|

市场调查报告书

商品编码

1698234

失眠治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Insomnia Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

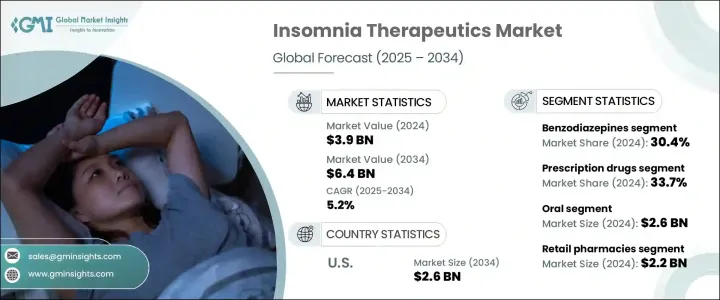

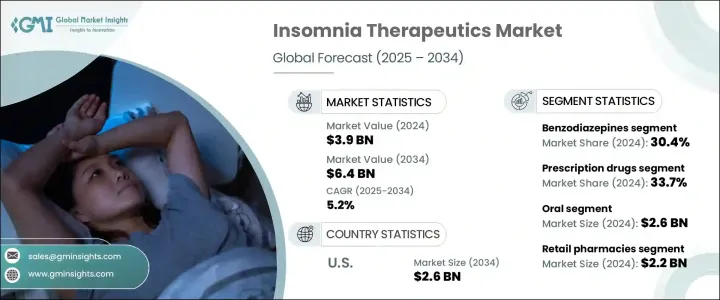

2024 年全球失眠治疗市场价值为 39 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.2%。失眠治疗涵盖广泛的治疗方法,旨在帮助患有睡眠障碍的个人,特别是那些难以入睡或保持睡眠的人。由于现代压力、生活方式的改变和人口老化,全球失眠的盛行率不断上升,这推动了对有效治疗方案的需求。随着人们越来越意识到睡眠障碍对整体健康的影响,失眠治疗市场正在迅速扩大,为製药公司、医疗保健提供者和数位健康平台提供了巨大的成长机会。

慢性失眠病例的增加推动了药物开发和替代疗法的创新。由于城市化、长时间工作和萤幕时间增加,与压力相关的睡眠障碍激增,导致对处方药和非处方药 (OTC) 的需求增加。失眠认知行为疗法(CBT-I)的进步以及人工智慧在睡眠管理解决方案中的整合正在进一步重塑市场。此外,新型失眠治疗方法的研究资金和监管部门的批准增加预计将促进市场扩张。对个人化治疗计划和精准医疗的重视也越来越受到关注,从而能够提供满足个别患者需求的客製化解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 39亿美元 |

| 预测值 | 64亿美元 |

| 复合年增长率 | 5.2% |

市场依药物类别分类,主要包括苯二氮平类药物、非苯二氮平类药物、食慾素受体拮抗剂、抗忧郁剂、抗组织胺、褪黑激素补充剂和其他药物。 2024 年,苯二氮平类药物占据最大的市场份额,占总销售额的 30.4%。这些药物被广泛用于治疗与压力和焦虑相关的失眠,因为它们能有效地减少入睡时间并提高睡眠品质。它们持续受欢迎的原因在于其快速的效果和广泛的可用性,使它们成为失眠治疗的主要选择。

失眠治疗市场依销售管道进一步细分,处方药和非处方药是两大主要类别。 2024年,处方药占市场总销售额的33.7%。远距医疗和线上医疗咨询的兴起使得个人更容易得到及时的诊断和适当的治疗,从而促进了处方药销售的成长。此外,消费者对睡眠不足的健康风险及其与精神健康障碍的关係的认识不断提高,鼓励更多人寻求医疗干预。

美国失眠治疗市场在 2024 年创造了 16 亿美元的产值,预计到 2034 年将达到 26 亿美元。领先製药公司的存在,加上强有力的研究计划和监管支持,正在推动该国市场的成长。美国医疗保健组织持续强调睡眠健康的重要性,并倡导增加研究资金和创新治疗方案。 FDA 对新型和改良失眠药物的批准进一步加速了市场扩张,巩固了美国在全球失眠治疗产业的关键地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 失眠症盛行率上升

- 研发进度

- 人们对睡眠障碍的认识不断提高

- 全球老年人口不断增加

- 产业陷阱与挑战

- 生物製剂和先进疗法成本高昂

- 副作用和依从性问题

- 成长动力

- 成长潜力分析

- 监管格局

- 差距分析

- 专利分析

- 管道分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按药物类别,2021 年至 2034 年

- 主要趋势

- 苯二氮平类

- 非苯二氮平类药物

- 食慾素受体拮抗剂

- 抗忧郁药

- 抗组织胺药

- 褪黑激素补充剂

- 其他药物类别

第六章:市场估计与预测:按销售管道,2021 年至 2034 年

- 主要趋势

- 非处方药

- 处方药

第七章:市场估计与预测:依管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 注射剂

- 透皮

- 鼻内

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 电子商务

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Eisai

- Eli Lilly and Company

- Meiji Seika Pharma

- Merck & Co.

- Neurocrine Biosciences

- Pfizer

- Sanofi

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries

- Vanda Pharmaceuticals

- Woodward Pharma Services

The Global Insomnia Therapeutics Market was valued at USD 3.9 billion in 2024 and is projected to grow at a CAGR of 5.2% between 2025 and 2034. Insomnia therapeutics encompass a broad spectrum of treatments designed to help individuals struggling with sleep disorders, particularly those who have difficulty falling asleep or maintaining sleep. The increasing prevalence of insomnia worldwide, driven by modern-day stressors, shifting lifestyles, and aging populations, is fueling the demand for effective treatment solutions. With growing awareness of the impact of sleep disorders on overall health, the market for insomnia therapeutics is expanding rapidly, providing significant growth opportunities for pharmaceutical companies, healthcare providers, and digital health platforms.

Rising cases of chronic insomnia are propelling innovation in drug development and alternative therapies. Stress-related sleep disorders have surged due to urbanization, long working hours, and increased screen time, leading to a higher demand for prescription and over-the-counter (OTC) medications. Advancements in cognitive behavioral therapy for insomnia (CBT-I) and the integration of artificial intelligence in sleep management solutions are further reshaping the market. Additionally, increased research funding and regulatory approvals for novel insomnia treatments are expected to bolster market expansion. The emphasis on personalized treatment plans and precision medicine is also gaining traction, enabling tailored solutions that cater to individual patient needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 5.2% |

The market is categorized by drug class, with key segments including benzodiazepines, non-benzodiazepines, orexin receptor antagonists, antidepressants, antihistamines, melatonin supplements, and other medications. Benzodiazepines held the largest share of the market in 2024, accounting for 30.4% of total sales. These drugs are widely prescribed for insomnia associated with stress and anxiety, as they effectively reduce sleep onset time and enhance sleep quality. Their continued popularity stems from their fast-acting results and widespread availability, making them a dominant choice in insomnia treatment.

The insomnia therapeutics market is further segmented by sales channels, with prescription and OTC drugs as the two primary categories. In 2024, prescription drugs accounted for 33.7% of total market sales. The rise of telemedicine and online healthcare consultations has made it easier for individuals to receive timely diagnoses and appropriate treatment, contributing to increased prescription medication sales. Additionally, growing consumer awareness about the health risks of sleep deprivation and its link to mental health disorders has encouraged more individuals to seek medical intervention.

The U.S. Insomnia Therapeutics Market generated USD 1.6 billion in 2024 and is expected to reach USD 2.6 billion by 2034. The presence of leading pharmaceutical companies, coupled with robust research initiatives and regulatory support, is driving market growth in the country. U.S.-based healthcare organizations continue to emphasize the importance of sleep health, advocating for increased research funding and innovative treatment solutions. FDA approvals for new and improved insomnia drugs are further accelerating market expansion, solidifying the U.S. as a key player in the global insomnia therapeutics industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of insomnia

- 3.2.1.2 Advancements in research and development

- 3.2.1.3 Growing awareness of sleep disorders

- 3.2.1.4 Increasing global geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of biologic and advanced therapies

- 3.2.2.2 Side effects and compliance issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Gap analysis

- 3.6 Patent analysis

- 3.7 Pipeline analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Benzodiazepines

- 5.3 Non-benzodiazepine

- 5.4 Orexin receptor antagonists

- 5.5 Antidepressants

- 5.6 Antihistamines

- 5.7 Melatonin supplements

- 5.8 Other drug classes

Chapter 6 Market Estimates and Forecast, By Sales Channel, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Over-the-counter (OTC) drugs

- 6.3 Prescription drugs

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

- 7.4 Transdermal

- 7.5 Intranasal

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Eisai

- 10.2 Eli Lilly and Company

- 10.3 Meiji Seika Pharma

- 10.4 Merck & Co.

- 10.5 Neurocrine Biosciences

- 10.6 Pfizer

- 10.7 Sanofi

- 10.8 Takeda Pharmaceutical Company Limited

- 10.9 Teva Pharmaceutical Industries

- 10.10 Vanda Pharmaceuticals

- 10.11 Woodward Pharma Services