|

市场调查报告书

商品编码

1685191

β-丙胺酸市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Beta Alanine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

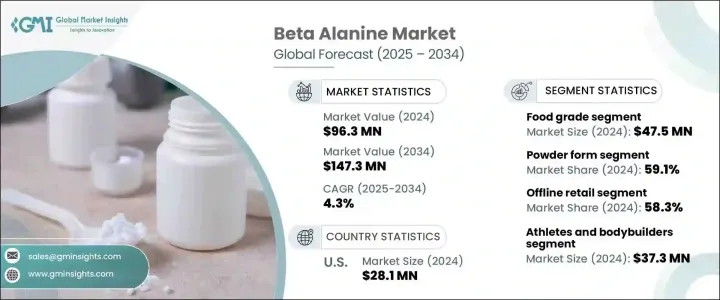

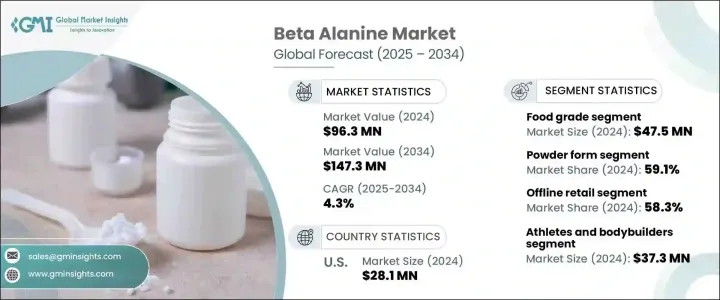

2024 年全球 β-丙胺酸市场规模达到 9,630 万美元,预估 2025 年至 2034 年的复合年增长率为 4.3%。 β-丙氨酸是一种非必需氨基酸,在提高体内肌肽水平方面发挥着至关重要的作用,透过减少剧烈体力活动期间乳酸的累积来帮助延缓肌肉疲劳。这种独特的优势使得β-丙氨酸成为运动前补充剂中备受追捧的成分,并推动了其在健身和运动营养市场上的受欢迎程度。随着越来越多的消费者透过健身来改善健康,β-丙胺酸已经成为他们追求更好表现和更快恢復的必需品。

多个行业的 β-丙氨酸市场正在稳步增长。在製药业,对β-丙胺酸的需求日益增长,因为它具有潜在的健康益处,特别是在治疗慢性病方面。健康问题的日益普遍以及对天然有效成分的日益偏好,推动了旨在改善身体健康的补充剂中采用 β-丙氨酸。此外,食品和饮料行业对 β-丙氨酸作为功能性成分的使用正在激增,尤其是在能量饮料和膳食产品中。消费者越来越倾向于有机和清洁标籤产品,这为 β-丙氨酸创造了新的机会,他们正在寻求自然的方式来增强自己的能量和耐力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9630 万美元 |

| 预测值 | 1.473亿美元 |

| 复合年增长率 | 4.3% |

依等级,β-丙胺酸市场分为食品级、饲料级和医药级。 2024 年,食品级细分市场占据市场主导地位,创收 4,750 万美元,由于消费者对富含氨基酸的功能性食品和饮料的需求增加,预计该细分市场将继续扩大。越来越健康的饮食习惯和更注重健康的消费者行为的转变对这一增长起到了重要作用。随着越来越多的人寻求改善健康的方法,食品中β-丙胺酸的使用量持续增加。

市场也按形式细分,主要类别为粉末、胶囊、片剂和液体。 2024 年,粉末形式占据最大的市场份额,占有 59.1% 的市场份额。它在运动营养和膳食补充剂中的多功能性和易用性是推动其主导的关键因素。粉状 β-丙胺酸可以轻鬆客製化剂量,满足各种消费者的需求和偏好,同时也方便其加入各种产品配方中。

在美国,受运动营养产品需求旺盛的推动,β-丙胺酸市场在 2024 年的收入为 2,810 万美元。日益增长的健身和健康趋势,加上消费者对 β-丙氨酸在提高运动表现和减少疲劳方面的益处的认识不断提高,预计将继续推动该地区的市场扩张。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 能量饮料越来越受欢迎

- 运动营养和补充需求不断成长

- 产业陷阱与挑战

- β-丙氨酸成本高

- 其他运动营养补充品的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模及预测:依等级,2021-2034 年

- 主要趋势

- 食品级

- 饲料级

- 医药级

第 6 章:市场规模与预测:按类型,2021-2034 年

- 主要趋势

- 粉末

- 胶囊

- 平板电脑

- 液体

第 7 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 膳食补充剂

- 药品

- 化妆品

- 食品和饮料

- 动物饲料

第 8 章:市场规模及预测:按配销通路,2021-2034 年

- 主要趋势

- 网路零售

- 线下零售

第 9 章:市场规模与预测:依最终用途,2021-2034 年

- 主要趋势

- 运动员和健美运动员

- 患有特定疾病的患者

- 食品和饮料製造商

- 化妆品和护肤品公司

- 其他的

第 10 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Anhui Huaheng Biotechnology

- Cellucor

- Evlution Nutrition

- Hi-Tech Pharmaceuticals

- Natural Alternatives International

- NOW Foods

- Nutricost

- Thorne Research

- Ultimate Nutrition

- Yuki Gosei Kogyo

The Global Beta Alanine Market reached USD 96.3 million in 2024 and is projected to expand at a CAGR of 4.3% from 2025 to 2034. Beta alanine, a non-essential amino acid, plays a crucial role in boosting carnosine levels in the body, helping delay muscle fatigue by reducing lactic acid buildup during intense physical activity. This unique benefit has made beta alanine a highly sought-after ingredient in pre-workout supplements, driving its popularity in the fitness and sports nutrition markets. As more consumers turn to fitness routines to improve health, beta alanine has become a staple in their pursuit of better performance and faster recovery.

The market for beta alanine is experiencing steady growth across multiple industries. In the pharmaceutical sector, there's a growing demand for beta alanine due to its potential health benefits, particularly in managing chronic diseases. The increasing prevalence of health issues and a rising preference for natural and effective ingredients are pushing the adoption of beta alanine in supplements aimed at improving physical well-being. Additionally, the food and beverage industry is seeing a surge in the use of beta alanine as a functional ingredient, especially in energy drinks and dietary products. This growing shift towards organic, clean-label products has created new opportunities for beta alanine, with consumers looking for natural ways to enhance their energy and stamina.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $96.3 Million |

| Forecast Value | $147.3 Million |

| CAGR | 4.3% |

By grade, the beta alanine market is divided into food grade, feed grade, and pharmaceutical grade. The food grade segment dominated the market in 2024, generating USD 47.5 million, and it is expected to continue expanding due to the increased consumer demand for functional foods and beverages enriched with amino acids. The rising trend toward healthier eating habits and the shift towards more health-conscious consumer behavior has been instrumental in supporting this growth. As more people seek ways to optimize their health, the use of beta alanine in food products continues to rise.

The market is also segmented by form, with powder, capsules, tablets, and liquid being the primary categories. In 2024, the powder form segment accounted for the largest market share, holding 59.1% of the market. Its versatility and ease of use in sports nutrition and dietary supplements are key factors driving this dominance. Powdered beta alanine allows for easy customization of dosages, catering to a variety of consumer needs and preferences while also facilitating its incorporation into various product formulations.

In the U.S., the beta alanine market generated USD 28.1 million in 2024, driven by the booming demand for sports nutrition products. The growing fitness and wellness trends, coupled with increasing consumer awareness about the benefits of beta alanine in enhancing exercise performance and reducing fatigue, are expected to continue propelling market expansion in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing popularity of energy drinks

- 3.6.1.2 Rising demand for sports nutrition and supplements

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of beta-alanine

- 3.6.2.2 Competition from other sports nutrition supplements

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Grade, 2021-2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Food grade

- 5.3 Feed grade

- 5.4 Pharmaceutical grade

Chapter 6 Market Size and Forecast, By Type, 2021-2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Capsules

- 6.4 Tablets

- 6.5 Liquid

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 Dietary supplements

- 7.3 Pharmaceuticals

- 7.4 Cosmetics

- 7.5 Food and beverages

- 7.6 Animal feed

Chapter 8 Market Size and Forecast, By Distribution Channel, 2021-2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 Online retail

- 8.3 Offline retail

Chapter 9 Market Size and Forecast, By End Use, 2021-2034 (USD Million, Units)

- 9.1 Key trends

- 9.2 Athletes and bodybuilders

- 9.3 Patients with specific medical conditions

- 9.4 Food and beverage manufacturers

- 9.5 Cosmetics and skincare companies

- 9.6 Others

Chapter 10 Market Size and Forecast, By Region, 2021-2034 (USD Million, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Anhui Huaheng Biotechnology

- 11.2 Cellucor

- 11.3 Evlution Nutrition

- 11.4 Hi-Tech Pharmaceuticals

- 11.5 Natural Alternatives International

- 11.6 NOW Foods

- 11.7 Nutricost

- 11.8 Thorne Research

- 11.9 Ultimate Nutrition

- 11.10 Yuki Gosei Kogyo