|

市场调查报告书

商品编码

1698266

医疗保健生物融合市场机会、成长动力、产业趋势分析及 2025-2034 年预测Healthcare Bioconvergence Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

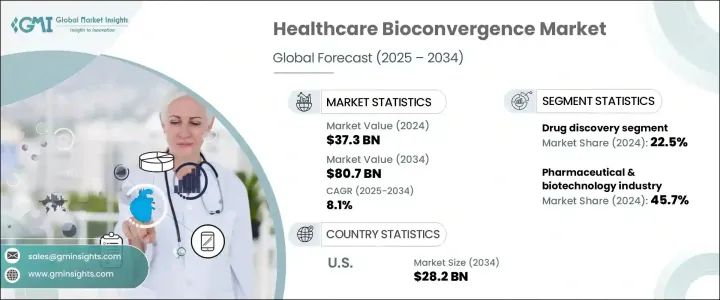

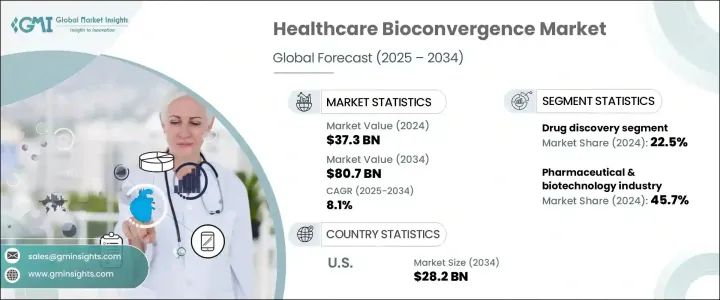

2024 年全球医疗保健生物融合市场规模达到 373 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 8.1%。这个快速发展的市场正在透过整合电脑科学、人工智慧 (AI)、工程和生物技术等尖端技术重新定义医疗保健的未来。透过弥合生命科学和技术之间的差距,生物融合正在加速医学研究、诊断和治疗个人化方面的创新。

由于慢性病盛行率上升、人口老化和治疗成本不断上涨,全球医疗保健系统面临越来越大的压力,对先进的数据驱动解决方案的需求正在激增。个人化医疗、再生疗法和人工智慧诊断的推动进一步推动了该领域的投资,使生物融合成为现代医疗保健的重要支柱。此外,大型製药和生技公司正在与科技驱动的新创公司合作开发突破性的解决方案,从而形成日益激烈的竞争格局。生物电子学、光遗传学和奈米机器人技术的日益普及将改变医疗保健,改善患者的治疗效果并优化医疗干预。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 373亿美元 |

| 预测值 | 807亿美元 |

| 复合年增长率 | 8.1% |

市场细分为各种应用,包括药物发现、药物传输奈米机器人、再生医学和精准医疗等。 2024 年,药物研发将占据最大份额,达到 22.5%,这得益于全球医疗成本的上涨、慢性病盛行率的上升以及关键药物专利的到期。製药公司正在迅速整合人工智慧工具,以加强药物发现、缩短研究时间并降低成本。由于奈米机器人能够改善标靶药物输送并最大限度地减少不良影响,预计其药物输送将在整个预测期内经历最快的成长。其他创新应用,如生物电子学和光遗传学,也正在获得发展势头,为神经治疗、视力恢復和慢性病管理开闢了新的可能性。

2024 年,製药和生技公司占据医疗保健生物融合市场的 45.7%,巩固了其作为领先终端用户的地位。这些行业在推进研究计划、确保资金和影响医疗保健决策方面发挥着至关重要的作用。製药巨头正在利用生物融合来提高营运效率、简化临床试验并开发下一代疗法。许多公司也透过利用健康数据扩大研究或转售来创造额外收入,从而实现健康资料的货币化。除了製药和生物技术公司外,合约研究组织 (CRO) 和医疗保健提供者也在为市场扩张做出贡献,医院和研究机构采用人工智慧驱动的生物融合平台来推动精准医疗的进步。

美国医疗保健生物融合市场在 2024 年创造了 142 亿美元的产值,预计到 2034 年将达到 282 亿美元,这得益于对人工智慧诊断技术的持续投资。领先的医院、研究中心和生物技术公司越来越多地采用人工智慧驱动的平台来分析遗传、环境和生活方式资料,制定高度客製化的治疗策略。随着数位健康解决方案、预测分析和人工智慧辅助临床决策的日益融合,美国仍然处于医疗保健生物融合创新的前沿,确保了长期的市场成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 提高对个人化治疗的认识

- 新治疗领域的新兴应用

- 製药生物技术领域研发支出不断成长

- 机器人技术在医疗保健产业的动态应用

- 产业陷阱与挑战

- 缺乏个人化治疗的长期资料

- 对精准医疗、再生医学和药物研发的严格监管

- 成长动力

- 成长潜力分析

- 技术格局

- 监管格局

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按应用,2021 年至 2032 年

- 主要趋势

- 药物研发

- 用于药物输送的奈米机器人

- 再生医学

- 诊断和生物感测器

- 生物电子学

- 工程生物材料

- 光遗传学

- 精准医疗

- 其他应用

第六章:市场估计与预测:依最终用途,2021 年至 2032 年

- 製药和生物技术产业

- 合约研究组织(CRO)

- 其他最终用途

第七章:市场估计与预测:按地区,2021 年至 2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Anima Biotech

- BICO - The Bio Convergence Company

- BioConvergent Health

- Biomx

- Century Therapeutics

- Cytena

- Galvani Bioelectronics

- GE Healthcare

- Ginkgo Bioworks

- Merck

- Pangea Biomed

- Setpoint Medical Corporation

- Singota Solution

- Thermo Fisher Scientific

- Zymergen

The Global Healthcare Bioconvergence Market reached USD 37.3 billion in 2024 and is expected to grow at a CAGR of 8.1% between 2025 and 2034. This rapidly evolving market is redefining the future of healthcare by integrating cutting-edge technologies such as computer science, artificial intelligence (AI), engineering, and biotechnology. By bridging the gap between life sciences and technology, bioconvergence is accelerating innovations in medical research, diagnostics, and treatment personalization.

As healthcare systems worldwide face increasing pressure due to rising chronic disease prevalence, aging populations, and escalating treatment costs, the demand for advanced, data-driven solutions is surging. The push for personalized medicine, regenerative therapies, and AI-driven diagnostics is further driving investments in this sector, making bioconvergence a key pillar of modern healthcare. Additionally, major pharmaceutical and biotechnology firms are collaborating with tech-driven startups to develop groundbreaking solutions, creating an increasingly competitive landscape. The growing adoption of bioelectronics, optogenetics, and nanorobotics is set to transform healthcare, enhancing patient outcomes and optimizing medical interventions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.3 Billion |

| Forecast Value | $80.7 Billion |

| CAGR | 8.1% |

The market is segmented into various applications, including drug discovery, nanorobotics for drug delivery, regenerative medicine, and precision medicine, among others. In 2024, drug discovery held the largest share at 22.5%, fueled by increasing global healthcare costs, the rising prevalence of chronic illnesses, and the expiration of key drug patents. Pharmaceutical companies are rapidly integrating AI-powered tools to enhance drug discovery, reduce research timelines, and cut costs. Nanorobotics for drug delivery is anticipated to experience the fastest growth throughout the forecast period, given its ability to improve targeted drug delivery and minimize adverse effects. Other innovative applications, such as bioelectronics and optogenetics, are also gaining momentum, unlocking new possibilities in neurological treatments, vision restoration, and chronic disease management.

Pharmaceutical and biotechnology companies accounted for 45.7% of the healthcare bioconvergence market in 2024, solidifying their position as the leading end-users. These industries play a crucial role in advancing research initiatives, securing funding, and influencing healthcare decision-making. Pharma giants are leveraging bioconvergence to improve operational efficiencies, streamline clinical trials, and develop next-generation therapies. Many companies are also monetizing health data by utilizing it for research expansion or reselling it to generate additional revenue. Alongside pharmaceutical and biotech firms, contract research organizations (CROs) and healthcare providers are also contributing to market expansion, with hospitals and research institutions adopting AI-powered bioconvergent platforms to drive precision medicine advancements.

The U.S. Healthcare Bioconvergence Market generated USD 14.2 billion in 2024 and is projected to reach USD 28.2 billion by 2034, driven by continuous investments in AI-powered diagnostic technologies. Leading hospitals, research centers, and biotech firms are increasingly adopting AI-driven platforms to analyze genetic, environmental, and lifestyle data, creating highly customized treatment strategies. With the rising integration of digital health solutions, predictive analytics, and AI-assisted clinical decision-making, the U.S. remains at the forefront of healthcare bioconvergence innovation, ensuring long-term market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing awareness towards personalized treatment

- 3.2.1.2 Emerging applications in new therapeutic areas

- 3.2.1.3 Growing R&D expenditure in pharma-biotech sector

- 3.2.1.4 Dynamic adoption of robotics in healthcare industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of long-term data for personalized treatments

- 3.2.2.2 Stringent regulations towards precision medicine, regenerative medicines and drug discovery

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technological landscape

- 3.5 Regulatory landscape

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Drug discovery

- 5.3 Nanorobotics for drug delivery

- 5.4 Regenerative medicine

- 5.5 Diagnostic and biological sensors

- 5.6 Bioelectronics

- 5.7 Engineered living materials

- 5.8 Optogenetics

- 5.9 Precision medicine

- 5.10 Other applications

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Bn)

- 6.1 Pharmaceutical & biotechnology industry

- 6.2 Contract research organization (CRO)

- 6.3 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Bn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Anima Biotech

- 8.2 BICO - The Bio Convergence Company

- 8.3 BioConvergent Health

- 8.4 Biomx

- 8.5 Century Therapeutics

- 8.6 Cytena

- 8.7 Galvani Bioelectronics

- 8.8 GE Healthcare

- 8.9 Ginkgo Bioworks

- 8.10 Merck

- 8.11 Pangea Biomed

- 8.12 Setpoint Medical Corporation

- 8.13 Singota Solution

- 8.14 Thermo Fisher Scientific

- 8.15 Zymergen