|

市场调查报告书

商品编码

1698280

肠促胰岛素药物市场机会、成长动力、产业趋势分析及 2025-2034 年预测Incretin-based Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

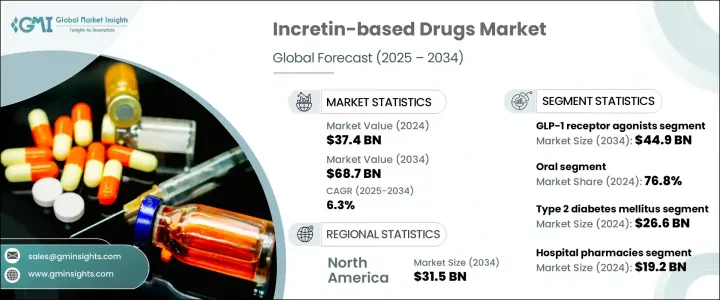

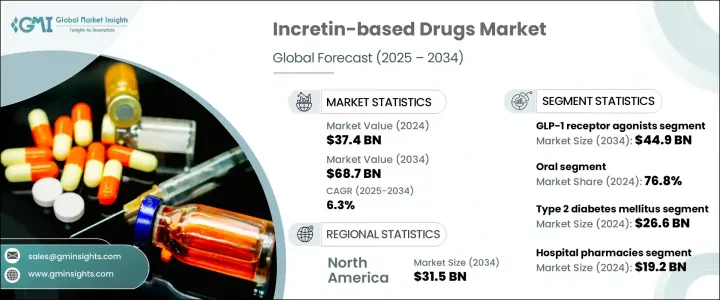

2024 年全球肠促胰岛素药物市值为 374 亿美元,预计 2025 年至 2034 年的复合年增长率为 6.3%。肠促胰岛素药物透过刺激肠道荷尔蒙分泌胰岛素来帮助控制第 2 型糖尿病,进而调节餐后血糖值。糖尿病盛行率不断上升,主要是由于肥胖、人口老化和久坐不动的生活方式,这是推动市场扩张的关键因素。患者意识的提高、药物配方的进步以及糖尿病治疗的可及性的提高进一步支持了这一增长。

市场按药物类型分为 GLP-1 受体激动剂和 DPP-4 抑制剂,2023 年市场规模为 355 亿美元。 GLP-1 受体激动剂的需求不断增长,是因为它们能够增强胰岛素分泌、抑制胰高血糖素水平,从而有效控制血糖。这些药物还可以透过控制食慾和减缓消化来促进减肥,因此成为糖尿病患者的首选。缓释製剂(例如每週注射一次)可提高患者的依从性并扩大市场范围。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 374亿美元 |

| 预测值 | 687亿美元 |

| 复合年增长率 | 6.3% |

根据给药途径,市场也分为口服药物和注射药物。 2024 年口服药物市场规模将达到 287 亿美元,市占率为 76.8%。口服製剂提供了一种比注射更方便的替代方法,从而提高了患者的依从性。持续的研究努力提高了疗效和安全性,使得口服药物越来越受欢迎。这些配方易于分发、储存和管理,减轻了医疗保健提供者的负担,并提高了各个医疗保健机构的可近性。

根据适应症,市场包括第 2 型糖尿病、肥胖症和体重管理以及其他代谢紊乱。 2 型糖尿病领域占最大份额,2024 年创造收入 266 亿美元。由于不良的饮食习惯和生活方式因素,全球 2 型糖尿病发生率不断上升,刺激了对肠促胰岛素类药物的需求。这些药物有效降低血糖水平,同时降低低血糖的风险,为老年族群和血糖波动较大的人提供更安全的治疗选择。

配销通路部分包括医院药房、零售药房和电子商务。医院药局在 2024 年以 192 亿美元的收入领先市场。这些设定确保了安全获得药物,特别是对于新诊断的患者或需要专门护理的患者。药师提供有关剂量、副作用和配方差异的指导,增强治疗顺从性。全面的支援服务(包括药物管理计划和密切监测治疗反应)进一步促进了市场成长。

北美占据市场主导地位,2024 年市场规模将达 171 亿美元,其中美国市场规模最高,为 155 亿美元。糖尿病、心血管疾病和肥胖症的盛行率不断上升,持续推动对肠促胰岛素类药物的需求。支持性的监管框架和药物开发的快速进步促进了该地区市场的扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 2型糖尿病盛行率上升

- 转向非胰岛素疗法

- 药物传输技术的进步

- 心血管和体重管理益处

- 产业陷阱与挑战

- 治疗费用高

- 不良反应和禁忌症

- 成长动力

- 成长潜力分析

- 监管格局

- 差距分析

- 管道分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按药物类型,2021 年至 2034 年

- 主要趋势

- GLP-1受体激动剂

- DPP-4抑制剂

第六章:市场估计与预测:依管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 注射剂

第七章:市场估计与预测:按适应症,2021 年至 2034 年

- 主要趋势

- 2型糖尿病

- 肥胖和体重管理

- 其他代谢紊乱

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 电子商务

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AstraZeneca

- Boehringer Ingelheim

- Eli Lilly and Company

- GlaxoSmithKline

- Lupin Limited

- Merck

- Novo Nordisk

- Pfizer

- Sanofi

- Takeda Pharmaceutical Company

- Viatris

The Global Incretin-Based Drugs Market was valued at USD 37.4 billion in 2024 and is predicted to grow at a CAGR of 6.3% from 2025 to 2034. Incretin-based drugs help manage type 2 diabetes by stimulating insulin secretion through gut hormones, which regulate blood sugar levels after meals. The growing prevalence of diabetes, primarily due to obesity, aging populations, and sedentary lifestyles, is a key factor driving market expansion. Increasing patient awareness, advancements in drug formulations, and improved accessibility to diabetes treatments further support this growth.

The market is categorized by drug type into GLP-1 receptor agonists and DPP-4 inhibitors, with a market size of USD 35.5 billion in 2023. The rising demand for GLP-1 receptor agonists is driven by their ability to enhance insulin secretion and suppress glucagon levels, effectively managing blood sugar. These drugs also promote weight loss by controlling appetite and slowing digestion, making them a preferred option for diabetes patients. Extended-release formulations, such as once-weekly injections, improve patient adherence and expand market reach.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.4 Billion |

| Forecast Value | $68.7 Billion |

| CAGR | 6.3% |

The market is also segmented by the route of administration into oral and injectable drugs. The oral segment accounted for USD 28.7 billion in 2024, with a market share of 76.8%. Oral formulations offer a convenient alternative to injections, leading to higher patient compliance. Continuous research efforts have led to improved efficacy and safety profiles, making oral medications increasingly preferred. These formulations are easy to distribute, store, and administer, reducing the burden on healthcare providers and enhancing accessibility across various healthcare settings.

By indication, the market includes type 2 diabetes mellitus, obesity and weight management, and other metabolic disorders. The type 2 diabetes mellitus segment held the largest share, generating USD 26.6 billion in revenue in 2024. The rising global incidence of type 2 diabetes, attributed to poor dietary habits and lifestyle factors, fuels the demand for incretin-based drugs. These medications effectively lower blood sugar levels while reducing the risk of hypoglycemia, offering a safer treatment option for aging populations and those prone to severe blood sugar fluctuations.

The distribution channel segment comprises hospital pharmacies, retail pharmacies, and e-commerce. Hospital pharmacies led the market with USD 19.2 billion in revenue in 2024. These settings ensure secure access to medications, particularly for newly diagnosed patients or those requiring specialized care. Pharmacists provide guidance on dosage, side effects, and formulation differences, enhancing treatment adherence. Comprehensive support services, including medication management programs and close monitoring of treatment responses, further contribute to market growth.

North America dominated the market, accounting for USD 17.1 billion in 2024, with the U.S. leading at USD 15.5 billion. The rising prevalence of diabetes, cardiovascular diseases, and obesity continues to drive demand for incretin-based drugs. Supportive regulatory frameworks and rapid advancements in drug development contribute to the region's market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of type 2 diabetes mellitus

- 3.2.1.2 Shift toward non-insulin therapies

- 3.2.1.3 Advancements in drug delivery technologies

- 3.2.1.4 Cardiovascular and weight management benefits

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs

- 3.2.2.2 Adverse effects and contraindications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Gap analysis

- 3.6 Pipeline analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 GLP-1 receptor agonists

- 5.3 DPP-4 inhibitors

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Injectable

Chapter 7 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Type 2 diabetes mellitus

- 7.3 Obesity and weight management

- 7.4 Other metabolic disorders

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AstraZeneca

- 10.2 Boehringer Ingelheim

- 10.3 Eli Lilly and Company

- 10.4 GlaxoSmithKline

- 10.5 Lupin Limited

- 10.6 Merck

- 10.7 Novo Nordisk

- 10.8 Pfizer

- 10.9 Sanofi

- 10.10 Takeda Pharmaceutical Company

- 10.11 Viatris