|

市场调查报告书

商品编码

1698236

电池热管理系统市场机会、成长动力、产业趋势分析及2025-2034年预测Battery Thermal Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

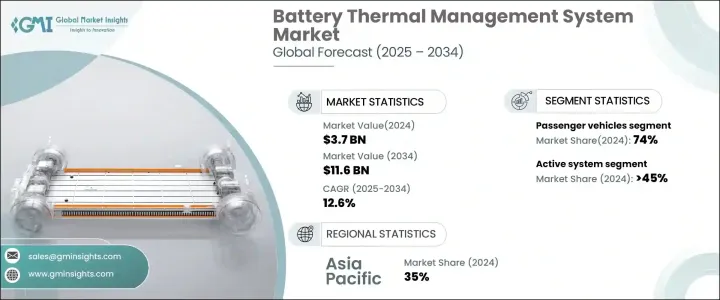

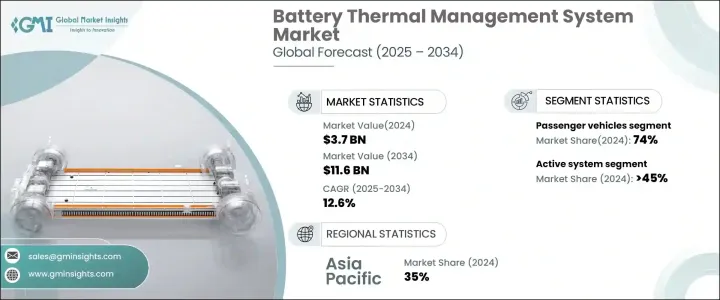

全球电池热管理系统市场价值 37 亿美元,预计在 2025 年至 2034 年期间将以 12.6% 的复合年增长率扩张,这得益于电动车 (EV) 产量的成长和电池技术的进步。随着对高性能和长寿命电池的需求不断增长,製造商正专注于确保电池效率、安全性和寿命的创新热管理解决方案。

随着电动车的普及,电池热管理系统已成为优化电池性能的关键组成部分。这些系统可以调节温度、防止过热并延长电池寿命,解决能源效率、充电速度和安全性等关键问题。政府对电池安全的严格监管以及快速充电技术的日益普及进一步推动了市场的成长。此外,电动车充电基础设施的扩张和电池冷却技术的持续研发正在为产业参与者创造丰厚的机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 37亿美元 |

| 预测值 | 116亿美元 |

| 复合年增长率 | 12.6% |

市场按热管理系统的类型进行细分,包括主动系统、被动系统和混合系统。 2024 年,主动系统领域占据 45% 的主导市场份额,这主要归功于其有效调节电池组内温度的能力。主动系统使用液体或空气冷却机制来保持最佳热条件,使其成为高性能电池的首选。同时,依赖自然冷却方法的被动系统预计到 2034 年将以 14% 的复合年增长率成长,因为它们可以补充主动系统,提高电池的安全性和效率。混合系统整合了主动和被动冷却机制,由于其能够提供卓越的温度调节能力而越来越受到关注。

根据车辆类型,电池热管理系统市场分为乘用车和商用车。到 2024 年,乘用车将占据 74% 的市场份额,这得益于电动车的普及和对高效能电池冷却解决方案的需求。人们越来越倾向于更长的行驶里程和更快的充电时间,这使得先进的热管理系统对于乘用车来说不可或缺。然而,商用车预计将经历更快的成长率,到 2034 年预计复合年增长率为 13%。对电动卡车、巴士和送货车的需求不断增长,以及政府推动永续交通的倡议,正在推动该领域采用热管理解决方案。

亚太地区成为电池热管理系统市场的主要参与者,到 2024 年将占据 35% 的市场。中国引领该地区,推动热管理解决方案的生产和消费。中国、台湾和印度拥有完善的供应链和主要电池製造商,这推动了市场扩张。电动车普及率的快速成长,加上都市化和政府的支持政策,进一步加速了该地区对电池热管理系统的需求。产业参与者正专注于技术进步、策略伙伴关係和製造业扩张,以加强其在竞争环境中的市场地位。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 最终客户

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 用例

- 衝击力

- 成长动力

- 电动车(EV)需求不断成长

- 电池技术的进步

- 快速充电站的普及率不断提高

- 电动车基础设施投资不断增加

- 产业陷阱与挑战

- 初始成本高

- 整合的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按供应量,2021 - 2034 年

- 主要趋势

- 主动系统

- 被动系统

- 混合系统

第六章:市场估计与预测:按电池,2021 - 2034 年

- 主要趋势

- 锂离子电池

- 镍氢(NiMH)电池

- 铅酸电池

- 固态电池

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车 轻型

- 商用车(LCV)

- 重型商用车(HCV)

第八章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 纯电动车(BEV)

- 插电式混合动力电动车 (PHEV)

- 混合动力电动车 (HEV)

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Aptiv PLC

- BASF

- Bosch

- Continental

- Dana Limited

- Gentherm

- Hanon Systems

- Hitachi

- Infineon

- Johnson Control

- MAHLE GmbH

- Marelli

- Modine

- Modine Manufacturing

- Sanden Corporation

- Schaeffler

- Valeo

- Vitesco Technologies

- VOSS Automotive

- ZF Friedrichshafen

The Global Battery Thermal Management System Market was valued at USD 3.7 billion and is projected to expand at a CAGR of 12.6% between 2025 and 2034, driven by the rising production of electric vehicles (EVs) and advancements in battery technologies. As the demand for high-performance and long-lasting batteries continues to rise, manufacturers are focusing on innovative thermal management solutions that ensure battery efficiency, safety, and longevity.

With the shift towards EVs gaining momentum, battery thermal management systems have become a critical component in optimizing battery performance. These systems regulate temperature, prevent overheating, and enhance battery lifespan, addressing key concerns such as energy efficiency, charging speed, and safety. Stringent government regulations on battery safety and the increasing adoption of fast-charging technology are further fueling market growth. Additionally, the expansion of EV charging infrastructure and continuous research and development (R&D) in battery cooling technologies are creating lucrative opportunities for industry players.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 12.6% |

The market is segmented by the type of thermal management system, including active, passive, and hybrid systems. In 2024, the active system segment held a dominant 45% market share, primarily due to its ability to regulate temperature effectively within the battery pack. Active systems use liquid or air cooling mechanisms to maintain optimal thermal conditions, making them a preferred choice for high-performance batteries. Meanwhile, passive systems, which rely on natural cooling methods, are projected to grow at a CAGR of 14% through 2034 as they complement active systems in enhancing battery safety and efficiency. Hybrid systems, which integrate both active and passive cooling mechanisms, are also gaining traction due to their ability to provide superior temperature regulation.

By vehicle type, the battery thermal management system market is categorized into passenger vehicles and commercial vehicles. In 2024, passenger vehicles accounted for a substantial 74% market share, driven by the increasing adoption of EVs and the need for efficient battery cooling solutions. The growing preference for longer driving ranges and faster charging times has made advanced thermal management systems indispensable for passenger vehicles. However, commercial vehicles are expected to witness a faster growth rate, with a projected CAGR of 13% through 2034. The rising demand for electric trucks, buses, and delivery vans, along with government initiatives promoting sustainable transportation, is propelling the adoption of thermal management solutions in this segment.

Asia Pacific emerged as a key player in the battery thermal management system market, holding a 35% share in 2024. China leads the region, driving both production and consumption of thermal management solutions. The presence of well-established supply chains and major battery manufacturers in China, Taiwan, and India is boosting market expansion. The rapid increase in EV adoption, coupled with urbanization and supportive government policies, is further accelerating demand for battery thermal management systems in the region. Industry players are focusing on technological advancements, strategic partnerships, and manufacturing expansion to strengthen their market position in the competitive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component providers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End customers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Use cases

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising demand for electric vehicles (EVs)

- 3.9.1.2 Advancements in battery technology

- 3.9.1.3 Increasing adoption of fast-charging stations

- 3.9.1.4 Growing investment in EV infrastructure

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial costs

- 3.9.2.2 Complexity in integration

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Active system

- 5.3 Passive system

- 5.4 Hybrid system

Chapter 6 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Lithium-ion battery

- 6.3 Nickel-Metal Hydride (NiMH) battery

- 6.4 Lead-acid battery

- 6.5 Solid-state battery

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles Light

- 7.3.1 Commercial Vehicles (LCV)

- 7.3.2 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Battery Electric Vehicles (BEVs)

- 8.3 Plug-in Hybrid Electric Vehicles (PHEVs)

- 8.4 Hybrid Electric Vehicles (HEVs)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aptiv PLC

- 10.2 BASF

- 10.3 Bosch

- 10.4 Continental

- 10.5 Dana Limited

- 10.6 Gentherm

- 10.7 Hanon Systems

- 10.8 Hitachi

- 10.9 Infineon

- 10.10 Johnson Control

- 10.11 MAHLE GmbH

- 10.12 Marelli

- 10.13 Modine

- 10.14 Modine Manufacturing

- 10.15 Sanden Corporation

- 10.16 Schaeffler

- 10.17 Valeo

- 10.18 Vitesco Technologies

- 10.19 VOSS Automotive

- 10.20 ZF Friedrichshafen