|

市场调查报告书

商品编码

1698291

啤酒罐市场机会、成长动力、产业趋势分析及 2025-2034 年预测Beer Cans Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

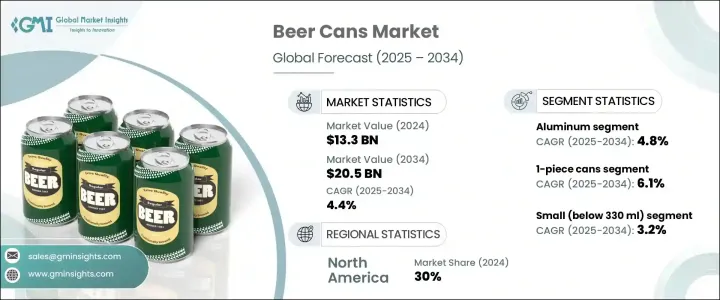

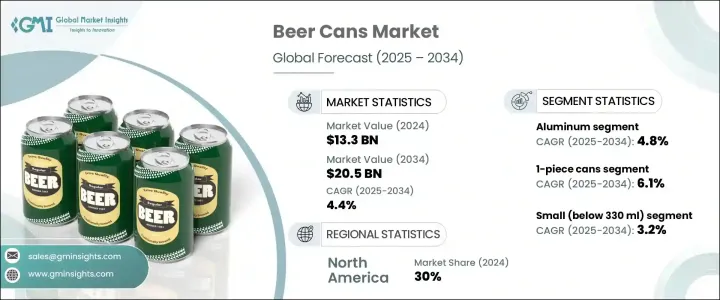

全球啤酒罐市场正在稳步成长,到 2024 年将达到 133 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.4%。啤酒消费量的增加,尤其是精酿啤酒和高端啤酒消费量的增加,是市场扩张的主要驱动力。消费者越来越青睐罐装啤酒,因为它具有保鲜、阻隔光线和氧气、便于携带等特点。另一方面,啤酒厂正在转向铝包装,因为他们优先考虑永续性、产品保存和成本效益。随着精酿啤酒产业的持续蓬勃发展,对能够保留独特风味和碳酸化的高品质包装的需求也在激增。

市场参与者也透过关注永续包装解决方案来应对不断变化的消费者偏好。铝罐以其重量轻和可回收性而闻名,正在成为主流的包装选择。预计该领域在预测期内的复合年增长率将达到 4.8%,这得益于其能够提供卓越的保护,抵御可能影响啤酒品质的外部因素。降低运输成本和延长产品保质期使铝成为大型和小型啤酒厂的首选材料。对环境责任的日益重视进一步强化了这一趋势,促使啤酒製造商将环保包装纳入其生产策略。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 133亿美元 |

| 预测值 | 205亿美元 |

| 复合年增长率 | 4.4% |

市场也根据产品类型进行细分,包括一片罐、两片罐和三片罐。单片罐市场正在经历强劲成长,预计预测期内复合年增长率将达到 6.1%。这些罐子因其无缝结构而越来越受欢迎,这种结构具有增强的防漏性和耐用性。加压和充氮啤酒受益于这种形式,使其成为优质和特色啤酒品种的首选。随着啤酒厂专注于提供高端产品,对单片罐的需求正在加速成长。

北美占据啤酒罐市场的很大份额,占 2024 年总收入的 30%。高啤酒消费量,尤其是精酿啤酒和高级啤酒,持续推动区域需求。光是在美国,2024 年的市场规模就达 32 亿美元,精酿啤酒的日益普及和电子商务管道的不断扩大支持了市场扩张。发达的铝回收生态系统和消费者对永续包装的日益增强的意识促使啤酒厂转向轻质、环保的罐头。随着消费者偏好转向多样化的啤酒口味和更高的包装效率,製造商正在优化其生产策略以满足不断变化的行业需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 啤酒消费量上升

- 精酿啤酒和高端啤酒市场的成长

- 为实现永续发展,从玻璃瓶转向铝罐

- 无酒精和低酒精啤酒的成长

- 成本效率和製造进步

- 产业陷阱与挑战

- 酒类包装的监管挑战与限制

- 来自替代包装材料的竞争

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 铝

- 钢

第六章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 单片罐

- 两片罐

- 三片罐

第七章:市场估计与预测:按产能,2021 年至 2034 年

- 主要趋势

- 小号(330毫升以下)

- 中号(330 毫升 – 500 毫升)

- 大杯(500毫升以上)

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Ardagh Group

- Asahi Group

- Baixicans

- Ball

- Canpack

- Ceylon Beverage Can

- Crown

- Daiwa Can

- Erjin Packaging

- G3 Enterprises

- Hainan Zhenxi

- Nampak

- Orora Packaging

- Scan Holdings

- Shining Aluminum

- Thai Beverage Can

- Toyo Seikan

- Visy

The Global Beer Cans Market is witnessing steady growth, reaching USD 13.3 billion in 2024, with projections indicating a CAGR of 4.4% between 2025 and 2034. Rising beer consumption, particularly in the craft and premium segments, is a key driver of market expansion. Consumers are increasingly gravitating toward canned beer for its ability to maintain freshness, block light and oxygen exposure, and enhance portability. Breweries, on the other hand, are shifting toward aluminum packaging as they prioritize sustainability, product preservation, and cost efficiency. With the craft beer industry continuing to thrive, demand for high-quality packaging that preserves unique flavors and carbonation is surging.

Market players are also responding to changing consumer preferences by focusing on sustainable packaging solutions. Aluminum cans, known for their lightweight nature and recyclability, are emerging as the dominant packaging choice. This segment is projected to grow at a CAGR of 4.8% during the forecast period, driven by its ability to provide superior protection against external elements that can impact beer quality. Reduced transportation costs and extended product shelf life make aluminum the preferred material for both large and small-scale breweries. The increasing emphasis on environmental responsibility is further reinforcing this trend, prompting beer manufacturers to integrate eco-friendly packaging into their production strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.3 Billion |

| Forecast Value | $20.5 Billion |

| CAGR | 4.4% |

The market is also segmented by product type, with 1-piece, 2-piece, and 3-piece cans available. The 1-piece can segment is experiencing robust growth, projected to register a CAGR of 6.1% over the forecast timeline. These cans are gaining popularity due to their seamless structure, which offers enhanced leak protection and durability. Pressurized and nitrogen-infused beers benefit from this format, making it a preferred choice for premium and specialty beer varieties. With breweries focusing on delivering high-end offerings, the demand for 1-piece cans is accelerating.

North America holds a significant share of the beer cans market, accounting for 30% of the total revenue in 2024. High beer consumption, particularly in craft and premium segments, continues to fuel regional demand. The United States alone generated USD 3.2 billion in 2024, with rising craft beer popularity and expanding e-commerce channels supporting market expansion. A well-developed aluminum recycling ecosystem and growing consumer awareness of sustainable packaging are prompting breweries to transition to lightweight, eco-friendly cans. As consumer preferences shift toward diverse beer flavors and improved packaging efficiency, manufacturers are optimizing their production strategies to meet evolving industry demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising beer consumption

- 3.2.1.2 Growth of craft beer and premium segments

- 3.2.1.3 Shift from glass bottles to aluminum cans for sustainability

- 3.2.1.4 Growth of non-alcoholic & low-alcohol beer

- 3.2.1.5 Cost efficiency & manufacturing advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and restrictions on alcohol packaging

- 3.2.2.2 Competition from alternative packaging materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Aluminum

- 5.3 Steel

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 1-piece cans

- 6.3 2-piece cans

- 6.4 3-piece cans

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 – 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 Small (Below 330 ml)

- 7.3 Medium (330 ml – 500 ml)

- 7.4 Large (Above 500 ml)

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 ANZ

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ardagh Group

- 9.2 Asahi Group

- 9.3 Baixicans

- 9.4 Ball

- 9.5 Canpack

- 9.6 Ceylon Beverage Can

- 9.7 Crown

- 9.8 Daiwa Can

- 9.9 Erjin Packaging

- 9.10 G3 Enterprises

- 9.11 Hainan Zhenxi

- 9.12 Nampak

- 9.13 Orora Packaging

- 9.14 Scan Holdings

- 9.15 Shining Aluminum

- 9.16 Thai Beverage Can

- 9.17 Toyo Seikan

- 9.18 Visy