|

市场调查报告书

商品编码

1685141

绝缘涂料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Insulation Coatings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

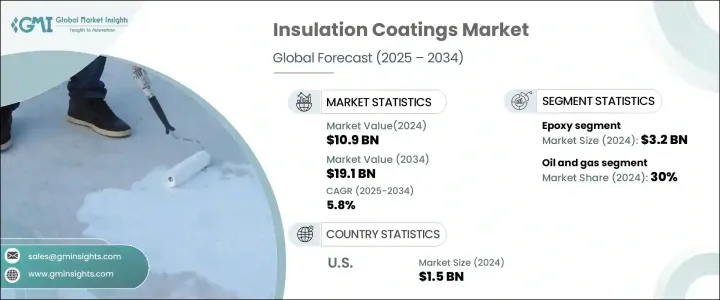

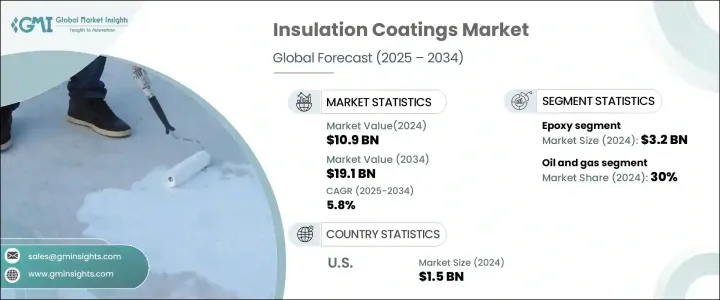

2024 年全球绝缘涂料市场规模将达到 109 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.8%。对节能解决方案的需求不断增长是这一增长的主要驱动力。随着世界城市化进程不断推进,对先进建筑和基础设施项目的需求正在迅速增加。这推动了绝缘涂料市场的扩张。製造厂、发电站和炼油厂等工业部门越来越多地采用绝缘涂层来提高能源效率、保护设备并降低营运成本。这些涂层对于保持最佳性能同时解决与能源消耗和永续性相关的环境问题至关重要。随着各行各业面临越来越大的减少碳足迹的压力,绝缘涂层被视为实现营运和环境目标的关键因素。

除了对能源效率的日益关注之外,人们对环境影响的认识不断提高以及监管对永续性的日益重视也刺激了全球市场的成长。製造商和工业参与者现在更加意识到绝缘涂层的成本节约潜力,这有助于延长设备的使用寿命,同时降低能源消耗和相关的营运成本。智慧建筑解决方案、节能係统和绿色建筑的趋势进一步支持了各个领域对这些涂料的采用。此外,随着企业持续面临波动的能源价格和更严格的环境法规,隔热涂料在节能环保方面的重大贡献正在得到认可。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 109亿美元 |

| 预测值 | 191亿美元 |

| 复合年增长率 | 5.8% |

市场依产品类型细分,包括环氧树脂、聚氨酯、压克力、氧化钇稳定氧化锆等。 2024 年环氧基绝缘涂料领域的价值为 32 亿美元。环氧涂料以其出色的附着力、耐用性和耐极端温度性而闻名,在各种工业应用中备受推崇。它们能够提供强大的防腐蚀、防潮和防环境压力保护,使其成为汽车、船舶和建筑等领域的首选。环氧涂料在提高能源效率和延长机械设备使用寿命方面有着良好的记录,对于降低维护成本和提高运行性能至关重要。

当谈到最终用户产业时,绝缘涂料市场分为石油和天然气、航太、海洋、建筑和建筑、汽车等。石油和天然气行业占有 30% 的市场份额,绝缘涂层在提供温度控制、防腐蚀以及保护管道和设备方面发挥着至关重要的作用。这些涂层有助于最大限度地减少热量损失,提高能源效率,并保护资产免受恶劣环境条件的影响。随着对安全性、永续性和营运效率的日益关注,整个产业对高性能绝缘涂料的需求正在稳步上升。

在美国,绝缘涂料市场规模将在 2024 年达到 15 亿美元,预计未来几年将显着成长。这一增长是由建筑、製造、石油和天然气等各个行业对节能解决方案日益增长的需求所推动的。更严格的能源效率法规的采用,加上永续发展倡议,导致了先进绝缘涂料的广泛使用。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 对节能解决方案的需求不断增长

- 工业和基础设施领域的成长

- 更加重视环境永续性

- 产业陷阱与挑战

- 绝缘涂层的初始成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模与预测:依产品类型,2021-2034 年

- 主要趋势

- 丙烯酸纤维

- 环氧树脂

- 聚氨酯

- 氧化钇稳定氧化锆

- 其他的

第 6 章:市场规模与预测:依最终用途产业,2021-2034 年

- 主要趋势

- 石油和天然气

- 航太

- 汽车

- 海洋

- 建筑和施工

- 其他的

第 7 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- 3M

- AkzoNobel

- BASF SE

- Hempel A/S

- PPG Industries

- Sherwin-Williams

- The Dow Chemical Company

The Global Insulation Coatings Market reached USD 10.9 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2034. The increasing demand for energy-efficient solutions is a primary driver of this growth. As the world continues to urbanize, the need for advanced construction and infrastructure projects is rising rapidly. This is driving the expansion of the insulation coatings market. Industrial sectors such as manufacturing plants, power stations, and oil refineries are increasingly adopting insulation coatings to enhance energy efficiency, protect equipment, and reduce operational costs. These coatings are crucial for maintaining peak performance while addressing environmental concerns related to energy consumption and sustainability. As industries continue to face mounting pressure to reduce their carbon footprints, insulation coatings are being seen as a key element in achieving both operational and environmental goals.

In addition to the growing focus on energy efficiency, global market growth is also spurred by rising awareness of environmental impacts and the increasing regulatory emphasis on sustainability. Manufacturers and industrial players are now more aware of the cost-saving potential of insulation coatings, which help extend the lifespan of equipment while reducing energy consumption and associated operational costs. The trend toward smart building solutions, energy-efficient systems, and green construction further supports the adoption of these coatings across sectors. Moreover, as businesses continue to face fluctuating energy prices and stricter environmental regulations, insulation coatings are being recognized for their significant contribution to energy conservation and environmental protection.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.9 Billion |

| Forecast Value | $19.1 Billion |

| CAGR | 5.8% |

The market is segmented by product types, including epoxy, polyurethane, acrylic, yttria-stabilized zirconia, and others. The epoxy-based insulation coatings segment was valued at USD 3.2 billion in 2024. Known for their excellent adhesion, durability, and resistance to extreme temperatures, epoxy coatings are highly regarded in a variety of industrial applications. Their ability to provide robust protection against corrosion, moisture, and environmental stress makes them a preferred choice in sectors like automotive, marine, and construction. With a proven track record in enhancing energy efficiency and extending the lifespan of machinery and equipment, epoxy coatings are integral to reducing maintenance costs and improving operational performance.

When it comes to end-user industries, the insulation coatings market is divided into oil and gas, aerospace, marine, building and construction, automotive, and others. The oil and gas sector holds a 30% market share, with insulation coatings playing a vital role in offering temperature control, corrosion resistance, and safeguarding pipelines and equipment. These coatings help minimize heat loss, increase energy efficiency, and protect assets from harsh environmental conditions. With an increasing focus on safety, sustainability, and operational efficiency, demand for high-performance insulation coatings is rising steadily across this industry.

In the U.S., the insulation coatings market reached USD 1.5 billion in 2024, with significant growth anticipated in the coming years. This surge is driven by the growing demand for energy-efficient solutions across various industries, such as construction, manufacturing, and oil and gas. The adoption of stricter energy efficiency regulations, combined with sustainability initiatives, has led to the widespread use of advanced insulation coatings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for energy-efficient solutions

- 3.6.1.2 Growth in industrial and infrastructure sectors

- 3.6.1.3 Increasing focus on environmental sustainability

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial costs of insulation coatings

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Acrylic

- 5.3 Epoxy

- 5.4 Polyurethane

- 5.5 Yttria stabilized zirconia

- 5.6 Others

Chapter 6 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Oil and gas

- 6.3 Aerospace

- 6.4 Automotive

- 6.5 Marine

- 6.6 Building and construction

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 3M

- 8.2 AkzoNobel

- 8.3 BASF SE

- 8.4 Hempel A/S

- 8.5 PPG Industries

- 8.6 Sherwin-Williams

- 8.7 The Dow Chemical Company