|

市场调查报告书

商品编码

1698252

汽车热交换器市场机会、成长动力、产业趋势分析及 2025-2034 年预测Automotive Heat Exchanger Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

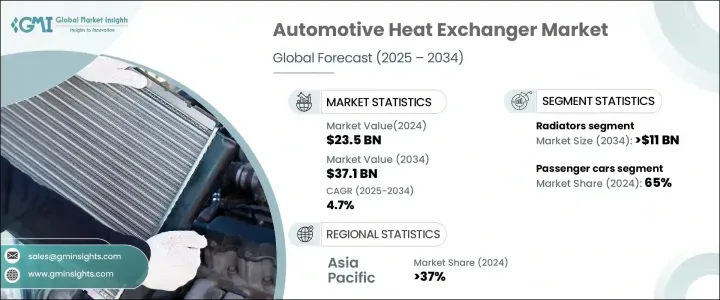

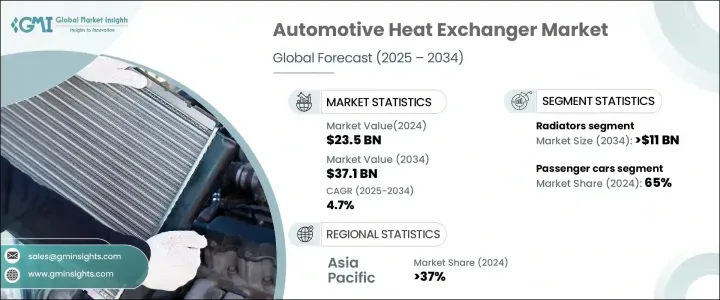

2024 年全球汽车热交换器市场价值为 235 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.7%。全球范围内电动车 (EV) 的日益普及和严格的排放法规正在推动对高效热管理解决方案的需求。随着充电基础设施的改善和零件成本的下降,电动车的普及率正在上升,对热管理系统的需求也随之增加。广泛应用于电动车的锂离子电池需要在 15°C 至 35°C 范围内稳定控制温度,以确保电池的使用寿命和性能。热交换器有助于维持最佳电池状态,防止过热并延长电池寿命。混合动力汽车也依靠这些系统来调节内燃机和电动马达的温度,确保高效运作。

美国、英国和中国等各国政府都在实施更严格的排放政策,促使汽车製造商开发先进的热管理解决方案。正在采用废气再循环 (EGR) 系统等技术来减少氮氧化物排放并提高燃油效率。对永续性的日益重视进一步加速了热管理的创新,使热交换器成为现代车辆的关键部件。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 235亿美元 |

| 预测值 | 371亿美元 |

| 复合年增长率 | 4.7% |

汽车热交换器市场按产品分类,其中散热器占据领先地位,2024 年市场份额超过 30%,预计到 2034 年将超过 110 亿美元。散热器对于引擎冷却、防止过热和优化燃油效率至关重要,尤其是在内燃机 (ICE) 汽车中。儘管替代燃料不断涌现,但由于成本和易获得性,汽油和柴油车辆仍然占据主导地位,这加强了对高效冷却系统的需求。

按车型划分,乘用车由于其广泛使用,到 2024 年将占据 65% 的市场份额。热交换器对于确保这些车辆的安全性、舒适性和运作效率至关重要。汽车需求的不断增长推动了中等辐射热管理系统的采用,该系统包括散热器、油冷却器和冷凝器,以保持引擎的性能和寿命。

政府遏制排放的措施正在推动热管理解决方案的进步。美国约 31% 的二氧化碳排放来自车辆,凸显了更严格的监管和技术改进的必要性。增强型热交换器系统越来越多地整合到车辆中以满足不断发展的标准,从而进一步推动市场成长。

从材料角度来看,铝凭藉其成本效益、重量轻和高导热性,将在 2024 年占据市场主导地位。汽车行业正在转向更轻的材料,以提高燃油效率和车辆性能,而铝因其耐用性和耐腐蚀性而成为首选。这延长了组件的使用寿命,降低了製造商和消费者的长期成本。

在销售通路方面,原始设备製造商 (OEM) 在 2024 年占据了相当大的份额。汽车製造商与热交换器製造商密切合作,开发适合车辆规格的标准和客製化组件。电动车和混合动力汽车市场的不断增长促进了原始设备製造商和热交换器供应商之间的合作,从而简化了生产和整合流程。

2024 年,亚太地区占据汽车热交换器市场的 37% 份额,占据主导地位。中国仍占主导地位,预计到 2034 年将达到 30 亿美元。该地区强大的汽车製造基础,加上较低的生产和劳动力成本,吸引了全球汽车製造商,推动了对热交换器零件的高需求。此外,由于该地区汽车保有量高,这些零件的售后市场蓬勃发展,导致更换需求持续成长。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 热交换器製造商

- 经销商

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 价格趋势

- 监管格局

- 衝击力

- 成长动力

- 电动和混合动力汽车的成长

- 严格的排放和燃油效率法规

- 热交换器材料的进步

- 汽车产量和需求不断增加

- 产业陷阱与挑战

- 材料和製造成本高

- 热管理系统的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 散热器

- 中冷器

- 油冷却器

- 废气再循环(EGR)

- 其他的

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 越野车

- 掀背车

- 商用车

- 轻型商用车

- 丙型肝炎病毒

- 越野车

第七章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 铝

- 铜

- 其他的

第八章:市场估计与预测:依设计,2021 - 2034 年

- 主要趋势

- 板棒

- 管翅片

- 其他的

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Ahaus Tool & Engineering

- AKG Group

- American Industrial Heat Transfer

- Banco Products

- Denso

- G&M Radiator

- Hanon Systems

- HAUGG Group

- Koyorad

- Mahle

- Modine Manufacturing

- Nippon Light Metals

- Nissens

- SM Auto Engineering

- Sanden

- Senior

- Spectra Premium

- T.RAD Co.

- Tokyo Radiator

- Valeo

The Global Automotive Heat Exchanger Market was valued at USD 23.5 billion in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2034. The increasing adoption of electric vehicles (EVs) and stringent emission regulations worldwide are driving demand for efficient heat management solutions. With improvements in charging infrastructure and declining component costs, EV adoption is rising, leading to a greater need for thermal management systems. Lithium-ion batteries, widely used in EVs, require stable temperature control within 15°C to 35°C to ensure longevity and performance. Heat exchangers help maintain optimal battery conditions, preventing overheating and extending battery life. Hybrid vehicles also rely on these systems to regulate temperatures for both internal combustion engines and electric motors, ensuring efficient operation.

Governments in various countries, including the US, UK, and China, are enforcing stricter emissions policies, prompting automakers to develop advanced heat management solutions. Technologies like exhaust gas recirculation (EGR) systems are being incorporated to reduce nitrogen oxide emissions and enhance fuel efficiency. The growing emphasis on sustainability has further accelerated innovations in thermal management, making heat exchangers a crucial component in modern vehicles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.5 Billion |

| Forecast Value | $37.1 Billion |

| CAGR | 4.7% |

The automotive heat exchanger market is categorized by product, with radiators leading at over 30% market share in 2024 and expected to surpass USD 11 billion by 2034. Radiators are essential for engine cooling, preventing overheating, and optimizing fuel efficiency, particularly in internal combustion engine (ICE) vehicles. Despite the rise of alternative fuels, gasoline and diesel vehicles remain prevalent due to cost and accessibility, reinforcing the demand for efficient cooling systems.

By vehicle type, passenger cars accounted for 65% of the market share in 2024, driven by their widespread usage. Heat exchangers are critical in these vehicles for ensuring safety, comfort, and operational efficiency. The increasing demand for automobiles is fueling the adoption of moderate radiation heat management systems that include radiators, oil coolers, and condensers to maintain engine performance and longevity.

Government initiatives to curb emissions are leading to advancements in thermal management solutions. Approximately 31% of CO2 emissions in the US originate from vehicles, emphasizing the need for stricter regulations and technological enhancements. Enhanced heat exchanger systems are increasingly integrated into vehicles to meet these evolving standards, further propelling market growth.

Material-wise, aluminum dominated the market in 2024, attributed to its cost-effectiveness, lightweight nature, and high thermal conductivity. The automotive industry is shifting towards more lightweight materials to improve fuel efficiency and vehicle performance, with aluminum emerging as the preferred choice due to its durability and resistance to corrosion. This extends component lifespan, reducing long-term costs for manufacturers and consumers.

In terms of sales channels, original equipment manufacturers (OEMs) held a significant share in 2024. Automakers collaborate closely with heat exchanger manufacturers to develop standard and custom components tailored to vehicle specifications. The growing EV and hybrid vehicle market has led to increased partnerships between OEMs and heat exchanger suppliers, streamlining production and integration processes.

Asia Pacific led the automotive heat exchanger market with a 37% share in 2024. China remains the dominant player, projected to reach USD 3 billion by 2034. The region's strong automobile manufacturing base, combined with lower production and labor costs, has attracted global automakers, driving high demand for heat exchanger components. Additionally, the aftermarket for these components is thriving due to the region's high vehicle population, leading to consistent replacement demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Heat exchanger manufacturers

- 3.2.3 Distributors

- 3.2.4 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Price trend

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growth of electric and hybrid vehicles

- 3.9.1.2 Stringent emissions and fuel efficiency regulations

- 3.9.1.3 Advancements in heat exchanger material

- 3.9.1.4 Increasing vehicle production and demand

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High material and manufacturing costs

- 3.9.2.2 Complexity of thermal management systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Radiators

- 5.3 Intercoolers

- 5.4 Oil coolers

- 5.5 Exhaust gas recirculation (EGR)

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial vehicle

- 6.3.1 LCV

- 6.3.2 HCV

- 6.4 Off highway vehicle

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Aluminum

- 7.3 Copper

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Design, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Plate bar

- 8.3 Tube fin

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Ahaus Tool & Engineering

- 11.2 AKG Group

- 11.3 American Industrial Heat Transfer

- 11.4 Banco Products

- 11.5 Denso

- 11.6 G&M Radiator

- 11.7 Hanon Systems

- 11.8 HAUGG Group

- 11.9 Koyorad

- 11.10 Mahle

- 11.11 Modine Manufacturing

- 11.12 Nippon Light Metals

- 11.13 Nissens

- 11.14 S.M. Auto Engineering

- 11.15 Sanden

- 11.16 Senior

- 11.17 Spectra Premium

- 11.18 T.RAD Co.

- 11.19 Tokyo Radiator

- 11.20 Valeo