|

市场调查报告书

商品编码

1698242

平版层压包装市场机会、成长动力、产业趋势分析及 2025-2034 年预测Litho Laminated Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

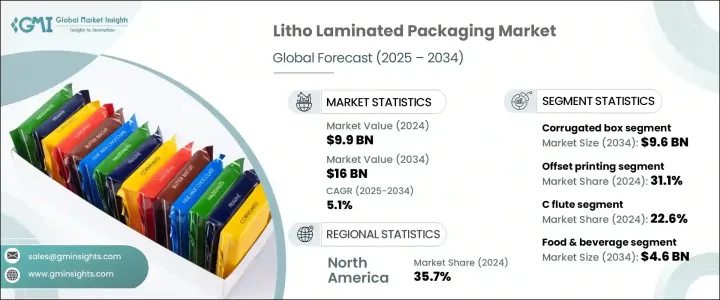

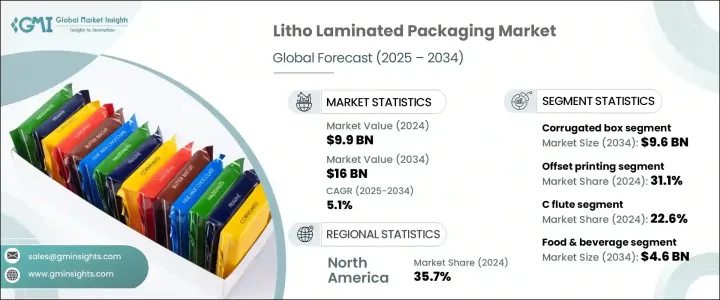

2024 年全球平版层压包装市场规模达到 99 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.1%。快速消费品产业的快速扩张和电子商务产业的蓬勃发展推动了对平版层压包装的需求不断增长。随着消费者行为不断向便利性和美观性转变,企业越来越多地投资于高品质、耐用且外观吸引人的包装解决方案。尤其是新兴市场,正在经历显着的城市化和可支配收入的增加,这进一步加速了对高端包装的需求。

品牌策略的演变也在推动市场成长方面发挥关键作用。各行业的公司都认识到包装作为客户参与的关键接触点的重要性。平版裱贴包装兼具出色的耐用性和高端印刷能力,是希望在竞争激烈的市场中脱颖而出的品牌的首选。永续性是影响市场趋势的另一个主要因素,因为製造商和消费者都在寻求环保的替代方案。在平版层压包装中采用可回收材料和可生物降解油墨的趋势越来越明显,这与全球永续发展目标一致。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 99亿美元 |

| 预测值 | 160亿美元 |

| 复合年增长率 | 5.1% |

市场主要分为两种产品类型:瓦楞纸箱和纸盒。受对坚固、环保包装解决方案的需求不断增长的推动,瓦楞纸箱市场规模预计将在 2034 年达到 96 亿美元。电子商务和零售业的企业越来越多地选择平版裱贴瓦楞纸箱,因为它们具有将强度、永续性和视觉吸引力完美结合的独特能力。包装不仅要保护产品,还要增强品牌认知度,这促使製造商在结构设计和印刷品质方面进行创新。

平版裱贴包装也根据印刷技术进行分类,包括胶印、柔版印刷、凹版印刷和数位印刷。 2024 年,胶印占据市场主导地位,占有 31.1% 的份额,这主要归功于其能够产生高品质的影像、鲜艳的色彩再现以及大规模生产的成本效率。品牌拥有者更喜欢胶印,因为它能够创造出引人注目的多色包装设计,吸引消费者的注意。向可客製化和永续包装的转变进一步加速了各行业对这项技术的需求。

2024 年,北美占据了平版层压包装市场的 35.7%,其需求受到人们对耐用、高性能和永续包装解决方案日益增长的偏好所推动。该地区对可生物降解和可回收包装材料的投资巨大,这与更广泛的永续发展目标一致。电子商务和零售业的不断崛起也推动了平版印刷包装的创新,使其成为企业寻求增强功能性和视觉吸引力的必备组成部分。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 客製化包装解决方案的需求不断增加

- 瓦楞包装市场的成长

- 电子商务和线上零售平台的兴起

- 快速消费品(FMCG)产业的成长

- 消费性电子市场需求不断成长

- 产业陷阱与挑战

- 生产成本高

- 严格的监管要求

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 瓦楞纸箱

- 纸箱

第六章:市场估计与预测:按长笛类型,2021 年至 2034 年

- 主要趋势

- B长笛

- C长笛

- E长笛

- F长笛

- BC长笛

- 吹笛子

- 其他的

第七章:市场估计与预测:按印刷技术,2021 年至 2034 年

- 主要趋势

- 胶印

- 柔版印刷

- 凹版印刷

- 数位印刷

第八章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 製药和医疗保健

- 消费品

- 工业包装

- 电学

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Accurate Box Company

- Alliance Packaging

- Brandon Packaging

- Frankston Packaging

- Graphic Packaging International

- Greif

- Infinity Packaging Solutions

- International Paper Company

- Jaymar Packaging

- LGR Packaging

- Mayr-Melnhof Karton

- Parksons Packaging

- Platypus Print Packaging

- PM Packaging

- Shanghai DE Printed Box

- SK Offset

- Smurfit Kappa Group

- The Cardboard Box Company

The Global Litho Laminated Packaging Market reached USD 9.9 billion in 2024 and is projected to expand at a CAGR of 5.1% between 2025 and 2034. The rising demand for litho-laminated packaging is fueled by the rapid expansion of the FMCG sector and the booming e-commerce industry. As consumer behavior continues to shift toward convenience and aesthetics, businesses are increasingly investing in high-quality, durable, and visually appealing packaging solutions. Emerging markets, in particular, are experiencing significant urbanization and rising disposable incomes, which are further accelerating the demand for premium packaging.

The evolution of branding strategies is also playing a key role in driving market growth. Companies across various sectors are recognizing the importance of packaging as a crucial touchpoint for customer engagement. Litho-laminated packaging offers a superior combination of durability and high-end printing capabilities, making it a preferred choice for brands looking to stand out in a competitive market. Sustainability is another major factor influencing market trends, as both manufacturers and consumers seek eco-friendly alternatives. The adoption of recyclable materials and biodegradable inks in litho-laminated packaging is gaining traction, aligning with global sustainability goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $16 Billion |

| CAGR | 5.1% |

The market is segmented into two primary product types: corrugated boxes and cartons. The corrugated box segment is on track to reach USD 9.6 billion by 2034, driven by the growing demand for strong, eco-friendly packaging solutions. Businesses in the e-commerce and retail sectors are increasingly opting for litho-laminated corrugated boxes due to their unique ability to combine strength, sustainability, and visual appeal. The need for packaging that not only protects products but also enhances brand perception is pushing manufacturers to innovate in structural design and print quality.

Litho-laminated packaging is also classified based on printing technologies, including offset printing, flexographic printing, gravure printing, and digital printing. In 2024, offset printing dominated the market with a 31.1% share, largely due to its ability to produce high-quality images, vibrant color reproduction, and cost efficiency for large-scale production. Brand owners prefer offset printing for its capability to create eye-catching, multi-color packaging designs that attract consumer attention. The shift toward customizable and sustainable packaging is further accelerating the demand for this technology across various industries.

North America accounted for a 35.7% share of the Litho Laminated Packaging Market in 2024, with demand driven by the increasing preference for durable, high-performance, and sustainable packaging solutions. The region has witnessed significant investments in biodegradable and recyclable packaging materials, aligning with the broader push for sustainability. The continuous rise of e-commerce and retail sectors is also propelling innovations in litho-laminated packaging, making it an essential component for businesses looking to enhance both functionality and visual appeal.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for customized packaging solutions

- 3.2.1.2 Growth in the corrugated packaging market

- 3.2.1.3 Rise in e-commerce and online retail platforms

- 3.2.1.4 Growth in the fast-moving consumer goods (FMCG) sector

- 3.2.1.5 Rising demand in the consumer electronics market

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Bn & Kilo Tons)

- 5.1 Key trends

- 5.2 Corrugated box

- 5.3 Cartons

Chapter 6 Market Estimates and Forecast, By Flute Type, 2021 – 2034 (USD Bn & Kilo Tons)

- 6.1 Key trends

- 6.2 B flute

- 6.3 C flute

- 6.4 E flute

- 6.5 F flute

- 6.6 Bc flute

- 6.7 Be flute

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Printing Technology, 2021 – 2034 (USD Bn & Kilo Tons)

- 7.1 Key trends

- 7.2 Offset printing

- 7.3 Flexographic printing

- 7.4 Gravure printing

- 7.5 Digital printing

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Bn & Kilo Tons)

- 8.1 Key trends

- 8.2 Food and beverage

- 8.3 Pharmaceutical and healthcare

- 8.4 Consumer goods

- 8.5 Industrial packaging

- 8.6 Electronics and electrical

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Accurate Box Company

- 10.2 Alliance Packaging

- 10.3 Brandon Packaging

- 10.4 Frankston Packaging

- 10.5 Graphic Packaging International

- 10.6 Greif

- 10.7 Infinity Packaging Solutions

- 10.8 International Paper Company

- 10.9 Jaymar Packaging

- 10.10 LGR Packaging

- 10.11 Mayr-Melnhof Karton

- 10.12 Parksons Packaging

- 10.13 Platypus Print Packaging

- 10.14 PM Packaging

- 10.15 Shanghai DE Printed Box

- 10.16 SK Offset

- 10.17 Smurfit Kappa Group

- 10.18 The Cardboard Box Company