|

市场调查报告书

商品编码

1698245

TC 仪表电缆市场机会、成长动力、产业趋势分析及 2025-2034 年预测TC Instrumentation Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

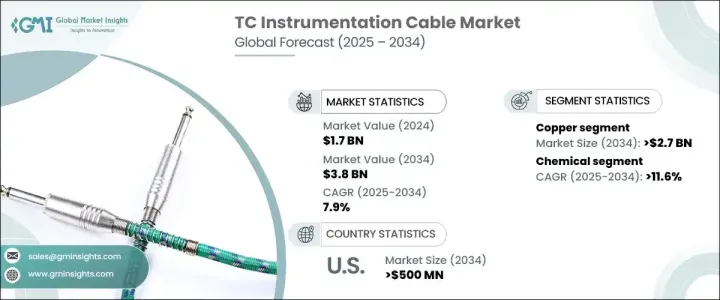

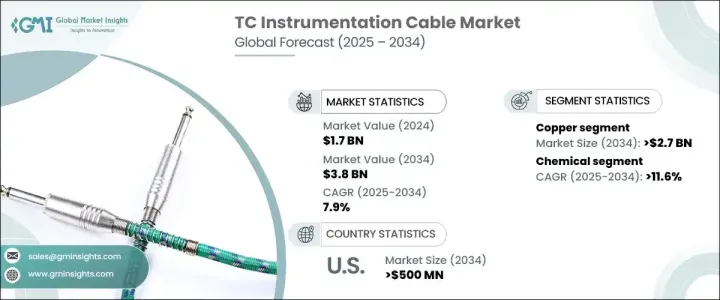

2024 年全球 TC 仪器电缆市场规模达到 17 亿美元,预计 2025 年至 2034 年的复合年增长率为 7.9%。这一成长主要得益于各行业日益采用工业自动化和製程控制系统。企业正在大力投资先进的仪器仪表技术,以提高营运效率、优化能源使用并确保关键应用的安全。随着各行各业越来越依赖精确的温度监控和安全的讯号传输,对这些电缆的需求也不断增加。此外,向再生能源的转变和现有能源基础设施的现代化为 TC 仪表电缆创造了新的机会。随着企业寻求即时资料采集和传输的可靠解决方案,智慧基础设施的不断扩展和数位监控系统的整合进一步促进了市场的成长。氟聚合物和耐高温涂层等先进材料正在提高电缆的耐用性,使其更适合复杂的工业环境。随着亚太和中东地区工业化进程不断加快,高性能仪器电缆的需求预计将大幅成长。

预计到 2034 年,采用铜导体的 TC 仪表电缆市场将达到 27 亿美元以上。铜具有优异的导电性、耐用性和抗腐蚀性,是需要稳定讯号传输和高效温度监控的行业的首选。这些电缆广泛应用于要求在高温和复杂条件下具有卓越性能的环境。预计预测期内采矿业的复合年增长率将超过 11.6%。在极端操作环境下对即时温度调节和精确监控的需求不断增长,这是推动该领域扩张的关键因素。特别是化学加工产业,依赖精密监测仪器在高温和危险环境下维持产品品质、安全和效率。在性能精度至关重要的工业系统中,TC 仪表电缆在确保控制电路和测量设备之间的可靠连接方面发挥着至关重要的作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 38亿美元 |

| 复合年增长率 | 7.9% |

预计到 2034 年,美国 TC 仪表电缆市场规模将超过 5 亿美元,主要归因于工业领域自动化要求的不断提高。对温度控制技术和即时资料中继系统日益增长的需求正在加速这些电缆在多个行业的应用。随着企业升级到先进的监控解决方案,可靠仪器电缆的需求持续成长。此外,全球向再生能源的转变和智慧基础设施的不断发展也进一步促进了市场扩张。

目录

第一章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依指挥,2021 年至 2034 年

- 主要趋势

- 铜

- 镍合金

- 其他的

第六章:市场规模及预测:依最终用户,2021 年至 2034 年

- 主要趋势

- 石油和天然气

- 化学

- 流程自动化

- 製造业

- 其他的

第七章:市场规模及预测:依地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Belden

- CommScope

- Elsewedy Electric

- Fujikura

- Furukawa Electric

- Helukabel

- Hellenic Group

- Kabelwerk Eupen

- Lapp Group

- Leoni

- LS Cable & Systems

- Nexans

- NKT

- Polycab

- Prysmian Group

- Shawcor

- Sumitomo

- Technikabel

- TFKable

The Global TC Instrumentation Cable Market reached USD 1.7 billion in 2024 and is projected to expand at a CAGR of 7.9% from 2025 to 2034. This growth is largely fueled by the increasing adoption of industrial automation and process control systems across various sectors. Businesses are investing heavily in sophisticated instrumentation technologies to enhance operational efficiency, optimize energy usage, and ensure safety in critical applications. The demand for these cables is rising as industries increasingly rely on precise temperature monitoring and secure signal transmission. Additionally, the transition to renewable energy sources and the modernization of existing energy infrastructure are creating new opportunities for TC instrumentation cables. The ongoing expansion of smart infrastructure and the integration of digital monitoring systems further contribute to market growth as companies seek reliable solutions for real-time data acquisition and transmission. Advanced materials such as fluoropolymers and high-temperature-resistant coatings are improving cable durability, making them more suitable for complex industrial environments. As industrialization continues to accelerate in Asia-Pacific and the Middle East, the demand for high-performance instrumentation cables is expected to grow significantly.

TC instrumentation cables with copper conductors are projected to reach over USD 2.7 billion by 2034. Copper's superior electrical conductivity, durability, and resistance to corrosion make it the preferred choice in industries requiring stable signal transmission and efficient temperature monitoring. These cables are widely utilized in environments that demand exceptional performance under high temperatures and complex conditions. The mining sector is anticipated to register a CAGR exceeding 11.6% during the forecast period. The rising need for real-time temperature regulation and accurate monitoring in extreme operational settings is a key factor driving segment expansion. Chemical processing industries, in particular, rely on precision monitoring instruments to maintain product quality, safety, and efficiency in high-temperature and hazardous environments. TC instrumentation cables play a critical role in ensuring reliable connections between control circuits and measurement devices in industrial systems where performance accuracy is paramount.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 7.9% |

U.S. TC instrumentation cable market is expected to exceed USD 500 million by 2034, primarily due to rising automation requirements in industrial sectors. The growing demand for temperature control technologies and real-time data relay systems is accelerating the adoption of these cables across multiple industries. As businesses upgrade to advanced monitoring solutions, the need for dependable instrumentation cables continues to grow. Additionally, the global shift towards renewable energy and the increasing development of smart infrastructure are further contributing to market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Conductor, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Nickel alloys

- 5.4 Others

Chapter 6 Market Size and Forecast, By End User, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 6.1 Key trends

- 6.2 Oil & gas

- 6.3 Chemical

- 6.4 Process automation

- 6.5 Manufacturing

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Belden

- 8.2 CommScope

- 8.3 Elsewedy Electric

- 8.4 Fujikura

- 8.5 Furukawa Electric

- 8.6 Helukabel

- 8.7 Hellenic Group

- 8.8 Kabelwerk Eupen

- 8.9 Lapp Group

- 8.10 Leoni

- 8.11 LS Cable & Systems

- 8.12 Nexans

- 8.13 NKT

- 8.14 Polycab

- 8.15 Prysmian Group

- 8.16 Shawcor

- 8.17 Sumitomo

- 8.18 Technikabel

- 8.19 TFKable