|

市场调查报告书

商品编码

1685144

磁振造影 (MRI) 系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Magnetic Resonance Imaging (MRI) Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

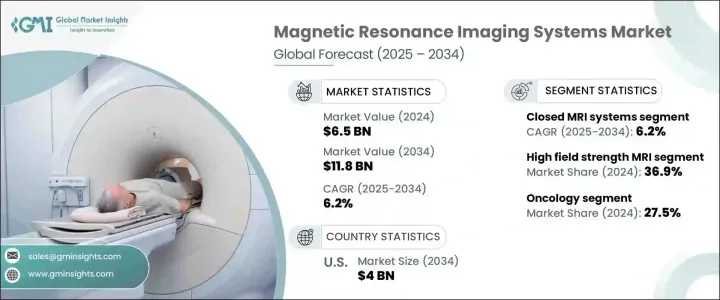

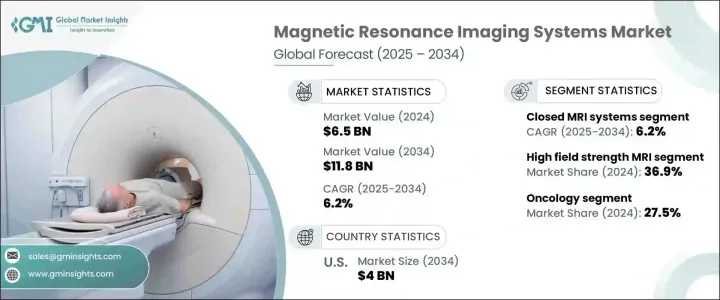

2024 年全球磁振造影系统市场规模将达到 65 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.2%。 MRI 技术是一种非侵入性成像方法,它利用强磁场和无线电波产生人体内部结构的详细影像,在现代诊断中发挥至关重要的作用。与其他影像技术不同,MRI 不需要切口或暴露于电离辐射,使其成为精确可视化软组织的首选。神经系统疾病、心血管疾病和肌肉骨骼问题等慢性疾病的发生率不断上升,加剧了对先进诊断解决方案的需求。

MRI 系统的技术进步正在推动市场扩张,重点是提高影像解析度、缩短扫描时间和增强患者舒适度。人工智慧 (AI) 与 MRI 成像的整合透过自动化影像解释和减少变异性进一步提高了诊断的准确性。此外,向便携式和开放式 MRI 系统的转变使得行动不便或幽闭恐惧症患者更容易获得影像。医疗保健投资的增加,加上对早期疾病检测的日益重视,预计将推动市场成长。政府和私人医疗保健提供者正在投资尖端诊断设备,以满足日益增长的精准成像需求。随着医疗保健基础设施的进步,特别是在新兴经济体,高性能 MRI 系统的采用将继续加速。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 65亿美元 |

| 预测值 | 118亿美元 |

| 复合年增长率 | 6.2% |

根据架构,市场分为开放式和封闭式 MRI 系统。预计整个预测期内封闭式 MRI 系统部分将以 6.2% 的复合年增长率成长。这些系统采用全封闭的圆柱形设计,透过最大限度地减少外部干扰和运动伪影来提供卓越的影像品质。封闭式 MRI 机器广泛用于神经病学和肿瘤学的高解析度诊断,其中精确的成像对于检测异常至关重要。最近的创新带来了更宽敞的设计和更短的扫描时间,减轻了患者对成像过程中幽闭恐惧症和不适的担忧。

根据场强,MRI 系统分为低场强、中场强、高场强。高场强领域在 2024 年占据市场主导地位,占有 36.9% 的份额,预计将保持领先地位。高场 MRI 系统通常在 1.5 特斯拉以上运行,可提供出色的影像清晰度,确保准确的诊断。这些系统受益于提高影像保真度、减少失真和加快扫描速度的进步,显着改善了整体患者体验。随着医院和影像中心重视精准诊断,对高场 MRI 技术的需求持续上升。

在对尖端诊断技术的高度关注的推动下,美国 MRI 系统市场预计到 2034 年将创造 40 亿美元。全国各地的医院和影像中心正在对下一代 MRI 设备进行大量投资,以提高诊断的准确性和效率。美国医疗保健产业正在转向整合人工智慧和机器学习的更先进的成像系统,优化工作流程并缩短扫描时间。随着对改善患者治疗结果的需求不断增长,MRI 技术的扩展预计将在不断发展的医疗诊断领域中发挥关键作用。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 已开发经济体和发展中经济体的老年人口都在成长

- 全球慢性病盛行率不断上升

- 北美和欧洲对早期诊断的认识不断提高

- 已开发经济体 MRI 系统的技术进步

- 亚太地区和其他新兴经济体的事故数量不断增加

- 产业陷阱与挑战

- 缺乏熟练的专业人员

- MRI 系统成本高

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 2024 年定价分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按建筑,2021 – 2034 年

- 主要趋势

- 开放系统

- 封闭系统

第 6 章:市场估计与预测:按场强,2021 – 2034 年

- 主要趋势

- 低场强

- 中场实力

- 高场强

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 肿瘤学

- 神经病学

- 肌肉骨骼

- 血管

- 胃肠病学

- 心臟病学

- 其他应用

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 影像中心

- 门诊手术中心

- 其他最终用户

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 波兰

- 瑞士

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 泰国

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 智利

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 以色列

第十章:公司简介

- Aurora Imaging Technologies

- Esaote

- Fonar

- FUJIFILM

- GE HealthCare Technologies

- Koninklijke Philips

- Neusoft Medical Systems

- Sanrad Medical Systems

- Siemens Healthineers

- Toshiba

The Global Magnetic Resonance Imaging Systems Market reached USD 6.5 billion in 2024 and is set to grow at a CAGR of 6.2% between 2025 and 2034. MRI technology, a non-invasive imaging method that utilizes strong magnetic fields and radio waves to generate detailed images of the body's internal structures, plays a crucial role in modern diagnostics. Unlike other imaging techniques, MRI does not require incisions or exposure to ionizing radiation, making it a preferred choice for precise visualization of soft tissues. The rising prevalence of chronic diseases, including neurological disorders, cardiovascular conditions, and musculoskeletal issues, has intensified the demand for advanced diagnostic solutions.

Technological advancements in MRI systems are driving market expansion, with a focus on improved image resolution, shorter scan times, and enhanced patient comfort. The integration of artificial intelligence (AI) into MRI imaging has further refined diagnostic accuracy by automating image interpretation and reducing variability. Additionally, the shift toward portable and open MRI systems has made imaging more accessible for patients with mobility challenges or claustrophobia. Increasing healthcare investments, coupled with a growing emphasis on early disease detection, are expected to propel market growth. Governments and private healthcare providers are investing in cutting-edge diagnostic equipment to meet the rising demand for precision imaging. As healthcare infrastructure advances, particularly in emerging economies, the adoption of high-performance MRI systems will continue to accelerate.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $11.8 Billion |

| CAGR | 6.2% |

The market is segmented based on architecture into open and closed MRI systems. The closed MRI system segment is anticipated to grow at a 6.2% CAGR throughout the forecast period. These systems, characterized by fully enclosed cylindrical designs, deliver superior image quality by minimizing external interference and motion artifacts. Closed MRI machines are widely used for high-resolution diagnostics in neurology and oncology, where precise imaging is critical for detecting abnormalities. Recent innovations have led to more spacious designs and shorter scan durations, alleviating patient concerns about claustrophobia and discomfort during imaging procedures.

Based on field strength, MRI systems are categorized into low, mid, and high field strength. The high field strength segment dominated the market in 2024 with a 36.9% share and is expected to maintain its leading position. Typically operating above 1.5 Tesla, high-field MRI systems provide exceptional image clarity, ensuring accurate diagnostics. These systems benefit from advancements that enhance image fidelity, reduce distortions, and expedite scanning, significantly improving the overall patient experience. As hospitals and imaging centers prioritize precision diagnostics, the demand for high-field MRI technology continues to rise.

U.S. MRI systems market is projected to generate USD 4 billion by 2034, driven by a strong focus on cutting-edge diagnostic technologies. Hospitals and imaging centers across the country are making significant investments in next-generation MRI equipment to enhance diagnostic accuracy and efficiency. The U.S. healthcare sector is shifting toward more advanced imaging systems that integrate AI and machine learning, optimizing workflow and reducing scan times. As the demand for improved patient outcomes grows, the expansion of MRI technology is expected to play a key role in the evolving landscape of medical diagnostics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing geriatric population in developed as well as developing economies

- 3.2.1.2 Increasing chronic disease prevalence globally

- 3.2.1.3 Growing awareness pertaining to early diagnosis in North America and Europe

- 3.2.1.4 Technological advancements in MRI system in developed economies

- 3.2.1.5 Increasing number of accidents in Asia Pacific and other emerging economies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled professionals

- 3.2.2.2 High cost of MRI system

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Pricing analysis, 2024

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Architecture, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Open system

- 5.3 Closed system

Chapter 6 Market Estimates and Forecast, By Field Strength, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Low field strength

- 6.3 Mid field strength

- 6.4 High field strength

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oncology

- 7.3 Neurology

- 7.4 Musculoskeletal

- 7.5 Vascular

- 7.6 Gastroenterology

- 7.7 Cardiology

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Imaging centers

- 8.4 Ambulatory surgical centers

- 8.5 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Poland

- 9.3.8 Switzerland

- 9.3.9 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Thailand

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.5.5 Chile

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Israel

Chapter 10 Company Profiles

- 10.1 Aurora Imaging Technologies

- 10.2 Esaote

- 10.3 Fonar

- 10.4 FUJIFILM

- 10.5 GE HealthCare Technologies

- 10.6 Koninklijke Philips

- 10.7 Neusoft Medical Systems

- 10.8 Sanrad Medical Systems

- 10.9 Siemens Healthineers

- 10.10 Toshiba