|

市场调查报告书

商品编码

1698293

耳垢清除产品市场机会、成长动力、产业趋势分析及 2025-2034 年预测Earwax Removal Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

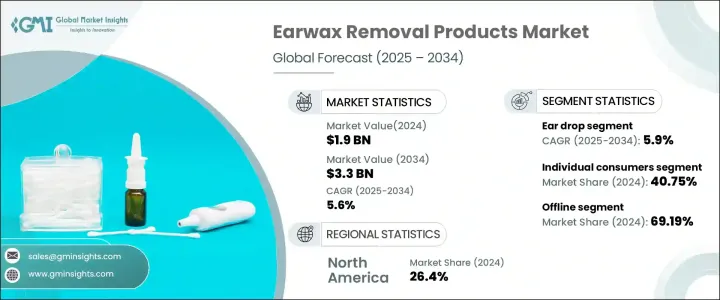

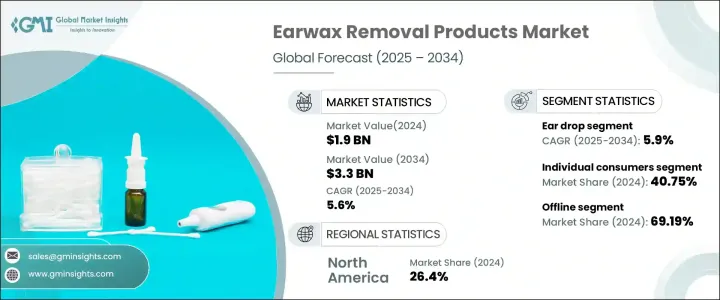

2024 年全球耳垢清除产品市场价值为 19 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.6%。随着越来越多的人出现耳垢堆积、感染、耳鸣和听力损失,耳部相关疾病的盛行率不断上升,推动了这个市场的扩张。频繁使用耳塞和耳机、人口老化以及生活习惯的改变等因素导致耳垢过度堆积,从而推动了对家庭耳垢清除解决方案的需求。消费者越来越注重耳部卫生,因此更倾向于选择非侵入性、易于使用且无需专业干预即可有效缓解耳部不适的产品。随着非处方耳垢清除产品越来越普及,人们开始转向自我照护解决方案,这进一步推动了市场的成长。智慧耳垢清除工具和自动灌溉系统等耳朵清洁技术的进步也越来越受到关注,尤其是在寻求创新和更安全替代品的技术娴熟的消费者中。

市场涵盖一系列产品,包括滴耳液、耳烛、耳喷雾剂、棉花棒以及微型吸力装置和耳勺等先进工具。滴耳液市场在 2024 年创造了 8 亿美元的收入,预计在预测期内的复合年增长率为 5.9%。滴耳液的强劲需求是由于其易于使用、价格实惠且广泛可用。医疗专业人员(包括医生和药剂师)经常建议使用滴耳液,作为治疗反覆出现耳垢堆积的安全有效的解决方案。老年人和助听器使用者尤其依赖这些产品进行定期的耳部卫生维护。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19亿美元 |

| 预测值 | 33亿美元 |

| 复合年增长率 | 5.6% |

市场根据最终用户进行分类,包括个人消费者、医疗保健专业人员、医院和诊所以及疗养院等其他设施。 2024年,个人消费者占了40%的市场份额,反映出人们对耳部卫生的意识不断增强,并且更倾向于自我照顾。随着与老化相关的听力问题、遗传倾向以及助听器和耳塞的使用增加,越来越多的人开始转向家庭耳垢清除解决方案。远距医疗咨询和线上药局购买的兴起趋势进一步增强了消费者对这些产品的获取,使他们无需专业医疗访问即可更轻鬆地解决耳垢问题。

北美耳垢清除产品市场占有 26.4% 的份额,2024 年产值达 5.1 亿美元。耳垢相关问题在该地区尤其普遍,尤其是在老年人群体中。许多消费者不喜欢寻求临床治疗,而是喜欢使用滴耳液、冲洗套件和高科技清洁工具等家庭解决方案。包括内视镜清洁器在内的智慧耳垢清除设备的采用正在增加,为使用者提供了更精确、更有效的方法来管理耳垢堆积。非处方药的供应不受严格的监管限制,进一步鼓励消费者根据医疗保健提供者的建议尝试这些解决方案,从而促进整体市场的扩张。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 製造商

- 经销商

- 衝击力

- 成长动力

- 耳朵问题

- 人们对耳朵健康的认识不断提高

- 耳垢清除产品的创新

- 产业陷阱与挑战

- 使用这些产品可能造成的损害风险

- 竞争激烈

- 成长动力

- 成长潜力分析

- 消费者购买行为

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年(十亿美元)

- 主要趋势

- 滴耳液

- 油基

- 水性

- 化学基

- 耳烛

- 耳喷雾

- 棉花棒和棉花棒

- 其他(微型吸力装置、耳匙/刮匙等)

第六章:市场估计与预测:以价格,2021-2034 年(十亿美元)

- 主要趋势

- 低的

- 中等的

- 高的

第七章:市场估计与预测:按最终用途,2021 - 2034 年(十亿美元)

- 主要趋势

- 个人消费者

- 医疗保健专业人员

- 耳鼻喉科专家

- 全科医生

- 听力学家

- 医院和诊所

- 其他(安养院、辅助生活设施等)

第八章:市场估计与预测:按配销通路,2021 - 2034 年(十亿美元)

- 主要趋势

- 在线的

- 电子商务网站

- 公司网站

- 离线

- 专卖店

- 大型零售商店

- 製药

- 其他(个别店舖等)

第九章:市场估计与预测:按地区,2021 - 2034 年(十亿美元)

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 玛米亚

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Bausch + Lomb

- Black Wolf Nation

- Cerumol (Reckitt Benckiser)

- Doctor Easy Medical Products

- Eosera Inc.

- Hear Right Technologies LLC

- Hydro-Clean (EarTech)

- Johnson & Johnson

- Murine Ear

- Neil Med Pharmaceuticals, Inc.

- Prestige Consumer Healthcare Inc.

- Shenzhen Bebird Technology Co., Ltd.

- Similasan AG

- WaxBGone

The Global Earwax Removal Products Market was valued at USD 1.9 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2034. The increasing prevalence of ear-related conditions is driving this market expansion as more individuals experience earwax buildup, infections, tinnitus, and hearing loss. Factors such as frequent use of earbuds and headphones, an aging population, and evolving lifestyle habits are contributing to excessive earwax accumulation, fueling the demand for at-home earwax removal solutions. Consumers are becoming increasingly aware of ear hygiene, leading to a strong preference for non-invasive, easy-to-use products that offer effective relief without requiring professional intervention. The shift toward self-care solutions, supported by greater accessibility of over-the-counter (OTC) earwax removal products, is further propelling market growth. Advancements in ear-cleaning technologies, such as smart earwax removal tools and automated irrigation systems, are also gaining traction, particularly among tech-savvy consumers seeking innovative and safer alternatives.

The market encompasses a range of products, including ear drops, ear candles, ear sprays, cotton swabs, and advanced tools like micro-suction devices and ear picks. The ear drops segment generated USD 800 million in 2024 and is expected to grow at a CAGR of 5.9% during the forecast period. The strong demand for ear drops is driven by their ease of use, affordability, and widespread availability. Medical professionals, including doctors and pharmacists, frequently recommend ear drops as a safe and effective solution for individuals who suffer from recurrent earwax buildup. Older adults and hearing aid users are particularly reliant on these products for regular ear hygiene maintenance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 billion |

| Forecast Value | $3.3 billion |

| CAGR | 5.6% |

The market is categorized based on end-users, including individual consumers, healthcare professionals, hospitals and clinics, and other facilities such as nursing homes. In 2024, individual consumers accounted for 40% of the market share, reflecting a growing awareness of ear hygiene and a preference for self-care. With aging-related hearing concerns, genetic predispositions, and increased use of hearing aids and earbuds, more individuals are turning to at-home earwax removal solutions. The rising trend of telehealth consultations and online pharmacy purchases has further enhanced consumer access to these products, making it easier to manage earwax concerns without professional medical visits.

North America earwax removal products market held a 26.4% share, generating USD 510 million in 2024. Earwax-related issues are particularly prevalent in the region, especially among the elderly population. Instead of seeking clinical treatments, many consumers prefer home-based solutions such as ear drops, irrigation kits, and high-tech cleaning tools. The adoption of smart earwax removal devices, including endoscopic cleaners, is on the rise, providing users with a more precise and effective way to manage earwax accumulation. The availability of OTC products without stringent regulatory restrictions further encourages consumers to try these solutions based on recommendations from healthcare providers, boosting overall market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research Approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier Landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising ear related issues

- 3.9.1.2 Growing awareness of ear health

- 3.9.1.3 Innovations in ear wax removal products

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Risks of damage associated with the use of these products

- 3.9.2.2 High Competition

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Consumer buying behavior

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Ear drops

- 5.2.1 Oil-based

- 5.2.2 Water-based

- 5.2.3 Chemical-based

- 5.3 Ear candles

- 5.4 Ear spray

- 5.5 Cotton Swabs & Buds

- 5.6 Others (Micro suction Devices, Ear Picks/Curettes, etc.)

Chapter 6 Market Estimates & Forecast, By Price, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By End-use, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Individual consumers

- 7.3 Healthcare professionals

- 7.3.1 ENT specialists

- 7.3.2 General practitioners

- 7.3.3 Audiologists

- 7.4 Hospitals and Clinics

- 7.5 Others (Nursing Homes, Assisted Living Facilities, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-Commerce site

- 8.2.2 Company website

- 8.3 Offline

- 8.3.1 Specialty stores

- 8.3.2 Mega retail stores

- 8.3.3 Pharma

- 8.3.4 Others (Individual Stores, etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MAMEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bausch + Lomb

- 10.2 Black Wolf Nation

- 10.3 Cerumol (Reckitt Benckiser)

- 10.4 Doctor Easy Medical Products

- 10.5 Eosera Inc.

- 10.6 Hear Right Technologies LLC

- 10.7 Hydro-Clean (EarTech)

- 10.8 Johnson & Johnson

- 10.9 Murine Ear

- 10.10 Neil Med Pharmaceuticals, Inc.

- 10.11 Prestige Consumer Healthcare Inc.

- 10.12 Shenzhen Bebird Technology Co., Ltd.

- 10.13 Similasan AG

- 10.14 WaxBGone