|

市场调查报告书

商品编码

1698231

合法拦截市场机会、成长动力、产业趋势分析及 2025-2034 年预测Lawful Interception Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

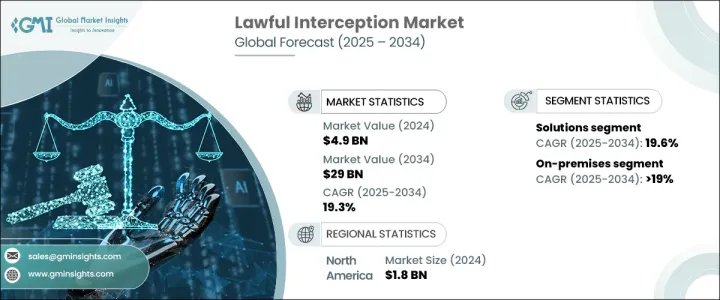

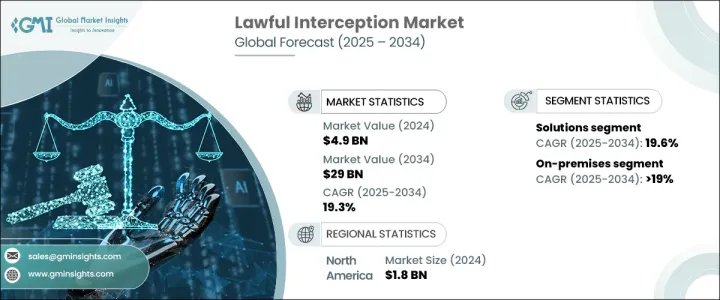

全球合法拦截市场在 2024 年的价值为 49 亿美元,预计在 2025 年至 2034 年期间的复合年增长率将达到 19.3%。这一市场成长主要得益于 5G 技术的快速扩张、物联网 (IoT) 设备的激增以及增强全球连通性的资料流量的不断增长。然而,向 5G 的过渡带来了严重的安全问题,因为这些网路的速度增加和延迟减少使其更容易受到犯罪分子和网路威胁的攻击。全球重视完善网路法律法规,以解决网路犯罪、恐怖主义和其他安全威胁等问题,这为合法拦截领域的公司创造了新的机会。世界各国政府都对电信服务供应商制定了更严格的合规要求,以确保网路能够适应合法拦截,同时平衡隐私问题。

合法拦截市场分为解决方案和服务,其中解决方案部分占据市场主导地位,到 2024 年将达到 33 亿美元。预计该部分将保持主导地位,复合年增长率为 19.6%。电信供应商、情报机构和政府专注于部署先进的中介设备、探测器和接口,以确保语音、资料和视讯通讯的拦截能力。这些技术有助于满足日益增长的即时监控需求,这对于国家安全、反恐和预防网路犯罪至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 49亿美元 |

| 预测值 | 290亿美元 |

| 复合年增长率 | 19.3% |

此外,市场根据部署模式细分为本地部署和基于云端的解决方案,其中本地部署系统将在 2024 年占据 73% 的市场份额。这些解决方案对于即时监控至关重要,而即时监控对于执法和安全营运至关重要。网路威胁日益复杂化,加上物联网设备的全球扩张和向 5G 的过渡,正在刺激拦截技术的创新。

受《通讯协助执法法案》(CALEA)等严格法规的推动,北美继续引领合法拦截市场,这些法规确保服务提供者遵守规定。随着 5G 网路和物联网设备变得越来越普及,电信业者和政府机构面临开发更先进的拦截技术以应对新兴安全威胁的挑战。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 技术提供者

- 网路营运商/通讯服务供应商 (CSP)

- 系统整合商

- 执法和情报机构

- 监管机构/政府

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 网路犯罪和恐怖主义威胁不断增加

- 5G 的快速部署和物联网设备的兴起

- 世界各国政府正在执行更严格的合规法规

- 人工智慧和巨量资料分析的进步

- 不断发展的数位通讯平台

- 产业陷阱与挑战

- 隐私问题和道德问题

- 加密和端对端安全

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 解决方案

- 中介设备

- 拦截存取点

- 路由器和网关

- 切换介面

- 探针

- 网路管理系统

- 服务

- 专业服务

- 託管服务

第六章:市场估计与预测:按网路技术,2021 - 2034 年

- 主要趋势

- 网际网路语音协定 (VoIP)

- 长期演进(LTE)

- 无线区域网路(WLAN)

- 全球微波存取互通性(WiMAX)

- 数位用户线路(DSL)

- 公共交换电话网路(PSTN)

- 综合业务数位网(ISDN)

- 其他的

第七章:市场估计与预测:依通讯方式,2021 - 2034 年

- 主要趋势

- 语音通讯

- 数据通讯

- 视讯通讯

第八章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 政府和执法机构

- 情报机构

- 电信服务供应商

- 网际网路服务供应商 (ISP)

- 企业

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- AQSACOM

- AT&T Inc

- Atos

- BAE Systems

- Cisco Systems

- ClearTrail Technologies

- Elbit Systems

- Ericsson

- Gamma Group

- Incognito Software Systems

- IPS SpA

- NetQuest Corporation

- NICE Systems

- Nokia

- SS8 Networks

- Trovicor Intelligence

- Utimaco

- Verint Systems

- Vocal Technologies Ltd

- ZTE Corporation

The Global Lawful Interception Market, valued at USD 4.9 billion in 2024, is expected to grow at a CAGR of 19.3% from 2025 to 2034. This market growth is primarily driven by the rapid expansion of 5G technology, the surge of Internet of Things (IoT) devices, and the rising volumes of data traffic that are enhancing connectivity worldwide. However, the transition to 5G has introduced substantial security concerns, as the increased speed and reduced latency of these networks make them more vulnerable to exploitation by criminals and cyber threats. The global emphasis on improving cyber laws and regulations to address issues like cybercrime, terrorism, and other security threats is creating new opportunities for companies in the lawful interception sector. Governments worldwide have established stricter compliance requirements for telecom service providers to ensure that networks can accommodate lawful interception, all while balancing privacy concerns.

The lawful interception market is divided into solutions and services, with the solutions segment leading the market, accounting for USD 3.3 billion in 2024. This segment is projected to maintain its dominance, with a CAGR of 19.6%. Telecom providers, intelligence agencies, and governments focus on deploying advanced mediation devices, probes, and interfaces that ensure interception capabilities for voice, data, and video communication. These technologies help meet the growing demand for real-time monitoring, which is essential for national security, counterterrorism, and cybercrime prevention.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $29 Billion |

| CAGR | 19.3% |

Additionally, the market is segmented by deployment modes into on-premises and cloud-based solutions, with on-premises systems commanding 73% of the market share in 2024. These solutions are crucial for real-time monitoring, which is integral to law enforcement and security operations. The increasing sophistication of cyber threats, along with the global expansion of IoT devices and the transition to 5G, is spurring innovation in interception technologies.

North America continues to lead the lawful interception market, driven by strict regulations such as the Communications Assistance for Law Enforcement Act (CALEA), which ensures compliance among service providers. As 5G networks and IoT devices become more prevalent, telecom providers and government agencies face the challenge of developing more advanced interception technologies to stay ahead of emerging security threats.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Technology providers

- 3.2.2 Network operators/communication service providers (CSPs)

- 3.2.3 System integrators

- 3.2.4 Law enforcement and intelligence agencies

- 3.2.5 Regulators/governments

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising cybercrime and terrorism threats

- 3.8.1.2 The rapid deployment of 5G and the rise of IoT-connected devices

- 3.8.1.3 Governments worldwide enforcing stricter compliance regulations

- 3.8.1.4 Advancements in AI and big data analytics

- 3.8.1.5 Growing digital communication platforms

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Privacy concerns and ethical issues

- 3.8.2.2 Encryption and end-to-end security

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Mediation devices

- 5.2.2 Intercept access points

- 5.2.3 Routers & gateways

- 5.2.4 Handover interfaces

- 5.2.5 Probes

- 5.2.6 Network management systems

- 5.3 Services

- 5.3.1 Professional services

- 5.3.2 Managed services

Chapter 6 Market Estimates & Forecast, By Network Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Voice-over-internet protocol (VoIP)

- 6.3 Long term evolution (LTE)

- 6.4 Wireless local area network (WLAN)

- 6.5 Worldwide interoperability for microwave access (WiMAX)

- 6.6 Digital subscriber line (DSL)

- 6.7 Public switched telephone network (PSTN)

- 6.8 Integrated services for digital network (ISDN)

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Communication, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Voice communication

- 7.3 Data communication

- 7.4 Video communication

Chapter 8 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 On-premises

- 8.3 Cloud-based

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Government & law enforcement agencies

- 9.3 Intelligence agencies

- 9.4 Telecom service providers

- 9.5 Internet service providers (ISPs)

- 9.6 Enterprises

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 AQSACOM

- 11.2 AT&T Inc

- 11.3 Atos

- 11.4 BAE Systems

- 11.5 Cisco Systems

- 11.6 ClearTrail Technologies

- 11.7 Elbit Systems

- 11.8 Ericsson

- 11.9 Gamma Group

- 11.10 Incognito Software Systems

- 11.11 IPS S.p.A

- 11.12 NetQuest Corporation

- 11.13 NICE Systems

- 11.14 Nokia

- 11.15 SS8 Networks

- 11.16 Trovicor Intelligence

- 11.17 Utimaco

- 11.18 Verint Systems

- 11.19 Vocal Technologies Ltd

- 11.20 ZTE Corporation