|

市场调查报告书

商品编码

1698264

智慧家庭安全摄影机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Smart Home Security Camera Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

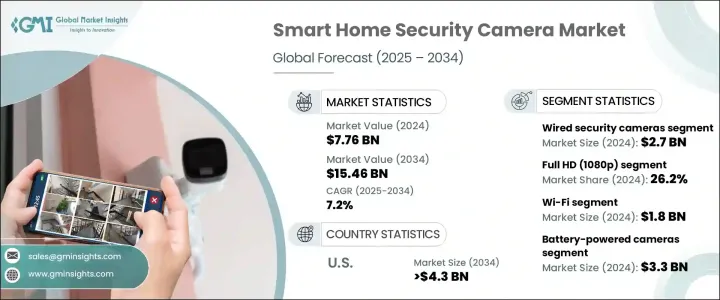

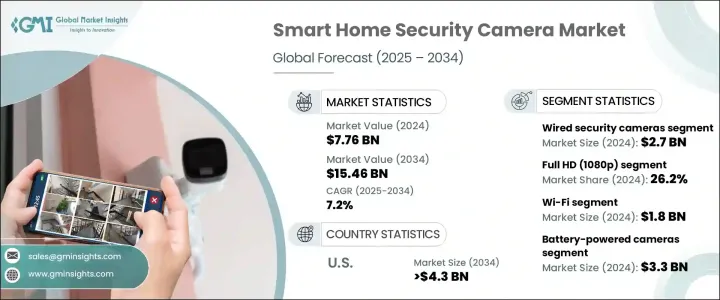

2024 年全球智慧家庭安全摄影机市场价值为 77.6 亿美元,预计 2025 年至 2034 年的复合年增长率为 7.2%。市场扩张主要受到智慧家庭设备日益普及和安全问题日益加剧的推动。智慧摄影机、锁和运动感测器正变得越来越重要,它们使用户能够远端监控他们的家,同时与家庭自动化系统无缝整合。 5G网路和物联网技术的广泛应用,显着提升了智慧安防系统的效能。此外,智慧型手机和语音助理用户数量的不断增长继续支持市场成长,使安全解决方案能够无缝运作。日益严重的安全威胁进一步刺激了对具有高清摄影机、云端储存和基于人工智慧的威胁侦测功能的先进监控解决方案的需求。

市场分为有线和无线安全摄影机。 2024 年,有线安全摄影机的估值为 27 亿美元。它们的受欢迎程度源于增强的可靠性、最佳的电源供应和卓越的视讯品质。此外,乙太网路供电 (PoE) 技术简化了多个安全设备的安装。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 77.6亿美元 |

| 预测值 | 154.6亿美元 |

| 复合年增长率 | 7.2% |

按分辨率,市场包括高清 (720p)、全高清 (1080p)、2K 和 4K 以上摄影机。 2024 年,全高清 (1080p) 摄影机占据了 26.2% 的市场。由于其可靠的连接性以及与网路录影机和集中监控系统的兼容性,它们被广泛应用于大型物业和商业场所。

市场还根据连接选项进行分类,包括 Wi-Fi、蓝牙和 ZigBee。 2024 年,支援 Wi-Fi 的安全摄影机以 18 亿美元的市场规模领先。其日益普及的原因是安装简单、与家庭网路的无缝整合以及远端存取。网状和双频 Wi-Fi 技术的发展提高了可靠性,同时减少了连线问题和延迟。

就电源而言,市场包括电池供电、插入式和太阳能供电的相机。电池供电的摄影机占据了主导地位,2024 年的估值为 33 亿美元。由于太阳能充电、人工智慧驱动的能源管理和锂离子电池技术的进步,室内和室外使用对电池供电摄影机的需求都在不断增长。人们对便携式、DIY 型安全解决方案的日益青睐继续推动其采用。

在应用方面,室内安全正在经历快速成长,预计复合年增长率为 10.4%。消费者和企业都越来越多地投资室内监控解决方案,特别是婴儿和宠物监控以及老年人照护。人工智慧运动侦测、脸部辨识和云端储存进一步增强了这些安全解决方案的吸引力。

配销通路部分包括线上销售、超市、大卖场、专卖店和电子产品零售商。 2024 年,线上销售将成为主导市场,创造 30 亿美元的销售额。人们对电子商务日益增长的偏好是由有竞争力的定价、产品多样性和便利的价格比较所推动的。

由于犯罪率上升和对智慧安全解决方案的需求增加,预计到 2034 年美国市场规模将超过 43 亿美元。安全系统与家庭自动化和保险激励措施的结合进一步支持了市场扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 智慧家庭设备的普及率不断提高

- 安全担忧加剧

- 技术进步

- 改进的连接性和即时监控

- DIY 安装,经济实惠

- 产业陷阱与挑战

- 高昂的初始成本和订阅费用

- 网路连线受限和频宽问题

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 有线安全摄影机

- 无线安全摄影机

第六章:市场估计与预测:依决议,2021 年至 2034 年

- 主要趋势

- 高清(720p)

- 全高清 (1080p)

- 2K

- 4K 以上

第七章:市场估计与预测:依连结性,2021 年至 2034 年

- 主要趋势

- 无线上网

- 蓝牙

- Zigbee

- 其他的

第八章:市场估计与预测:按电源,2021 年至 2034 年

- 主要趋势

- 电池供电相机

- 插入式电源摄影机

- 太阳能摄影机

第九章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 室内安防

- 户外安全

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 网上销售

- 电子商务平台

- 品牌网站

- 超市/大卖场

- 专卖店

- 电子产品商店

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳新银行

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十二章:公司简介

- Abode Systems, Inc.

- ADT Inc.

- Arlo Technologies, Inc.

- Blink

- Canary Connect, Inc.

- D-Link Corporation

- Ecobee

- Eufy

- Frontpoint Security Solutions, LLC

- Google Nest

- Hikvision Digital Technology

- Lorex

- Reolink

- Ring

- Samsung Electronics Co., Ltd.

- SimpliSafe

- Synology

- TP-Link

- Ubiquiti Inc.

- Vivint Smart Home

- Wyze Labs, Inc.

- Xiaomi Inc.

- YI Technology

- Zmodo

The Global Smart Home Security Camera Market was valued at USD 7.76 billion in 2024 and is projected to grow at a CAGR of 7.2% from 2025 to 2034. Market expansion is largely driven by the increasing adoption of smart home devices and heightened security concerns. Smart cameras, locks, and motion sensors are becoming essential, allowing users to monitor their homes remotely while seamlessly integrating with home automation systems. The widespread adoption of 5G networks and IoT technology has significantly enhanced the performance of smart security systems. Moreover, the growing number of smartphone and voice assistant users continues to support market growth, enabling seamless operation of security solutions. Rising security threats have further fueled the need for advanced surveillance solutions featuring high-definition cameras, cloud storage, and AI-based threat detection.

The market is divided into wired and wireless security cameras. In 2024, wired security cameras held a valuation of USD 2.7 billion. Their popularity stems from enhanced reliability, optimal power supply, and superior video quality. Additionally, Power over Ethernet (PoE) technology has simplified the installation of multiple security devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.76 Billion |

| Forecast Value | $15.46 Billion |

| CAGR | 7.2% |

By resolution, the market includes HD (720p), Full HD (1080p), 2K, and 4K & above cameras. Full HD (1080p) cameras accounted for 26.2% of the market share in 2024. They are widely used in large properties and commercial settings due to their reliable connectivity and compatibility with network video recorders and centralized monitoring systems.

The market is also categorized by connectivity options, including Wi-Fi, Bluetooth, and ZigBee. Wi-Fi-enabled security cameras led the market with USD 1.8 billion in 2024. Their increasing adoption is attributed to easy installation, seamless integration with home networks, and remote access. The development of mesh and dual-band Wi-Fi technology has improved reliability while reducing connectivity issues and lag.

Regarding power sources, the market consists of battery-powered, plug-in, and solar-powered cameras. Battery-powered cameras dominated the segment with a valuation of USD 3.3 billion in 2024. Their demand is rising for both indoor and outdoor use due to advancements in solar charging, AI-driven energy management, and lithium-ion battery technology. The increasing preference for portable, DIY-friendly security solutions continues to drive adoption.

In terms of application, indoor security is witnessing rapid growth, with a projected CAGR of 10.4%. Consumers and businesses alike are increasingly investing in indoor surveillance solutions, particularly for baby and pet monitoring, as well as elderly care. AI-powered motion detection, facial recognition, and cloud storage further enhance the appeal of these security solutions.

The distribution channel segment includes online sales, supermarkets, hypermarkets, specialty stores, and electronics retailers. Online sales emerged as the dominant segment in 2024, generating USD 3 billion. The growing preference for e-commerce is driven by competitive pricing, product variety, and convenient price comparisons.

The U.S. market is expected to exceed USD 4.3 billion by 2034, fueled by rising crime rates and increased demand for smart security solutions. The integration of security systems with home automation and insurance incentives is further supporting market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of smart home devices

- 3.2.1.2 Rising security concerns

- 3.2.1.3 Technological advancements

- 3.2.1.4 Improved connectivity and real-time monitoring

- 3.2.1.5 DIY installation and cost-effectiveness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial cost and subscription fees

- 3.2.2.2 Limited internet connectivity and bandwidth issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Mn)

- 5.1 Key trends

- 5.2 Wired security cameras

- 5.3 Wireless security cameras

Chapter 6 Market Estimates and Forecast, By Resolution, 2021 – 2034 (USD Mn)

- 6.1 Key trends

- 6.2 HD (720p)

- 6.3 Full HD (1080p)

- 6.4 2K

- 6.5 4K & Above

Chapter 7 Market Estimates and Forecast, By Connectivity, 2021 – 2034 (USD Mn)

- 7.1 Key trends

- 7.2 Wi-Fi

- 7.3 Bluetooth

- 7.4 Zigbee

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Power Source, 2021 – 2034 (USD Mn)

- 8.1 Key trends

- 8.2 Battery-powered cameras

- 8.3 Plug-in power cameras

- 8.4 Solar-powered cameras

Chapter 9 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Mn)

- 9.1 Key trends

- 9.2 Indoor security

- 9.3 Outdoor security

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Mn)

- 10.1 Key trends

- 10.2 Online sales

- 10.2.1 E-commerce platforms

- 10.2.2 Brand websites

- 10.3 Supermarkets/Hypermarkets

- 10.4 Specialty stores

- 10.5 Electronics stores

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 Middle East and Africa

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Abode Systems, Inc.

- 12.2 ADT Inc.

- 12.3 Arlo Technologies, Inc.

- 12.4 Blink

- 12.5 Canary Connect, Inc.

- 12.6 D-Link Corporation

- 12.7 Ecobee

- 12.8 Eufy

- 12.9 Frontpoint Security Solutions, LLC

- 12.10 Google Nest

- 12.11 Hikvision Digital Technology

- 12.12 Lorex

- 12.13 Reolink

- 12.14 Ring

- 12.15 Samsung Electronics Co., Ltd.

- 12.16 SimpliSafe

- 12.17 Synology

- 12.18 TP-Link

- 12.19 Ubiquiti Inc.

- 12.20 Vivint Smart Home

- 12.21 Wyze Labs, Inc.

- 12.22 Xiaomi Inc.

- 12.23 YI Technology

- 12.24 Zmodo