|

市场调查报告书

商品编码

1698281

电子药物市场机会、成长动力、产业趋势分析及 2025-2034 年预测Electroceuticals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

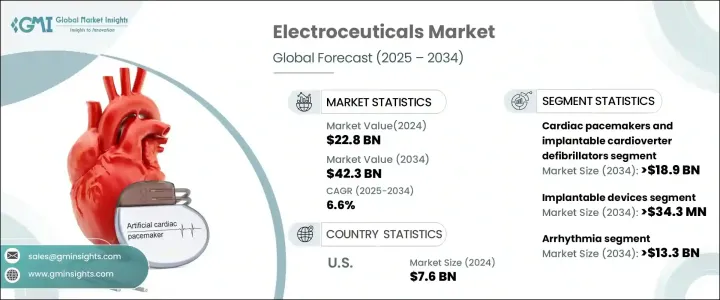

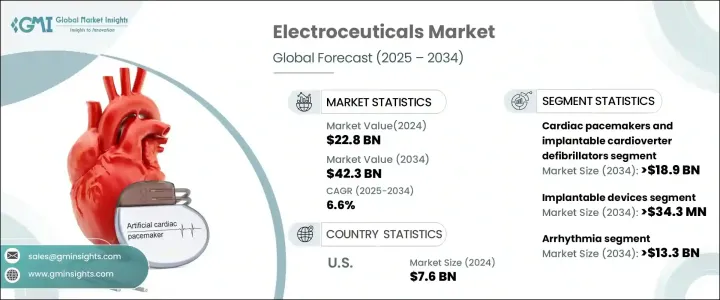

2024 年全球电子药物市场价值为 228 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.6%。受生物电子医学技术进步、慢性病盛行率上升以及对非药物治疗替代品的需求不断增长的推动,该市场正在显着扩张。电疗利用电刺激来治疗疾病,随着患者和医疗保健提供者寻求比传统药物更有效、微创且副作用更少的治疗方法,电疗正受到广泛关注。心血管疾病、神经系统疾病和疼痛管理挑战等慢性病负担日益加重,激发了人们对这些设备的兴趣。随着医疗保健行业转向以患者为中心的护理,电子药物正在成为现代治疗方法的重要组成部分。

生物电子医学的创新正在推动更有效率、更精确的电疗设备的开发,进一步推动市场成长。不断增加的研究投入和有利的监管政策正在鼓励製造商扩大其产品组合。此外,消费者对非侵入性治疗方案的认识不断提高以及医疗保健解决方案的可近性不断提高,也提高了采用率。随着人工智慧和智慧监控功能的整合,电子药物设备在管理长期病症方面变得更加个人化和有效。该市场也受惠于医疗科技公司和研究机构之间的合作,推动了设备小型化、无线通讯和电池寿命改进的突破。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 228亿美元 |

| 预测值 | 423亿美元 |

| 复合年增长率 | 6.6% |

市场根据产品类别进行细分,包括心臟设备、神经调节器和植入物。心臟节律器和除颤器等心臟设备预计将经历最高成长,复合年增长率为 6.7%,到 2034 年将达到 189 亿美元。心血管疾病的盛行率不断上升,加上全球人口老化,正在推动对这些救生设备的需求。心臟技术的不断改进,例如 MRI 相容起搏器和远端病人监控系统,使得这些解决方案更加有效和易于使用。人工智慧诊断和即时健康追踪的结合进一步增强了它们在临床环境中的应用。

电子药物市场也分为植入式设备和非侵入式设备。预计到 2034 年植入式设备市场规模将达到 343 亿美元,复合年增长率为 6.3%。慢性病发病率的上升和生物电子医学的不断进步是主要的成长动力。植入式电疗,例如脊髓刺激器和人工耳蜗,为无需持续用药的疾病管理提供了长期解决方案,使其成为患者和医疗保健提供者都青睐的选择。

美国电子药物市场在 2024 年创造了 76 亿美元的产值,预计在 2025 年至 2034 年期间的复合年增长率为 5.7%。慢性疾病(尤其是心血管和神经系统疾病)的盛行率不断上升,推动了对电子药物解决方案的需求。人口快速老化和医疗技术的不断进步进一步支持了市场成长。心律调节器、深部脑部刺激器和其他电疗设备因其在治疗慢性疼痛、心臟病和神经系统疾病方面的疗效而被广泛需求。随着医疗基础设施的加强和报销政策变得更加优惠,美国电子药物市场将持续扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 生物电子学和神经刺激技术的进步

- 微创手术的采用率不断提高

- 疼痛管理解决方案的需求不断增长

- 扩大在神经和精神疾病领域的应用

- 生物电医学研究投资不断增加

- 产业陷阱与挑战

- 电疗设备成本高

- 设备故障风险与安全问题

- 替代治疗方案的可用性

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

- 价值链分析

- 临床驱动的智慧植入式电子设备迈向精准治疗概述

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 心臟节律器和植入式心律转復除颤器

- 神经调节剂

- 脊髓刺激器

- 深部脑部刺激器

- 迷走神经刺激器

- 荐神经刺激器

- 胃电刺激器

- 经皮电神经刺激器

- 经颅磁刺激器

- 其他神经调节剂

- 人工耳蜗

- 视网膜植入物

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 植入式装置

- 非侵入式设备

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 心律不整

- 慢性疼痛管理

- 神经系统疾病

- 听力损失

- 帕金森氏症

- 尿失禁

- 其他应用

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 门诊手术中心(ASC)

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abbott

- Axonics

- BIOTRONIK

- Boston Scientific

- Cala Health

- Cochlear

- LivaNova

- Medico SpA

- Medtronic

- MicroPort

- Monarch

- NEUROPACE

- Nevro

- Nurotron

- SetPoint Medical

- Sky Medical Technology

- SONOVA

The Global Electroceuticals Market was valued at USD 22.8 billion in 2024 and is projected to grow at a CAGR of 6.6% between 2025 and 2034. The market is witnessing significant expansion, driven by technological advancements in bioelectronic medicine, increasing prevalence of chronic diseases, and rising demand for non-drug treatment alternatives. Electroceuticals, which leverage electrical stimulation to treat medical conditions, are gaining widespread attention as patients and healthcare providers seek more effective, minimally invasive therapies with fewer side effects compared to traditional pharmaceuticals. The growing burden of chronic conditions such as cardiovascular diseases, neurological disorders, and pain management challenges has fueled interest in these devices. As the healthcare industry shifts towards more patient-centric care, electroceuticals are emerging as a critical component of modern treatment approaches.

Innovations in bioelectronic medicine are enabling the development of more efficient and precise electroceutical devices, further propelling market growth. Increasing research investments and favorable regulatory policies are encouraging manufacturers to expand their product portfolios. Moreover, rising consumer awareness about non-invasive treatment options and improved accessibility to healthcare solutions are boosting adoption rates. With the integration of artificial intelligence and smart monitoring capabilities, electroceutical devices are becoming more personalized and effective in managing long-term conditions. The market is also benefiting from collaborations between medtech companies and research institutions, driving breakthroughs in device miniaturization, wireless communication, and battery life improvements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.8 Billion |

| Forecast Value | $42.3 Billion |

| CAGR | 6.6% |

The market is segmented based on product categories, including cardiac devices, neuromodulators, and implants. Cardiac devices, which include pacemakers and defibrillators, are expected to experience the highest growth, with a CAGR of 6.7%, reaching USD 18.9 billion by 2034. The increasing prevalence of cardiovascular diseases, coupled with an aging global population, is driving demand for these life-saving devices. Continuous improvements in cardiac technologies, such as MRI-compatible pacemakers and remote patient monitoring systems, are making these solutions more effective and accessible. The integration of AI-powered diagnostics and real-time health tracking is further enhancing their adoption in clinical settings.

The electroceuticals market is also classified into implantable and non-invasive devices. The implantable devices segment is projected to reach USD 34.3 billion by 2034, growing at a CAGR of 6.3%. Rising incidences of chronic diseases and ongoing advancements in bioelectronic medicine are key growth drivers. Implantable electroceuticals, such as spinal cord stimulators and cochlear implants, offer long-term solutions for managing conditions without continuous medication use, making them an attractive option for both patients and healthcare providers.

U.S. Electroceuticals Market generated USD 7.6 billion in 2024 and is forecasted to grow at a CAGR of 5.7% between 2025 and 2034. The increasing prevalence of chronic diseases, particularly cardiovascular and neurological disorders, is fueling demand for electroceutical solutions. A rapidly aging population and continuous advancements in medical technology are further supporting market growth. Pacemakers, deep brain stimulators, and other electroceutical devices are in high demand due to their proven efficacy in treating chronic pain, heart conditions, and neurological disorders. As healthcare infrastructure strengthens and reimbursement policies become more favorable, the U.S. electroceuticals market is poised for sustained expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in bioelectronics and neurostimulation technologies

- 3.2.1.2 Increasing adoption of minimally invasive procedures

- 3.2.1.3 Rising demand for pain management solutions

- 3.2.1.4 Expansion of applications in neurological and psychiatric disorders

- 3.2.1.5 Growing investments in bioelectric medicine research

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of electroceutical devices

- 3.2.2.2 Risk of device malfunction and safety concerns

- 3.2.2.3 Availability of alternative treatment options

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

- 3.11 Overview on clinically driven smart implantable electronic devices moving towards precision therapy

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiac pacemakers and implantable cardioverter defibrillators

- 5.3 Neuromodulators

- 5.3.1 Spinal cord stimulators

- 5.3.2 Deep brain stimulators

- 5.3.3 Vagus nerve stimulators

- 5.3.4 Sacral nerve stimulators

- 5.3.5 Gastric electrical stimulators

- 5.3.6 Transcutaneous electrical nerve stimulators

- 5.3.7 Transcranial magnetic stimulators

- 5.3.8 Other neuromodulators

- 5.4 Cochlear implants

- 5.5 Retinal implants

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Implantable devices

- 6.3 Non-invasive devices

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Arrhythmia

- 7.3 Chronic pain management

- 7.4 Neurological disorders

- 7.5 Hearing loss

- 7.6 Parkinson's disease

- 7.7 Urine incontinence

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Ambulatory surgical centers (ASCs)

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 Axonics

- 10.3 BIOTRONIK

- 10.4 Boston Scientific

- 10.5 Cala Health

- 10.6 Cochlear

- 10.7 LivaNova

- 10.8 Medico S.p.A.

- 10.9 Medtronic

- 10.10 MicroPort

- 10.11 Monarch

- 10.12 NEUROPACE

- 10.13 Nevro

- 10.14 Nurotron

- 10.15 SetPoint Medical

- 10.16 Sky Medical Technology

- 10.17 SONOVA