|

市场调查报告书

商品编码

1685233

再处理医疗器材市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Reprocessed Medical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

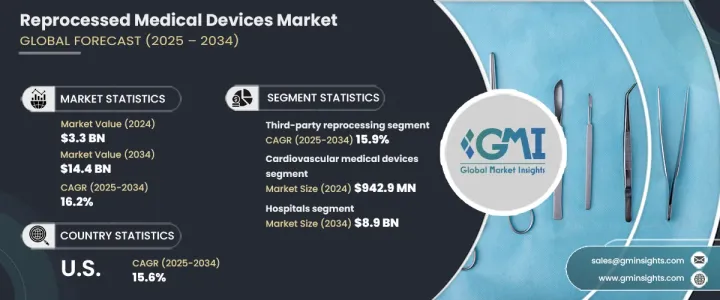

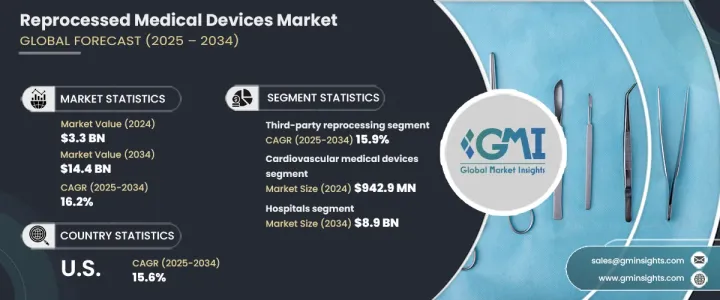

2024 年全球再处理医疗器材市场规模达到 33 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 16.2%。这一增长得益于再处理技术的进步、一次性设备再处理需求的不断增长以及对感染控制的高度关注。发展中地区医疗保健服务的拓展也对市场成长发挥至关重要的作用。强调再处理设备的安全性、效率和环境效益的教育计画得到了医疗保健提供者和患者的广泛认可,从而进一步推动了市场扩张。

环境问题是影响市场的另一个关键因素。减少医疗废弃物的需求日益增加,促使医疗保健提供者采取可持续的做法。再处理医疗器材可最大限度地减少浪费,符合全球永续发展努力,并确保遵守严格的环境法规。这些因素持续推动全球对再处理设备的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 33亿美元 |

| 预测值 | 144亿美元 |

| 复合年增长率 | 16.2% |

再处理医疗器械最初设计为一次性使用,在重新使用前要经过彻底清洁、消毒、灭菌和测试,以满足高安全和性能标准。市场按产品类型细分,其中心血管医疗设备的收入最高,2024 年为 9.429 亿美元。

市场还根据再加工类型进行分类,包括第三方再加工和内部再加工。 2024 年第三方再处理的市场规模为 27 亿美元,预计到 2034 年复合年增长率将达到 15.9%。这些专业服务为医院和医疗中心节省了大量成本,确保设备符合严格的安全和监管要求。第三方再处理商的专业知识可协助医疗机构维持合规性,同时降低营运成本。

在最终用户方面,医院占据主导地位,预计到 2034 年将达到 89 亿美元。医疗保健产业的成本压力持续上升,使得再处理医疗器材成为新设备的有吸引力的替代品。医院可以透过重复使用设备来优化预算,同时又不损害病患的安全。此外,医疗保健产业对永续发展的推动正在增加再加工设备的采用,减少对一次性塑胶的需求,并降低对环境的影响。

2024 年美国再处理医疗器材市场价值为 14 亿美元,预计到 2034 年复合年增长率将达到 15.6%。医疗成本的上涨促使医院和医疗中心寻求具有成本效益的解决方案。 FDA 制定了明确的监管指南,确保再处理设备符合严格的安全和性能标准,从而增强医疗保健提供者的信心并推动全国范围内的采用。

。目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 永续废弃物处理方法的有利监管环境

- 价格实惠,加上新兴经济体经销商网络不断加强

- 再加工产品在众多心臟手术和血压监测的应用日益增多

- 产业陷阱与挑战

- 手术部位感染的风险

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 报销场景

- 波特的分析

- PESTEL 分析

- 差距分析

- 医疗器材再处理涉及的步骤

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 — 2034 年

- 主要趋势

- 心血管医疗器材

- 血压袖带/止血带袖带

- 诊断电生理导管

- 电生理学电缆

- 心臟稳定和定位装置

- 深部静脉压迫袖套(DVT)

- 其他心血管医疗器材

- 腹腔镜

- 内视镜套管针及零件

- 超音波刀

- 骨科/关节镜

- 胃肠病学和泌尿科

- 胃肠病学切片设备

- 泌尿科切片设备

- 一般外科手术设备

- 点滴压力袋

- 气球充气装置

- 其他产品

第六章:市场估计与预测:依类型,2021 — 2034 年

- 主要趋势

- 第三方再处理

- 内部再处理

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用户

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Arjo

- Boston Scientific

- Cardinal Health

- GE Healthcare

- Halomedicals Systems

- INNOVATIVE HEALTH

- Johnson & Johnson

- MEDLINE

- Medtronic

- SOMA TECH

- STERIS

- Stryker

- SURETECH MEDICAL

- Teleflex

- VANGUARD

The Global Reprocessed Medical Devices Market reached USD 3.3 billion in 2024 and is set to expand at a CAGR of 16.2% from 2025 to 2034. This growth is driven by advancements in reprocessing technology, rising demand for single-use device reprocessing, and a strong focus on infection control. The expansion of healthcare services in developing regions also plays a crucial role in market growth. Educational programs highlighting the safety, efficiency, and environmental benefits of reprocessed devices have led to greater acceptance among healthcare providers and patients, further boosting market expansion.

Environmental concerns are another key factor influencing the market. The need to reduce medical waste is increasing, prompting healthcare providers to adopt sustainable practices. Reprocessing medical devices minimizes waste, aligns with global sustainability efforts, and ensures compliance with strict environmental regulations. These factors continue to drive the demand for reprocessed devices worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $14.4 Billion |

| CAGR | 16.2% |

Reprocessed medical devices, originally designed for single use, undergo thorough cleaning, disinfection, sterilization, and testing to meet high safety and performance standards before reuse. The market is segmented by product type, with cardiovascular medical devices generating the highest revenue of USD 942.9 million in 2024.

The market is also categorized by reprocessing type, which includes third-party reprocessing and in-house reprocessing. Third-party reprocessing accounted for USD 2.7 billion in 2024 and is projected to grow at a CAGR of 15.9% through 2034. These specialized services provide significant cost savings for hospitals and medical centers, ensuring devices meet rigorous safety and regulatory requirements. The expertise of third-party reprocessors helps healthcare facilities maintain compliance while reducing operational costs.

In terms of end users, hospitals represent the dominant market segment, expected to reach USD 8.9 billion by 2034. Cost pressures in the healthcare industry continue to rise, making reprocessed medical devices an attractive alternative to new equipment. Hospitals can optimize budgets by reusing devices without compromising patient safety. Additionally, the healthcare sector's push for sustainability is increasing the adoption of reprocessed devices, reducing the demand for single-use plastics, and lowering the environmental impact.

The U.S. reprocessed medical devices market was valued at USD 1.4 billion in 2024 and is expected to grow at a CAGR of 15.6% through 2034. Rising healthcare costs have led hospitals and medical centers to seek cost-effective solutions. The presence of clear regulatory guidelines set by the FDA ensures that reprocessed devices meet strict safety and performance standards, fostering confidence among healthcare providers and driving adoption across the country.

.Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Favorable regulatory landscape regarding sustainable waste disposal methods

- 3.2.1.2 Affordable costs coupled with the strengthening network of distributors in emerging economies

- 3.2.1.3 Growing use of reprocessed products in numerous cardiac surgeries and blood pressure monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of surgical site infections

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Steps involved in medical device reprocessing

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiovascular medical devices

- 5.2.1 Blood pressure cuffs/tourniquet cuffs

- 5.2.2 Diagnostic electrophysiology catheters

- 5.2.3 Electrophysiology cables

- 5.2.4 Cardiac stabilization and positioning devices

- 5.2.5 Deep vein compression sleeves (DVT)

- 5.2.6 Other cardiovascular medical devices

- 5.3 Laparoscopic

- 5.3.1 Endoscopic trocars and components

- 5.3.2 Harmonic scalpels

- 5.4 Orthopedic/arthroscopic

- 5.5 Gastroenterology and urology

- 5.5.1 Gastroenterology biopsy devices

- 5.5.2 Urology biopsy devices

- 5.6 General surgery equipment

- 5.6.1 Infusion pressure bags

- 5.6.2 Balloon inflation devices

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By Type, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Third-party reprocessing

- 6.3 In-house reprocessing

Chapter 7 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Arjo

- 9.2 Boston Scientific

- 9.3 Cardinal Health

- 9.4 GE Healthcare

- 9.5 Halomedicals Systems

- 9.6 INNOVATIVE HEALTH

- 9.7 Johnson & Johnson

- 9.8 MEDLINE

- 9.9 Medtronic

- 9.10 SOMA TECH

- 9.11 STERIS

- 9.12 Stryker

- 9.13 SURETECH MEDICAL

- 9.14 Teleflex

- 9.15 VANGUARD