135

保险桿感测器市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Bumper Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

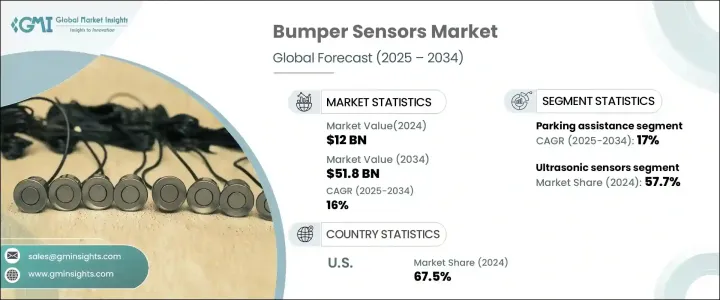

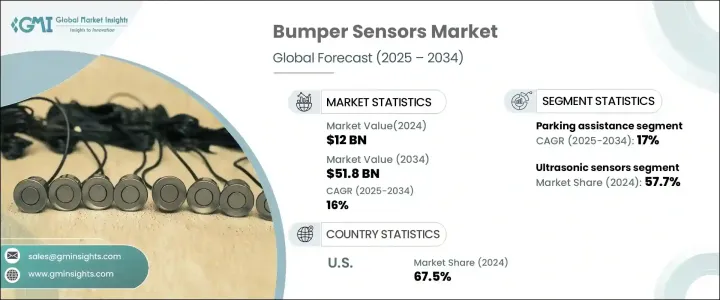

2024 年全球保险桿感测器市场价值为 120 亿美元,预计 2025 年至 2034 年的复合年增长率为 16%。这一增长得益于保险桿感测器与高级驾驶辅助系统 (ADAS) 的日益融合,透过自动煞车和事故预防来提高车辆安全性。这些感测器收集即时资料的能力可改善驾驶体验、最大限度地减少事故并增强对高级安全功能的需求。现代车辆中 ADAS 的广泛采用正在推动对保险桿感测器的需求,从而形成加速技术创新和市场扩张的协同效应。

保险桿感测器可以自动侦测障碍物并发送警报或启动煞车,在防止碰撞和减少保险索赔方面发挥着至关重要的作用。这些感测器有助于确保乘客安全,同时也使车辆对保险公司和製造商更具吸引力。随着汽车製造商将安全性放在首位,车辆中保险桿感测器的整合度不断提高,进一步支持了市场的成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 120亿美元 |

| 预测值 | 518亿美元 |

| 复合年增长率 | 16% |

按技术划分,保险桿感测器市场包括超音波感测器、电磁感测器、红外线感测器等。 2024年,超音波感测器以57.7%的份额引领市场。这些感测器透过发射超音波并测量波返回所需的时间来准确地检测附近的物体。它们在确定距离方面的可靠性使其成为现代车辆中必不可少的,特别是对于停车辅助和 ADAS 功能。超音波感测器因其成本效益、多功能性和效率,已成为汽车製造商的首选,进一步推动了保险桿感测器产业的扩张。

根据应用,市场分为停车辅助、盲点侦测、防撞等。预测期内,停车辅助领域预计将以 17% 的复合年增长率成长。消费者对便利性和安全性的需求日益增长,推动了保险桿感测器在停车辅助系统中的采用。这些系统可协助车辆识别障碍物并提供即时回馈,确保驾驶者能够更准确、更安全地停车。这项功能在停车空间有限、操纵车辆颇具挑战性的城市地区尤其有价值。

随着 ADAS 变得越来越普及,停车辅助现在已经成为高端汽车和大众汽车的关键功能。汽车製造商优先考虑由保险桿感测器驱动的停车辅助系统,以提高车辆安全性并符合不断发展的安全标准。因此,这些系统被广泛应用于新车型中,并支持了市场的快速成长。

在北美,美国在 2024 年占据保险桿感测器市场的主导地位,占有 67.5% 的份额。中国对汽车创新的关注以及消费者对高科技安全系统的需求正在推动市场扩张。在车辆中加入保险桿感测器以实现防撞和停车辅助等 ADAS 功能正在成为整个行业的标准。此外,电动和自动驾驶汽车产量的成长以及严格的安全法规进一步增加了这些感测器的采用。随着领先的汽车製造商和技术供应商不断推进感测器技术,美国仍然是全球保险桿感测器市场的重要参与者。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 先进驾驶辅助系统(ADAS) 的组合

- 减少事故和保险索赔

- 监管要求推动保险桿感测器消费

- 汽车产业不断扩张,保险桿感测器需求增加

- 产业陷阱与挑战

- 与旧车辆的整合有限

- 修復程式复杂

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 超音波感测器

- 电磁感测器

- 红外线感测器

- 其他的

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 停车辅助

- 避免碰撞

- 盲点侦测

- 其他的

第 7 章:市场估计与预测:按车型,2021-2034 年

- 主要趋势

- 搭乘用车

- 商用车

第 8 章:市场估计与预测:按销售管道,2021-2034 年

- 主要趋势

- 原始设备製造商 (OEM)

- 售后市场

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Analog Devices, Inc.

- Aptiv (Formerly Delphi Technologies)

- Continental AG

- Denso Corporation

- Gentex Corporation

- HELLA GmbH & Co. KGaA

- Heraeus Sensor Technology

- Hitachi Automotive Systems

- Hyundai Mobis

- Infineon Technologies AG

- Leddartech

- Magna International Inc.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors

- Proxel

- Robert Bosch GmbH

- Steelmate Automotive

- Texas Instruments Incorporated

- Valeo

- ZF Friedrichshafen AG

The Global Bumper Sensor Market was valued at USD 12 billion in 2024 and is projected to grow at a CAGR of 16% from 2025 to 2034. This growth is driven by the increasing integration of bumper sensors with Advanced Driver Assistance Systems (ADAS), which enhance vehicle safety through automated braking and accident prevention. The ability of these sensors to collect real-time data improves driving experiences, minimizes accidents, and strengthens the demand for advanced safety features. The widespread adoption of ADAS in modern vehicles is fueling the demand for bumper sensors, creating a synergy that accelerates technological innovation and market expansion.

Bumper sensors play a crucial role in preventing collisions and reducing insurance claims by automatically detecting obstacles and sending alerts or activating brakes. These sensors help ensure passenger safety while also making vehicles more attractive to insurance companies and manufacturers. As automakers prioritize safety, the integration of bumper sensors in vehicles continues to increase, further supporting market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12 billion |

| Forecast Value | $51.8 billion |

| CAGR | 16% |

By technology, the bumper sensor market includes ultrasonic sensors, electromagnetic sensors, infrared sensors, and others. In 2024, ultrasonic sensors led the market with a 57.7% share. These sensors accurately detect nearby objects by emitting ultrasonic waves and measuring the time it takes for the waves to return. Their reliability in determining proximity makes them essential in modern vehicles, particularly for parking assistance and ADAS features. Due to their cost-effectiveness, versatility, and efficiency, ultrasonic sensors have become the preferred choice for automakers, further driving the expansion of the bumper sensor industry.

Based on application, the market is segmented into parking assistance, blind spot detection, collision avoidance, and others. The parking assistance segment is projected to grow at a CAGR of 17% during the forecast period. Increasing consumer demand for convenience and safety is propelling the adoption of bumper sensors in parking assistance systems. These systems help vehicles identify obstacles and provide real-time feedback, ensuring drivers can park more accurately and safely. This feature is particularly valuable in urban areas with limited parking space, where maneuvering can be challenging.

With ADAS becoming more prevalent, parking assistance is now a key feature in both premium and mass-market vehicles. Automakers are prioritizing parking assistance systems powered by bumper sensors to enhance vehicle safety and comply with evolving safety standards. As a result, these systems are being widely integrated into new vehicle models, supporting the rapid growth of the market.

In North America, the United States dominated the bumper sensor market in 2024, holding a 67.5% share. The country's focus on automotive innovation and consumer demand for high-tech safety systems is driving market expansion. The incorporation of bumper sensors in vehicles for ADAS features, such as collision avoidance and parking assistance, is becoming standard across the industry. Additionally, the rise in electric and autonomous vehicle production, along with stringent safety regulations, is further increasing the adoption of these sensors. With leading automotive manufacturers and technology providers advancing sensor technologies, the United States remains a significant player in the global bumper sensor market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Combination of advanced driver assistance systems (ADAS)

- 3.6.1.2 Reduction in accidents and insurance claims

- 3.6.1.3 Regulatory requirements boosting bumper sensor consumption

- 3.6.1.4 Expanding automotive sector boosting demand for bumper sensors

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Limited integration with older vehicles

- 3.6.2.2 Complex repair procedures

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Volume Units)

- 5.1 Key trends

- 5.2 Ultrasonic sensors

- 5.3 Electromagnetic sensors

- 5.4 Infrared sensors

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Volume Units)

- 6.1 Key trends

- 6.2 Parking assistance

- 6.3 Collision avoidance

- 6.4 Blind spot detection

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Vehicle Type, 2021-2034 (USD Billion) (Volume Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.3 Commercial vehicles

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021-2034 (USD Billion) (Volume Units)

- 8.1 Key trends

- 8.2 Original Equipment Manufacturers (OEMs)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Volume Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Analog Devices, Inc.

- 10.2 Aptiv (Formerly Delphi Technologies)

- 10.3 Continental AG

- 10.4 Denso Corporation

- 10.5 Gentex Corporation

- 10.6 HELLA GmbH & Co. KGaA

- 10.7 Heraeus Sensor Technology

- 10.8 Hitachi Automotive Systems

- 10.9 Hyundai Mobis

- 10.10 Infineon Technologies AG

- 10.11 Leddartech

- 10.12 Magna International Inc.

- 10.13 Murata Manufacturing Co., Ltd.

- 10.14 NXP Semiconductors

- 10.15 Proxel

- 10.16 Robert Bosch GmbH

- 10.17 Steelmate Automotive

- 10.18 Texas Instruments Incorporated

- 10.19 Valeo

- 10.20 ZF Friedrichshafen AG