|

市场调查报告书

商品编码

1685148

入侵侦测系统/入侵防御系统 (IDS/IPS) 市场机会、成长动力、产业趋势分析与预测 2025 - 2034Intrusion Detection System / Intrusion Prevention System (IDS / IPS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

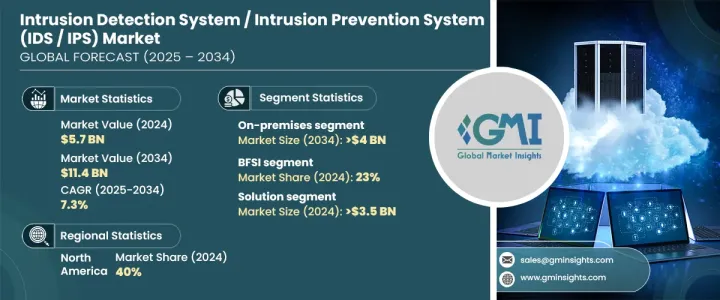

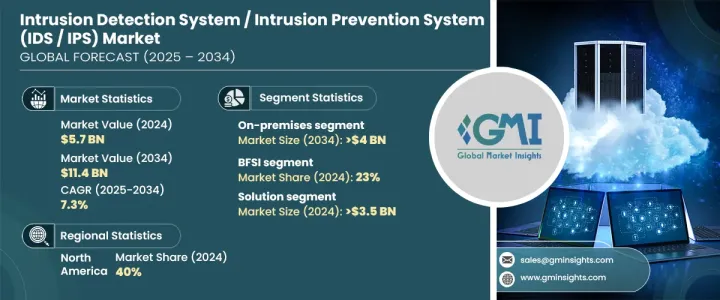

2024 年全球入侵侦测系统/入侵预防系统市场价值为 57 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.3%。网路威胁日益复杂化,推动了对先进的 IDS/IPS 解决方案的需求,以保护网路、应用程式和敏感资料。各行各业的企业都优先考虑这些系统,以增强安全性、防止未经授权的存取并即时检测潜在的漏洞。数位技术的快速应用、对资料外洩的担忧日益加剧以及遵守严格的资料保护法规的需要进一步推动了市场的成长。

随着企业认识到敏感资料的价值日益增长,对 IDS/IPS 解决方案的投资已成为其网路安全策略的关键组成部分。此外,对云端运算、物联网设备和远端工作环境的日益依赖增加了对强大安全措施的需求,进一步推动了市场的扩张。人工智慧和机器学习与 IDS/IPS 系统的整合也增强了其功能,能够即时侦测威胁并主动应对不断演变的网路风险。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 57亿美元 |

| 预测值 | 114亿美元 |

| 复合年增长率 | 7.3% |

根据部署模式,市场分为内部部署、云端和混合解决方案。 2024 年,本地部署部分占据了超过 40% 的市场份额,预计到 2034 年将超过 40 亿美元。处理高度敏感资料的行业(例如政府、金融和医疗保健)更喜欢本地部署系统,因为它们具有增强的控制和安全性。这些部门优先考虑减轻第三方风险并确保遵守 HIPAA、PCI DSS 和 GDPR 等法规。此外,航太和能源等行业也受益于内部部署 IDS/IPS 解决方案,因为它们允许根据特定的安全需求自订检测规则。由于其可扩展性、成本效益以及支援远端操作的能力,云端和混合部署模型也越来越受到关注。

根据应用,IDS/IPS 市场服务于各个领域,包括 BFSI(银行、金融服务和保险)、医疗保健、IT 和电信、政府、製造业、运输和物流以及零售业。由于数位交易日益普及以及网路犯罪风险不断上升,BFSI 部门在 2024 年将占据约 23% 的市场份额。随着数位银行的不断发展,金融机构正在大力投资 IDS/IPS 解决方案,以保护敏感的客户资料并维护信任。同样,医疗保健行业正在采用这些系统来保护患者资料并遵守法规,而 IT 和电信行业则利用 IDS/IPS 来保护庞大的网路并防止服务中断。

2024 年,北美占据 IDS/IPS 市场的主导地位,占有 40% 的份额,其中美国是最大的贡献者。该地区对先进安全系统的需求是由于针对关键基础设施、政府组织和金融机构的网路攻击日益频繁。网路犯罪分子正在采用更为复杂的策略,例如网路入侵和电子邮件攻击,这加剧了对可靠的 IDS/IPS 解决方案的需求。随着北美的企业和政府继续优先考虑网路安全,IDS/IPS 系统的采用预计将保持强劲,确保对不断演变的威胁提供强有力的保护。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- IDS/IPS解决方案供应商

- IDS/IPS 服务供应商

- 系统整合商

- 加值经销商 (VAR) 和分销商

- 最终用户

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻及倡议

- 监管格局

- 各地区的网路安全威胁

- 案例研究

- 衝击力

- 成长动力

- 网路攻击的频率和复杂度不断增加

- 云端服务和混合基础设施的快速采用

- 物联网设备整合度不断提高

- 日益增长的监管合规要求

- 产业陷阱与挑战

- 实施和营运成本高

- 管理误报和维护系统准确性的复杂性增加

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 解决方案

- IDS/IPS 软体

- 实体/虚拟设备

- 整合安全平台

- 服务

- 託管服务

- 专业服务

第 6 章:市场估计与预测:按解决方案架构,2021 - 2034 年

- 主要趋势

- 基于主机的IDS/IPS

- 基于无线的IDS/IPS

- 网路为基础的IDS/IPS

第 7 章:市场估计与预测:按检测方法,2021 - 2034 年

- 主要趋势

- 基于签名

- 基于异常

- 基于策略

第 8 章:市场估计与预测:按部署模型,2021 - 2034 年

- 主要趋势

- 本地

- 云

- 杂交种

第 9 章:市场估计与预测:按组织规模,2021 - 2034 年

- 主要趋势

- 大型企业

- 中小企业

第 10 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 金融保险业协会

- 航太和国防

- 卫生保健

- 资讯科技和电信

- 政府

- 製造业

- 运输与物流

- 零售

- 其他的

第 11 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 12 章:公司简介

- Alert Logic

- AT&T

- Barracuda Networks

- Check Point Software Technologies

- Cisco

- CrowdStrike

- Darktrace

- F5 Networks

- FireEye

- Fortinet

- IBM

- Imperva

- Juniper Networks

- McAfee

- Palo Alto Networks

- SonicWall

- Sophos

- Splunk

- Trend Micro

- Trustwave

The Global Intrusion Detection System / Intrusion Prevention System Market was valued at USD 5.7 billion in 2024 and is projected to grow at a CAGR of 7.3% from 2025 to 2034. The increasing sophistication of cyber threats has driven the demand for advanced IDS/IPS solutions to protect networks, applications, and sensitive data. Businesses across industries are prioritizing these systems to enhance security, prevent unauthorized access, and detect potential breaches in real-time. The market's growth is further fueled by the rapid adoption of digital technologies, rising concerns over data breaches, and the need to comply with stringent data protection regulations.

As organizations recognize the growing value of sensitive data, investments in IDS/IPS solutions have become a critical component of their cybersecurity strategies. Additionally, the increasing reliance on cloud computing, IoT devices, and remote work environments has heightened the need for robust security measures, further propelling the market's expansion. The integration of artificial intelligence and machine learning into IDS/IPS systems is also enhancing their capabilities, enabling real-time threat detection and proactive responses to evolving cyber risks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $11.4 Billion |

| CAGR | 7.3% |

The market is segmented by deployment models into on-premises, cloud, and hybrid solutions. In 2024, the on-premises segment accounted for over 40% of the market share and is expected to surpass USD 4 billion by 2034. Industries handling highly sensitive data, such as government, finance, and healthcare, prefer on-premises systems due to their enhanced control and security. These sectors prioritize mitigating third-party risks and ensuring compliance with regulations like HIPAA, PCI DSS, and GDPR. Additionally, industries such as aerospace and energy benefit from on-premises IDS/IPS solutions, as they allow for customized detection rules tailored to specific security needs. The cloud and hybrid deployment models are also gaining traction, driven by their scalability, cost-effectiveness, and ability to support remote operations.

By application, the IDS/IPS market serves various sectors, including BFSI (banking, financial services, and insurance), healthcare, IT and telecom, government, manufacturing, transportation and logistics, and retail. The BFSI segment held approximately 23% of the market share in 2024, driven by the increasing prevalence of digital transactions and the rising risk of cybercrime. As digital banking continues to grow, financial institutions are investing heavily in IDS/IPS solutions to safeguard sensitive customer data and maintain trust. Similarly, the healthcare sector is adopting these systems to protect patient data and comply with regulations, while the IT and telecom industry leverages IDS/IPS to secure vast networks and prevent service disruptions.

North America dominated the IDS/IPS market in 2024, holding a 40% share, with the United States being the largest contributor. The region's demand for advanced security systems is driven by the increasing frequency of cyberattacks targeting critical infrastructure, government organizations, and financial institutions. Cybercriminals are employing more sophisticated tactics, such as network intrusions and email compromises, which has intensified the need for reliable IDS/IPS solutions. As businesses and governments in North America continue to prioritize cybersecurity, the adoption of IDS/IPS systems is expected to remain strong, ensuring robust protection against evolving threats.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 IDS/IPS solution providers

- 3.1.2 IDS/IPS service providers

- 3.1.3 System integrators

- 3.1.4 Value-Added Resellers (VARs) and distributors

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cybersecurity threats, by region

- 3.9 Case studies

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing frequency and sophistication of cyberattacks

- 3.10.1.2 Rapid adoption of cloud services and hybrid infrastructures

- 3.10.1.3 Rising integration of IoT devices

- 3.10.1.4 Growing regulatory compliance requirements

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High implementation and operational costs

- 3.10.2.2 Increasing complexity in managing false positives and maintaining system accuracy

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 IDS/IPS software

- 5.2.2 Physical/virtual appliances

- 5.2.3 Integrated security platforms

- 5.3 Services

- 5.3.1 Managed services

- 5.3.2 Professional services

Chapter 6 Market Estimates & Forecast, By Solution Architecture, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Host-based IDS/IPS

- 6.3 Wireless-based IDS/IPS

- 6.4 Network-based IDS/IPS

Chapter 7 Market Estimates & Forecast, By Detection Method, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Signature-based

- 7.3 Anomaly-based

- 7.4 Policy-based

Chapter 8 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 On-premises

- 8.3 Cloud

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Large enterprises

- 9.3 SME

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 BFSI

- 10.3 Aerospace & defense

- 10.4 Healthcare

- 10.5 IT & telecom

- 10.6 Government

- 10.7 Manufacturing

- 10.8 Transportation & logistics

- 10.9 Retail

- 10.10 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Alert Logic

- 12.2 AT&T

- 12.3 Barracuda Networks

- 12.4 Check Point Software Technologies

- 12.5 Cisco

- 12.6 CrowdStrike

- 12.7 Darktrace

- 12.8 F5 Networks

- 12.9 FireEye

- 12.10 Fortinet

- 12.11 IBM

- 12.12 Imperva

- 12.13 Juniper Networks

- 12.14 McAfee

- 12.15 Palo Alto Networks

- 12.16 SonicWall

- 12.17 Sophos

- 12.18 Splunk

- 12.19 Trend Micro

- 12.20 Trustwave